|

市场调查报告书

商品编码

1636439

东南亚国协电动车电池製造设备:市场占有率分析、产业趋势、成长预测(2025-2030)ASEAN Countries Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

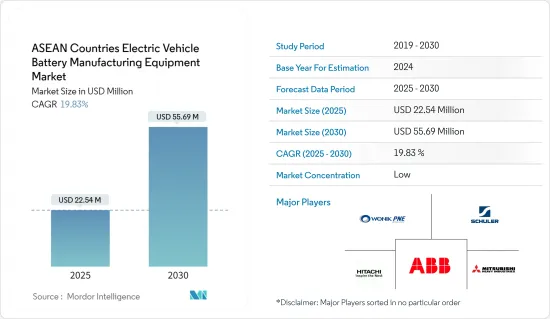

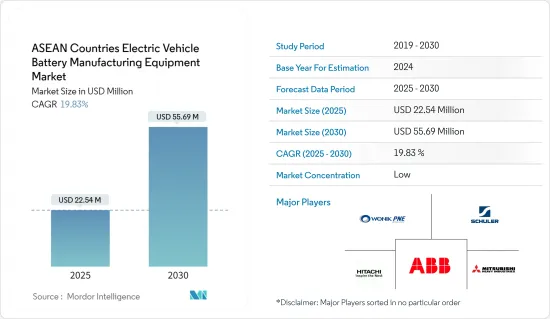

预计2025年东南亚国协电动车电池製造设备市场规模为2,254万美元,预计2030年将达5,569万美元,预测期内(2025-2030年)复合年增长率为19.83%。

主要亮点

- 从中期来看,政府对电池製造的政策和投资,以及电池原料(特别是锂离子)成本的下降,预计将在预测期内推动市场发展。

- 另一方面,高昂的初始投资成本预计将拖累市场的未来发展。

- 然而,这些国家对电动车有着长期雄心勃勃的目标,预计在预测期内创造重大商机。

- 由于该国对电动车电池製造的投资增加,预计泰国将出现强劲成长。

东南亚国协电动车电池製造设备市场趋势

锂离子电池领域预计将大幅成长

- 锂离子电池製造设备包括专门製造锂离子电池的专用机械和工具。近年来,东南亚国协电动车(EV)用锂离子电池产量快速成长。这是由电动车需求不断增长、政府支持政策以及该地区在全球供应链中的关键作用所推动的。随着製造业的增加,对锂离子电池製造设备的需求也增加。

- 此外,国内製造设施的进步在降低这些国家的锂离子电池价格方面发挥关键作用。随着电动车需求的成长,规模经济导致生产成本降低。因此,随着锂离子电池价格的下降,企业正在增加对电动车电池生产的投资,进一步推动该地区相关製造设备的需求。

- 2023年锂离子电池组价格与前一年同期比较%,稳定在139美元/kWh。除了价格下降之外,泰国、印尼、越南和马来西亚等国家的个人和商用电动车的使用量也在激增。这一势头正在刺激国内锂离子电池的生产,并扩大对电池製造设备的需求,旨在减少对进口的依赖并加强国内电动车产业。

- 例如,全球知名锂电池製造商中国亿纬锂能于2023年8月在马来西亚吉打州居林破土动工新工厂,首期投资4.22亿美元。这些战略投资正在扩大电动车锂离子电池的生产,并增加对製造设备的需求。

- 鑑于价格下降和电动车锂离子电池生产的快速投资,该行业可能在未来几年获得显着的市场份额。

泰国,预计将出现显着成长

- 由于电动车锂离子电池的生产环境良好,泰国电动车锂离子电池製造设备市场预计将大幅成长。在政府的支持下,泰国正在成为电动车生产的区域中心。政府制定了一个雄心勃勃的目标,即到 2030 年,电动车占汽车产量的 30%,透过税收优惠和补贴吸引电动车和电池製造商。

- 此外,特别是中国电池製造商正在积极投资在泰国新建电动车电池工厂。投资的激增将增加对该国生产电动车电池所需的设备的需求。

- 例如,2024年3月,中国着名电池製造商蜂巢能源开始在其位于泰国春武里府是拉差的最先进工厂大规模生产电动车电池组。该工厂的年生产能力约为 60,000 个模组和电池组。

- 泰国电动车的普及正在加速,各公司正在增加对当地製造地的投资。泰国汽车研究所的资料凸显了这个趋势。 2023年,泰国註册电动车数量激增至172,540辆,较前一年的84,570辆大幅增加。电动车普及率的显着提高支持了对电动车製造设备不断增长的需求。

- 在泰国,由于泰国4.0和东部经济走廊(EEC)等政府倡议,电动车电池製造设备的前景仍然乐观。这些倡议旨在透过提供税收减免和简化监管等有吸引力的奖励,使泰国成为电动车和电池等高科技领域的地区领跑者。

- 鑑于政府的坚定支持和电动车的加速采用,泰国有望在未来几年实现显着成长。

东南亚国协电动车电池製造设备产业概况

东南亚国协的电动车电池製造设备市场已减半。市场主要企业包括(排名不分先后)WONIK PNE、舒勒股份公司、日立、ABB 有限公司和三菱重工。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 电池製造的政府政策和投资

- 电池原物料成本下降

- 抑制因素

- 初期投资成本高

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 按流程

- 混合物

- 涂层

- 日历

- 狭缝/电极加工

- 其他工艺

- 透过电池

- 锂离子

- 铅酸电池

- 镍氢电池

- 其他电池

- 按地区

- 东南亚国协

- 印尼

- 马来西亚

- 菲律宾

- 新加坡

- 泰国

- 越南

- 其他东南亚国协

- 东南亚国协

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- WONIK PNE CO., LTD.

- Schuler AG

- Hitachi Ltd

- ABB Ltd.

- Mitsubishi Heavy Industries, Ltd

- Sovema Group

- Daiichi Jitsugyo Thailand Co Ltd

- Yokogawa India Ltd.

- 其他知名企业名单

- 市场排名分析

第七章 市场机会及未来趋势

- 电动车的长期目标

简介目录

Product Code: 50003706

The ASEAN Countries Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 22.54 million in 2025, and is expected to reach USD 55.69 million by 2030, at a CAGR of 19.83% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, government policies and investments towards battery manufacturing, and a decline in the cost of battery raw materials, especially lithium-ion, are expected to drive the market in the forecast period.

- On the other hand, high initial investment costs are expected to hamper the market in the future.

- Nevertheless, long-term ambitious targets for electric vehicles in these countries are expected to create a significant opportunity in the forecast period.

- Thailand is expected to grow significantly owing to the increasing investment in EV battery manufacturing in the country.

ASEAN Countries Electric Vehicle Battery Manufacturing Equipment Market Trends

Lithium-ion Battery Segment is Expected to Grow Significantly

- Lithium-ion battery manufacturing equipment includes specialized machines and tools tailored for producing lithium-ion batteries. In recent years, ASEAN countries have seen a surge in lithium-ion battery production for electric vehicles (EVs), spurred by rising EV demand, supportive government policies, and the region's pivotal role in global supply chains. With this uptick in manufacturing, the need for lithium-ion battery production equipment is set to rise.

- Moreover, advancements in domestic manufacturing equipment have played a crucial role in driving down lithium-ion battery prices across these nations. As EV demand escalates, achieving economies of scale has led to reduced production costs. Consequently, with falling lithium-ion battery prices, companies are ramping up investments in EV battery production, further fueling the demand for associated manufacturing equipment in the region.

- In 2023, lithium-ion battery pack prices plummeted by 14% from the prior year, settling at USD139/kWh. Beyond this price dip, countries like Thailand, Indonesia, Vietnam, and Malaysia are experiencing a surge in both personal and commercial EV adoption. This momentum has spurred local lithium-ion battery production, aiming to lessen import reliance and bolster domestic EV sectors, thereby amplifying the demand for battery manufacturing equipment.

- For example, in August 2023, EVE Energy Co. Ltd., a prominent global lithium battery manufacturer from China, broke ground on a new facility in Kulim, Kedah, Malaysia, with an initial investment of USD 422 million. Such strategic investments are poised to elevate lithium-ion battery production for EVs, subsequently driving up the demand for manufacturing equipment.

- Given the declining prices and surging investments in EV lithium-ion battery production, this segment is poised to command a substantial share in the coming years.

Thailand is Expected to Grow Significantly

- Thailand's electric vehicle (EV) battery manufacturing equipment market is poised for substantial growth, bolstered by a favorable environment for EV battery production. With government backing, Thailand has emerged as a regional hub for EV production. The government is luring EV manufacturers and battery producers with tax incentives and subsidies, setting an ambitious goal to have 30% of its automotive output as EVs by 2030.

- Furthermore, a growing number of battery manufacturers, especially from China, are keenly investing in new facilities for EV batteries in Thailand. This surge in investments is set to boost the demand for equipment essential for EV battery production in the country.

- For example, in March 2024, SVOLT Energy, a prominent Chinese battery manufacturer, kicked off mass production of EV battery packs at its state-of-the-art facility in Si Racha, located in Chonburi province, Thailand. This facility is equipped with an impressive annual production capacity of around 60,000 modules and packs.

- As the adoption of electric vehicles continues to surge in Thailand, companies are amplifying their investments in local manufacturing hubs, consequently spurring demand for manufacturing equipment. Data from the Thailand Automotive Institute highlights this trend: in 2023, registered electric vehicles in Thailand surged to 172,540 units, a notable increase from the previous year's 84,570. Such a significant uptick in EV adoption underscores the expanding need for EV manufacturing equipment.

- Looking ahead, the outlook for EV battery manufacturing equipment in Thailand remains optimistic, due to government initiatives like Thailand 4.0 and the Eastern Economic Corridor (EEC). These initiatives are designed to elevate Thailand's status as a regional frontrunner in high-tech sectors, including EVs and batteries, by providing attractive incentives such as tax breaks and simplified regulations.

- Given the government's unwavering support and the accelerating adoption of EVs, Thailand is set for notable growth in the coming years.

ASEAN Countries Electric Vehicle Battery Manufacturing Equipment Industry Overview

The ASEAN country's electric vehicle battery manufacturing equipment market is semi-fragmented. Some of the major players in the market (in no particular order) include WONIK PNE CO., LTD., Schuler AG, Hitachi Ltd, ABB Ltd., and Mitsubishi Heavy Industries, Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 High initial investment costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendering

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Process

- 5.2 Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-Acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Other Batteries

- 5.3 Geography

- 5.3.1 ASEAN Countries

- 5.3.1.1 Indonesia

- 5.3.1.2 Malaysia

- 5.3.1.3 Philippines

- 5.3.1.4 Singapore

- 5.3.1.5 Thailand

- 5.3.1.6 Vietnam

- 5.3.1.7 Rest of ASEAN Counties

- 5.3.1 ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 WONIK PNE CO., LTD.

- 6.3.2 Schuler AG

- 6.3.3 Hitachi Ltd

- 6.3.4 ABB Ltd.

- 6.3.5 Mitsubishi Heavy Industries, Ltd

- 6.3.6 Sovema Group

- 6.3.7 Daiichi Jitsugyo Thailand Co Ltd

- 6.3.8 Yokogawa India Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219