|

市场调查报告书

商品编码

1630461

东南亚国协UCaaS(统一通讯即服务)市场:份额分析、产业趋势、成长预测(2025-2030)ASEAN Unified Communication-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

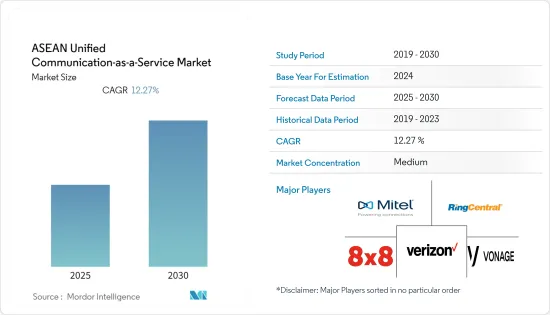

东南亚国协的UCaaS(统一通讯即服务)市场预计在预测期间内复合年增长率为12.27%。

主要亮点

- IT 预算有限的组织越来越多地采用经济高效的云端基础的解决方案。消费者行动解决方案在同一台装置上提供聊天、语音和视讯通话通信,以回答所有客户问题。因此,这些解决方案旨在改善自助服务、产品查询和客户支援协助。员工还可以从虚拟培训和产品管理系统中受益。

- 鑑于该地区客服中心过时,显然越来越需要易于维护的网路系统,以实现大量企业之间的高效通讯。

- 此外,低效率的客服中心的存在正在推动对易于维护且能够促进医疗保健、零售和製造等各种最终用户行业的高效通信的网路系统的需求。根据互动多媒体与协作通讯联盟 (IMCCA) 的调查,90% 的远距工作者认为视讯有助于他们与同事保持密切联繫。

- 对于消费者而言,行动优先解决方案可透过同一装置实现聊天、语音和视讯通话通信,使您能够回应任何客户询问。因此,这些解决方案增强了客户服务协助、产品查询和自助服务。员工还可以从虚拟培训和产品管理工具中受益。

- 网路威胁日益复杂,导致组织将一项或多项安全业务外包给云端基础的服务的趋势日益明显。

- 由于COVID-19的爆发,东南亚国协的公司增加了对UCaaS(统一通讯即服务)的投资。根据 Voxbone 研究,COVID-19 显着增加了对云端通讯的需求。公司一直在寻找减少团体聚会和通勤时间等威胁的方法。

东南亚国协UCaaS(统一通讯即服务)市场趋势

公司采用 BYOD 预计将推动市场发展

- BYOD 是一个整合了行动装置管理 (MDM)、费用处理和安全措施的系统。这提供了一个方便、集中的平台,用于自动化关键活动并提高企业内使用的设备的可见性。

- 由于 BYOD 趋势和其他行动解决方案的日益使用,UCaaS 解决方案预计将变得更加流行。在这个各家公司工作的员工都需要灵活且易于存取网路的时代,BYOD(自备设备)已成为提高职场生产力的重要趋势。

- 此外,BYOD 允许企业透过「零接触」来管理安全性问题。一旦 BYOD 解决方案到位,公司的资料需求就会受到保护,因为行动装置管理 (MDM) 系统可以与 BYOD 集成,以确保员工安全。

- 透过实施行动统一通讯整合支援的 BYOD 规则,所有这些顶级应用程式都整合到一种流畅的用户行动工作者。整合通讯解决方案为行动工作者提供了提高工作效率和更好沟通所需的工具。然而,BYOD 不仅可以提高员工满意度,还可以解决企业面临的安全问题。可以在任何装置上存取整合通讯应用程序,这增加了对远端网路安全存取的需求

印尼预计将占有很大份额

- 通讯法规是国际服务供应商向印度、中国、印尼和越南等亚洲国家扩张的主要障碍。外国服务供应商不得在这些国家/地区託管 VoIP 或云端服务。因此,本土通讯业者在UCaaS市场享有一定的垄断优势。

- 该地区中小型企业基于互联网的通讯需求的扩大和增加预计将推动对互联网通讯协定语音、音讯会议和视讯会议等通讯服务的需求。

- 此外,Telkomtelstra (PT Teltranet TeltranetSolusi) 去年被 PT Telkom Indonesia (Persero) 透过 TelkomMetrain 收购后,更名为 Digiserve by Telkom Indonesia (PT Digital Application Solusi)。 Digiserve 越来越专注于开发其服务,认为这项转变将促进客户业务并帮助他们取得更好的成果。 DigiserveUC&C 创造可提高企业生产力的身临其境型体验。人们可以更有效地跨团队合作,并在任何地方、任何装置上保持联繫。

- 此外,该地区积极采用经济实惠的高速网路和智慧型手机的快速普及,正在推动企业选择 UCaaS 解决方案,以使其员工能够远端工作。这些因素正在推动 UCaaS 解决方案和平台在整个全部区域的渗透,预计将有助于预测期内的整体需求。

东南亚国协UCaaS(统一通讯即服务)产业概况

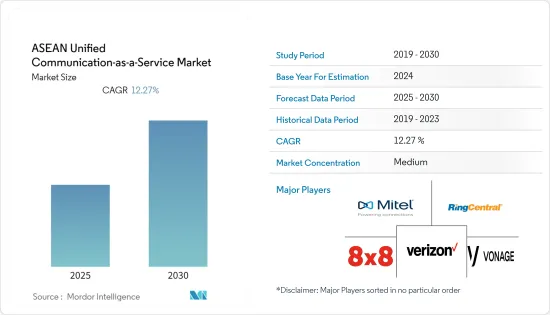

东南亚国协的UCaaS(统一通讯即服务)市场正在经历整合,Mitel Networks Corporation、Ring Central Inc.、Cisco Systems Inc.等少数公司占据较大份额。这些公司透过在研发方面的大量投资引入创新,这使他们比其他公司具有竞争优势。透过策略联盟、併购,这些公司已经占据了很大一部分市场。

2022 年 3 月,8x8 Inc. 首次为在印尼和泰国等 50 个国家营运的跨国公司推出了全面、完全云端基础的UCaaS(统一通讯即服务)和客服中心解决方案。 8x8 是第一家将 UCaaS 和 CCaaS 结合的公司,满足全球所有员工的通讯需求,同时协作提供差异化的客户体验。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 零售、製造等领域快速采用云端技术。

- BYOD在企业中的采用

- 市场限制因素

- 对基于云端基础的服务等的安全性担忧日益增加。

第六章 市场细分

- 按类型

- 网路电话解决方案

- 企业协作

- 客服中心服务

- 其他的

- 按最终用户产业

- 医疗保健

- 零售业

- 製造业

- 金融服务

- 其他的

- 依部署类型

- 云

- 本地

- 按国家/地区

- 新加坡

- 马来西亚

- 菲律宾

- 印尼

- 其他东南亚国协

第七章 竞争格局

- 公司简介

- Mitel Networks Corporation

- Ring Central Inc.

- 8X8 Inc.

- Verizon Communications Inc.

- Vonage Holdings Inc.

- Cisco Systems Inc.

- Avaya Inc.

- VADS Berhad

- Singapore Telecommunications Limited

- PLDT Enterprise

- NTT Communication Corporation

- Telstra Corporation Limited

- PCCW Global

- Mitel Networks Corporation

- Maxis Communications

第八章投资分析

第9章市场的未来

The ASEAN Unified Communication-as-a-Service Market is expected to register a CAGR of 12.27% during the forecast period.

Key Highlights

- Organizations, which are frequently characterized as having minimal IT budgets, have boosted their adoption of cost-effective cloud-based solutions. Consumer-focused mobile solutions that offer communication via chat, audio, and video calls on the same device to respond to all customer questions. Therefore, these solutions are meant to improve self-service, product inquiries, and customer support assistance. The use of virtual training and product management systems benefits employees as well.

- The region's presence of outdated contact centers makes it clear that there is a growing need for an easily maintained network system that can enable efficient communications across numerous enterprises.

- Furthermore, given the ineffective contact centers, it is clear that a growing demand exists for network systems that are simple to maintain and can facilitate efficient communications across various end-user industries, including healthcare, retail, and manufacturing. 90% of remote workers believe that video helps them maintain a closer connection with their coworkers, according to the Interactive Multimedia & Collaborative Communications Alliance (IMCCA).

- Concerning consumers, mobile-first solutions where communication is enabled through chat, audio, and video call through the same device can address all customer queries. Thus, these solutions enhance customer service assistance, merchandise inquiries, and self-service. Employees also benefit from deploying virtual training and merchandise management tools.

- The increasing complexity of cyber threats has driven the trend toward outsourcing one or more of an organization's security operations for cloud-based services.

- With the outbreak of COVID-19, businesses in the ASEAN region increased their investment in unified communications (UC). According to a study by Voxbone, COVID-19 pushed a massive increase in demand for cloud communications. Businesses have been looking for ways to reduce threats, such as group gatherings and the work commute.

ASEAN Unified Communication-as-a-Service Market Trends

BYOD adoption among the Enterprises is Expected to Drive the Market

- BYOD is a system that integrates mobile device management (MDM), reimbursement procedures, and security measures. This provides a handy, centralized platform for automating crucial activities and enhances the visibility of the devices used within the enterprise.

- It is anticipated that UCaaS solutions will become more popular due to the growing use of the BYOD trend and other mobility solutions. In this era of flexibility and network accessibility for employees working in the area for various businesses, Bring Your Own Device (BYOD) is emerging as a significant trend, increasing productivity in the workplace.

- Additionally, BYOD enables businesses to manage security concerns with "zero touches." When a BYOD solution is implemented, corporate data requirements are secured since the mobile device management (MDM) system can be integrated with BYOD to enable employee security.

- All of these top applications are combined into one fluid user experience that provides complete support for mobile workers via email, business phone, video conferencing, instant messaging, and more by implementing BYOD rules supported with Mobile UC integration. The tools mobile workers need to increase productivity and improve communications are provided by unified communications solutions. However, BYOD can increase security concerns a firm confronts as well as employee satisfaction. Access to unified communication applications can happen on any device, making the need to safeguard access on remote networks a growing concern.

Indonesia is Expected to Hold Significant Share

- Telecommunications regulations are one of the significant impediments to international service providers entering Asian countries, such as India, China, Indonesia, and Vietnam. In these nations, foreign service providers cannot host their VoIP and cloud services. As a result, local telecom carriers in the UCaaSmarket enjoy a monopolistic advantage to some extent.

- Demand for communication services like voice over internet protocol, audio conferencing, and video conferencing is projected to be driven by the expansion and increase in the need for internet-based communication among small and medium-sized businesses in the area.

- Moreover, after being bought by PT Telkom Indonesia (Persero) through TelkomMetrain last year, Telkomtelstra (PT Teltranet TeltranetSolusi) was renamed Digiserve by Telkom Indonesia (PT Digital Application Solusi). Digiserveis increasingly encouraged in developing services with the notion that it will boost the customer's business and help them achieve better outcomes due to this transition. DigiserveUC&C creates immersive experiences that allow companies to become more productive. People can collaborate more effectively across teams and stay connected on any device, no matter where they are.

- Furthermore, the aggressive rollout of high-speed internet at affordable prices in the region and the rapid uptake of smartphones encourage businesses to choose UCaaS solutions to enable employees to work remotely. These factors are driving the uptake of UCaaS solutions and platforms throughout the region and are anticipated to contribute to the overall demand during the forecast period.

ASEAN Unified Communication-as-a-Service Industry Overview

The ASEAN Unified Communication-as-a-Service Market is consolidated as a few players, such as Mitel Networks Corporation, Ring Central Inc., and Cisco Systems Inc., hold a significant share. Due to their capacity to introduce innovations through substantial investments in research and development, these organizations can achieve a competitive advantage over the other players. The corporations' strategic alliances, mergers, and acquisitions have allowed them to occupy a large portion of the market.

In March 2022, 8x8 Inc. was the first to offer a completely cloud-based, comprehensive, unified communications and contact center solution for multinational organizations operating in 50 countries, including Indonesia and Thailand. 8x8 is the first company to combine UCaaS and CCaaS to meet the communications needs of all employees worldwide while they collaborate to offer differentiated customer experiences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Cloud Adoption across Retail, Manufacturing, etc.

- 5.1.2 BYOD Adoption among the Enterprises

- 5.2 Market Restraints

- 5.2.1 Increasing Security Concerns for Cloud-based Services, etc.

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 VOIP Solutions

- 6.1.2 Enterprise Collaboration

- 6.1.3 Contact Center Services

- 6.1.4 Other Types

- 6.2 By End-user Industry

- 6.2.1 Healthcare

- 6.2.2 Retail

- 6.2.3 Manufacturing

- 6.2.4 Financial Services

- 6.2.5 Other End-user Industries

- 6.3 By Deployment Type

- 6.3.1 Cloud

- 6.3.2 On-premise

- 6.4 By Country

- 6.4.1 Singapore

- 6.4.2 Malaysia

- 6.4.3 Philippines

- 6.4.4 Indonesia

- 6.4.5 Rest of the ASEAN Region

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mitel Networks Corporation

- 7.1.2 Ring Central Inc.

- 7.1.3 8X8 Inc.

- 7.1.4 Verizon Communications Inc.

- 7.1.5 Vonage Holdings Inc.

- 7.1.6 Cisco Systems Inc.

- 7.1.7 Avaya Inc.

- 7.1.8 VADS Berhad

- 7.1.9 Singapore Telecommunications Limited

- 7.1.10 PLDT Enterprise

- 7.1.11 NTT Communication Corporation

- 7.1.12 Telstra Corporation Limited

- 7.1.13 PCCW Global

- 7.1.14 Mitel Networks Corporation

- 7.1.15 Maxis Communications