|

市场调查报告书

商品编码

1631610

北美聊天机器人:市场占有率分析、产业趋势/统计、成长预测(2025-2030)North America Chatbot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

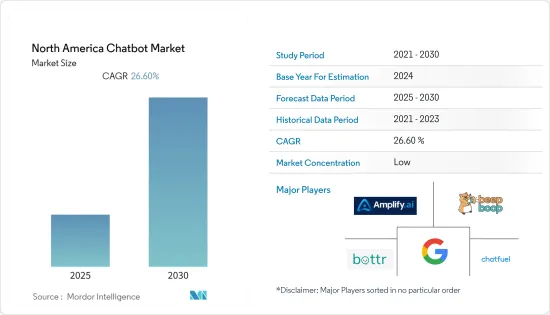

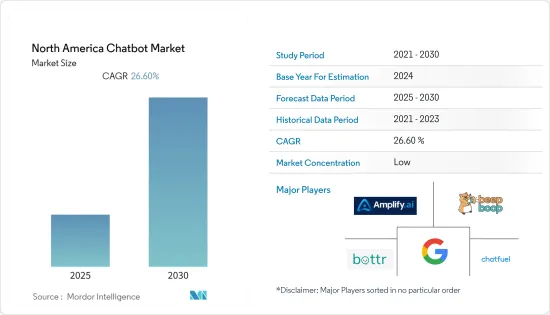

北美聊天机器人市场预计在预测期内复合年增长率为 26.6%。

主要亮点

- 市场正在出现一些关键趋势,包括企业更多地采用顾客关怀服务来降低营运成本、通讯服务的显着增加以及自然语言处理(NLP) 和人工智慧技术的发展,预计将展现出令人印象深刻的趋势。

- 高度对话式的聊天机器人应用程式使企业能够创建跨各种数位管道和设备进行互动的无摩擦客户旅程。一些开发的聊天机器人平台允许企业捕获和分析整个对话,以了解客户的声音。

- 最好的人工智慧聊天机器人系统可以帮助公司简化业务流程并提高生产力。例如,机器人流程自动化 (RPA) 和其他人工智慧资产越来越多地整合到聊天机器人中,为大量流程提供「零干预」解决方案。

- COVID-19 的爆发对北美聊天机器人市场产生了积极影响。北美各国政府宣布的封锁措施导致更多采用聊天机器人来解决医疗保健、BFSI、零售和电子商务等行业的巨大查询负担。此外,聊天机器人还帮助多个组织设定了稳定的远端工作条件。这增加了对聊天机器人的需求,并带动了整体市场的成长。

- 此外,使用互动式人工智慧聊天机器人可以减少沟通不良和错误的可能性,从而提高准确性和更好的结果。机器人可以透过语音和文字进行通信,并且可以部署在应用程式、网站和通讯管道(例如 Whatsapp、Facebook Messenger 和 Twitter)中。

北美聊天机器人市场趋势

BSFI预计将大幅成长

- 聊天机器人简化了操作,并以对话方式安全地引导客户完成各种财务操作。消费者可以独立执行简单的操作,例如验证帐户、报告被盗卡、付款、续保和管理退款。

- 即时聊天作为一种成功的客户参与方式的接受以及聊天机器人技术的普及正在为市场提供者创造许多新的机会。

- 银行聊天机器人可以包含在专用的行动银行应用程式中,也可以作为单独的功能嵌入银行网站上。根据其来源,聊天机器人可以是个人化的,也可以是现成的。自订人工智慧助理更有效和安全,因为它们是按照精确的规格建造的,并且受到机器人所整合的金融机构的密切控制。现成的机器人是通用机器人,其设计目的是尽可能通用,同时仍允许一定程度的客製化。

- 多家公司正采取策略措施采用互动式人工智慧技术。例如,美国银行推出了一个聊天机器人,可以向用户发送通知、告诉他们余额、建议储蓄并提供信用报告更新。

- 今年 8 月,西太平洋银行 (Westpac) 和 FIS 向人工智慧聊天机器人公司 Kasisto 进行了资金筹措,宣布利用金融服务数位体验平台 KAI 技术,实现数位化消费者互动的人性化。

- 此外,去年 9 月,面向银行和信用社的人工智慧聊天机器人平台 Finn AI 宣布,其互动式人工智慧聊天机器人现已作为 Genesys AppFoundry 上的高级客户端应用程式提供。

美国占最高市场占有率

在美国,医疗保健聊天机器人和金融聊天机器人有大量投资和创新,市场正在向人工智慧聊天机器人和语音辨识聊天机器人技术发展。许多供应商都希望透过聊天机器人来增强该国的客户服务。

- 社群媒体管理是电子商务和顾客关怀之间的新介面,市场供应商正在将人工智慧功能引入世界各地的行销、销售和支援团队,使他们能够大规模提供重要的体验。例如,去年8月,社群媒体管理公司Hootsuite以6,000万美元收购了人工智慧聊天机器人公司Heyday。

- 同样,去年 9 月,人工智慧主导的能力参与和沟通平台解决方案的着名供应商 Sense 宣布推出用于招募的人工智慧聊天机器人。 Sense 的 AI 聊天机器人提供流畅的集成,可快速引导和监控更多合格的候选人,同时提供白手套、个人化、以候选人为中心的体验。

- 聊天机器人可以提供常见问题的解答,包括有关 COVID-19、通讯协定、您所在地区正在进行的工作以及可选服务的资讯。此外,市场上的供应商正致力于发展其服务以增强客户服务体验。今年7月,美国全面监管的公用事业公司NIPSCO宣布推出聊天机器人和即时聊天技术,提供改善的客户体验。

- 许多Start-Ups正在进入聊天机器人市场,以帮助组织更好地沟通。例如,今年3月,inFeedo宣布筹集1,200万美元A轮资金筹措。 inFeedo 充当员工和经理之间的联络人,透过一个名为 Amber 的聊天机器人进行调查,该公司将其称为「首席监听官」。

北美聊天机器人产业概况

- 北美聊天机器人市场高度分散,由大量全球和区域参与者组成。这些参与者占据了很大的市场份额,并致力于在全球范围内扩大基本客群。为了在预测期内保持竞争力,这些公司将投资于研发、策略联盟以及其他有机和无机成长策略。

- 2022 年 10 月,全球云端通讯平台和全通路互动领域的领导者 Infobip 宣布为 Uber 推出一款人工智慧驱动的聊天机器人。这个聊天机器人是世界上第一个能够透过 WhatsApp 预订乘车的机器人。这使得预订乘车变得容易。

- 2022 年 6 月,总部位于纽约的金融科技公司 Greer 宣布收购 FinAI,这是一个面向银行和信用社的人工智慧聊天机器人平台。此次收购使 Greer 能够将虚拟助理带入金融服务公司的「主流」。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- COVID-19 对市场的影响

- 市场驱动因素

- 通讯应用程式的兴起

- 对消费者分析的需求不断增长

- 市场挑战

- 缺乏整合意识且复杂

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 主要技术趋势

第五章市场区隔

- 按公司规模

- 小型企业

- 大公司

- 按行业分类

- 零售

- BFSI

- 卫生保健

- 资讯科技/通讯

- 旅游/酒店业

- 其他最终用户产业

- 按国家/地区

- 美国

- 加拿大

第六章 竞争状况

- 公司简介

- Amplify.ai

- Beep Boop

- Bottr

- Chatfuel

- Conversable

- Gubshup

- IBM

- ManyChat

- Microsoft

- Nuance Communications Inc.

- Octane.ai

- Pandorabots

- Pypestream

- Recime

- Reply.ai

- Semantic Machines

- Yekaliva.ai

- Meya.ai

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 72309

The North America Chatbot Market is expected to register a CAGR of 26.6% during the forecast period.

Key Highlights

- The market is set to display impressive growth during the forecast period with some key trends emerging, such as the growing adoption of customer care services in enterprises to reduce operational costs, a significant rise in messaging services, and development in Natural language processing (NLP) and AI technologies.

- Highly conversational chatbot apps allow enterprises to create frictionless customer journeys as they interact over various digital channels and devices. Some development chatbot platforms enable enterprises to capture and analyze entire conversations to understand the voice of the customer.

- The best AI chatbot systems enable enterprises to streamline business processes and increase productivity allowing organizations to do more without increasing headcount. For example, robotic process automation (RPA) and other AI assets are increasingly integrated into chatbots to deliver 'zero intervention' solutions for high-volume processes.

- The covid-19 pandemic has positively affected the North American Chatbot market. Due to the lockdown announced by the government in North America, the adoption of chatbots to solve the huge burden of queries in various verticals such as healthcare, BFSI, retail & e-commerce, among others, has increased. In addition, the chatbot helped multiple organizations set up stable remote work conditions. This led to the increased demand for chatbots and growth in the overall market.

- Moreover, by using Conversational AI chatbots, the chances of miscommunication and errors reduce, thus, leading to improved accuracy and better results. Bots can communicate through voice and text and can be deployed across applications, websites, and messaging channels, such as Whatsapp, Facebook Messenger, or Twitter.

North America Chatbot Market Trends

BSFI is expected to witness a significant growth

- Chatbots simplify operations and guide customers to perform various financial operations conversationally and with complete safety. The consumer can do simple operations independently, such as checking an account, reporting stolen cards, making payments, renewing a policy, and managing a refund.

- A number of new opportunities are emerging for market providers as a result of the growing acceptance of live chats as a successful means of client engagement and chatbot technologies.

- Banking chatbots can be included in dedicated mobile banking apps or as a standalone feature on a bank's website. Chatbots can be personalized or ready-made, depending on their origin. Custom AI assistants are more effective and secure since they are built to exact specifications and under the close control of the financial institution into which the bot will be integrated. Ready-made bots are generic bots designed to be as versatile as possible while allowing for some customization.

- Several companies are taking strategic measures to adopt conversational AI technology. For instance, Bank of America launched a chatbot that sends users notifications, informs them about their balances, makes recommendations for saving money, provides updates to credit reports, and so on.

- In August this year, Westpac and FIS announced their investment of USD 15.5m Series C funding round extension in AI chatbot company Kasisto to leverage their KAI technology, a digital experience platform for financial services across their digital banking capabilities, to humanize digital consumer interactions.

- Moreover, in September last year, Finn AI, the AI-powered chatbot platform for banks and credit unions, announced that its conversational AI chatbot is now available as a premium Client Application on Genesys AppFoundry.

United States to Hold the Highest Market Share

The United States is witnessing significant investments and innovations for health care chatbots and financial chatbots, and the market is driving towards AI chatbots and voice recognition chatbot technology. Various vendors are aiming to enhance customer service in the country with chatbots.

- Social media management is the new interface of e-commerce and customer care, and market vendors are providing AI capabilities to marketing, sales, and support teams worldwide, allowing them to deliver significant experiences at scale. For instance, in August last year, Hootsuite, a social media management company, acquired Heyday, an artificial intelligence chatbot company, for USD 60 million.

- Similarly, in September last year, sense, the prominent provider of AI-driven competency engagement and communication platform solutions, announced the launch of an AI chatbot for recruiting. The Sense AI Chatbot provides a smooth integration that channels and monitors more qualified candidates quickly while still providing white-glove, personalized candidate-focused experiences.

- The chatbots can provide answers to frequently asked questions, such as information about COVID-19, protocols, work taking place in the user's area, and optional services. Further, market vendors are focusing on service advancements for an enhanced customer service experience. In July this year, NIPSCO, a fully-regulated utility company in the United States, announced the launch of chatbots and live chat technologies to provide an improved customer experience.

- Many start-ups are stepping into the chatbot market in order to help organizations better communicate. For instance, in March this year, inFeedo announced that it had raised USD 12 million in Series A funding. inFeedo will act as a bridge between employees and their managers, with surveys executed by a chatbot called Amber, which the company refers to as a "chief listening officer."

North America Chatbot Industry Overview

- The North America Chatbot market is highly fragmented and consists of a significant number of global and regional players. These players account for a considerable share of the market and focus on expanding their client base across the globe. To remain competitive during the forecast period, these companies will invest in R&D, strategic alliances, and other organic and inorganic growth strategies.

- In October 2022, Infobip, a global cloud communication platform and leader in omnichannel engagement, announced the launch of an AI-powered chatbot for Uber. The chatbot is a world first because it lets people book rides through WhatsApp. This makes booking rides easy.

- In June 2022, Glia, a New York-based fintech, announced the acquisition of Finn AI, the artificial intelligence-powered chatbot platform for banks and credit unions. The acquisition will enable Gila to make virtual assistants "mainstream" for financial services companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 on the Market

- 4.3 Market Drivers

- 4.3.1 Rising domination of Messenger Applications

- 4.3.2 Increasing Demand for Consumer Analytics

- 4.4 Market Challenges

- 4.4.1 Lack of Awareness and Integration Complexities

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Key Technology Trends

5 MARKET SEGMENTATION

- 5.1 By Enterprise Size

- 5.1.1 Small and Medium Enterprise

- 5.1.2 Large Enterprises

- 5.2 By End-User Vertical

- 5.2.1 Retail

- 5.2.2 BFSI

- 5.2.3 Healthcare

- 5.2.4 IT and Telecom

- 5.2.5 Travel and Hospitality

- 5.2.6 Other End-User Verticals

- 5.3 By Country

- 5.3.1 United States

- 5.3.2 Cananda

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amplify.ai

- 6.1.2 Beep Boop

- 6.1.3 Bottr

- 6.1.4 Chatfuel

- 6.1.5 Conversable

- 6.1.6 Google

- 6.1.7 Gubshup

- 6.1.8 IBM

- 6.1.9 ManyChat

- 6.1.10 Microsoft

- 6.1.11 Nuance Communications Inc.

- 6.1.12 Octane.ai

- 6.1.13 Pandorabots

- 6.1.14 Pypestream

- 6.1.15 Recime

- 6.1.16 Reply.ai

- 6.1.17 Semantic Machines

- 6.1.18 Yekaliva.ai

- 6.1.19 Meya.ai

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219