|

市场调查报告书

商品编码

1636452

义大利电动汽车电池製造:市场占有率分析、产业趋势、成长预测(2025-2030)Italy Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

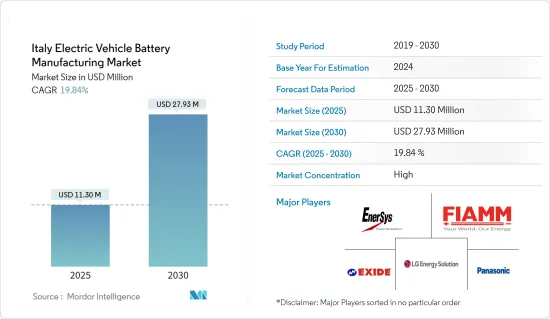

义大利电动车电池製造市场规模预计到2025年为1,130万美元,预计2030年将达到2,793万美元,预测期内(2025-2030年)复合年增长率为19.84%。

主要亮点

- 从中期来看,增加投资以提高电池产能和降低电池原材料成本预计将在预测期内推动电动车电池製造需求。

- 另一方面,原材料蕴藏量短缺可能会显着抑制电动车电池製造市场的成长。

- 然而,扩大产能、加强技术进步和降低成本等电动车的长期雄心勃勃的目标预计将在不久的将来为电动车电池製造市场创造重大机会。

义大利电动汽车电池製造市场趋势

锂离子电池类型主导市场

- 锂离子 (Li-ion) 电池彻底改变了电动车 (EV) 市场,并刺激了电池製造的创新。锂离子电池的关键特性,如高能量密度、长循环寿命和快速充电,使其成为当今电动车的选择。

- 此外,锂离子二次电池具有优异的容量重量比,这使得它们优于其他技术。儘管锂离子二次电池往往比其他替代品更昂贵,但市场领导者正在加大研发投入、扩大生产、加剧竞争,从而压低价格。

- 电动车电池组和电池能源储存系统(BESS)的平均价格一直在上涨,但到2023年将大幅下降,下降13%至139美元/kWh。据预测,这种下降趋势预计将持续下去,到2025年将达到113美元/千瓦时,并在2030年进一步降至80美元/千瓦时。

- 在全球范围内,各国政府正在推出政策和奖励,以加速电动车(EV)的普及并扩大锂离子电池的生产。作为一项策略性倡议,主要国际公司正在对当地企业进行大量投资,以扩大锂离子电池的生产,特别是电动车(EV)的锂离子电池生产。

- 例如,2024年2月,Automotive Cells公司获得47亿美元资金,在法国、德国和义大利建立三个锂离子电池超级工厂。该合资企业得到了 Stellantis、梅赛德斯-奔驰和 Saft(TotalEnergies 子公司)等行业巨头的支持,预计将在不久的将来推动先进锂离子电池的需求,从而加强该地区的电动汽车电池製造。的。

- 此外,各国政府正在製定政策和奖励,以促进电动车(EV)的采用和发展锂离子电池产业。这些政府重点关注研究和开发,旨在寻找具有成本效益的材料替代品,以取代钴等材料,而钴等材料因高成本且供应有限而闻名。这项策略支点不仅降低了生产成本,也加强了永续的供应链。

- 例如,2024年7月,POSCO N.EX.T Hub推出了一款突破性的负极保护层,具有专为固态固态电池定制的功能性黏合剂(PVA-g-PAA)。这项创新功能可确保均匀的锂沉积,显着减少锂的使用量并提高电池寿命和能量密度。这些突破性技术可能在未来几年加速国内电池生产。

- 因此,这些倡议和计划预计将在预测期内提高锂离子电池产量并显着提高电动车电池产能。

乘用车板块实现大幅成长

- 义大利汽车产业正在向电动车 (EV) 进行决定性转型,以促进全球永续性并减少碳排放。这项转变的关键因素是更加关注电动车电池的生产和改进。这项变化不仅正在改变义大利乘用车市场的动态,也影响着该产业的多个方面。

- 此外,随着义大利拥抱清洁能源,转型为电动车款已成为许多公司的中心主题。义大利的电动车销量大幅成长。例如,根据国际能源总署(IEA)的报告,2023年电动车销量将为13.6万辆,比2022年增长19.3%,比2019年增长惊人的6.8倍。在这一势头和加拿大政府最近倡议的推动下,电动车销量预计将进一步增加,这表明对电动车电池生产的需求激增。

- 为了对抗空气污染并减少对石化燃料的依赖,义大利正在积极推广电动车(EV)的采用,并将其扩展到更广泛的乘用车领域。政府的多管齐下策略包括财政诱因、基础设施增强和公众意识提升宣传活动,所有这些都是为了促进这一转变。

- 作为其承诺的标誌,义大利于 2024 年 2 月拨款 9.5 亿欧元(约 10 亿美元)。该资金旨在透过加速向清洁汽车,特别是电动车(EV)的转变,重振汽车产业。具体来说,罗马的策略包括高达 13,750 欧元(15,042 美元)的慷慨补贴,主要使低收入者受益。这笔补助金用于购买一辆价值高达 35,000 欧元(38,290 美元)的新型全电动汽车。这些措施预计将增加该地区对乘用车的需求,并在预测期内增加对电池製造的需求。

- 此外,在义大利,主要汽车製造商正在推出尖端的插电式混合动力电动车(PHEV)。此举反映了全行业向插电式混合动力车发展的趋势,製造商寻求将电动车和传统引擎的优势结合起来,以满足消费者需求和当地法规。

- 例如,2024年5月,Stellantis宣布计划推出其500e小型电动车的混合动力版本,该车将在其位于义大利的Mirafiori工厂生产。 500e 已在义大利都灵生产。此类策略营运预计将促进混合动力乘用车在该地区的普及,并在短期内推动电池製造的需求。

- 因此,这些倡议和计划预计将增强电动车需求,并在未来几年显着增加对电动车电池製造的需求。

义大利电动汽车电池製造业概况

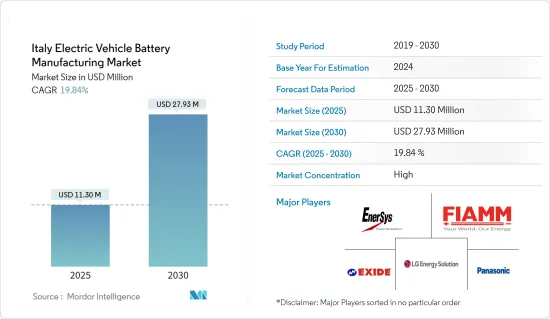

义大利电动车电池製造市场正在变得半固体。主要企业(排名不分先后)包括Panasonic Holdings、Exide Industries Ltd、EnerSys、FIAMM Energy Technology SpA 和 LG Chem Ltd。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 投资增加电池产能

- 电池原物料成本下降

- 抑制因素

- 原料蕴藏量不足

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 透过电池

- 锂离子

- 铅酸电池

- 镍氢电池

- 其他的

- 依电池形状分类

- 方形

- 袋型

- 圆柱形

- 搭车

- 客车

- 商用车

- 其他的

- 透过促销

- 电池电动车

- 油电混合车

- 插电式混合动力电动车

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- FIAMM Energy Technology SpA

- Panasonic Corporation

- LG Chem Ltd

- EnerSys

- Saft Groupe SA

- FAAM(Fabbrica Accumulatori Motocarri Montenero)

- Exide Industries Ltd

- STMicroelectronics NV

- MIDAC SpA

- Gotion High tech Co Ltd

- List of Other Prominent Companies

- 市场排名分析

第七章 市场机会及未来趋势

- 电动车的长期目标

简介目录

Product Code: 50003719

The Italy Electric Vehicle Battery Manufacturing Market size is estimated at USD 11.30 million in 2025, and is expected to reach USD 27.93 million by 2030, at a CAGR of 19.84% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising investments to enhance the battery production capacity and the decline in the cost of raw battery materials are expected to drive the demand for electric vehicle battery manufacturing during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the electric vehicle battery manufacturing market.

- Nevertheless, the long-term ambitious targets for electric vehicles like scaling up production capacity, enhancing technological advancements, and reducing costs are expected to create significant opportunities for the electric vehicle battery manufacturing market in the near future.

Italy Electric Vehicle Battery Manufacturing Market Trends

Lithium-Ion Battery Type Dominate the Market

- Lithium-ion (Li-ion) batteries have revolutionized the electric vehicle (EV) market, driving innovations in battery production. Their key attributes-high energy density, long cycle life, and swift charging-make them the preferred choice for today's EVs.

- Moreover, lithium-ion rechargeable batteries surpass other technologies due to their excellent capacity-to-weight ratio. Although they tend to be more expensive than alternatives, leading players in the market are boosting R&D investments and ramping up production, heightening competition, and pushing prices down.

- Despite rising average battery pack prices for EVs and battery energy storage systems (BESS), 2023 witnessed a significant dip, with prices falling to USD 139/kWh-a 13% decrease. Projections suggest this downward trajectory will persist, with prices anticipated to reach USD 113/kWh by 2025 and further decline to USD 80/kWh by 2030, driven by relentless technological and manufacturing progress.

- Globally, governments are rolling out policies and incentives to accelerate the adoption of electric vehicles (EVs) and expand Lithium-ion battery production. In a strategic move, major international firms are channeling significant investments into local companies to boost lithium-ion battery production, particularly for electric vehicles (EVs).

- For example, in February 2024, the Automotive Cells Company clinched a USD 4.7 billion funding to set up three lithium-ion battery gigafactories in France, Germany, and Italy. This venture, backed by industry giants like Stellantis, Mercedes-Benz, and Saft (a TotalEnergies subsidiary), is poised to elevate the demand for advanced lithium-ion batteries in the near future, subsequently bolstering EV battery manufacturing in the region.

- Additionally, governments nationwide are pushing policies and incentives to accelerate electric vehicle (EV) adoption and advance the Lithium-ion battery industry. With a focus on R&D, these governments aim to discover cost-effective substitutes for materials like cobalt, known for their high cost and limited availability. This strategic pivot not only reduces production expenses but also strengthens a sustainable supply chain.

- As an illustration, in July 2024, the POSCO N.EX.T Hub introduced a groundbreaking anode protection layer, equipped with a functional binder (PVA-g-PAA), tailored for all-solid-state batteries. This innovative feature guarantees even lithium deposition, significantly curtailing lithium usage, while enhancing battery lifespan and energy density. Such breakthroughs are set to expedite battery production in the country in the forthcoming years.

- Consequently, these initiatives and projects are poised to boost lithium-ion battery production and markedly elevate EV battery manufacturing capacity during the forecast period.

Passengers Cars Segment to Witness Significant Growth

- Italy's automotive sector is making a decisive shift towards electric vehicles (EVs), driven by a global push for sustainability and a commitment to reducing carbon emissions. A key element of this transformation is the intensified focus on the production and refinement of electric vehicle batteries. This shift is not only altering the dynamics of Italy's passenger car market but also influencing various facets of the industry.

- Moreover, as Italy embraces clean energy, the transition to electric vehicles has become a central theme for numerous companies. EV sales in Italy have surged dramatically. For instance, in 2023, the International Energy Agency (IEA) reported 136,000 electric vehicles sold, marking a 19.3% increase from 2022 and a staggering 6.8-fold rise since 2019. With this momentum and buoyed by recent Canadian government initiatives, EV sales are poised to climb further, signaling a booming demand for EV battery production.

- In a bid to tackle air pollution and reduce reliance on fossil fuels, Italy is vigorously promoting the adoption of electric vehicles (EVs), extending this push to encompass a broader range of passenger cars. The government's multifaceted strategy includes financial incentives, infrastructure enhancements, and public awareness campaigns, all designed to facilitate this transition.

- As a testament to its commitment, in February 2024, Italy allocated a significant 950 million euros (about USD 1 billion) in subsidies. This funding aims to accelerate the shift to cleaner vehicles, especially electric cars (EVs), and rejuvenate the automotive sector. Specifically, Rome's strategy includes generous subsidies of up to 13,750 euros (USD 15,042), predominantly benefiting low-income individuals. This financial boost is intended for purchasing new, fully electric vehicles, capped at a price of 35,000 euros (USD 38,290). Such measures are poised to amplify the demand for passenger cars in the region and subsequently heighten the need for battery manufacturing during the forecast period.

- In addition, leading automotive manufacturers are introducing state-of-the-art plug-in hybrid electric vehicles (PHEVs) in Italy. This trend reflects a wider industry movement towards PHEVs, as manufacturers seek to merge the benefits of electric and conventional engines, catering to both consumer desires and regional regulations.

- For example, in May 2024, Stellantis announced its plan to launch a hybrid version of its 500e compact electric car, with production slated at its Mirafiori facility in Italy. The 500e is already in production in Turin, Italy. Such strategic maneuvers are set to boost the uptake of hybrid passenger vehicles in the region and drive the demand for battery manufacturing in the foreseeable future.

- Consequently, these initiatives and projects are anticipated to bolster EV demand and substantially elevate the need for EV battery manufacturing in the coming years.

Italy Electric Vehicle Battery Manufacturing Industry Overview

Italy's electric vehicle battery manufacturing market is semi-consolidated. Some of the key players (not in particular order) are Panasonic Holdings Corporation, Exide Industries Ltd, EnerSys, FIAMM Energy Technology SpA, and LG Chem Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Investments to Enhance the battery production capacity

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FIAMM Energy Technology SpA

- 6.3.2 Panasonic Corporation

- 6.3.3 LG Chem Ltd

- 6.3.4 EnerSys

- 6.3.5 Saft Groupe SA

- 6.3.6 FAAM (Fabbrica Accumulatori Motocarri Montenero)

- 6.3.7 Exide Industries Ltd

- 6.3.8 STMicroelectronics N.V

- 6.3.9 MIDAC SpA

- 6.3.10 Gotion High tech Co Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219