|

市场调查报告书

商品编码

1635535

电池製造设备:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

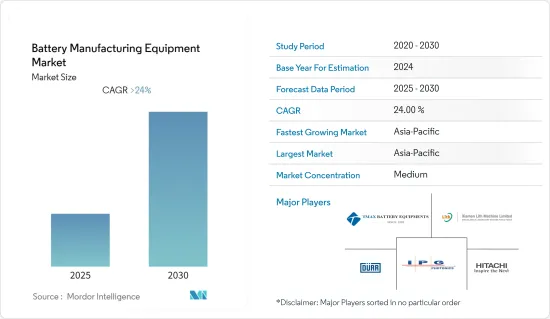

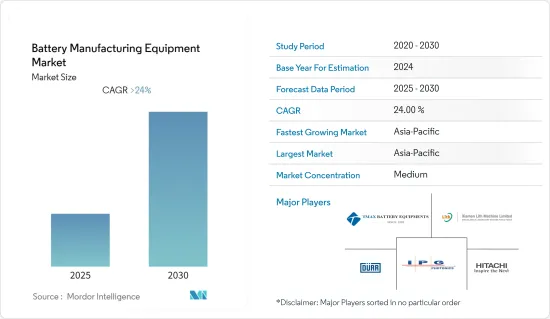

电池製造设备市场预计在预测期内复合年增长率将超过24%

主要亮点

- 从长远来看,电动车渗透率的不断提高预计将推动市场发展。

- 另一方面,缺乏製造电池製造设备的公司是市场成长的主要限制因素。

- 更高容量和更低放电率等各种技术的进步预计将使电池设备製造变得更加可行和高效,为电池製造设备市场创造巨大机会。

- 亚太地区在市场上占据主导地位,并且在预测期内也可能实现最高的复合年增长率。这一增长得益于印度、中国和澳大利亚等该地区国家的投资增加以及政府的支持措施。

电池製造设备市场趋势

主导市场的汽车细分市场

- 由于汽油和天然气等燃料成本不断上涨,以及各国对废气法规的要求不断提高,人们的注意力正从传统汽车转向电动车(EV)。电动车效率很高,再加上电力成本,为电动车充电比加满出行所需的汽油或柴油便宜。透过使用可再生能源,电动车可以变得更加环保。

- 此外,由于对电动车的需求不断增加,汽车製造公司正在为每个汽车细分市场设计不同类型和设计的电动车,以增加汽车销售。这种车辆设计的客製化为电池製造带来了巨大的成长机会,可以满足汽车製造商的需求。

- 此外,支持电动车本地化的政府规则、法规和财政激励措施也使汽车产业受益。

- 例如,德国联邦经济事务和气候变迁部宣布了一项名为「环境奖金」的新车购买补助(非混合动力电动车为 3,800 美元,插电式混合动力汽车为 2,850 美元)。该补贴适用于购买标价不超过 57,000 美元的车辆。这预计将增加电动车的需求,从而使电池设备製造业受益。

- 因此,由于电动车需求的增加和政府的支持措施,汽车产业预计将成为预测期内成长最快的领域。

亚太地区主导市场

- 在亚太地区,由于人们对环境问题的认识不断增强以及改善日益恶化的环境的技术,电池製造设备市场不断增长。

- 由于亚太地区人口众多、经济快速成长,中国、印度、东南亚国协等国家正在带动市场,预计亚太地区的电池需求也将稳定成长。

- 凭藉着重要的电动车产业、整个供应链的行业领先参与企业以及快速成长的经济,中国在电池製造设备市场占据主导地位。该地区占世界锂离子蕴藏量的大部分。锂离子可用于各种最终用途产业,例如汽车和家用电子电器。

- 2022年11月,比亚迪宣布将在浙江温州兴建新厂,进一步扩大在中国的电池产能。新厂年产能20吉瓦时,计画于2024年投产。

- 此外,印度对电池的需求大幅增加。印度是亚太地区成长最快的经济体之一,拥有世界第二大人口。

- 印度也拥有大量资讯科技公司,逐年成长。由于对电池供电设备的高需求,这些公司正在推动电池设备製造业的发展。

- 因此,由于电池设备製造市场的产量增加、技术进步和政府支援措施,预计亚太地区将在预测期内主导市场。

电池製造设备产业概况

全球电池製造设备市场适度细分。该市场的主要企业(排名不分先后)包括厦门力思机械有限公司、IPG Photonics Corporation、Durr AG、日立和厦门天迈电池设备有限公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 机器类型

- 涂料及干燥机

- 日历

- 狭缝

- 混合

- 电极堆迭

- 组装及搬运机

- 成型/检查机

- 最终用户

- 车

- 工业的

- 其他的

- 2028年之前的市场规模和需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 波兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 韩国

- 日本

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 卡达

- 南非

- 其他中东/非洲

- 南美洲

- 智利

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Duerr AG

- Schuler AG

- Wuxi Lead Intelligent Equipment Co Ltd

- Hitachi Ltd.

- Xiamen Tmax Battery Equipments Limited

- Xiamen TOB New Energy Technology Co., Ltd.

- ACEY New Energy Technology

- InoBat

- Xiamen Lith Machine Limited

- Andritz AG

- Xiamen Lith Machine Limited

- IPG Photonics Corporation

第七章 市场机会及未来趋势

简介目录

Product Code: 93580

The Battery Manufacturing Equipment Market is expected to register a CAGR of greater than 24% during the forecast period.

Key Highlights

- Over the long term, the increasing adoption of electric vehicles is expected to drive the market.

- On the other hand, a shortage of companies manufacturing battery equipment is a significant restraint hindering market growth.

- Nevertheless, the increasing technological advancements in various technologies like higher capacity and low discharge rate is expected to make the manufacturing of battery equipment more feasible and efficient and create enormous opportunities for the battery manufacturing equipment market.

- Asia-Pacific region dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with supportive government policies in the countries of this region, including India, China, and Australia.

Battery Manufacturing Equipment Market Trends

Automotive Segment to Dominate the Market

- The rising fluctuation in the cost of fuels like gasoline and natural gases and the increasing demand for emission controls in various countries have shifted the focus from conventional vehicles to electric vehicles (EVs). Electric vehicles are more efficient, which, combined with the electricity cost, is charging an electric vehicle cheaper than filling petrol or diesel for your travel requirements. Using renewable energy sources can make the use of electric vehicles more eco-friendly.

- Moreover, as the demand for electric vehicles is increasing, automobile manufacturing companies are designing electric vehicles for all car segments in various types and designs to increase the sales of their vehicles. This customization in the designing of automobiles provides a significant growth opportunity for battery manufacturing to meet the demands of automobile manufacturers.

- Furthermore, the government's supportive rules, regulations, and financial benefits for adapting electric vehicles in their regions have also benefitted the automobile industry.

- For instance, the Federal Ministry for Economic Affairs and Climate Action of Germany announced a purchase grant, known as the environmental bonus, which is paid towards new vehicles - USD 3800 for non-hybrid electric cars and USD 2850 for plug-in hybrids. The grant is paid towards purchases of cars with a list price of up to USD 57,000. This is expected to increase EV demand, consequently benefitting the battery equipment manufacturing industry.

- Hence, the automotive sector is expected to be the fastest-growing segment in the forecast period due to increased demand for electric vehicles and supportive government policies.

Asia-Pacific to Dominate the Market

- The market for battery manufacturing equipment is on a constant rise in the Asia-pacific region due to the rising awareness in public regarding environmental issues and the techniques to improve the constantly deteriorating condition.

- Due to the region's large population and fast-growing economy, the demand for batteries in the Asia-Pacific region is also expected to grow steadily, with countries such as China, India, and the ASEAN countries driving the market.

- Due to the presence of a significant electric car industry, leading industry players across the supply chain, and a rapidly rising economy, China dominates the battery manufacturing equipment market. The region has the majority of the world's lithium-ion reserves. It can be utilized in various end-use industries such as automotive, consumer electronics, and others.

- In November 2022, BYD announced that they are further expanding its battery production capacities in China with a new plant in Wenzhou in Zhejiang province. The new factory will have an annual capacity of 20 gigawatt-hours and is scheduled to start production in 2024.

- Furthermore, the demand for batteries have increased significanlty in India. India is one of the fastest growing economies of the Asia-Pacific region, with the second largest population in the world, which subsequently translates into a large consumption of electrical equipments that operates through batteries.

- In addition, India boasts a large number of information technology enterprises that are growing yearly. It is also propelling the battery equipment manufacturing industry as these companies have a high demand for battery-operated devices.

- Hence, Asia Pacific is expected to dominate the market in the forecast period due to increased production, technological advancements, and supportive government policies in the battery equipment manufacturing market.

Battery Manufacturing Equipment Industry Overview

The Global battery manufacturing equipment market is moderately fragmented. Some key players in this market (in no particular order) include Xiamen Lith Machine Limited, IPG Photonics Corporation, Durr AG, Hitachi Ltd, and Xiamen Tmax Battery Equipments Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Machine Type

- 5.1.1 Coating & Dryer

- 5.1.2 Calendaring

- 5.1.3 Slitting

- 5.1.4 Mixing

- 5.1.5 Electrode Stacking

- 5.1.6 Assembly & Handling Machines

- 5.1.7 Formation & Testing Machines

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Industrial

- 5.2.3 Other End Users

- 5.3 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Poland

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 South Korea

- 5.3.3.4 Japan

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 Qatar

- 5.3.4.3 South Africa

- 5.3.4.4 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Chile

- 5.3.5.2 Brazil

- 5.3.5.3 Argentina

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Duerr AG

- 6.3.2 Schuler AG

- 6.3.3 Wuxi Lead Intelligent Equipment Co Ltd

- 6.3.4 Hitachi Ltd.

- 6.3.5 Xiamen Tmax Battery Equipments Limited

- 6.3.6 Xiamen TOB New Energy Technology Co., Ltd.

- 6.3.7 ACEY New Energy Technology

- 6.3.8 InoBat

- 6.3.9 Xiamen Lith Machine Limited

- 6.3.10 Andritz AG

- 6.3.11 Xiamen Lith Machine Limited

- 6.3.12 IPG Photonics Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219