|

市场调查报告书

商品编码

1636467

中国电动汽车电池製造:市场占有率分析、产业趋势/统计、成长预测(2025-2030)China Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

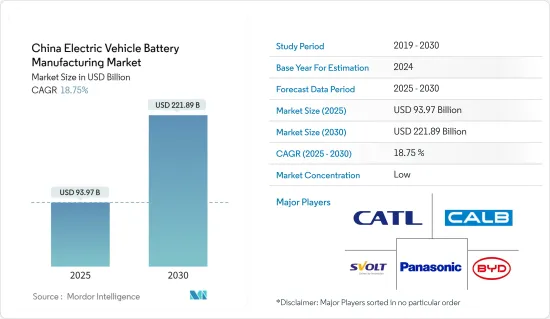

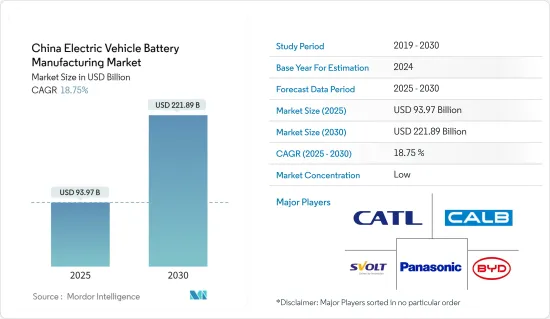

预计2025年中国电动车电池製造市场规模为939.7亿美元,2030年将达2,218.9亿美元,预测期间(2025-2030年)复合年增长率为18.75%。

主要亮点

- 从长远来看,增加电池产能的投资和电池原材料成本下降等因素预计将成为预测期内中国电动车电池製造市场的最大推动力之一。

- 另一方面,关键电池原料依赖进口,导致产业容易受到价格波动和发展不平衡的影响。这对预测期内的中国电动车电池製造市场构成威胁。

- 我们对电动车的长期雄心仍在继续。预计这一因素将在未来为市场创造一些机会。

中国电动汽车电池製造市场趋势

锂离子电池类型主导市场

- 锂离子电池以其高能量密度和长生命週期而闻名,已成为电动车製造商的首选。该技术不仅确保了高效的电动车生产,而且满足了消费者的期望和行业基准。

- 为了普及电动车并加强国内电池生产,中国政府实施了一系列强有力的措施。新能源汽车(NEV)指令等倡议以及补贴和税收优惠正在刺激电动车产业的快速扩张。此外,「中国製造2025」倡议凸显了中国巩固其作为先进製造业全球领跑者地位的雄心。

- 中国减少碳排放和解决空气污染的努力是电动车市场蓬勃发展的重要动力。支持清洁能源汽车的政策正在加速从内燃机转向电动车的转变。中国是全球最大的电动车市场,其需求快速成长是由都市化、环保意识增强和严格的汽车排放法规所推动的,所有这些都增加了对国产电池的需求。

- 2024年5月,中国将投资约60亿元人民币(8.45亿美元)开发下一代电动车(EV)电池技术。全固态电池(ASSB)是传统锂离子电池(LIB)的前沿进步,利用固体导电电解质来提高安全性和能量密度。 CATL 是一家领先的电动车电池公司,它认识到了这一潜力,并准备好获得政府对这项技术飞跃的支持。

- 中国大规模的充电基础设施建设对于电动车在国内的普及至关重要。这项策略性投资将确保电动车用户轻鬆获得高效的充电解决方案,进一步增加对电动车电池的需求。同时,中国企业正投入资源进行研发,旨在提高电池技术并降低生产成本。与国际高科技公司和研究机构的合作是电池製造创新的催化剂。

- 例如,2024年5月,国营上汽集团宣布计画在2025年将固态电池整合到其电动车品牌中,并于2026年实现量产。此电池能量密度超过400Wh/kg,续航里程至少1000公里。去年6月,国内电动车製造商蔚来成功测试了固态电池,取得了360Wh/kg能量密度和1044公里续航里程的惊人纪录。此外,上汽集团部分控股的 IM Motors 于 4 月推出了 IM L6 EV 车型。该车型搭载超快充固态电池,电量为130kWh,支援1000公里续航里程和900V超快充电能力。

- 中国的製造能力接近900吉瓦时,占全球整体的77%。此外,全球十大电池製造商中有六家在中国。中国对从金属开采到汽车生产的整个电动车供应链的全面控制进一步强化了这一优势。全球超过一半的电动车持有在中国,中国的锂离子电池製造能力在2023年达到1,705GWh,预计2027年将激增至6,197GWh。

- 鑑于这一发展和投资,随着对锂离子电池的需求不断增长,预计未来几年全部区域的电动车电池产量将激增。

投资加强电池产能

- 中国正在策略性地提高电池产能,以满足快速成长的电动车(EV)需求。补贴和投资诱因等政府措施正在刺激国内企业提高产能。此次合作旨在巩固中国作为电动车电池製造领域全球领导者的地位,并确保为不断扩大的电动车市场稳定供应优质电池。

- 中国各地正在建立新的电池生产工厂,推动电动车电池製造市场的发展。 CATL和比亚迪等工业巨头正在安装最先进的设备来扩大生产。这些最先进的工厂配备了先进技术,并有望提高产量和效率,成为满足快速成长的国内外电动车电池需求的关键要素。

- 浆料搅拌机浮动竞标对于改进电池生产流程起着至关重要的作用。这些搅拌机保证了电池材料配方的均匀性,直接影响锂离子电池的品质和性能。透过对如此重要的搅拌机进行竞标,中国不仅增强了其电池製造技术,而且提高了整个电动车电池市场的成长和效率,支持了该行业的快速扩张。

- 例如,2024年6月,中国电池製造商国轩高科发布了一款革命性的电动车电池,可在10分钟内完成充电,使其成为全球领先企业宁德时代的有力竞争对手。这种快速充电创新直接解决了消费者对充电时间的担忧。 Gothion已开始大量生产远距混合动力汽车的G-Current电池。同时,一条电动车电池生产线也在兴建中,计画年内开始量产。

- 中国政府仍坚定支持电动车产业,推出税收优惠、对製造商和消费者的补贴以及加强充电基础设施等措施。这些倡议旨在提高电动车的可负担性和便利性,提高采用率,进而扩大对电池材料的需求。电池技术的创新也正在改变电动车的格局。例如,比亚迪正在开创磷酸锂铁(LFP)电池等新化学电池,其能量密度比传统锂离子电池略低,但更安全、更经济。这些突破对于电动车在市场上的广泛采用至关重要。

- 展望未来,中国电动车电池製造市场可望走上看涨轨道。凭藉着坚定不移的政府支持、技术进步和战略产业合作,中国将保持在全球电动车领域的主导地位。主要电池製造商产能的不断扩张,加上对永续实践的关注,导致对关键材料的稳定需求,推动了电动车电池製造业的快速崛起。

- 中国锂离子电池产能已达到惊人的1.2兆瓦时(TWh),占全球76%的份额。随着全球一半以上的电动车在中国道路上行驶,预计到 2030 年产能将激增至 4.65TWh。

- 这种投资和生产扩张预计将放大对锂离子电池产能的需求。

中国电动汽车电池製造业概况

中国电动车电池製造市场已被削减一半。市场的主要企业(排名不分先后)包括比亚迪、宁德时代新能源科技有限公司、松下电器产业株式会社、中航锂电、蜂巢能源科技。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 投资增加电池产能

- 电池原物料成本下降

- 抑制因素

- 主要电池材料依赖进口

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池

- 锂离子

- 铅酸

- 镍氢电池

- 其他的

- 电池形式

- 方形

- 袋型

- 圆柱形

- 车辆

- 客车

- 商用车

- 其他的

- 晋升

- 电池电动车

- 油电混合车

- 插电式混合动力电动车

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- EnerSys

- GS Yuasa Corporation

- LG Chem Ltd

- Exide Industries

- Panasonic Corporation

- CALB(China Aviation Lithium Battery)

- SVOLT Energy Technology

- EVE Energy

- 其他知名公司名单

- 市场排名分析

第七章 市场机会及未来趋势

- 电动车的长期目标

简介目录

Product Code: 50003734

The China Electric Vehicle Battery Manufacturing Market size is estimated at USD 93.97 billion in 2025, and is expected to reach USD 221.89 billion by 2030, at a CAGR of 18.75% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as investments to enhance the battery production capacity and a decline in the cost of battery raw materials are expected to be among the most significant drivers for the China Electric Vehicle Battery Manufacturing Market during the forecast period.

- On the other hand, import dependency for key battery materials leaves the industry vulnerable to price fluctuations and imbalanced development. This poses a threat to the China Electric Vehicle Battery Manufacturing Market during the forecast period.

- Nevertheless, continued Long-term ambitious targets for electric vehicles. This factor is expected to create several opportunities for the market in the future.

China Electric Vehicle Battery Manufacturing Market Trends

Lithium-ion Battery Type to Dominate the Market

- Li-ion batteries, known for their high energy density and long life cycles, have become the go-to choice for EV manufacturers. This technology not only ensures the production of efficient electric vehicles but also meets both consumer expectations and industry benchmarks.

- To bolster EV adoption and domestic battery production, the Chinese government has rolled out a series of robust policies. Initiatives like the New Energy Vehicle (NEV) mandate, alongside subsidies and tax incentives, are fueling the rapid expansion of the EV sector. Furthermore, the "Made in China 2025" initiative underscores China's ambition to cement its status as a global frontrunner in advanced manufacturing.

- China's drive to cut carbon emissions and tackle air pollution is a pivotal force behind its booming EV market. With policies championing clean energy vehicles, the nation is witnessing a swift transition from internal combustion engines to electric mobility. As the globe's largest EV market, China's surging demand is propelled by urbanization, heightened environmental consciousness, and stringent vehicle emission regulations, all of which amplify the need for domestically produced batteries.

- In May 2024, China is set to channel approximately CNY 6 billion (USD 845 million) into pioneering next-generation battery technologies for electric vehicles (EVs). All Solid State Batteries (ASSBs), a cutting-edge advancement over traditional lithium-ion batteries (LIBs), utilize a solid conductive electrolyte, enhancing safety and energy density. Recognizing their potential, EV battery titan CATL is poised to receive government backing for this technological leap.

- China's expansive charging infrastructure development is pivotal for the country's electric vehicle adoption. This strategic investment guarantees EV users easy access to efficient charging solutions, further amplifying the demand for EV batteries. Concurrently, Chinese firms are pouring resources into R&D, aiming to refine battery technologies and curtail production costs. Collaborations with international tech giants and research entities are catalyzing innovations in battery manufacturing.

- For example, in May 2024, state-owned SAIC announced plans to integrate full solid-state batteries into its EV brands by 2025, with mass production slated for 2026. Boasting an energy density exceeding 400Wh/kg, this battery promises a driving range of at least 1,000km. Last June, domestic EV maker Nio successfully tested a solid-state battery achieving a 360Wh/kg energy density and a remarkable 1,044km range. Additionally, IM Motors, partially owned by SAIC, revealed in April its IM L6 EV model, featuring an ultra-fast charging solid-state battery with 130kWh power, supporting a 1,000km range and 900V ultra-fast charging capability.

- China dominates the global battery landscape, boasting a manufacturing capacity nearing 900 gigawatt-hours, which translates to a commanding 77% share of the worldwide total. Furthermore, six of the top ten battery manufacturers globally hail from China. This dominance is further reinforced by China's holistic control over the entire EV supply chain, from metal mining to vehicle production. With more than half of the world's electric vehicle fleet residing in China, the nation's lithium-ion battery cell manufacturing capacity, recorded at 1705 GWh in 2023, is projected to skyrocket to 6197 GWh by 2027.

- Given these developments and investments, a surge in EV battery production across the region is anticipated, alongside a growing demand for lithium-ion batteries in the coming years.

Investments to Enhance the Battery Production Capacity

- China is strategically ramping up its battery manufacturing capacity to cater to the surging demand for electric vehicles (EVs). Government initiatives, including subsidies and investment incentives, are spurring domestic companies to bolster their production capabilities. This concerted effort seeks to cement China's status as a global frontrunner in EV battery manufacturing, guaranteeing a consistent supply of premium batteries for the expanding EV market.

- The establishment of new battery production plants throughout China is propelling the EV battery manufacturing market. Industry giants like CATL and BYD are rolling out cutting-edge facilities to amplify their production. These state-of-the-art plants, outfitted with advanced technologies, promise heightened output and efficiency-key factors in satisfying the surging domestic and international appetite for EV batteries.

- Floating tenders for slurry mixers play a pivotal role in refining the battery production process. These mixers ensure uniformity in battery material blending, directly influencing the quality and performance of lithium-ion batteries. By soliciting tenders for these crucial mixers, China is not only enhancing its battery manufacturing technology but also bolstering the overall growth and efficiency of the EV battery market, fueling the industry's swift expansion.

- For example, in June 2024, Gotion High-tech, a Chinese battery cell manufacturer, unveiled a groundbreaking electric vehicle battery capable of charging in under 10 minutes, positioning it as a formidable competitor to global leader CATL. This swift-charging innovation directly addresses consumer concerns about charging durations. Gotion has commenced mass production of its G-Current batteries, tailored for extended-range hybrids. Meanwhile, production lines for all-electric vehicle batteries are under construction, with mass production slated to kick off by year's end.

- China's government remains steadfast in its support for the EV sector, rolling out measures like tax incentives, subsidies for manufacturers and consumers, and bolstering charging infrastructure. Such initiatives aim to enhance the affordability and convenience of EVs, driving up adoption rates and, in turn, amplifying the demand for battery materials. Battery technology innovations are also reshaping the landscape. For instance, BYD is pioneering new chemistries like lithium iron phosphate (LFP) batteries-safer and more economical, albeit with a marginally lower energy density than conventional lithium-ion counterparts. These breakthroughs are pivotal in making EVs more accessible to the broader market.

- Looking ahead, China's EV battery manufacturing market is poised for a bullish trajectory. With unwavering government backing, technological strides, and strategic industry collaborations, China is set to uphold its dominance in the global EV arena. The relentless expansion of production capacities by leading battery manufacturers, coupled with a focus on sustainable practices, bodes well for a consistent demand for essential materials, propelling the swift ascent of the EV battery manufacturing sector.

- China's lithium-ion battery manufacturing capacity stands at a staggering 1.2 terawatt hours (TWh), commanding a robust 76 percent share of the global landscape. With more than half of the world's electric vehicles gracing Chinese roads, projections indicate this capacity will surge to 4.65 TWh by 2030.

- Such investments and production expansions are set to amplify the demand for lithium-ion battery capacity.

China Electric Vehicle Battery Manufacturing Industry Overview

The China Electric Vehicle Battery Manufacturing Market is semi-fragmented. Some of the key players in this market (in no particular order) are BYD Co. Ltd., Contemporary Amperex Technology Co. Limited, Panasonic Corporation, CALB (China Aviation Lithium Battery), and SVOLT Energy Technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Investments to Enhance the battery production capacity

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Import Dependency for Key Battery Material

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 EnerSys

- 6.3.4 GS Yuasa Corporation

- 6.3.5 LG Chem Ltd

- 6.3.6 Exide Industries

- 6.3.7 Panasonic Corporation

- 6.3.8 CALB (China Aviation Lithium Battery)

- 6.3.9 SVOLT Energy Technology

- 6.3.10 EVE Energy

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219