|

市场调查报告书

商品编码

1630455

法国核子反应炉退役:市场占有率分析、行业趋势和成长预测(2025-2030)France Nuclear Power Reactor Decommissioning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

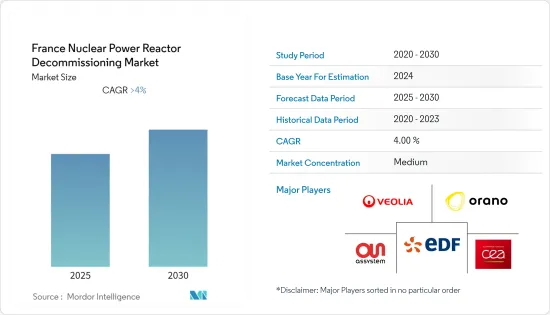

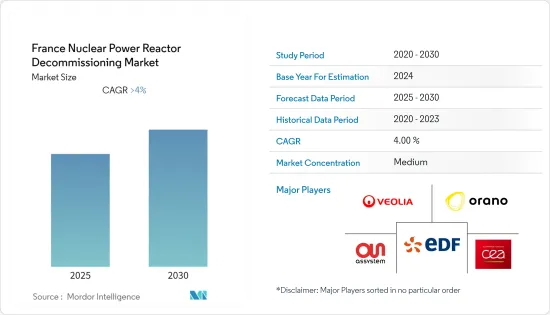

法国核子反应炉退役市场预计在预测期内复合年增长率将超过4%

COVID-19 对 2020 年市场产生了负面影响。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,日本现有核能发电厂的老化(许多核电厂已达退休年龄)预计将在预测期内推动市场发展。

- 另一方面,高昂的除役成本预计将阻碍预测期内的市场成长。

- 法国政府减少核能发电、增加可再生能源份额的策略预计将为法国核能发电反应器除役市场创造重大机会。

法国核子反应炉退役市场趋势

商业核子反应炉预计将主导市场

- 商业核能发电厂是部署在社区内用于发电的发电厂,用于国家能源网,将电力传输和分配到国家各部门。在法国,大多数核能发电厂属于商业反应器类别。

- 根据世界核能协会统计,法国运作56座商用核子反应炉,分布在18个地点,总发电量为61,370 MWe(2019年为63,130 MWe)。与此同时,一座核子反应炉正在兴建中。此外,截至2022年12月,法国已关闭14座核子反应炉,总发电量为5,549兆瓦。

- 2021年法国核能总发电量为554.8兆瓦时(TWh)。儘管近年来核能在能源生产总量中的比重下降,核能发电厂仍占法国总发电量的70%左右。

- 截至2021年,法国电力公司(EDF)已宣布将关闭和除役9座核子反应炉。布尼里斯、Busy 1、Chinon A1、A2、A3、Choze A、Cle Marville、Saint Laurent A1、A2。预计燃料清除工作将于2023年夏季完成,完全除役预计最快将于2040年完成。

- 因此,鑑于上述几点,商业电力部门很可能在预测期内主导法国核子反应炉除役市场。

可再生能源的成长推动市场

- 法国的可再生能源发电产业可能在不久的将来进一步成长。这主要归功于旨在将能源转向清洁发电的政府计划以及可再生技术的持续改进。法国最近制定了多项气候变迁目标以实现碳中和。

- 2020年,法国向欧盟委员会提交了2030年国家能源与气候计画(NECP)。该国的目标是到 2030 年将可再生能源占其能源结构的 33%。这相当于电力产业40%的可再生能源,其中风力发电可提供一半。该计划为能源转型製定了雄心勃勃且现实的目标。

- 该国的发电产业正在经历从石化燃料到可再生能源的重大转变。根据国际可再生能源机构统计,法国可再生能源装置量从2017年的4,279万千瓦增加到2021年的超过5,900万千瓦,录得显着成长。

- 2022年12月,Neoen宣布获得法国180MW太阳能和风发电工程合约。作为能源管理委员会 (CRE) 多年能源计画 (PPE2) 的一部分,该计划在法国政府进行的技术中立竞标中中标。作为能源管理委员会 (CRE) 多年能源计画 (PPE2) 的一部分,计划在法国政府最新的技术中立竞标中中标。

- 因此,鑑于上述情况,可再生能源的成长预计将在预测期内推动法国核子反应炉除役市场。

法国核子反应炉退役行业概况

法国核子反应炉退役市场适度整合。该市场的主要企业(排名不分先后)包括威立雅环境公司、欧安诺集团、法国电力公司(EDF)、Assystem SA 以及法国替代能源和原子能委员会(CEA)。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 核子反应炉类型

- 压水式反应炉

- 加压重水反应器

- 沸水式反应炉

- 高温反应炉

- 液态金属快滋生反应器

- 其他的

- 目的

- 商业动力反应炉

- 演示反应炉

- 研究反应器

- 核子反应炉容量

- 100MW以下

- 100~1,000MW

- 1,000MW以上

第六章 竞争状况

- 合併、收购、联盟和合资企业

- 主要企业策略

- 公司简介

- Veolia Environnement SA

- Leniko bvba

- Orano SA

- Electricite de France SA(EDF)

- Assystem SA

- French Alternative Energies and Atomic Energy Commission(CEA)

第七章 市场机会及未来趋势

简介目录

Product Code: 71568

The France Nuclear Power Reactor Decommissioning Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing age of existing nuclear power plants and many power plants reaching retirement age in the country is expected to drive the market during the forecasted period.

- On the other hand, the high cost of decommissioning plants is the major restraint expected to hinder the market's growth during the forecasted period.

- Nevertheless, the French government's strategy of reducing the energy generated through nuclear energy and increasing the share of renewable energy is expected to create significant opportunities for the France Nuclear Power Reactor Decommissioning Market.

France Nuclear Power Reactor Decommissioning Market Trends

Commercial Power Reactor Expected to Dominate the Market

- Commercial nuclear power plants are the power plants deployed in the region to generate electricity and utilized in the national energy grid through which the generated electricity is transmitted and distributed to various sectors of the country. In France, the majority of nuclear power plants fall under the commercial reactor category.

- According to World Nuclear Association, 56 commercial nuclear reactors are functioning in France, distributed in 18 sites with a total generating capacity of 61370, MWe compared to 63130 MWe in 2019. At the same time, one reactor is under construction. Moreover, till December 2022, France has shut down 14 reactors with a total capacity of 5549 MWe.

- The total power produced by nuclear energy in France in 2021 was 554.8 Terawatt-hours (TWh); even though the share of nuclear energy in total energy production has been decreasing in recent years, nuclear power plants still account for around 70 percent of the entire power generation in the country.

- As of 2021, Electricite de France SA (EDF) has announced that nine reactors have been shut down and are being decommissioned: Brennilis, Bugey 1, Chinon A1, A2 and A3, Chooz A, Creys-Malville, Saint-Laurent A1 and A2. The fuel removal is expected to be completed by the summer of 2023, and the complete decommissioning is expected to be completed by 2040 at the earliest.

- Hence, owing to the above points, the commercial power rector segment will likely dominate the France nuclear power reactor decommissioning market during the forecast period.

Increasing Renewable Energy Expected to Drive the Market

- France's renewable power sector is likely to thrive more in the near future, mainly due to the government programs for an energy transition to cleaner power generation sources and the continuous improvement in renewable technology. The country has set many climate goals in the recent picture to achieve carbon neutrality.

- In 2020, France presented its 2030 National Energy and Climate Plan (NECP) to the European Commission. The country aims for 33% renewable energy in its energy mix in 2030. This translates into 40% renewables in the power sector - wind energy could deliver half of this. The Plan outlines ambitious yet realistic targets for the energy transition.

- The power generation industry in the country is undergoing a significant transition, shifting from fossil fuels to renewable energy sources. According to the International Renewable Energy Agency, renewable power installed in France increased from 42.79 GW in 2017 to more than 59 GW in 2021, recording massive growth.

- In December 2022, Neoen announced that they had been allocated contracts worth 180 MW in solar and wind projects in France. The projects were awarded in the technology-neutral call for tenders held by the French government as part of the energy regulation commission's (CRE) multi-year energy plan (PPE2). The projects were awarded in the latest technology-neutral call for tenders held by the French government as part of the energy regulation commission's (CRE) multi-year energy plan (PPE2).

- Hence, owing to the above points, increasing renewable energy is expected to drive the France nuclear power reactor decommissioning market during the forecast period.

France Nuclear Power Reactor Decommissioning Industry Overview

The France Nuclear Power Reactor Decommissioning Market is moderately consolidated. Some of the key players in this market (not in a particular order) include Veolia Environnement SA, Orano Group, Electricite de France SA (EDF), Assystem SA, and French Alternative Energies and Atomic Energy Commission (CEA).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Reactor Type

- 5.1.1 Pressurized Water Reactor

- 5.1.2 Pressurized Heavy Water Reactor

- 5.1.3 Boiling Water Reactor

- 5.1.4 High-temperature Gas-cooled Reactor

- 5.1.5 Liquid Metal Fast Breeder Reactor

- 5.1.6 Other Reactor Types

- 5.2 Application

- 5.2.1 Commercial Power Reactor

- 5.2.2 Prototype Power Reactor

- 5.2.3 Research Reactor

- 5.3 Capacity

- 5.3.1 Below 100 MW

- 5.3.2 100-1000 MW

- 5.3.3 Above 1000 MW

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Veolia Environnement SA

- 6.3.2 Leniko bvba

- 6.3.3 Orano SA

- 6.3.4 Electricite de France SA (EDF)

- 6.3.5 Assystem SA

- 6.3.6 French Alternative Energies and Atomic Energy Commission (CEA)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219