|

市场调查报告书

商品编码

1628852

製造业中的 UCaaS:市场占有率分析、行业趋势和成长预测(2025-2030 年)UCaaS In The Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

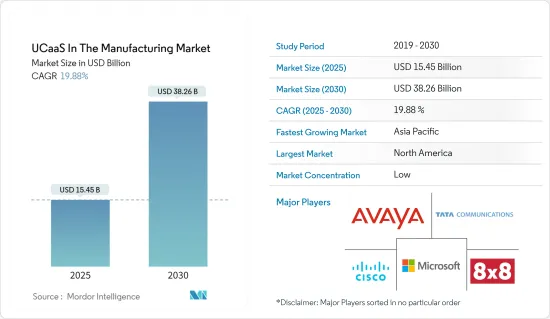

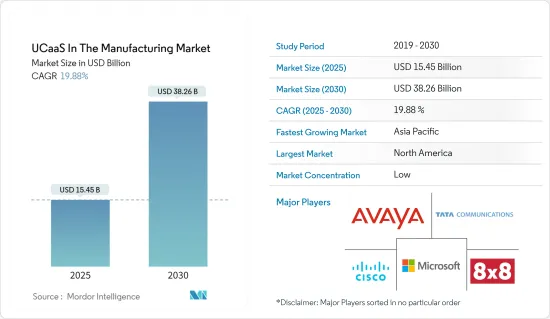

製造业的 UCaaS 市场规模预计到 2025 年为 154.5 亿美元,预计到 2030 年将达到 382.6 亿美元,预测期(2025-2030 年)复合年增长率为 19.88%。

主要亮点

- 整合通讯即服务 (UCaaS) 正在透过提供统一通讯和协作解决方案来改变製造业,从而提高业务效率、简化流程并促进创新。

- 製造业中 UCaaS 市场的成长是由地理分散的团队之间无缝通信的需求不断增长、远端工作的增加以及行业内的数位转型工作所推动的。製造商正在使用 UCaaS 来改善内部和外部通讯、减少停机时间并透过即时资料共用和协作工具增强决策流程。

- 此外,UCaaS 解决方案的扩充性和灵活性使其成为各种规模的製造公司的理想选择。製造业中小型企业 (SME) 可以受益于 UCaaS 的成本效率和扩充性,使他们无需大量前期投资即可获得先进的通讯和协作工具。这种技术的民主化将使中小企业能够透过提高业务效率和敏捷性来更有效地与大公司竞争。

- 例如,统一通讯、SIP 中继、业务通讯、Microsoft Teams 直接路由和客服中心解决方案的整合通讯于 2024 年 8 月宣布推出下一代整合通讯。 。 MyCloud UCaaS 的设计初衷是为了最大限度地提高 Linevent 的白牌和联合品牌经销商合作伙伴的收益。

- 此外,与 Office 365 集成的 Microsoft Teams 允许製造团队协作处理文件、举行虚拟会议以及与各种业务应用程式集成,以简化工作流程并提高生产力。 RingCentral 的 UCaaS 解决方案提供了一套全面的通讯工具,包括语音、视讯、通讯和客服中心功能,这对于维持製造业的高效通讯管道至关重要。

- 总之,製造业 UCaaS 市场的成长是由加强沟通和协作的需求、数位转型的兴起以及物联网等先进技术的整合所推动的。

製造业UCaaS市场趋势

云端部署模式部分预计将占据主要市场占有率

- 製造业中的统一通讯即服务 (UCaas)云端部署为寻求增强协作和能力的组织提供了多种优势。製造业根据其生产週期和业务成长可能有不同的通讯需求。这样的解决方案可让您根据需要增加或减少通讯资源,使您能够回应不断变化的需求,而不会过度使用资源。

- 采用云端无需在硬体、软体和基础设施方面进行大量前期投资。製造商可以避免与购买、维护和升级本地设备相关的成本,而是以订阅方式支付 UCaas 服务费用。

- 此外,NTT 资料将在 2023 年 11 月解决组织在优化协作工具方面面临的挑战,特别是在整合通讯(UC) 和即服务( UCaaS) 领域。层级构造服务。 UCaaS 等云端交付模式为企业提供了一整套通讯和协作应用程式和服务。 UCaaS 可以将语音通话、视讯会议和即时通讯等各种通讯工具整合到一个统一平台中。

- 此外,与传统的本地系统相比,这些解决方案的部署速度相对较快。这对于营运敏捷性和应变能力至关重要的製造业尤其有价值。云端基础的Ucaas 支援远端和行动存取通讯工具。这在员工可能位于远端位置的车间的製造环境中非常重要。远端存取提高了协作和沟通的效率。

- 製造环境中的物联网设备从机器、感测器和设备收集大量资料。这些资料被发送到云端进行储存、分析和视觉化。云端平台提供处理这些资料并从中获取见解所需的运算能力和储存。根据Cisco的说法,物联网 (IoT) 是一个普遍的系统,其中人、资料、流程和事物连接到互联网并相互连接。全球整体M2M 连线预计将成长 2.4 倍,从 2018 年的 61 亿成长到 2023 年的 147 亿。到 2023 年,全球每人将拥有 1.8 个 M2M 连线。

亚太地区市场预计将显着成长

- 由于世界製造地中国、印度和日本等经济强国的存在,亚太地区预计将显着成长。该地区是多个新兴经济体的所在地,并已成为製造业强国。随着这些经济体的不断发展,对高效通讯和协作解决方案的需求不断增加,这使得 UCaaS 成为一个有价值的提案。

- IBEF表示,印度製定了一项旨在2025年将製造业占GDP比重提高到25%的国家製造业政策,以及一项旨在到2025年将製造业占GDP比重提高到25%的国家製造业政策,以及 2022 年制定国家製造业倡议,发展符合全球製造业标准的核心製造业。

- 根据GSMA预测,到2025年,40-50%的中国行动用户将使用5G。该国在网路虚拟、融合和切片方面正在取得更多进展。各国政府也开始将独立网络作为初始 5G 部署的一部分,从头开始建立 5G 网络,而不是花时间将 4G 网路演进为 5G 网路。它也有助于当地供应商的发展。

- 此外,2023 年 6 月,RingCentral 在印度推出了云端语音通信服务。 RingCentral 宣布,透过此举,它已成为印度第一家提供合规企业级云端语音通信的全球云端供应商。在印度建立云端电话服务的供应商向位于印度的跨国公司提供云端电话功能,从而实现与客户、合作伙伴、领导和员工的顺畅沟通。

- 此外,印度政府的「印度製造」等倡议鼓励企业在印度製造产品,并鼓励对製造业的大量投资,为市场呈指数级增长提供了机会。因此,所有这些因素预计将补充该地区製造业市场中整合通讯即服务的成长。

- 此外,旨在让中国在全球高科技製造业中占优势的「中国製造2025」等政府倡议正在对其他地区产生影响并推动市场发展。该计划的重点是製造电动车和其他新能源汽车、下一代资讯技术(IT)和通讯、以及先进的机器人和人工智慧。预计这将推动製造业的整合通讯即服务 (UCaaS)。

製造业 UCaaS 产业概述

製造业的整合通讯即即服务(UCaaS) 市场高度分散,主要参与者包括Cisco、Tata Communications、Abaya、8X8 和 Microsoft。市场上的公司正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场洞察

- 市场驱动因素

- 行动性和 BYOD 趋势不断增长

- 一体化供应链管理

- 市场限制因素

- 缺乏整合通讯即即服务的意识

第六章 市场细分

- 按公司规模

- 小型企业

- 企业

- 按发展

- 本地

- 云

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 世界其他地区

- 北美洲

第七章 竞争格局

- 公司简介

- Cisco Systems, Inc.

- Tata Communications Limited

- Avaya Inc.

- 8X8, Inc.

- Microsoft Corporation

- Dimension Data

- DXC Technology Company

- Getronics

- IBM Corporation

- Mitel Networks Corporation

- RingCentral, Inc

- Verizon Wireless(Verizon Communications)

第八章投资分析

第9章市场的未来

The UCaaS In The Manufacturing Market size is estimated at USD 15.45 billion in 2025, and is expected to reach USD 38.26 billion by 2030, at a CAGR of 19.88% during the forecast period (2025-2030).

Key Highlights

- Unified Communication as a Service (UCaaS) is transforming the manufacturing industry by offering integrated communication and collaboration solutions that enhance operational efficiency, streamline processes, and foster innovation.

- The growth of the UCaaS market in manufacturing is driven by the increasing need for seamless communication across geographically dispersed teams, the rise of remote work, and the digital transformation initiatives within the industry. Manufacturers are leveraging UCaaS to improve internal and external communication, reduce downtime, and enhance decision-making processes through real-time data sharing and collaboration tools.

- Moreover, the scalability and flexibility of UCaaS solutions make them ideal for manufacturing companies of all sizes. Small and medium-sized enterprises (SMEs) in the manufacturing sector can benefit from the cost-effective and scalable nature of UCaaS, which allows them to access advanced communication and collaboration tools without significant upfront investment. This democratization of technology is enabling SMEs to compete more effectively with larger players by enhancing their operational efficiency and agility.

- For instance, in August 2024, Reinvent Telecom, which is a provider of wholesale unified communications, SIP trunking, business messaging, direct routing for Microsoft Teams and contact center solutions, launched MyCloud UCaaS, its next-generation unified communications and collaboration (UC&C) platform. MyCloud UCaaS was designed from the ground up to maximize revenue for Reinvent's white-label and co-branded reseller partners.

- In addition to this, Microsoft Teams, integrated with Office 365, enables manufacturing teams to collaborate on documents, hold virtual meetings, and integrate with various business applications, thereby streamlining workflow and enhancing productivity. RingCentral's UCaaS solutions provide a comprehensive suite of communication tools, including voice, video, messaging, and contact center capabilities, which are crucial for maintaining efficient communication channels within manufacturing operations.

- In conclusion, the growth of the UCaaS market in the manufacturing industry is being propelled by the need for enhanced communication and collaboration, the rise of digital transformation, and the integration of advanced technologies such as IoT.

UCaaS Manufacturing Market Trends

Cloud Deployment Model Segment is Expected to Hold Significant Market Share

- Cloud deployment of UCaas (Unified Communication as a Service) in manufacturing offers various benefits to organizations seeking to enhance their collaboration and capabilities. Manufacturing operations can experience varying communication demands based on production cycles and business growth. These solutions allow manufacturers to scale their communication resources up or down as needed, ensuring they can accommodate changing requirements without over-committing resources.

- Cloud deployment eliminates the need for substantial upfront investments in hardware, software, and infrastructure. Manufacturers can avoid the costs associated with purchasing, maintaining, and upgrading on-premises equipment and instead pay for UCaas services on a subscription basis.

- Furthermore, in November 2023, NTT DATA announced EX Managed Services which is a two-tier service that's designed to address the challenges faced by organizations in optimizing their collaboration tools particularly in the areas of unified communications (UC) and unified communications as a service (UCaaS). A cloud-delivery model such as UCaaS makes a comprehensive set of communication and collaboration applications and services available to enterprises. UCaaS can bring together a range of communication tools, such as voice calling, videoconferencing and instant messaging, into a single unified platform.

- In addition to this, these solutions can be deployed relatively quickly compared to traditional on-premises systems. This is particularly valuable in manufacturing, where operational agility and responsiveness are crucial. Cloud-based Ucaas enables remote and mobile access to communication tools. This is important in manufacturing environments where employees may locate on the production floor remotely. Remote access enhances collaboration and communication efficiency.

- IoT devices in manufacturing environments collect vast amounts of data from machines, sensors, and equipment. This data can be sent to the cloud for storage, analysis, and visualization. Cloud platforms provide the computational power and storage needed to process and derive insights from this data. According to Cisco Systems, the Internet of Things (IoT) has become a prevalent system in which people, data, processes, and things connect to the Internet and each other. M2M connections are expected to grow 2.4-fold globally, from 6.1 billion in 2018 to 14.7 billion by 2023. There would be 1.8 M2M connections for each member of the global population by 2023.

Asia Pacific Expected to Witness Significant Growth in the Market

- Asia-Pacific is expected to witness significant growth owing to the presence of the global manufacturing hub, i.e., China, and other big economies such as India and Japan. The region is home to several emerging economies and an established manufacturing powerhouse. As these economies continue to develop, there is a growing need for efficient communication and collaboration solutions, making UCaaS a valuable proposition.

- According to IBEF, India is gradually progressing on the road to Industry 4.0 through the Government of India's initiatives like the National Manufacturing Policy, which aims to increase the share of manufacturing in GDP to 25% by 2025, and the PLI scheme for manufacturing which was launched in 2022 to develop the core manufacturing sector at par with global manufacturing standards.

- According to the GSMA, by 2025, 40-50% of China's mobile users may be using 5G. The country is gaining more regarding network virtualization, convergence, and slicing. The government also started to include standalone as part of its initial 5G deployment, owing to building a 5G network from the ground rather than spending the time to evolve a 4G network into a 5G network. It has also helped the growth of local vendors.

- Moreover, in June 2023, RingCentral launched Cloud Telephony Service in India. RingCentral announced the move makes it India's first global cloud provider to provide compliant enterprise-grade cloud telephony. The vendor establishing a cloud phone service in India enables multinational organizations with a basis in India to access cloud phone capabilities, empowering smoother communication with customers, partners, leaders, and workers.

- Additionally, Indian government initiatives such as Make in India which encourages companies to manufacture their products in India and enthuse with dedicated investments into manufacturing, are providing an opportunity for the market to grow exponentially. Therefore, all the factors are expected to complement the growth of the unified communication-as-a-service in the manufacturing market in the region.

- Furthermore, government initiatives such as Made in China 2025, which aim to make China dominant in the global high-tech manufacturing sector, are influencing other regions, which in return is driving the market. This initiative is focused on manufacturing electric cars and other new energy vehicles, next-generation information technology (IT) and telecommunications, and advanced robotics and artificial intelligence. It is expected to drive the unified communication-as-a-service in the manufacturing market.

UCaaS Manufacturing Industry Overview

Unified Communication-as-a-service in the Manufacturing market is highly fragmented, with the presence of major players like Cisco Systems, Inc., Tata Communications, Avaya Inc., 8X8, Inc., and Microsoft Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Growing Trends Towards Mobility and BYOD

- 5.1.2 Integrated Supply Chain Management

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness About the Unified Communication-as-a-service

6 MARKET SEGMENTATION

- 6.1 By Business Size

- 6.1.1 Small and Midsize Business

- 6.1.2 Enterprise

- 6.2 By Deployment Mode

- 6.2.1 On-Premises

- 6.2.2 Cloud

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Rest of World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems, Inc.

- 7.1.2 Tata Communications Limited

- 7.1.3 Avaya Inc.

- 7.1.4 8X8, Inc.

- 7.1.5 Microsoft Corporation

- 7.1.6 Dimension Data

- 7.1.7 DXC Technology Company

- 7.1.8 Getronics

- 7.1.9 IBM Corporation

- 7.1.10 Mitel Networks Corporation

- 7.1.11 RingCentral, Inc

- 7.1.12 Verizon Wireless (Verizon Communications)