|

市场调查报告书

商品编码

1636454

北美电动车电池製造设备:市场占有率分析、产业趋势、成长预测(2025-2030)North America Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

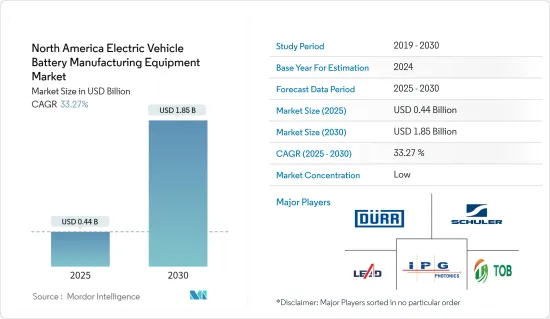

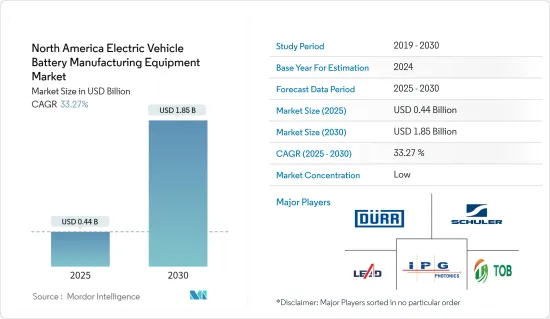

预计2025年北美电动车电池製造设备市场规模为4.4亿美元,2030年达18.5亿美元,预测期间(2025-2030年)复合年增长率为33.27%。

主要亮点

- 从中期来看,该地区电动车渗透率的提高以及政府的支持措施和法规等因素预计将成为预测期内北美电动车电池製造设备市场的最大推动力之一。

- 另一方面,亚太地区等现有电池市场正在竞争。这对预测期内的北美电动车电池製造设备市场构成威胁。

- 北美国家电池製造供应链在地化的持续努力预计将在未来几年为市场创造一些机会。

- 由于政府加大力度建立电池製造和提高电动车的普及率,预计美国将主导市场并在预测期内实现最高成长。

北美电动车电池製造设备市场趋势

狭缝和电极製造经历了巨大的成长

- 狭缝和电极製造领域在北美电动车电池製造设备市场中发挥着至关重要的作用。该细分市场强调精度、效率和适应性的重要性,特别是在电动车需求迅速增长的情况下。该部分包括一系列复杂的工艺,将涂层电极材料转化为最终结构并将其组装成电池/电池。这些电池对于电动车电池的性能和可靠性至关重要。

- 在北美,交通运输变得更加电气化,分切製程将大卷涂层电极材料切成窄条。这些条带必须满足各种电池设计的精确规格。正极通常是铝,负极是铜,最重要的是高精度地执行此过程,以避免损坏活性锂化合物和集流体箔等精緻材料。

- 截至2024年1月,国家再生能源实验室的资料显示,其在北美的电极和电池製造情况中占有很大份额。美国以 80 家设施和 66 家公司位居榜首,其次是加拿大,拥有 11 家设施和公司,北美其他地区、中东和非洲则拥有 4 家设施和 2 家公司。

- 这证实了北美电动车(EV)电池製造设备市场的活跃成长。设施的数量表明必要的基础设施已经到位,可以满足对电动车不断增长的需求。

- 切割后,电极製造过程开始。在这里,各个条带被切割成精确的尺寸并准备组装。此准备工作包括添加极耳以及施加保护涂层和处理,以增强电极性能和寿命。

- 此外,北美市场对创新和永续性的重视正在推动分切设备和电极製造设备的进步。製造商正在积极寻求减少废弃物并提高材料可回收性的方法。我们的目标是提高产量比率、减少废品,并引入系统来回收和再循环电极涂层和製备阶段的多余材料和溶剂。

- 例如,2023 年 9 月,橡树岭国家实验室的工程师推出了突破性的干电池製造流程。这项创新解决了通常依赖有毒溶剂的传统湿浆法的挑战。这种依赖不仅增加了生产成本,也带来健康和环境风险。 Oakridge的无溶剂製程生产的电池更轻、更耐用,并且在使用后保持高能源储存能力。

- 鑑于这些进步和对精确度的重视,狭缝电极製造业预计在未来几年将显着成长。

美国主导市场

- 在美国,电动车电池製造设备市场受到推动产业成长的多种因素的支持,包括联邦激励措施、地方政府措施和私人投资。例如,投资电池製造的公司可以获得各种税额扣抵和津贴,降低新进入障碍并帮助现有公司扩张。

- 例如,从2023年开始,美国政府将透过《通膨削减法案》提供税额扣抵,《两党基础设施法案》则分配高达1兆美元的税额扣抵以促进能源转型。根据《减少通货膨胀法案》,电池生产商可以获得每千瓦时 35 美元的电池生产信贷和每千瓦时 10 美元的电池模组生产信贷。此外,公司还可以申请电极活性材料成本 10% 的折扣。值得注意的是,企业可以灵活地将这些税额扣抵转让或出售给其他纳税人。

- 此外,电动车供应链在地化的动力强劲,导致对国内电池製造设施的投资增加。美国政府更严格的排放法规进一步推动了这一趋势,促使汽车製造商转向更永续的电池驱动汽车。

- 根据国家再生能源实验室的数据,截至 2024 年 1 月,美国有 64 家从事电池製造设备领域的公司,65 家工厂分布在各个地区。这种强大的基础设施正在支持电动车电池製造设备市场的成长。

- 创新是美国市场的另一个基石,许多公司都在努力提高电池效率、降低成本并使电池生产更具永续性。重点不仅在于锂离子技术的进步,还在于探索替代化学物质和解决方案,例如固态电池,预计它有望提高能量密度并改善安全性。

- 因此,预计美国在预测期内将出现强劲成长。

北美电动汽车电池製造设备产业概况

北美电动车电池製造设备市场已被削减一半。该市场的主要企业(排名不分先后)包括Durr AG、Schuler AG、IPG Photonics Corporation、无锡利德智慧装备和厦门TOB新能源科技。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 政府支持性法规和措施

- 抑制因素

- 与现有市场的竞争

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 过程

- 混合物

- 涂层

- 日历

- 狭缝/电极加工

- 其他的

- 电池

- 锂离子

- 铅酸

- 镍氢电池

- 其他电池

- 地区

- 美国

- 加拿大

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Duerr AG

- Schuler AG

- Hitachi Ltd.

- Xiamen Tmax Battery Equipments Limited

- ACEY New Energy Technology

- IPG Photonics Corporation

- Wuxi Lead Intelligent Equipment Co Ltd

- ACEY New Energy Technology

- Xiamen Lith Machine Limited

- Xiamen TOB New Energy Technology Co., Ltd.

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 供应链本地化

简介目录

Product Code: 50003721

The North America Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 0.44 billion in 2025, and is expected to reach USD 1.85 billion by 2030, at a CAGR of 33.27% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing adoption of electric vehicles in the region coupled with supportive government policies and regulations are expected to be among the most significant drivers for the North American Electric Vehicle Battery Manufacturing Equipment Market during the forecast period.

- On the other hand, established battery markets such as Asia Pacific are competing. This poses a threat to the North American Electric Vehicle Battery Manufacturing Equipment Market during the forecast period.

- Nevertheless, continued efforts to localize battery manufacturing supply chains in North American countries are expected to create several opportunities for the market in the future.

- United States is expected to dominate the market and will likely register the highest growth during the forecast period due to the government's rising efforts to establish battery manufacturing and the growing adoption of electric vehicles.

North America Electric Vehicle Battery Manufacturing Equipment Market Trends

Slitting and Electrode Making to Witness Significant Growth

- The slitting and electrode-making segment plays a pivotal role in North America's electric vehicle battery manufacturing equipment market. This segment underscores the importance of precision, efficiency, and adaptability, especially given the surging demand for electric vehicles. It involves a series of intricate processes that convert coated electrode materials into final structures, primed for assembly into battery cells. These cells are crucial for the performance and reliability of electric vehicle batteries.

- In North America, where the drive towards transport electrification is gaining momentum, the slitting process cuts large rolls of coated electrode material into narrower strips. These strips must meet precise specifications for various battery designs. Executing this process with high precision is paramount to avoid damaging delicate materials, including active lithium compounds and current collector foils, which are typically aluminum for cathodes and copper for anodes.

- As of January 2024, data from the National Renewable Energy Laboratory reveals a significant presence in North America's electrode and cell manufacturing landscape. The U.S. leads with 80 facilities and 66 companies, followed by Canada with 11 facilities and companies, and the rest of North America with four facilities and two companies.

- This underscores the vigorous growth of the electric vehicle (EV) battery manufacturing equipment market in North America. The multitude of facilities indicates a well-established infrastructure, crucial for meeting the rising demand for electric vehicles.

- After slitting, the electrode-making process commences. Here, individual strips are cut to precise dimensions and readied for assembly. This preparation may involve adding tabs and applying protective coatings or treatments to boost the electrode's performance and longevity.

- Furthermore, the North American market emphasizes innovation and sustainability, propelling advancements in slitting and electrode-making equipment. Manufacturers are actively seeking methods to minimize waste and bolster material recyclability. Innovations aim to enhance yield, reduce scrap, and implement systems for recovering and recycling excess materials or solvents from the electrode coating and preparation stages.

- For example, in September 2023, engineers at Oak Ridge National Laboratory introduced a groundbreaking dry battery manufacturing process. This innovation tackles the challenges of the traditional wet slurry method, which often depends on toxic solvents. Such reliance not only escalates manufacturing costs but also poses health and environmental risks. Oak Ridge's solvent-free process yields a battery that's lighter, more durable, and maintains a high energy storage capacity even after use.

- Given these advancements and the emphasis on precision, the slitting and electrode-making segment is poised for significant growth in the coming years.

United States to Dominate the Market

- In the United States, the electric vehicle battery manufacturing equipment market is supported by a confluence of factors, including federal incentives, local government policies, and private investments that collectively enhance the industry's growth. For example, various tax credits and grants are available to companies that invest in battery manufacturing, which lowers the entry barrier for new players and supports the expansion of existing companies.

- For instance, starting in 2023, the United States government is offering Tax Credits via the Inflation Reduction Act, and Bipartisan Infrastructure Law laws have allocated a staggering USD 1 trillion in tax credits to facilitate the energy transition. Under the Inflation Reduction Act, battery producers benefit from manufacturing credits, receiving USD 35 per kilowatt-hour for battery cell production and USD 10 per kilowatt-hour for battery modules. Additionally, companies can claim a 10% reimbursement on costs for electrode-active materials. Notably, businesses have the flexibility to transfer or sell these tax credits to other taxpayers.

- Additionally, there is a strong push towards localizing the electric vehicle supply chain, which has led to increased investments in battery manufacturing facilities across the country. This trend is further bolstered by the United States government's stringent emissions regulations, which encourage automotive manufacturers to shift towards more sustainable, battery-powered vehicles.

- According to the National Renewable Energy Laboratory, as of January 2024, the United States boasted 64 companies operating in the battery manufacturing equipment sector, with 65 facilities spread across various regions. This robust infrastructure drives the growth of the Electric Vehicle Battery Manufacturing Equipment Market.

- Technological innovation is another cornerstone of the United States market, with numerous companies engaged in pioneering work to improve battery efficiency, reduce costs, and enhance the sustainability of battery production. The focus is not only on advancing lithium-ion technology but also on exploring alternative chemistries and solutions, such as solid-state batteries, which promise higher energy densities and improved safety profiles.

- Therefore, the United States is expected to witness significant growth during the forecast period, as mentioned above.

North America Electric Vehicle Battery Manufacturing Equipment Industry Overview

The North America Electric Vehicle Battery Manufacturing Equipment Market is semi-fragmented. Some of the key players in this market (in no particular order) are Duerr AG, Schuler AG, IPG Photonics Corporation, Wuxi Lead Intelligent Equipment Co. Ltd., and Xiamen TOB New Energy Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Supportive Government Regulations and Policies

- 4.5.2 Restraints

- 4.5.2.1 Competition From Established Markets

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendaring

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Process

- 5.2 Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-Acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Other Batteries

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Duerr AG

- 6.3.2 Schuler AG

- 6.3.3 Hitachi Ltd.

- 6.3.4 Xiamen Tmax Battery Equipments Limited

- 6.3.5 ACEY New Energy Technology

- 6.3.6 IPG Photonics Corporation

- 6.3.7 Wuxi Lead Intelligent Equipment Co Ltd

- 6.3.8 ACEY New Energy Technology

- 6.3.9 Xiamen Lith Machine Limited

- 6.3.10 Xiamen TOB New Energy Technology Co., Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Localization of Supply Chains

02-2729-4219

+886-2-2729-4219