|

市场调查报告书

商品编码

1636237

美国SLI电池:市场占有率分析、产业趋势、成长预测(2025-2030)United States SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

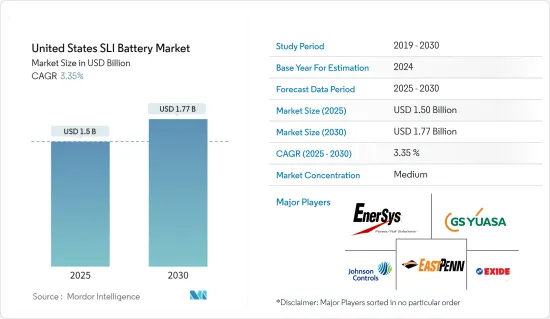

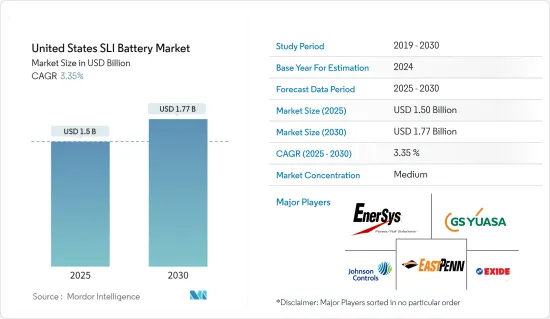

美国SLI电池市场规模预计到2025年为15亿美元,预计到2030年将达到17.7亿美元,预测期内(2025-2030年)复合年增长率为3.35%。

主要亮点

- 从中期来看,该地区电动车产业的成长以及工业应用中 SLI 电池的日益采用等因素预计将成为预测期内美国SLI 电池市场的最大推动力之一。

- 同时,来自替代电池化学品的竞争正在加剧,对预测期内的市场成长构成威胁。

- SLI 电池的持续研发工作预计将在未来创造多个市场机会。

美国SLI电池市场趋势

汽车最终用户市场预计将显着成长

- 汽车最终用户市场占据了美国SLI 电池市场的大部分。该细分市场主要包括乘用车、商用车和越野车,所有这些车辆的核心功能都严重依赖 SLI 电池。该细分市场对 SLI 电池的需求受到多种因素的推动,包括新车销售、现有持有以及旧车的电池更换週期。

- 近年来,由于经济状况、消费者偏好以及 COVID-19 大流行等世界事件,美国汽车业的新车销售出现波动。儘管存在这些波动,但总体趋势是美国道路上的车辆总数逐渐增加,直接影响了对 SLI 电池的需求。

- 根据国际汽车工业协会统计,近年来汽车产量大幅增加。 2020年至2023年汽车产量年复合成长率超过5%。同时,2022年至2023年成长超过5.5%,显示汽车需求正在扩大。

- 该领域的技术进步正在推动更复杂的车辆电气系统的发展,从而推动 SLI 电池技术的创新。现代汽车配备了先进的怠速熄火系统、再生煞车以及更多的电气元件,这些都给汽车电池带来了更大的压力。

- 为此,电池製造商推出了增强型电解铅酸(EFB)和吸收玻璃毡(AGM)电池,与传统铅酸电池相比,它们具有更高的性能和更长的使用寿命。这些先进的电池越来越多地安装在新车上,特别是那些配备怠速熄火系统的汽车上,并正在逐步扩大其在替换市场中的份额。

- 例如,2024年4月,占据全球低压汽车电池市场三分之一份额的主要製造商Clarios与一家主要目标商标产品製造商签署了关键供应商协议。此次合作以 Clarios 的最新创新成果为中心,即高性能 12 伏特可充电吸收玻璃毡 (AGM) 电池。这种尖端电池具有改进的充电接受性能,不仅降低了燃料消耗,而且在减少二氧化碳排放方面发挥了关键作用。最初,该公司将专注于为小型、中型和重型车辆设计这种创新的 AGM 电池,并透过与目标商标产品製造商达成协议,将其独家引入美国。

- 此外,该领域持续的电气化趋势,例如混合动力汽车和全电动汽车的兴起,从长远来看可能会减少对传统 SLI 电池的需求。然而,这种转变将是渐进的,预计内燃机汽车多年来仍将在美国持有中占据大多数。

- 因此,鑑于上述几点,汽车最终用户领域预计在预测期内将显着成长。

工业应用中电池的广泛采用推动了市场的发展

- 工业应用中越来越多地采用电池是市场成长的关键驱动力。这一趋势正在重塑工业电源解决方案的格局,SLI 电池在传统汽车应用之外找到了新的、不断扩展的角色。

- 製造、物流、农业和建筑等工业领域越来越认识到 SLI 电池的多功能性和可靠性,导致各种应用的需求激增。这项转变不仅扩大了 SLI 电池的市场,也刺激了电池技术的创新,以满足工业用户的特定需求。

- 美国经济分析局报告称,2023年第四季度,製造业总产值从2021年的59,504亿美元飙升至72,611亿美元。随着製造业的稳定扩张,各种工业应用对 SLI 电池的需求预计将同步成长。

- 在製造领域,SLI 电池越来越多地用于堆高机、托盘搬运车和自动导引运输车(AGV) 等物料输送设备。这些应用需要电池提供高启动功率并承受频繁的充电/放电循环。 SLI 电池可提供即时能量,使其特别适合需要间歇但稳健运作的装置。

- 随着製造设施日益自动化并优化其流程,对 SLI 电池等可靠且经济高效的电源解决方案的需求预计将会增加。由于对环境问题的担忧和对业务效率的追求,工业现场电气化的推广将进一步加速这一趋势。

- 例如,2024年2月,工业自动化领域的知名公司欧姆龙自动化美洲公司发布了MD系列自主移动机器人(AMR)。 MD 系列旨在提高生产车间的工作效率,并扩展了欧姆龙的产品组合,以满足更广泛的零件和材料处理需求。特别是在使用 SLI 电池的行业中,MD 系列可以简化关键部件的运输和处理,从而使生产工作流程更加顺畅。

- 物流和仓储领域是SLI Batteries的另一个重要成长领域。随着电子商务的爆炸性增长以及美国各地配送中心的相应扩张,电动物料输送设备的使用也增加。 SLI电池广泛用于各种物流车辆,从小型电动托盘车到大型仓库堆高机。

- 因此,如上所述,在工业和製造环境中越来越多地采用这些电池预计将在预测期内推动市场发展。

美国SLI电池产业概况

美国SLI电池市场呈现半分裂状态。该市场的主要企业(排名不分先后)包括 GS Yuasa International Ltd、Exide Technologies、Johnson Controls、EnerSys 和 East Penn Manufacturing Company。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车销量成长

- 扩大电池在工业应用的采用

- 抑制因素

- 来自替代电池化学物质的竞争

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 类型

- 电池被淹

- VRLA 电池

- EBF电池

- 最终用户

- 用于汽车

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略及SWOT分析

- 公司简介

- GS Yuasa International Ltd

- Exide Technologies

- Johnson Controls

- EnerSys

- Leoch International Technology Limited Inc.

- East Penn Manufacturing Company

- C&D Technologies Inc.

- Clarios International Inc.

- Trojan Battery Company

- Crown Battery Manufacturing Company

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章市场机会与未来趋势

- 研发投资

简介目录

Product Code: 50003507

The United States SLI Battery Market size is estimated at USD 1.50 billion in 2025, and is expected to reach USD 1.77 billion by 2030, at a CAGR of 3.35% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing electric vehicles industry in the region and the increasing adoption of SLI batteries in industrial applications are expected to be among the most significant drivers for the US SLI battery market during the forecast period.

- On the other hand, there is increasing competition from alternate battery chemistries that pose a threat to the market's growth during the forecast period.

- Nevertheless, continued efforts to conduct research and development regarding SLI batteries are expected to create several future market opportunities.

United States SLI Battery Market Trends

The Automotive End-user Segment is Expected to Witness Significant Growth

- The automotive end-user segment represents a significant portion of the US SLI battery market. This segment primarily encompasses passenger vehicles, commercial vehicles, and off-road vehicles, all of which rely heavily on SLI batteries for their core functionalities. The segment's demand for SLI batteries is driven by several factors, including new vehicle sales, the existing vehicle fleet size, and replacement cycles for batteries in older vehicles.

- In recent years, the US automotive industry has experienced fluctuations in new vehicle sales, influenced by economic conditions, consumer preferences, and global events such as the COVID-19 pandemic. Despite these fluctuations, the overall trend showed a gradual increase in the total number of vehicles on US roads, directly impacting the demand for SLI batteries.

- According to the International Organization of Motor Vehicle Manufacturers, the production of vehicles has increased significantly in recent years. The annual average growth rate for vehicle production between 2020 and 2023 was over 5%. In contrast, the growth rate between 2022 and 2023 was over 5.5%, signifying the growing demand for vehicles.

- Technological advancements in the segment have led to the development of more sophisticated vehicle electrical systems, which has driven innovations in SLI battery technology. Modern vehicles feature advanced start-stop systems, regenerative braking, and a growing number of electrical components, placing higher pressure on the vehicle's battery.

- In response, battery manufacturers have introduced enhanced flooded batteries (EFB) and absorbent glass mat (AGM) batteries, which offer improved performance and longevity compared to traditional lead-acid batteries. These advanced batteries are becoming increasingly common in new vehicles, particularly in those with start-stop systems, and are gradually gaining shares in the replacement market as well.

- For instance, in April 2024, Clarios, a leading producer accounting for a third of the global low-voltage car battery market, inked a significant supplier deal with a major original equipment manufacturer. This partnership is centered around Clarios' latest innovation: a high-performance 12-volt rechargeable absorbent glass mat (AGM) battery. This cutting-edge battery boasts enhanced charge acceptance, a feature that not only aids in curbing fuel consumption but also plays a pivotal role in reducing CO2 emissions. Initially, the focus is expected to be on introducing this innovative AGM battery, designed for light, medium, and heavy-duty vehicles, exclusively in the United States, through the aforementioned original equipment manufacturer contract.

- Additionally, the ongoing electrification trend in the segment, including the rise of hybrid and fully electric vehicles, may reduce the demand for traditional SLI batteries in the long term. However, this transition is gradual, and internal combustion engine vehicles are expected to remain a significant part of the US vehicle fleet for many years.

- Therefore, as per the points mentioned above, the automotive end-user segment is expected to witness significant growth during the forecast period.

Growing Adoption of Batteries in Industrial Applications to Drive the Market

- The growing adoption of batteries in industrial applications is a significant growth driver for the market. This trend is reshaping the landscape of industrial power solutions, with SLI batteries finding new and expanded roles beyond their traditional automotive applications.

- Industrial sectors such as manufacturing, logistics, agriculture, and construction are increasingly recognizing the versatility and reliability of SLI batteries, leading to a surge in demand across various applications. This shift is not only expanding the market for SLI batteries but also spurring innovation in battery technology to meet the specific needs of industrial users.

- In the fourth quarter of 2023, the US Bureau of Economic Analysis reported a significant surge in the manufacturing sector's gross output, which soared to USD 7,261.1 billion, up from USD 5,950.4 billion in 2021, marking a remarkable growth rate of over 22% in just two years. Given this robust expansion in manufacturing, the demand for SLI batteries is poised for a parallel uptick across diverse industrial applications.

- In the manufacturing sector, SLI batteries are being increasingly utilized in material handling equipment such as forklifts, pallet jacks, and automated guided vehicles (AGVs). These applications require batteries that can provide high starting power and withstand frequent charge-discharge cycles. The ability of SLI batteries to deliver quick bursts of energy makes them particularly suitable for equipment that requires intermittent but robust operation.

- As manufacturing facilities continue to automate and optimize their processes, the demand for reliable and cost-effective power solutions like SLI batteries is expected to grow. This trend is further accelerated by the push toward electrification in industrial settings, which is driven by environmental concerns and the pursuit of operational efficiencies.

- For instance, in February 2024, OMRON Automation Americas, a prominent player in industrial automation, unveiled its MD Series of autonomous mobile robots (AMRs). The MD Series aims to enhance operational efficiency at production facilities, broadening OMRON's portfolio to address a more diverse range of part and material transport needs. This launch was particularly significant for industries relying on SLI batteries, as the MD Series can streamline the transport and handling of these critical components, ensuring smoother production workflows.

- The logistics and warehousing sector represents another significant growth area for SLI batteries. With the explosive growth of e-commerce and the consequent expansion of distribution centers across the United States, there has been a corresponding increase in the use of electric material handling equipment. SLI batteries are finding applications in a wide range of logistics vehicles, from small electric pallet trucks to large warehouse forklifts.

- Therefore, as mentioned above, the increasing adoption of these batteries in industrial and manufacturing settings is expected to drive the market during the forecast period.

United States SLI Battery Industry Overview

The US SLI battery market is semi-fragmented. Some of the key players in this market (in no particular order) include GS Yuasa International Ltd, Exide Technologies, Johnson Controls, EnerSys, and East Penn Manufacturing Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Growing Adoption of Batteries in the Industrial Applications

- 4.5.2 Restraints

- 4.5.2.1 Competition From Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa International Ltd

- 6.3.2 Exide Technologies

- 6.3.3 Johnson Controls

- 6.3.4 EnerSys

- 6.3.5 Leoch International Technology Limited Inc.

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 C&D Technologies Inc.

- 6.3.8 Clarios International Inc.

- 6.3.9 Trojan Battery Company

- 6.3.10 Crown Battery Manufacturing Company

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Investment in Research and Development Activities

02-2729-4219

+886-2-2729-4219