|

市场调查报告书

商品编码

1632077

欧洲食品契约製造与包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Food Contract Manufacturing & Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

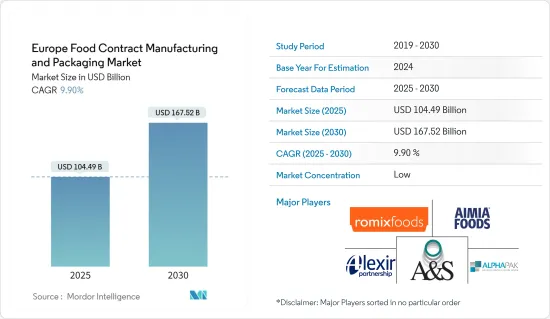

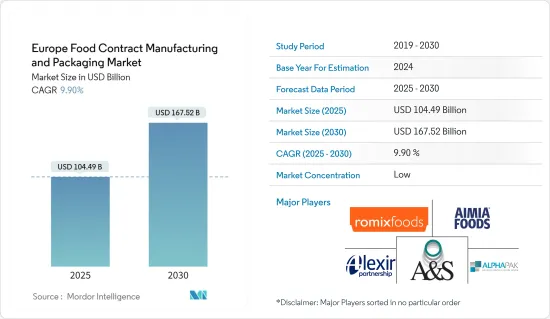

预计2025年欧洲食品契约製造和包装市场规模为1,044.9亿美元,预测期内(2025-2030年)复合年增长率为9.9%,到2030年预计将达到1675.2亿美元。

主要亮点

- 由于不断变化的消费者偏好、技术创新和永续性的推动,欧洲的食品契约製造和包装行业正在经历重大变化。一个显着的趋势是对自有品牌产品的需求不断增长。零售商和超级市场正在寻找具有成本效益的品牌产品替代品,为契约製造製造商以有竞争力的价格提供高品质食品铺平道路。同时,随着注重健康的消费者寻求适合自己的饮食选择,纯素食、无麸质和无过敏原的利基产品显着增加。

- 永续性是欧洲食品生产领域的重要力量。消费者越来越重视环保包装,偏好可回收、生物分解性和可堆肥的材料。这种转变促使食品製造商与擅长创造创新和环保包装解决方案的契约製造製造商合作。此外,人们越来越关注循环经济原则,製造商努力减少食物废弃物,并在製造和包装中采用回收材料。

- 技术进步正在彻底改变该行业,自动化和人工智慧 (AI) 成为食品生产的中心舞台。这些创新提高了效率、降低了成本并确保了产品的一致性。人工智慧应用涵盖预测性维护、品管和库存监控,而自动化则寻求生产的速度和灵活性。包装领域也出现了创新解决方案,可以即时了解产品的新鲜度、温度和有效期,满足当今消费者对便利性和透明度的渴望。

- 健康和保健趋势越来越多地影响产品开发。对具有额外健康益处(例如增强免疫力、益生菌和高蛋白质含量)的机能性食品的需求正在迅速增加。此外,消费者也被「清洁标籤」食品所吸引,这些食品的成分易于理解,不含任何添加剂或防腐剂。作为回应,食品製造商正在寻求契约製造製造商来生产这些洁净标示产品,以满足消费者对透明度和健康益处的需求。

- 监管合规性在欧洲食品製造业仍然至关重要。欧盟严格的食品安全和标籤义务迫使製造商保持高标准,特别是在成分透明度、过敏原细节和营养标籤方面。同时,消费者强烈要求食品供应链具有更高的可追溯性。这种需求正在推动製造商利用区块链等技术来确保全面的产品可追溯性。这些不断变化的动态要求契约製造製造商保持敏捷,支持永续实践,并应对复杂的法规网络,以保持在欧洲的竞争力。

- 在欧洲,契约製造和包装商正在努力降低价格边际收益。造成这种扭曲的原因包括原材料成本上涨、劳动力短缺、运输成本上涨以及更严格的监管合规要求。原材料成本波动、供应链中断以及为提高效率而对自动化和技术的投资将进一步降低盈利。不断上升的人事费用和运输成本,以及欧盟严格的食品安全和永续性法规带来的财务负担,降低了製造商的价格竞争力。为此,许多製造商正在提高业务效率,利用自动化,并扩展到利基市场和专业服务。然而,持续不断的利润压力需要持续创新和严格的成本管理才能保持竞争力。

欧洲食品契约製造与包装市场趋势

加工製造占主要市场占有率

- 欧洲对食品加工和合约製造服务的需求正在迅速增长,这主要是由于人们对自有品牌产品的偏好日益增加。超级市场和零售连锁店正在寻求食品製造承包商的帮助,以帮助他们以自有品牌提供具有成本效益的高品质产品。随着消费者被有竞争力的价格和接近品牌的品质所吸引,越来越倾向于自有品牌产品,这种转变将变得更加明显。因此,食品製造商正在加紧满足这些零售商的广泛生产需求,同时确保一致的品质并严格遵守食品安全标准。

- 随着消费者积极寻求更健康、更功能性的食品选择,健康和保健趋势正在推动这种需求。偏好正在转向植物性、无麸质、低碳水化合物和高蛋白质的选择。这种演变迫使食品製造商调整其生产能力。契约製造製造商,特别是那些提供小批量生产、专业配方和快速生产週转弹性的合约製造商,正在成为品牌扩张到健康食品领域不可或缺的一部分。生产特定产品的技巧已成为食品品牌成功的关键决定因素,扩大了对合约製造服务的需求。

- 永续性正在成为整个欧洲契约製造需求不断增长的关键驱动力。随着消费者和监管机构敦促食品公司减少环境足迹,倡导环保包装、永续采购和废弃物最小化的製造商看到了需求的成长。

- 此外,电子商务的繁荣和直接面向消费者的食品销售的激增要求契约製造製造商提出创新的包装解决方案并应对线上食品零售物流的复杂性。这些进步凸显了对食品製造商日益增长的需求,这些製造商善于提供永续和可扩展的生产解决方案,同时满足消费者对品质和环境管理的期望。

- 2021年至2023年,德国简便食品製造业的收益稳步增长,证实了对方便食品的需求正在迅速增加。该部门的收入2021年为44亿美元,2022年跃升至55.6亿美元,2023年进一步增加至63.5亿美元。

- 这一上升轨迹表明,德国方便食品製造业正乘着强劲消费需求的浪潮。日益忙碌的生活方式、都市化和饮食习惯的改变等因素刺激了人们对即食食品、方便零食和冷冻食品的需求。此外,健康意识、永续包装以及线上杂货购物的日益普及等趋势也正在推动产业成长。

- 德国方便食品产业收益的快速成长凸显了应对力。这些趋势越来越青睐更健康、植物来源和无过敏原的选择。由于製造商优先考虑创新并响应欧洲市场不断变化的需求,这种成长轨迹仍然强劲。

德国呈现显着成长

- 在几个关键因素的推动下,德国食品契约製造和包装市场正在不断成长。随着消费者的生活方式越来越忙碌,对方便的即食产品的需求大幅增加。这种变化迫使公司依赖擅长提供高品质即食食品的契约製造和包装专家。此外,人们对健康意识、有机食品和机能性食品的日益重视正在为专业製造服务铺平道路。

- 食品加工和製造的需求不断增长也推动了市场扩张。随着食品偏好多样化,尤其是植物性食品、有机食品和机能性食品,製造商更倾向于优质产品的加工、包装和交付服务。这种对契约製造的依赖使公司能够满足对利基产品不断增长的需求,而无需在生产设备上进行大量投资。这种趋势在替代蛋白质来源、营养补充剂和家常小菜食品等领域尤其明显。

- 电子商务的蓬勃发展和直接面向消费者的食品的激增增加了对专业包装的需求,以在运输过程中保护产品的完整性。随着线上食品购买的激增,对既具有保护性又美观的包装解决方案的需求不断增长。餐套件配送和线上杂货购物等服务凸显了对专为远距运输量身定制的高效、高品质包装的需求。

- 技术进步正在彻底改变食品製造和包装产业。调气包装(MAP)、真空密封和创新包装等技术作为延长保质期和维持食品品质的优秀技术而越来越受欢迎。此外,在生产中引入自动化和数数位化可以提高效率和客製化。这些进步使製造商能够应对各种食品类别,从现有食品类别到植物性食品和机能性食品等新兴趋势。这些技术创新将增加对具有创造力和扩充性的契约製造服务的需求。

- 德国食品工业的加工部门收益强劲,对食品契约製造和包装市场产生了重大影响。肉类加工和肉类加工(541.2 亿美元)以及包括冰淇淋在内的牛奶加工(415.4 亿美元)等先进行业正在转向先进的契约製造和包装解决方案。这些解决方案满足了对传统食品和加工食品快速成长的需求。例如,肉类加工商依赖契约製造製造商提供专门的包装,以确保安全、延长保质期并遵守严格的食品安全标准。同样,随着对优质即食乳製品的需求飙升,乳製品製造商开始转向合约製造商来生产和包装牛奶、起司和冰淇淋。

- 烘焙点心和义式麵食生产(282.7 亿美元)也严重依赖契约製造和包装。这些服务确保高效生产和创新包装,保持新鲜度和美观。随着消费者对家常小菜(63.5 亿美元)的需求不断增长,契约製造至关重要,他们需要提供快速、一流的预製家常小菜生产和专业包装,以在运输和储存过程中保护产品。此外,海鲜加工(24.2 亿美元)尤其受益于契约製造製造商,他们监督冷冻、罐装和已调理食品从生产到包装的各个环节。总之,德国食品工业的扩张和多元化支撑了对合约製造和包装服务不断增长的需求。公司越来越多地寻求这些专业且经济高效的解决方案,以提高产量、提高效率并满足消费者的期望。

欧洲食品契约製造和包装产业概况

欧洲食品契约製造和包装市场由大量供应商经营,包括大型跨国公司和服务特定食品产业领域的专业公司。公司透过併购和产品创新等策略措施进行竞争。该市场包括主要企业,例如: Romix Foods Limited、Aimia Foods Ltd、Alphapak International Limited、A & S Packing 和 Alexir Co-Packers Ltd. 公司透过併购来扩大市场份额、实现产品组合多样化并提高营运效率。新开发的包装解决方案和製造流程来满足消费者需求并符合监管标准,从而建立市场差异化。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场动态

- 市场驱动因素

- 加工食品领域需求稳定成长

- 越来越多的公司专注于将製造和包装外包给整合解决方案提供商

- 市场挑战

- 契约製造和包装商面临价格利润问题

第六章 食品契约製造外包现状

第七章 市场区隔

- 按服务类型

- 加工/製造

- 包装

- 仓库/履约

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 西班牙

第八章 竞争格局

- 公司简介

- Romix Foods Limited

- Aimia Foods Ltd

- Norvik Foods

- A & S Packing

- Alexir Co-Packers Ltd

- Alphapak International Ltd

- Agilery

- SternMaid GmbH & Co. KG

- Hearthside Europe

- STOCKMEIER Food GmbH & Co. KG

- Budelpack Poortvliet BV

- Complete Co-Packing Services Ltd

- Marvinpac SA

第九章投资分析

第十章市场机会与未来趋势

The Europe Food Contract Manufacturing & Packaging Market size is estimated at USD 104.49 billion in 2025, and is expected to reach USD 167.52 billion by 2030, at a CAGR of 9.9% during the forecast period (2025-2030).

Key Highlights

- Europe's food contract manufacturing and packaging industry is undergoing notable changes spurred by evolving consumer preferences, technological innovations, and a push for sustainability. A prominent trend is the surging appetite for private-label products. Retailers and supermarkets are gravitating towards these cost-effective alternatives to branded items, paving the way for contract manufacturers to deliver high-quality food at competitive rates. Alongside this, there's a notable uptick in vegan, gluten-free, and allergen-free niche offerings as health-conscious consumers pursue tailored dietary choices.

- Sustainability stands out as a pivotal force in Europe's food manufacturing landscape. Consumers prioritize eco-friendly packaging, showing a marked preference for recyclable, biodegradable, and compostable materials. This shift is nudging food manufacturers to partner with contract manufacturers adept at crafting innovative, environmentally-conscious packaging solutions. Furthermore, there's an intensified focus on circular economy principles, with manufacturers striving to curtail food waste and incorporate recycled materials in production and packaging.

- Technological advancements are revolutionizing the sector, with automation and artificial intelligence (AI) taking center stage in food production. These innovations bolster efficiency, cut costs, and ensure product consistency. AI applications span predictive maintenance, quality control, and inventory oversight, while automation champions speed and flexibility in production. Innovative solutions are emerging in packaging, offering real-time insights into product freshness, temperature, and expiration features that resonate with today's consumers' desires for convenience and transparency.

- Health and wellness trends are increasingly influencing product development. There's a burgeoning demand for functional foods, those boasting added health perks like immune-boosting properties, probiotics, and heightened protein content. Moreover, consumers gravitate towards "clean label" foods, characterized by straightforward, recognizable ingredients devoid of additives or preservatives. In response, food manufacturers seek contract manufacturers to craft these clean-label products, aligning with consumer demands for transparency and health benefits.

- Regulatory compliance remains paramount in Europe's food manufacturing arena. The EU's stringent food safety and labeling mandates compel manufacturers to uphold high standards, especially concerning ingredient transparency, allergen details, and nutritional labeling. Coupled with this, consumers are clamoring for enhanced traceability within the food supply chain. This demand drives manufacturers to harness technologies like blockchain, ensuring comprehensive product traceability. As these dynamics shift, contract manufacturers are challenged to be nimble, champion sustainable practices, and navigate the intricate web of regulatory demands to maintain their competitive edge in Europe.

- In Europe, contract manufacturers and packagers grapple with tightening price margins. This strain is attributed to surging raw material costs, labor shortages, escalating transportation expenses, and the demands for stricter regulatory compliance. Ingredient cost fluctuations, disruptions in the supply chain, and the imperative investments in automation and technology for efficiency further challenge profitability. Rising labor and transportation costs and the financial weight of stringent EU food safety and sustainability regulations curtail manufacturers' pricing competitiveness. In response, many manufacturers are honing in on operational efficiency, harnessing automation, and delving into niche markets or specialized services. Yet, the relentless margin pressures necessitate continuous innovation and astute cost management to maintain a competitive edge.

Europe Food Contract Manufacturing & Packaging Market Trends

Processing & Manufacturing to Hold Significant Market Share

- The demand for contract food processing and manufacturing services in Europe is surging, mainly due to a rising preference for private-label products. Supermarkets and retail chains are turning to contract manufacturers for food production, allowing them to present cost-effective, high-quality items under their brands. This shift gains prominence as consumers increasingly gravitate towards private-label goods, drawn by their competitive pricing and quality akin to branded counterparts. Consequently, food manufacturers are stepping up to meet the expansive production demands of these retailers, all while ensuring consistent quality and strict adherence to food safety standards.

- Health and wellness trends fuel this demand, with consumers actively seeking healthier, functional food choices. Preferences are shifting towards plant-based, gluten-free, low-sugar, and high-protein options. This evolution is pushing food manufacturers to adjust their production capabilities. Contract manufacturers, especially those offering flexibility in small-batch runs, specialized formulations, and swift production turnarounds, are becoming indispensable as brands venture into the health-centric food arena. The knack for producing niche-specific products is emerging as a pivotal determinant of success for food brands, amplifying the demand for contract manufacturing services.

- Sustainability is emerging as a pivotal driver for the uptick in contract manufacturing demand across Europe. With consumers and regulatory entities urging food companies to curtail their environmental footprint, manufacturers championing eco-friendly packaging, sustainable sourcing, and waste minimization are witnessing heightened demand.

- Moreover, the e-commerce boom and the surge in direct-to-consumer food sales are prompting contract manufacturers to devise innovative packaging solutions and navigate the intricacies of online food retail logistics. This evolution underscores the growing need for food manufacturers adept at delivering sustainable, scalable production solutions while aligning with consumer expectations for quality and environmental stewardship.

- Germany's Convenience Food Manufacturing Sector has seen its revenue climb steadily from 2021 to 2023, underscoring a burgeoning appetite for convenient food products. Starting at USD 4.40 billion in 2021, the sector's revenue jumped to USD 5.56 billion in 2022, and further ascended to USD 6.35 billion in 2023.

- This upward trajectory signals that Germany's convenience food manufacturing is riding the wave of robust consumer demand. Factors such as increasingly hectic lifestyles, urbanization, and shifting eating habits have fueled the appetite for ready-to-eat meals, quick snacks, and frozen foods. Additionally, the industry's growth is buoyed by trends emphasizing health-conscious choices, sustainable packaging, and the surging popularity of online grocery shopping.

- The revenue surge in Germany's convenience food sector highlights its responsiveness to consumer needs and evolving dietary trends. These trends increasingly favor healthier, plant-based, and allergen-free options. This growth trajectory remains strong, with manufacturers prioritizing innovation and attuning to the European market's changing demands.

Germany to Show Significant Growth

- Germany's Food Contract Manufacturing & Packaging Market is on an upward trajectory, fueled by several pivotal factors. As consumers juggle busier lifestyles, there's a pronounced surge in demand for convenience and ready-to-eat products. This shift compels companies to turn to contract manufacturers and packaging experts adept at delivering high-quality, ready-to-consume food items. Furthermore, an increasing emphasis on health-conscious, organic, and functional foods is paving the way for specialized manufacturing services.

- The escalating demand for food processing and manufacturing is another driving force behind the market's expansion. With food preferences diversifying, especially toward plant-based, organic, and functional foods-manufacturers are leaning more toward contract services for processing, packaging, and delivering premium products. This reliance on contract manufacturing enables companies to cater to the rising demand for niche products without the hefty investment in production facilities. This trend is evident in sectors like alternative protein sources, dietary supplements, and ready-made meals.

- The booming e-commerce landscape and the surge in direct-to-consumer food sales have amplified the need for specialized packaging that safeguards product integrity during transit. As online food purchases soar, there's a heightened demand for packaging solutions that are both protective and visually appealing. Services like meal kit deliveries and online grocery shopping underscore the necessity for efficient, high-quality packaging tailored for long-distance shipping.

- Technological advancements are revolutionizing the food manufacturing and packaging sectors. Techniques like modified atmosphere packaging (MAP), vacuum sealing, and innovative packaging are becoming popular for their prowess in extending shelf life and maintaining food quality. Moreover, infusing automation and digitalization into production boosts efficiency and customization. This evolution empowers manufacturers to cater to various food categories, from established ones to emerging trends like plant-based and functional foods. Such innovations amplify the demand for contract manufacturing services that promise creativity and scalability.

- Germany's food industry is witnessing robust revenues across its processing segments, significantly influencing the Food Contract Manufacturing & Packaging market. Leading sectors, such as slaughter and meat processing (USD 54.12 billion) and milk processing, including ice cream (USD 41.54 billion), are turning to advanced contract manufacturing and packaging solutions. These solutions cater to the soaring demand for traditional and processed food items. For instance, meat processors depend on contract manufacturers for specialized packaging that ensures safety, prolongs shelf life, and adheres to strict food safety standards. Likewise, as the appetite for premium, ready-to-consume dairy products surges, dairy producers are increasingly collaborating with contract manufacturers to produce and pack milk, cheese, and ice cream.

- Baked goods and pasta production (USD 28.27 billion) also leans heavily on contract manufacturing and packaging. These services ensure efficient output and innovative packaging that preserves freshness and visual appeal. With a rising consumer appetite for ready-made meals (USD 6.35 billion), contract manufacturers are pivotal, delivering swift, top-notch meal production and specialized packaging that safeguards products during transit and storage. Furthermore, fish processing (USD 2.42 billion) reaps the benefits of contract manufacturers, overseeing everything from production to packaging, especially for frozen, canned, or ready-to-eat offerings. In summary, Germany's food industry's expansion and variety underscore a growing demand for contract manufacturing and packaging services. Companies are increasingly pursuing these specialized, cost-effective solutions to boost production, enhance efficiency, and align with consumer expectations.

Europe Food Contract Manufacturing & Packaging Industry Overview

The Europe food contract manufacturing and packaging market operates with numerous vendors, including large multinational corporations and specialized firms serving specific food industry segments. Companies compete through strategic initiatives, including mergers and acquisitions and product innovation. The market includes key players such as Romix Foods Limited, Aimia Foods Ltd, Alphapak International Limited, A & S Packing, and Alexir Co-Packers Ltd. Companies pursue mergers and acquisitions to expand market presence, diversify product portfolios, and achieve operational efficiencies. Additionally, firms focus on product innovation to establish market differentiation by developing new packaging solutions and manufacturing processes that address consumer needs and comply with regulatory standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady Growth in Demand from Processed Food Segment

- 5.1.2 Companies are Increasingly Focusing on Outsourcing of Manufacturing and Packaging to Integrated Solution Providers

- 5.2 Market Challenges

- 5.2.1 Contract Manufacturers & Packagers are Increasingly Faced with Price Margins

6 Current Share of Outsourcing in Contract Food Manufacturing

7 MARKET SEGMENTATION

- 7.1 By Service Type

- 7.1.1 Processing & Manufacturing

- 7.1.2 Packaging

- 7.1.3 Warehousing & Fulfilment

- 7.2 By Country

- 7.2.1 United Kingdom

- 7.2.2 Germany

- 7.2.3 France

- 7.2.4 Italy

- 7.2.5 Spain

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Romix Foods Limited

- 8.1.2 Aimia Foods Ltd

- 8.1.3 Norvik Foods

- 8.1.4 A & S Packing

- 8.1.5 Alexir Co-Packers Ltd

- 8.1.6 Alphapak International Ltd

- 8.1.7 Agilery

- 8.1.8 SternMaid GmbH & Co. KG

- 8.1.9 Hearthside Europe

- 8.1.10 STOCKMEIER Food GmbH & Co. KG

- 8.1.11 Budelpack Poortvliet BV

- 8.1.12 Complete Co-Packing Services Ltd

- 8.1.13 Marvinpac SA