|

市场调查报告书

商品编码

1632112

亚太地区策略咨询服务:市场占有率分析、产业趋势与成长预测(2025-2030)Asia Pacific Strategic Consulting Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

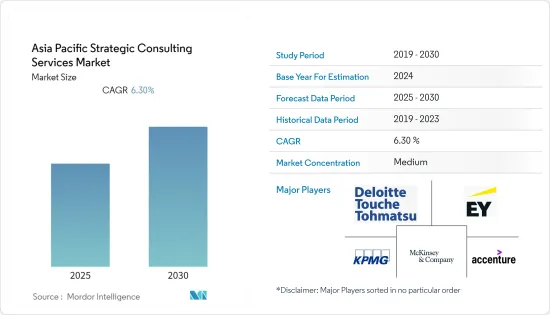

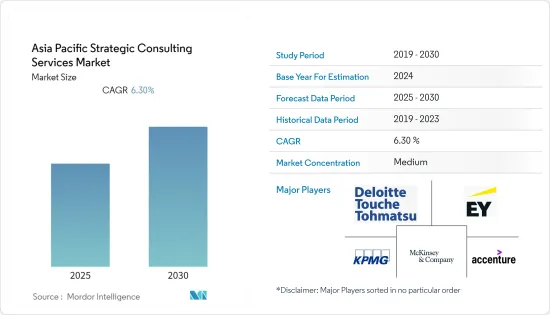

预计亚太地区策略咨询服务市场在预测期内的复合年增长率为 6.3%。

由于区域业务多样性的增加,亚太地区策略咨询服务市场预计将成长。对专家主导的咨询和业务的需求预计将推动亚太地区策略咨询服务市场的发展。由于多个行业的存在,亚太地区策略咨询市场呈现分散状态,预计未来几年市场持续的竞争动态将会改变。此外,政府机构正在实施一系列措施来加速亚太战略咨询市场的发展。

主要亮点

- 在多个最终用户中采用 BI 和先进的资料管理策略将推动市场成长。市场竞争加剧是推动市场成长的因素之一,包括新产品的推出、新市场的进入以及每个地区的业务扩张。此外,亚太地区新业务数量的增加、克服网路安全挑战的需求、企业数位转型的不断发展以及跨行业经营模式转型的增加正在推动市场需求。

- 新兴技术正在塑造未来最成功的企业。区块链、人工智慧和量子运算等技术有望改变当今企业的运作方式。随着新的颠覆性技术不断出现,企业主很难知道何时何地进行投资。这些因素预计将支持亚太地区战略咨询的成长。人工智慧在许多业务中的整合将支援市场成长,分析趋势和模式以进行适当的投资并改变经营模式,支援未来的成长。例如,根据MIT Technology 的数据,在商业中使用AI 技术的受访者比例将从2019 年的62% 大幅增加到2022 年的IT 管理领域,以及2019 年的61% 的客户服务领域,预计将增加18%。

- 然而,内部咨询部门数量的增加以及独立或自由职业顾问数量的增加预计将成为阻碍策略咨询市场成长的主要限制因素。

- 儘管 COVID-19 大流行对许多行业产生了负面影响,但它为咨询公司创造了机会,因为一些公司可能会寻求咨询公司的指导和专业知识来製定未来的策略和业务场景。其他人需要策略知识来重组其运营,以在当前环境中做出回应、恢復和发展,从而确保业务连续性和弹性。

亚太地区策略咨询服务市场趋势

经济成长带动市场需求

- 亚太地区的经济成长预计将在未来几年推动市场需求。例如,根据国际货币基金组织的预测,2021年亚洲GDP将成长5.67%。预计到2027年GDP将达3.52%。

- 该地区的几个新兴国家正在经历经济成长,这可能是由于电子商务公司的出现。客户支出的增加可能会推动策略咨询市场的需求。阿里巴巴、亚马逊、Flipkart、Myntra、Nykaa 等众多电子商务公司之间的竞争日益激烈,加上消费者购买模式的快速变化,可能会创造对专业人士的需求。

- 对灵活、多维模型的需求不断增长,正在推动策略投资、商业经营模式转型、公司策略、併购、经济倡议、组织策略、职能策略、策略与营运、数位策略和未来成长的决策。一点。预计这将推动该地区对战略咨询的需求。

- 许多公司正在投资扩大在其他地区的业务。了解消费者的需求和要求对企业来说非常重要,因此他们正在尝试进入本地市场以外的国际市场。公司的内部专家团队可能不熟悉公司为未来业务寻求开发的地区的人口统计。预计这些将推动该地区战略咨询市场的需求。

中国预计将经历显着成长

- 预计中国将在预测期内引领亚太战略咨询市场。 IT 管理、金融、生命科学和医疗保健、零售、政府和能源等领域对策略咨询的需求不断增长也有望推动成长。

- 在中国,策略咨询市场在政府资助下不断扩大。此外,政府也放宽对新兴企业的支持力度,营造有利于新兴企业发展与生存的环境,加强策略咨询市场建置。中国市场很不稳定,在其他国家卖得好的产品在中国不一定卖得好。为此,设计咨询对于企业的重要性正在从基于绩效的收费经营模式,转向基于时间的经营模式,而不是基于时间的经营模式。

- 此外,技术渗透正成为策略咨询模式的核心能力。许多最终用户行业对人工智慧的需求不断增长预计将推动成长。人工智慧主导的资料可帮助企业做出可行的决策,并在快速变化的市场中保持竞争优势。在中国,支援日益增长的策略咨询需求的人工智慧公司数量正在增加,预计将支援成长。

- 市场参与企业可以帮助您转变业务并帮助您充分发挥潜力。无论零售商是寻求现代化经营模式、数位转型或重新定义其进入市场策略,策略咨询都可以与零售商合作,帮助他们选择正确的企业和成长策略。此外,我们的跨境併购咨询和融资服务专注于企业、战略投资者和最尖端科技汇聚的大中华区境内入境关係和交易的交叉点,并提供中国零售领域的战略咨询这预计会增加需求。例如,根据中国国家统计局的数据,2021年中国社会消费品零售总额为44.1兆元。中国都市区零售总额为38.2兆元人民币,而中国农村零售额为5.9兆元。

亚太区策略咨询服务业概况

亚太地区咨询服务市场竞争激烈。它由许多区域参与企业组成,占据了重要的市场占有率,并专注于扩大基本客群。这些公司的目标是透过专注于研发活动、策略联盟以及其他有机和无机成长策略,在市场上立足多年。

- 2021 年 5 月,总部位于波士顿的电信、媒体和技术 (TMT) 领域顾问公司 Altman Solon 透过收购总部位于雪梨的 TMT 专家 Venture Consulting,将业务扩展到澳洲。这家全球顾问公司上週也宣布开设新加坡办事处。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 增加区域业务多样性 对专家主导的咨询和营运的需求

- 跨多个最终用户采用 BI 和进阶资料管理策略

- 扩大计划多方采购范围

- 市场挑战/限制

- 独立/自由职业顾问的增加

第六章 市场细分

- 最终用户产业

- 金融服务

- 生命科学与医学

- 零售

- 政府机构

- 活力

- 其他的

- 按国家/地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

第七章 竞争格局

- 公司简介

- AT Kearney, Inc.

- Bain & Company

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Ltd.

- KPMG

- McKinsey & Company

- Accenture PLC

- Mercer LLC

- The Boston Consulting Group

- PwC

第八章投资分析

第9章市场的未来

The Asia Pacific Strategic Consulting Services Market is expected to register a CAGR of 6.3% during the forecast period.

Asia Pacific Strategic Consulting Services Market is expected to grow due to increasing regional business diversities. Demand for skilled-driven consultations and operations is expected to drive the strategic consulting services market in the Asia Pacific. The Asia Pacific Strategy consulting market is fragmented owing to the presence of several industries, and the ongoing competitive dynamics in the market are anticipated to change during the upcoming years. In addition, governmental bodies undertake numerous initiatives to accelerate the Asia Pacific Strategy consulting market.

Key Highlights

- Adopting BI and advanced data management strategies across multiple end-users will boost market growth. The increasing competition among players to launch a new product, enter a new market, and expand in different regions are some factors aiding the market growth. Additionally, a growing number of new businesses in the Asia Pacific, demand to overcome cyber security challenges, growing digital transformation among the enterprises, and increasing business model transformation across industry verticals has boosted the demand for the market.

- Emerging technologies are shaping the most successful businesses of tomorrow. Technologies such as blockchain, AI, and quantum computing are poised to transform the way companies work today. The constant emergence of new and disruptive technology has made it difficult for business owners to decide where and when to invest. These factors are expected to support growth for strategic consulting in the Asia Pacific. The Integration of AI in numerous businesses to analyze the trend and patterns to make suitable investments and change business models, among other things, to bolster future growth will support market growth. For instance, According to MIT Technology, the share of respondents using AI technology in their businesses is expected to increase majorly in IT management from 62% in 2019 to 72% in 2022, and customer service grew by 18% in 2022 from 61% in 2019.

- However, factors such as the increasing in-house consulting divisions and the increasing number of independent or freelancing consultants are anticipated to be some of the major restraining factors hindering the strategy consulting market growth.

- The COVID-19 pandemic has negatively impacted numerous industries; it gave some consulting firms opportunities as some companies may seek the guidance and expertise of such firms to map their future strategies and business scenarios. While some firms will also need the strategic knowledge to restructure their operations to respond, recover, and thrive in the current environment., thereby ensuring business continuity and resiliency.

Asia Pacific Strategic Consulting Services Market Trends

Economic Growth to Drive Market Demand

- The region's economic growth is expected to drive market demand in the coming years. For instance, as per IMF, the GDP of Asia will increase by 5.67 % in 2021. The increase came after the year of decline caused due to COVID-19 pandemic.GDP is expected to reach 3.52% by 2027.

- Several developing countries in the region are experiencing economic growth, likely due to the advent of eCommerce companies. Increased customer spending can drive the demand for the strategy consulting market. The growing competition among numerous e-commerce companies such as Alibaba, Amazon, Flipkart, Myntra, and Nykaa, along with the rapid changes in consumer buying patterns, will create demand for experts.

- The rising demand for a highly flexible and multidimensional model provides companies with trusted data to make decisions based on strategic investment, business model transformation, corporate strategy, mergers & acquisitions, economic policy, organizational strategy, functional strategy, strategy & operations, and digital strategy, and future growth. This will propel the demand for strategic consulting in the region.

- Numerous companies are investing in expanding in other regions. They are trying to enter international markets other than their local market to understand the needs and requirements of the consumer, as it is highly crucial for a business. The internal team of experts of the company might not be well acquainted with the region's demographics that the company aims to tap for future business. All this is expected to propel the demand for the strategic consulting market in the region.

China is Expected to Witness Significant Growth

- China is expected to lead the strategy consulting market in the Asia Pacific region in the forecast period. The increasing requirement for strategy consulting for IT management, finance, life science and healthcare, retail, government, and energy is also expected to propel growth.

- With the government's support in funding in China, the market for strategy consulting is progressing. Also, the government is supporting the start-ups coupled with the relaxation in policies, making it favorable for start-ups to breed and survive, strengthening the strategy consulting market. The China market is very volatile; the product that sells in other countries might not necessarily sell in China; this makes design consulting more important for companies to use a performance-based billing business model to a time-based business model instead of a time-based business model.

- Additionally, technology penetration is making its mark as a core capability within strategic consulting models. The rising demand for AI in numerous end-user industries is expected to propel growth. The AI-driven data helps the company take actionable decisions and stay ahead of its competition in the rapidly changing market. The increasing number of AI enterprises in China to support the growing need for strategy consulting is expected to support growth.

- The market players aid the business transformation and help unlock the full potential. Whether the retailer is seeking business model reinvention, digital transformation, or a re-defined go-to-market strategy, strategy consultancy can work with the retailer to help make the right corporate and growth strategy choices. Also, the Cross-border M&A advisory and capital raising focus on the intersection of Greater China inbound and outbound relationships and transactions wherein businesses, strategic investors, and leading-edge technologies converge will propel the demand for strategy consulting in the Retail sector in China. For instance, according to the national bureau of statistics of China, the total consumer goods retail sales in China amounted to CNY 44.1 trillion in 2021 from CNY. The total retail sales in urban China amounted to CNY38.2 trillion, whereas sales in rural China Totalled CNY 5.9 trillion.

Asia Pacific Strategic Consulting Services Industry Overview

The Asia Pacific consulting service market is highly competitive. It consists of many regional players, accounting for a considerable market share and focusing on expanding its client base. They aim to focus on research and development activities, strategic alliances, and other organic and inorganic growth strategies to stay in the market for years.

- May 2021: Altman Solon, a Boston-headquartered telecom, media, and technology (TMT) sector consulting firm, has entered Australia by acquiring Sydney-based TMT specialist Venture Consulting. The global consultancy also last week announced the launch of a Singapore office.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Regional Business Diversities Demand for Skilled Driven Consultations and Operations

- 5.1.2 Adoption of BI and Advanced Data Management Strategies across Multiple End-user

- 5.1.3 Domain Adoption of Multi-sourcing of Projects

- 5.2 Market Challenges / Restrain

- 5.2.1 Increasing Number of Independent or Freelancing Consultants

6 MARKET SEGMENTATION

- 6.1 End-User Industry

- 6.1.1 Financial Services

- 6.1.2 Life Sciences and Healthcare

- 6.1.3 Retail

- 6.1.4 Government

- 6.1.5 Energy

- 6.1.6 Others

- 6.2 By Country

- 6.2.1 China

- 6.2.2 Japan

- 6.2.3 India

- 6.2.4 Australia

- 6.2.5 South Korea

- 6.2.6 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 A.T. Kearney, Inc.

- 7.1.2 Bain & Company

- 7.1.3 Deloitte Touche Tohmatsu Limited

- 7.1.4 Ernst & Young Ltd.

- 7.1.5 KPMG

- 7.1.6 McKinsey & Company

- 7.1.7 Accenture PLC

- 7.1.8 Mercer LLC

- 7.1.9 The Boston Consulting Group

- 7.1.10 PwC