|

市场调查报告书

商品编码

1636619

欧洲IP电话与 UCaaS(统一通讯即服务)-市场占有率分析、产业趋势、成长预测(2025-2030 年)Europe IP Telephony And Unified Communications As-a-service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

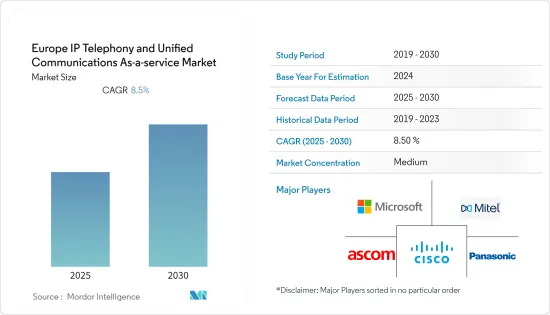

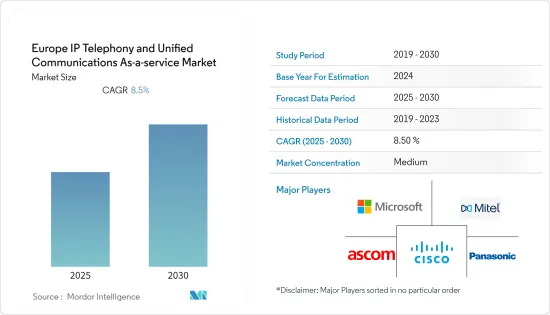

欧洲IP电话和 UCaaS(统一通讯即服务)市场预计在预测期内复合年增长率为 8.5%。

主要亮点

- 欧洲IP电话和UCaaS(统一通讯即服务)市场正在快速成长,为企业创造价值,为服务供应商创造机会。 ISDN(综合业务数位网路)的退役为企业转向基于 IP(网际网路协定)的通讯解决方案(例如线路侧 VoIP、SIP 丛集、云端 PBX 和 UCaaS)创造了机会。

- 过去 20 年来,VoIP 一直呈上升趋势,随着技术进步、行业支持和采用,这个市场似乎不会很快放缓。随着越来越多的人和组织使用和依赖 VoIP,研究和监控市场趋势以确保您的公司充分利用 VoIP 非常重要。

- 在过去几年中,通讯管道已稳步整合为单一服务。 UCaaS(统一通讯即服务)就是从这项技术中诞生的。儘管 VoIP 是基础技术,但这些服务提供的不仅仅是电话通话。 Web 和视讯会议、传真、即时通讯和团队协作功能是可以整合到单一服务平台中的其他一些服务。

- 使用 UCaaS 的最大好处之一是,无需单独购买和安装视讯和音讯设备、即时通讯软体和电话解决方案,从而节省了建立通讯网路的时间和金钱。

- UCaaS 的另一个重要优势是它是云端基础的。这意味着客户只要有网路接入,就可以从任何地方存取和登录,这就是 5G 发挥作用的地方。 UCaaS是云端基础的,因此很容易与其他行销工具整合。

- VoIP 是企业在这些不确定时期迅速适应需求的工具,当时大部分劳动力被迫在家工作以遏制新冠病毒感染的上升。员工需要科技来与同事保持联繫和协作。 VoIP 通话透过 Internet 进行,让员工可以使用家庭 Internet 连线呼叫同事、参加视讯会议并保持联繫。随着许多 IT 和通讯行业将企业活动转移到线上以在 COVID-19 封锁期间继续业务,对云端基础的UCC 解决方案的需求正在不断增加。 UCC 解决方案由 UCC、企业语音通信和远距临场系统组成,大多数通讯供应商(包括 Google、Microsoft 和 Zoom)都提供 UCC 解决方案,并提供具有成本效益的通讯平台,可降低业务成本、提高生产力。

欧洲IP电话和 UCaaS 市场趋势

5G 采用推动市场

- 5G 是第五代无线网路技术,预计将彻底改变网路连线。其主要优点包括更快的网路速度、更快的反应时间以及消除资料传输过程中的封包遗失和抖动。 VoIP 用户将受益于改进的通话品质、拨打和接听电话时更快的连接以及更高的容量。

- 欧盟委员会很早就认识到5G的潜力,并于2013年成立了5G官民合作关係(5G-PPP),以加速5G研发。欧盟委员会已拨款超过 7 亿欧元的公共资金来支持 Horizon 2020 计画下的这项工作。

- Telefonica 德国公司(品牌名称为 O2)打算部署该基地台以增加大型活动的容量。每个行动装置都有一个最长可达 30 公尺的天线。 O2 客户可以使用各种频段(包括 3.6GHz 频段)从基地台获得 4G 和 5G 覆盖范围。

- 5G环境将比4G快20倍,速度和资料处理能力的提升将使人工智慧技术能够近乎即时地处理大量资料。现在,您可以使用更强大的线上协作工具,延迟更低,连线速度更快。 5G 无线将把网路服务推向新的高度,在办公室、家庭和旅途中提供更快的通讯,并支援新一代远端协作工具。

- 随着 5G 的发展,UCaaS 将促进更强大的通讯和协作解决方案的整合和交付。

人工智慧融合将驱动市场

- 人工智慧在许多领域都取得了长足的进步,VoIP 产业也不例外。例如,依靠人工拨打和接听电话的客服中心可以改善服务交付。这可以透过为消费者提供人工智慧辅助的自助解决方案和选项来实现,让人类代理人只处理最困难的问题。

- 人工智慧还可以评估客服中心客服人员与客户之间的互动,并预测客户行为以及他们最常被问到的问题。一旦以易于理解的方式提取这些资料,人工代理就可以透过预测客户的需求并在更短的时间内解决问题来更好地服务客户。

- 2022 年 2 月,欧洲云端和 EDGE 供应商 G-Core Labs 宣布在欧洲推出新的公共 AI 云端服务。该公司表示,选择IPU系统是为了满足对强大、高效和安全的云端基础的人工智慧日益增长的需求。为了满足欧洲公司、领先实验室和研究机构的资料主权需求,G-Core Labs的首个IPU服务将建立在卢森堡的初始IPU丛集上,预计将在中欧进一步发展。

- STARLIGHT 是欧盟支持的创新计划,旨在增强欧盟在执法机构 (LEA) 人工智慧 (AI) 领域的战略自主权,于 2021 年 10 月 1 日启动。 STARLIGHT 是由 CEA(法国替代能源和核能委员会)主导的一个为期四年的协作创新计划,旨在提高执法部门对人工智慧的合法和道德使用的了解,以加强调查和网路安全业务,并支持人工智慧协助打击犯罪和原子能委员会。

- 与当今仅透过 VoIP 技术实现的优势相比,人工智慧和 VoIP 正在对技术产生巨大影响。特别是在通讯领域,人工智慧正被用于传送 VoIP,为小型企业到大型企业带来更多好处并提高效率。

欧洲IP电话和 UCaaS 产业概述

欧洲IP电话和 UCaaS(统一通讯即服务)市场因不同区域参与企业的存在而被细分。此外,主要企业正在采取併购和产品创新等多种策略,以获得相对于竞争对手的优势。

- 2021年9月,RingCentral获得了统一许可,允许该公司在印度提供UCaaS(统一通讯即服务)和CCaaS(联络中心即服务)解决方案。这使得 RingCentral 成为第一家在印度提供完全相容的语音和其他统一云端通讯的全球云端供应商。 RingCentral 为各种规模的全球企业提供了在印度和世界各地使用 RingCentral 的讯息和视讯电话 (MVP) 解决方案的权限,加速了他们的云端之旅。

- 2021 年 11 月,RingCentral, Inc. 宣布与全球商业通讯先驱 Mitel 达成策略协议,为 Mitel 的全球客户群提供存取 RingCentral 的云端通讯平台讯息 Video Telephony (MVP) 的无缝迁移路线。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19对国内付款市场的影响

第五章 主要市场细分

- 按解决方案

- 硬体

- 软体

- 按类型

- 整合接入/对话启动协定(SIP) 集群

- 託管IP PBX

- 託管 IP PBX

- 按组织规模

- 大公司

- 小型企业

- 按最终用户

- BFSI

- 医疗保健

- 零售

- 资讯科技/通讯

- 政府机构

- 製造业

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Freshworks Inc

- Intermedia.net, Inc

- Microsoft

- Mitel Networks Corp.

- Ooma, Inc

- RingCentral MVP

- Vonage

- Ziff Davis, Inc.

- 8x8, Inc.

- Ascom Holding AG

- Cisco Systems, Inc.

- Panasonic Corporation

- NEC Corporation

- Grandstream Networks, Inc.

- DIALPAD, INC.

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 91209

The Europe IP Telephony And Unified Communications As-a-service Market is expected to register a CAGR of 8.5% during the forecast period.

Key Highlights

- The European market for IP telephony and unified communications as a service (UCaaS) is growing rapidly, generating value for enterprises and opportunities for service providers. Decommissioning of the Integrated Services Digital Network (ISDN) is creating chances for enterprises to migrate to Internet Protocol (IP)-based communications solutions, such as line-side voice over IP (VoIP), SIP trunking, cloud private branch exchange (PBX), and UCaaS.

- VoIP has been increasing for the past two decades, and with technology advancements, industry support, and widespread use, it does not appear that this market will slow down anytime soon. As more people and organizations use and rely on VoIP, it's important to research and monitor market trends to ensure that you and your company are getting the most out of it.

- Communication channels have been steadily consolidated into a single service during the last few years. Unified Communications as a Service was born due to this technique (UCaaS). Although VoIP is the underlying technology, these services provide much more than just phone calls. Web and video conferencing, faxing, instant messaging, and team collaboration features are some of the other services that can be integrated into a single service platform.

- One of the most significant benefits of utilizing UCaaS is that it may save organizations time and money when setting up their communications networks because they won't have to buy and install separate video and audio equipment, instant messaging software, or phone solutions.

- Another key benefit of UCaaS is that it is cloud-based, which is why organizations should keep an eye on it. This means that customers can access it or log in from wherever as long as they have access to the Internet, which is where 5G comes in. Because UCaaS is cloud-based, linking it with other marketing tools is simple.

- VoIP was the tool that businesses quickly adapted to meet their needs in these uncertain times when a large portion of the working world was sent to work from home to help stem the rising tide of COVID infections. Employees needed technology to keep them connected to and collaborate with their coworkers. Employees might work from home and use their domestic Internet connections to call coworkers, participate in video conferences, and stay reachable because VoIP calling happens over the Internet. The demand for cloud-based UCC solutions is increasing due to many IT and telecom industries moving their company activities online to continue operations during the COVID-19-imposed lockdown. UCC solutions, comprising UCC, enterprise telephony, and telepresence, are being offered by the majority of telecom providers, including Google, Microsoft, and Zoom, to enable cost-effective communication platforms, lowering business costs, and boost productivity.

Europe IP Telephony and UCaaS Market Trends

Adoption of 5G will drive the Market

- The fifth-generation wireless network technology, 5G, is expected to revolutionize internet connectivity. Its primary benefits include higher internet speeds, shorter reaction times, and eliminating packet loss and jitter during data transmission. VoIP users will benefit from improved call quality, faster connectivity while making and receiving calls, and higher capacity.

- The European Commission recognized 5G prospects early on, forming a public-private partnership on 5G (5G-PPP) in 2013 to speed up 5G research and development. The European Commission has allocated more than EUR 700 million in public funds to support this work under the Horizon 2020 program.

- Telefonica Germany, which goes by the brand name O2, intends to deploy the base stations to boost capacity for huge events. Each mobile device has an antenna that may be extended up to 30 meters. O2 customers can get 4G and 5G coverage from the base stations, which will use a range of spectrum bands, including the 3.6 GHz band.

- With a 20-fold increase in speed over 4G in a 5G setting, Artificial intelligence technologies will be able to process large amounts of data in near real-time as speed and data processing capabilities increase. Using more powerful online collaboration tools with lower latency and faster connectivity will be possible. 5G wireless will catapult internet service to new heights, offering faster speeds in the office, at home, and on the go and supporting a new generation of remote collaboration tools.

- As 5G evolves, UCaaS will facilitate the consolidation and delivery of even more robust communications and collaboration solutions.

Artificial Intelligence Integration will drive the Market

- AI has made enormous strides in many areas, and the VoIP industry is no exception. Service delivery will improve at call centers that rely on humans to make and pick calls, for example. This can be accomplished by giving consumers AI-assisted self-help solutions and options, leaving human agents to handle only the most difficult issues.

- AI can also evaluate call center interactions between agents and customers to forecast customer behavior and the most frequently asked questions. Human agents can better serve clients by predicting what they need and resolving their issues in less time once this data has been distilled into an understandable manner.

- In February 2022 - G-Core Labs, a European cloud and EDGE provider, introduced a new public AI cloud service in Europe, which the company claims to use Graphcore Intelligence Processing Units. The company stated that it chose IPU systems to fulfill the growing demand for cloud-based AI that is powerful, efficient, and safe. To fulfill the data sovereignty demands of European corporations, major labs, and research institutions, G-Core Labs' first IPU service will be constructed on an initial IPU cluster in Luxembourg, with further development anticipated in Central Europe.

- STARLIGHT, a European Union-backed innovation project aimed at increasing the EU's strategic autonomy in the field of artificial intelligence (AI) for law enforcement agencies (LEAs), began on October 1, 2021. STARLIGHT is a four-year collaborative innovation project led by CEA (the French Alternative Energies and Atomic Energy Commission) to improve law enforcement agencies' understanding of AI's legal and ethical use, bolstering their investigative and cybersecurity operations and assisting them in combating the misuse of AI-supported crime and terrorism.

- Compared to today's benefits achieved only through VoIP technology, artificial intelligence and VoIP have significantly impacted technology, specifically in the telecommunications world where artificial intelligence is used for shipping VoIP delivering more benefits and increased efficiency for small businesses to large.

Europe IP Telephony and UCaaS Industry Overview

The Europe IP Telephony and Unified Communications as- a- service market is fragmented due to the presence of various regional players. In addition, key companies are involved in multiple strategies such as mergers & acquisitions and product innovation, among others, to gain a competitive edge over others.

- In September 2021 - RingCentral received a Unified License, allowing it to offer its Unified Communications as a Service (UCaaS) and Contact Center as a Service (CCaaS) solutions in India. This makes RingCentral the first global cloud provider to offer fully compliant voice and other unified cloud communications in India. RingCentral will give global enterprises of all sizes access to RingCentral's Message Video Phone (MVP) solutions globally, including in India, to help them speed their journey to the cloud.

- In November 2021 - RingCentral, Inc. announced a strategic agreement with Mitel, a global pioneer in business communications, to provide Mitel's global client base with a seamless migration route to RingCentral's Message Video Phone (MVP) cloud communications platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the payments market in the country

5 Key Market Segments

- 5.1 By Solution

- 5.1.1 Hardware

- 5.1.2 Software

- 5.2 By Type

- 5.2.1 Integrated Access/Session Initiation Protocol (SIP) Trunking

- 5.2.2 Managed IP PBX

- 5.2.3 Hosted IP PBX

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 Healthcare

- 5.4.3 Retail

- 5.4.4 IT & Telecom

- 5.4.5 Government

- 5.4.6 Manufacturing

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Freshworks Inc

- 6.1.2 Intermedia.net, Inc

- 6.1.3 Microsoft

- 6.1.4 Mitel Networks Corp.

- 6.1.5 Ooma, Inc

- 6.1.6 RingCentral MVP

- 6.1.7 Vonage

- 6.1.8 Ziff Davis, Inc.

- 6.1.9 8x8, Inc.

- 6.1.10 Ascom Holding AG

- 6.1.11 Cisco Systems, Inc.

- 6.1.12 Panasonic Corporation

- 6.1.13 NEC Corporation

- 6.1.14 Grandstream Networks, Inc.

- 6.1.15 DIALPAD, INC.

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219