|

市场调查报告书

商品编码

1851272

能源领域统一通讯即服务 (UCaaS) - 市场份额分析、产业趋势、统计数据和成长预测 (2025-2030)UCaaS In Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

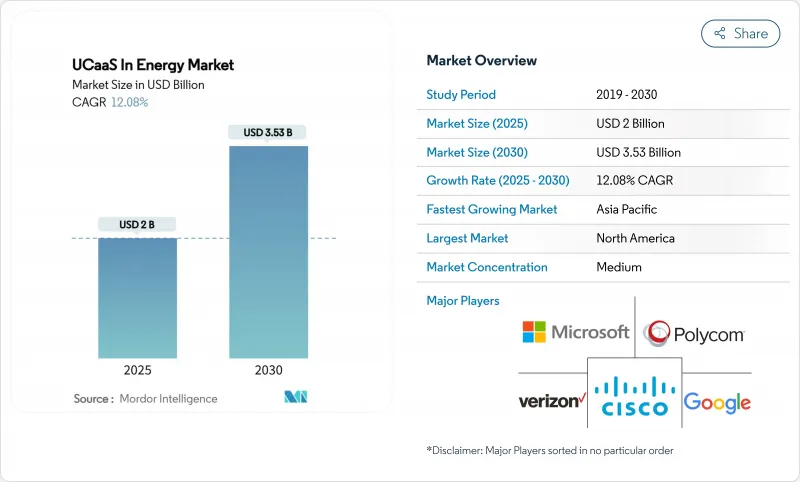

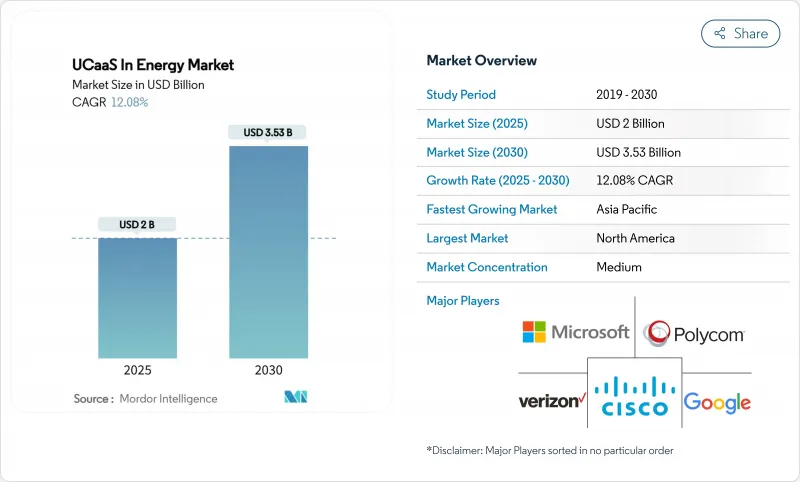

预计到 2025 年,能源 UCaaS 市场规模将达到 20 亿美元,到 2030 年将达到 35.3 亿美元,2025 年至 2030 年的复合年增长率为 12.08%。

快速的数位化、日益增长的现场人员协作需求以及操作技术和资讯技术的融合正在加速统一通讯技术的应用。公共产业正在对其电网进行现代化改造,油气营运商正在对油井进行数位化改造,可再生能源资产所有者正在采用云端原生工具——所有这些都需要能够在严苛的分散式环境中可靠运作的统一通讯。边缘架构、专用5G连接和基于消费的定价模式正在降低整体拥有成本,而网路安全弹性要求则促使企业采用安全、整合的语音和影像平台。市场竞争较为温和,主要通讯集团、云端供应商和专注于能源领域的专家都在寻求透过混合部署和特定领域的功能来获取市场份额。儘管整合复杂性和资料主权规则正在减缓一些计划的进度,但监管机构对现代化、人工智慧赋能通讯的支援仍在不断为各个领域和地区带来新的机会。

全球能源统一通讯即服务 (UCaaS) 市场趋势与洞察

云端原生能源IT生态系统的普及

像沙特阿美这样的领先营运商正在部署工业分散式云,将运算和储存资源更靠近资产,从而实现需要同样敏捷通讯的即时分析。透过开放API整合的云端原生UCaaS平台简化了资源配置,使能源公司能够在边缘工作负载的同时推出新的语音、视讯和通讯服务。从本地PBX迁移到可扩展的云端中心系统,有助于满足监管补丁管理要求,同时降低生命週期成本。随着越来越多的营运应用程式采用容器化技术,基于微服务建构的整合通讯能够实现控制室和现场团队之间的无缝资料流,从而显着提高生产力和安全性。

基于边缘运算的远端资产协作

雪佛龙和壳牌部署了边缘网关来监控井口感应器,并在出现异常情况时立即触发语音或视讯通话,从而减少停机时间和差旅成本。扩增实境头戴装置使技术人员能够在接收专家指导的同时,将示意图迭加到装置上,并透过统一通讯即服务 (UCaaS) 视讯串流进行指导。边缘端的低延迟处理确保关键警报通过冗余通道路由,即使在海上和沙漠地区也能保证安全合规性。因此,支援边缘运算的工作流程提高了协作质量,而不会使回程传输链路过载,从而增强了在现场部署整合通讯的商业价值。

传统资产OT-IT整合的复杂性

炼油厂依赖使用了数十年的SCADA和DCS平台,这些平台运行专有通讯协定,并且出于安全考虑与企业网路隔离。采用云端基础的UCaaS需要安全闸道、通讯协定转换器和严格的变更控制,所有这些都会延长部署週期。工厂工程师优先考虑运作而非新功能,这种抵触情绪也迫使采用分阶段部署的方式,将本地语音功能与最新的云端功能结合。高昂的咨询和网路安全成本阻碍了近期采用,尤其是对于中型资产所有者而言。

细分市场分析

2024年,语音通信仍将占据能源统一通讯即服务(UCaaS)市场37.5%的最大份额,这主要得益于电厂和管线以语音为中心的安全通讯协定。然而,随着公用事业公司采用人工智慧聊天机器人和全通路介面来处理停电报告和帐单查询,客服中心即服务(CCaaS)预计到2030年将以17.86%的复合年增长率成长。这种转变将提高客户满意度,同时降低呼叫处理成本。

除了前台办公优势外,CCaaS 还与停电管理系统和智慧电錶资料集成,使代理商能够在电网事件发生时主动提醒客户。同时,协作套件、统一通讯和会议工具透过整合桌面、行动装置和现场设备,增强了内部团队的协作能力。受 API 整合等「其他服务」的推动,能源 UCaaS 市场规模预计将随着营运商将通讯融入物联网和维护工作流程而稳定成长。

至2024年,公共云端实例将占能源统一通讯即服务(UCaaS)市场规模的60.4%。然而,企业对本地资料储存的需求,例如SCADA对话和事件日誌,将推动混合模式模式达到21.2%的复合年增长率。混合模式将低风险流量路由到超大规模区域,同时将敏感资料流锚定到本地或边缘节点。

这种架构兼具敏捷性和合规性,因此在遵守严格资料隐私法律的欧洲公用事业公司中广受欢迎。虽然在核能发电厂和海上钻机等必须完全隔离的场所,私有部署仍然至关重要,但不断上涨的维护成本促使非关键工作负载逐步迁移到云端,凸显了混合架构的长期吸引力。

能源产业整合通讯(即服务)市场报告按组件(语音通信、协作工具、统一通讯、会议等)、部署模式(私人、公共、混合)、公司规模(大型企业、中小企业)、能源子行业(石油和天然气、发电等)和地区对产业进行细分。

区域分析

北美地区2024年44.3%的收入份额反映了其庞大的数位化油田、智慧电网试点计画和成熟的云端基础设施的装置量。联邦政府对电网修復的奖励策略以及页岩盆地的私有5G试点计画将支撑持续的需求。仅由公共产业推动的能源统一通讯即服务(UCaaS)市场规模就将成长,因为投资者拥有的公司正在升级客服中心以处理电气化咨询。

到2030年,亚太地区将以19.8%的复合年增长率成长,这主要得益于中国加速推进基于人工智慧的电力产业改革,以及印度开闢可再生能源走廊,而这些走廊需要云端整合通讯。区域各国政府倾向在国内进行资料託管,从而推动了混合模式和本地边缘节点的发展。日本天然气发行和澳洲液化天然气出口商也积极整合统一通讯即服务(UCaaS),以监控远端资产并满足员工安全要求。

在「Fit for 55」法规的推动下,欧洲保持着稳步发展势头。该法规要求电网具备网路安全性和互通性。跨境能源交易和离岸风力发电丛集需要输电系统营运商(TSO)和服务船之间进行即时协调。东欧电网正在投资云端原生调度工具,以减少对俄罗斯天然气的依赖。同时,中东和非洲正在为大型企划部署专用LTE和5G网络,但农村生产基地的网路连接不足阻碍了这些技术的全面应用。监管政策的清晰度和可靠的宽频仍然是决定各地区普及速度的关键因素。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 云端原生能源IT生态系统的普及

- 基于边缘运算的远端资产协作

- 油田和工厂的5G专用网络

- 供应商转向以消费量定价

- 将 UCaaS 和 O-RAN 整合到现场通讯中

- 监管机构强制要求建立网路安全语音/视讯系统

- 市场限制

- 传统资产的OT-IT整合复杂性

- 持续存在的数据主权障碍

- 能源价格波动会延缓IT资本投资。

- 偏远地区最后一公里连结的局限性

- 关键法规结构评估

- 价值链分析

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 主要用例和案例研究

- 宏观经济因素对市场的影响

- 投资分析

第五章 市场区隔

- 按组件

- 语音通信

- 协作工具

- 统一通讯

- 会议

- 客服中心即服务

- 其他服务

- 按部署模式

- 公共

- 私人的

- 杂交种

- 按公司规模

- 大公司

- 小型企业

- 按能源子部门

- 石油和天然气

- 发电

- 公共产业(输配电)

- 可再生能源资产

- 采矿和开采

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Verizon Communications Inc.

- Microsoft Corporation

- Cisco Systems, Inc.

- RingCentral, Inc.

- Google LLC

- 8x8, Inc.

- Zoom Video Communications, Inc.

- Avaya LLC

- BT Group plc

- Vodafone Group Plc

- AT&T Inc.

- Vonage Holdings Corp.

- Genesys Telecommunications Laboratories, Inc.

- Twilio Inc.

- Mitel Networks Corporation

- NEC Corporation

- ALE International SAS

- West Technology Group, LLC

- Plantronics, Inc.

- Fuze, Inc.

- Tata Communications Limited

- Orange SA

- GoTo Group, Inc.

第七章 市场机会与未来展望

The UCaaS in energy market size stood at USD 2 billion in 2025 and is forecast to reach USD 3.53 billion by 2030, translating into a 12.08% CAGR over 2025-2030.

Rapid digitalization, rising field-worker collaboration needs and the fusion of operational technology with information technology are accelerating adoption. Utilities are modernizing grids, oil and gas operators are digitizing wells, and renewable asset owners are deploying cloud-native tools, all of which demand unified communications that operate reliably across harsh, distributed environments. Edge architectures, private-5G connectivity and consumption-based pricing lower total cost of ownership, while cyber-resilience mandates push firms to standardize on secure, unified voice and video platforms. Competitive intensity is moderate; large telecom groups, cloud vendors and energy-focused specialists seek share through hybrid deployments and domain-specific features. Although integration complexity and data-sovereignty rules slow some projects, regulatory support for modern, AI-enabled communications continues to unlock opportunities across segments and regions.

Global UCaaS In Energy Market Trends and Insights

Proliferation of Cloud-Native Energy IT Ecosystems

Major operators such as Aramco are rolling out industrial distributed clouds that bring compute and storage closer to assets, enabling real-time analytics that demand equally agile communications . Cloud-native UCaaS platforms integrate via open APIs, streamline provisioning and allow energy firms to spin up new voice, video and messaging services alongside edge workloads. Shifting from on-premises PBXs to scalable, cloud-centric systems also helps reduce lifecycle costs while satisfying regulatory patch-management requirements. As more operational applications become container-based, unified communications embedded within those micro-services enable seamless data flow between control rooms and field teams, driving a tangible uplift in productivity and safety.

Edge-Enabled Remote Asset Collaboration

Chevron and Shell deploy edge gateways that monitor wellhead sensors and instantly trigger voice or video calls when anomalies surface, lowering downtime and travel costs. Augmented-reality headsets let technicians overlay schematics while receiving expert guidance through UCaaS video streams that stay local when connectivity falters. Low-latency processing at the edge ensures critical alerts route through redundant channels, preserving safety compliance even in offshore or desert sites. Edge-enabled workflows therefore upgrade collaboration quality without overloading backhaul links, strengthening the business case for unified communications embedded at site level.

OT-IT Integration Complexity in Legacy Assets

Refineries still depend on decades-old SCADA and DCS platforms that run proprietary protocols and isolate themselves from corporate networks for safety reasons. Introducing cloud-based UCaaS requires secure gateways, protocol converters and rigorous change-management, all of which extend roll-out timelines. Resistance also stems from plant engineers who prioritize uptime over new features, forcing phased deployments that blend on-premises voice with modern cloud functions. High consulting and cybersecurity costs therefore curb short-term uptake, particularly among mid-sized asset owners.

Other drivers and restraints analyzed in the detailed report include:

- 5G Private Networks in Oilfields and Plants

- Vendor Shift to Consumption-Based Pricing

- Persistent Data-Sovereignty Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Telephony retained the biggest slice of the UCaaS in energy market share at 37.5% in 2024, supported by voice-centric safety protocols across plants and pipelines . Yet Contact-Center-as-a-Service (CCaaS) is projected to post a 17.86% CAGR through 2030 as utilities deploy AI chatbots and omnichannel interfaces to handle outage reports and billing queries. This pivot improves satisfaction scores while trimming call-handling costs.

Beyond front-office gains, CCaaS also integrates with outage-management systems and smart-meter data, letting agents proactively alert customers during grid events. Collaboration suites, unified messaging and conferencing tools meanwhile serve internal teams by unifying desktop, mobile and field devices. Across the forecast, the UCaaS in energy market size attributable to "other services" such as API integrations will expand steadily as operators embed communications within IoT and maintenance workflows.

Public cloud instances commanded 60.4% of the UCaaS in energy market size in 2024 due to rapid spin-up times and minimal hardware needs. However enterprises seeking local data residency for SCADA conversations or incident recordings are driving hybrid models toward a 21.2% CAGR. Hybrid designs route low-risk traffic via hyperscale regions while anchoring sensitive streams in on-premises or edge nodes.

This architecture balances agility with compliance and has become popular among European utilities navigating strict privacy statutes. Private deployments remain vital for nuclear plants and offshore rigs where full isolation is mandatory, yet rising maintenance costs encourage gradual migration of non-critical workloads to cloud touchpoints, underscoring hybrid's long-term appeal.

The Unified Communication As-A-Service in Energy Market Report Segments the Industry Into by Component (Telephony, Collaboration Tools, Unified Messaging, Conferencing, and More), Deployment Model (Private, Public, and Hybrid), Enterprise Size (Large Enterprise, and Small and Medium Enterprise), Energy Subsector (Oil and Gas, Power Generation, and More), and Geography.

Geography Analysis

North America's 44.3% 2024 revenue share reflects a large installed base of digital oilfields, smart-grid pilots and mature cloud infrastructure. Federal stimulus for grid resilience coupled with private-5G pilots in shale basins underpin continued demand. The UCaaS in energy market size attributable to utilities alone is set to climb as investor-owned firms upgrade contact centers to manage electrification queries.

Asia-Pacific will expand at a 19.8% CAGR through 2030 as China accelerates AI-based power-sector reforms and India opens renewable corridors that require cloud-integrated communications . Regional governments endorse domestic data hosting, spurring hybrid models and local edge nodes. Japanese gas distributors and Australian LNG exporters likewise integrate UCaaS to oversee remote assets and meet workforce-safety mandates.

Europe maintains steady momentum driven by Fit-for-55 regulations demanding cyber-secure, interoperable grids. Cross-border energy exchanges and offshore wind clusters necessitate real-time coordination among TSOs and service vessels. Eastern European grids, seeking to reduce Russian gas dependency, invest in cloud-native dispatch tools. Meanwhile, Middle East and Africa embrace private-LTE and 5G for mega-projects, yet connectivity gaps in rural production sites restrain full-scale adoption. Across all regions, regulatory clarity and reliable broadband remain key determinants of rollout pace.

- Verizon Communications Inc.

- Microsoft Corporation

- Cisco Systems, Inc.

- RingCentral, Inc.

- Google LLC

- 8x8, Inc.

- Zoom Video Communications, Inc.

- Avaya LLC

- BT Group plc

- Vodafone Group Plc

- AT&T Inc.

- Vonage Holdings Corp.

- Genesys Telecommunications Laboratories, Inc.

- Twilio Inc.

- Mitel Networks Corporation

- NEC Corporation

- ALE International SAS

- West Technology Group, LLC

- Plantronics, Inc.

- Fuze, Inc.

- Tata Communications Limited

- Orange SA

- GoTo Group, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of cloud-native energy IT ecosystems

- 4.2.2 Edge-enabled remote asset collaboration

- 4.2.3 5G private networks in oilfields and plants

- 4.2.4 Vendor shift to consumption-based pricing

- 4.2.5 O-RAN integration with UCaaS for field comms

- 4.2.6 Cyber-resilient voice/video mandates by regulators

- 4.3 Market Restraints

- 4.3.1 OT-IT integration complexity in legacy assets

- 4.3.2 Persistent data-sovereignty hurdles

- 4.3.3 Volatile energy prices delaying IT cap-ex

- 4.3.4 Limited last-mile connectivity in remote sites

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Telephony

- 5.1.2 Collaboration Tools

- 5.1.3 Unified Messaging

- 5.1.4 Conferencing

- 5.1.5 Contact-Center-as-a-Service

- 5.1.6 Other Services

- 5.2 By Deployment Model

- 5.2.1 Public

- 5.2.2 Private

- 5.2.3 Hybrid

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises

- 5.4 By Energy Sub-Sector

- 5.4.1 Oil and Gas

- 5.4.2 Power Generation

- 5.4.3 Utilities (TandD)

- 5.4.4 Renewable Energy Assets

- 5.4.5 Mining and Extraction

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Verizon Communications Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Cisco Systems, Inc.

- 6.4.4 RingCentral, Inc.

- 6.4.5 Google LLC

- 6.4.6 8x8, Inc.

- 6.4.7 Zoom Video Communications, Inc.

- 6.4.8 Avaya LLC

- 6.4.9 BT Group plc

- 6.4.10 Vodafone Group Plc

- 6.4.11 AT&T Inc.

- 6.4.12 Vonage Holdings Corp.

- 6.4.13 Genesys Telecommunications Laboratories, Inc.

- 6.4.14 Twilio Inc.

- 6.4.15 Mitel Networks Corporation

- 6.4.16 NEC Corporation

- 6.4.17 ALE International SAS

- 6.4.18 West Technology Group, LLC

- 6.4.19 Plantronics, Inc.

- 6.4.20 Fuze, Inc.

- 6.4.21 Tata Communications Limited

- 6.4.22 Orange SA

- 6.4.23 GoTo Group, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment