|

市场调查报告书

商品编码

1636433

义大利电动汽车电池製造设备:市场占有率分析、产业趋势、成长预测(2025-2030)Italy Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

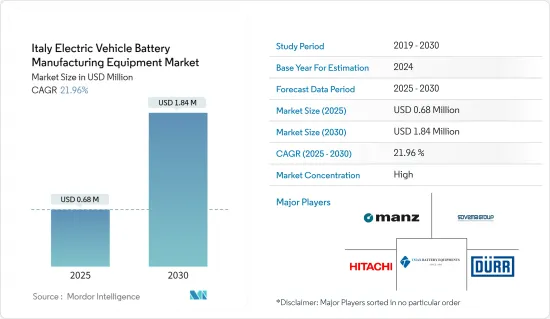

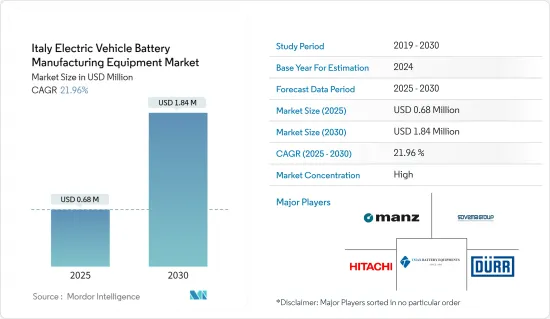

义大利电动车电池製造设备市场规模预计到2025年为68万美元,预计2030年将达到184万美元,预测期内(2025-2030年)复合年增长率为21.96%。

主要亮点

- 从长远来看,预计市场将受到电动车的广泛采用以及政府对电池製造积极投资的措施的推动。

- 另一方面,缺乏製造电池设备的公司极大地阻碍了市场的成长。

- 更高容量和更低放电率等各种技术的进步预计将使电池设备製造变得更加可行和高效,为电池製造设备市场创造巨大机会。

义大利电动汽车电池製造设备市场趋势

锂离子电池领域可望主导市场

- 多年来,由于电动车的普及、家用电子电器产品支出的增加以及消费者和製造业活动的增加等因素,义大利对一次和二次电池类型的锂离子电池的需求不断增加。创新最强大的经济体之一。

- 对自然资源枯竭的环保意识不断增强,二氧化碳排放不断增加,以及公共和私营部门不断努力减少二氧化碳排放和减少燃料消费量,是推动锂离子电池市场成长的因素。

- 义大利政府对碳排放也有严格的规定,随着锂离子电池在该国的使用,电动车的采用预计将会增加。最近,电动车电池製造商 Italvolt 宣布开设义大利第一家最先进的工厂,该工厂旨在满足电动车、工业设备、网格储存和其他应用程式」。用地面积超过30万平方公尺,员工约3000人,年产能高达45GWh。

- 2024年1月,义大利政府宣布其下一代潜水艇U212 NFS将配备先进的锂离子(Li-ion)电池系统。锂电池系统的测试结果预计将提高潜舰的运作效率,同时提高推进力和续航力,减少维护并提供最高水准的船上安全性。

- 此外,锂离子电池成本的下降也支撑了这个领域。截至 2023 年,锂离子电池的成本约为每千瓦时 139 美元,低于 2013 年的 780 美元。

- 鑑于上述情况,预计锂离子电池领域将在预测期内主导市场。

电动车的普及将带动市场的前景

- 义大利汽车工业蓬勃发展,拥有多家知名汽车製造商。这一背景正在推动电动车市场的成长。这家义大利汽车製造商在电动车研发方面投入巨资,推出了高品质、技术精湛的车型。这些进步增强了消费者对电动车的信心并刺激了市场扩张。

- 2023年,义大利电动车销量将达到13.6万辆,其中插电式混合动力车将占近7万辆。为了进一步促进电动车的普及,义大利推出了一系列措施和奖励,包括税收减免、补贴和津贴。这些努力不仅使电动车在经济上更加可行,而且加速了其采用。由此,义大利电动车的份额从2022年的0.39%上升至2023年的0.53%。车辆总数从2022年的158,131辆迅速增加至2023年12月的219,540辆。

- 此外,政府雄心勃勃的温室排放减排目标也进一步推动了电动车市场的发展。鑑于这些驱动力,义大利电动车市场可能会继续扩大。

- 2024年5月,法国政府与汽车业签署协议,目标是到2027年每年销售80万辆电动车。这个目标将在短短四年内将乘用车电动车销量增加近三倍,并显着提高纯电动轻型车的销量。欧洲也强调增加对电动车的投资,以符合欧洲在 2035 年实现 100% 新车销量的目标。

- 综上所述,消费者对环保汽车的需求、充电基础设施的成长、电动车车型的多样化、汽车工业基础的雄厚以及政府的支持措施不断增强,义大利电动车市场正在快速成长。

义大利电动汽车电池製造设备产业概况

义大利电动车电池製造设备市场正在变得半固体。该市场的主要企业(排名不分先后)包括Manz AG、Sovema Group、Durr AG、Hitachi 和Xiamen Tmax Battery Equipments Limited。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 政府有利措施

- 抑制因素

- 缺乏电池设备製造企业

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 过程

- 混合物

- 涂层

- 日历

- 狭缝/电极加工

- 其他的

- 电池

- 锂离子电池

- 铅酸电池

- 镍氢电池

- 其他电池

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Manz AG

- Sovema Group SpA

- Durr AG

- Hitachi Ltd

- Xiamen Tmax Battery Equipments Limited.

- Rosendahl Nextrom GmbH

- 市场排名/份额(%)分析

- 其他知名公司名单

第七章 市场机会及未来趋势

- 电池製造设备技术不断进步

简介目录

Product Code: 50003642

The Italy Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 0.68 million in 2025, and is expected to reach USD 1.84 million by 2030, at a CAGR of 21.96% during the forecast period (2025-2030).

Key Highlights

- Over the long term, the increasing adoption of electric vehicles and government policies with active investments in battery manufacturing are expected to drive the market.

- On the other hand, the shortage of companies manufacturing battery equipment significantly hinders the market's growth.

- Nevertheless, the increasing technological advancements in various technologies like higher capacity and low discharge rate is expected to make the manufacturing of battery equipment more feasible and efficient and create enormous opportunities for the battery manufacturing equipment market.

Italy Electric Vehicle Battery Manufacturing Equipment Market Trends

Lithium-Ion batteries Segment is expected to Dominate the Market

- Over the years, Italy has emerged as one of the strongest economies in the World in research and innovation in lithium-ion batteries. both primary and secondary battery types, owing to factors such as increased electric vehicle deployment, increased spending on consumer electronics, and increased consumer and manufacturing activities.

- The growing environmental awareness about the depletion of natural resources, increased carbon emissions, and ongoing efforts by public and private sectors to reduce carbon emissions and reduce fuel consumption are factors contributing to the growth of the lithium-ion battery market

- Also, stringent government regulations for carbon emissions in Italy are expected to increase the adoption of electric vehicles along with the use of lithium-ion batteries in the country. Moreover, recently, Italvolt, the manufacturer of electric vehicle batteries intended for electric vehicles announced Italy's first "Gigafactory", a state-of-the-art facility to satisfy rapidly growing demand for lithium-ion cells for electric vehicles, industrial equipment, grid battery storage and other applications. Scheduled to open in 2025, the site will cover more than 300,000 m2, is expected to employ around 3,000 people and have a production capacity of up to 45 GWh per year,

- In January 2024, the Government of Italy announced next generation U212 NFS submarines will feature advanced Lithium Ion (Li-ion) battery systems. The Lithium Battery System Tests results envisaged higher submarines' operational efficiency, simultaneously enhancing propulsion and endurance capabilities, reducing maintenance and granting highest levels of on-board safety.

- In addition, the declining cost of lithium-ion batteries are likely to support the segment. As of 2023, the cost of lithium-ion battery cost was around USD 139 per kWh, decreased from 780 per kWh in 2013.

- Owing to the above points, Lithium-ion battery segment is expected to dominate the market during the forecast period.

Increasing Adoption of Electric Vehicles is expected to Drive the Market

- Italy boasts a robust automotive industry, home to several prominent car manufacturers. This backdrop has fostered the growth of the Electric Vehicles market. Italian automakers are heavily investing in Electric Vehicle R&D, resulting in the creation of high-quality, tech-savvy models. Such advancements have bolstered consumer trust in Electric Vehicles, fueling market expansion.

- In 2023, Italy recorded electric vehicle sales reaching 136,000, with PHEVs accounting for nearly 70,000 of that figure. To further bolster Electric Vehicle adoption, Italy has rolled out a suite of policies and incentives, including tax breaks, subsidies, and grants. These initiatives have not only made Electric Vehicles more financially accessible but have also spurred their uptake. Consequently, the proportion of electric cars in Italy climbed from 0.39% in 2022 to 0.53% in 2023. The total count surged from 158,131 in 2022 to 219,540 by December 2023.

- Moreover, the government's ambitious greenhouse gas emission reduction targets have further galvanized the Electric Vehicles market. Given these driving forces, the Electric Vehicles market in Italy is poised for continued expansion in the years ahead.

- In May 2024, the French government inked a deal with the automotive sector, aiming for 800,000 annual EV sales by 2027. This target seeks to nearly triple passenger car EV sales in just four years and significantly boost BEV light-duty vehicle sales. The agreement also emphasizes ramping up investments in EVs, aligning with Europe's goal of achieving 100% electric new car sales by 2035.

- In summary, Italy's Electric Vehicles market is on a rapid ascent, fueled by a blend of consumer demand for eco-friendly vehicles, a growing charging infrastructure, a diverse array of Electric Vehicle models, a solid automotive industry foundation, and supportive government policies.

Italy Electric Vehicle Battery Manufacturing Equipment Industry Overview

The Italy Electric Vehicle Battery Manufacturing Equipment Market is semi-consolidated. Some of the key players in this market (in no particular order) are Manz AG, Sovema Group, Durr AG, Hitachi Ltd, and Xiamen Tmax Battery Equipments Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Favorable Government Policies

- 4.5.2 Restraints

- 4.5.2.1 The Shortage of Companies Manufacturing Battery Equipment

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendering

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Process

- 5.2 Battery

- 5.2.1 Lithium-Ion Batteries

- 5.2.2 Lead-Acid Batteries

- 5.2.3 Nickel-Metal Hydride Batteries

- 5.2.4 Other Batteries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Manz AG

- 6.3.2 Sovema Group S.p.A.

- 6.3.3 Durr AG

- 6.3.4 Hitachi Ltd

- 6.3.5 Xiamen Tmax Battery Equipments Limited.

- 6.3.6 Rosendahl Nextrom GmbH

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Advancements in Battery Manufacturing Equipment

02-2729-4219

+886-2-2729-4219