|

市场调查报告书

商品编码

1636238

英国SLI 电池:市场占有率分析、行业趋势和成长预测(2025-2030 年)United Kingdom SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

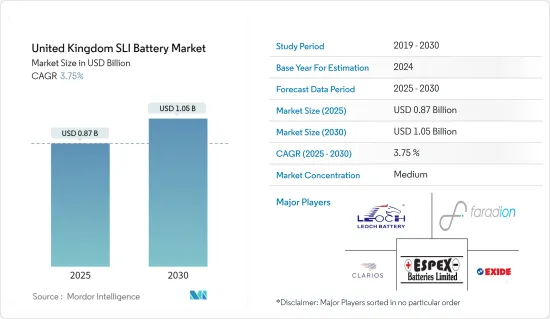

英国SLI电池市场规模预计到2025年为8.7亿美元,预计2030年将达到10.5亿美元,预测期间(2025-2030年)复合年增长率为3.75%。

主要亮点

- 从中期来看,该地区汽车行业的成长以及工业应用中 SLI 电池的日益采用等因素预计将成为预测期内英国SLI 电池市场的最大推动力之一。

- 同时,来自替代电池化学品的竞争正在加剧,对预测期内的市场成长构成威胁。

- 也就是说,SLI 电池的持续研发工作预计将在未来创造多个市场机会。

英国SLI电池市场趋势

VRLA电池类型细分市场可望显着成长

- VRLA(阀式铅酸电池)领域近年来经历了显着成长,VRLA 电池被广泛应用于各种工业应用。这些免维护电池因其密封设计而广受欢迎,无需定期补充水并降低了酸洩漏的风险。

- 这项特性使得 VRLA 电池特别适合在敏感环境和需要最少维护的应用中使用。在工业领域,VRLA电池广泛应用于不断电系统(UPS)系统、紧急照明、警报系统、关键基础设施的备用电源等。

- VRLA 电池的多功能性使其在英国各种工业环境中越来越多的采用。这些电池通常用于通讯基础设施,为蜂窝塔和通讯设备提供可靠的备用电源。它能够在较宽的温度范围内有效运行,并且设计紧凑,非常适合户外安装和远端位置。

- 据欧洲回收论坛称,从 2023 年到 2024 年,SLI 电池的数量出现了大幅增加。 2024第一季,该地区SLI电池累积出货量约375吨,较2023年大幅增加34%。这一增长证实了 SLI 电池的日益普及,从而增强了对 VRLA 电池的需求。

- 对再生能源来源的日益重视,使 VRLA 电池在能源储存应用中获得了新的生命,特别是在偏远地区或寻求减少对国家电网依赖的工业设施的离网和混合电力系统中。 。

- 英国医疗保健产业也是 VRLA 电池的重要消费者,特别是在不断电系统至关重要的医院和医疗设施中。这些电池用于医疗设备、紧急电源系统和行动医疗设备。

- 随着英国医疗保健基础设施的不断扩大和现代化,该行业对 VRLA 电池的需求预计将进一步增长,从而推动电池技术的创新,以满足医疗应用的特定需求。

- 例如,2024年4月,英国统计局宣布2023年医疗保健支出达到约2,920亿英镑。与 2022 年相比,名目成长率显着成长 5.6%,较 2022 年微薄的 0.9% 增幅大幅跃升。值得注意的是,2023年医疗保健支出占英国名目国内生产总值的10.9%。随着医疗机构扩大和升级其基础设施以满足患者不断增长的需求,对可靠电源的需求变得至关重要。

- 因此,如上所述,VRLA 产业预计在预测期内将出现显着成长。

不断增长的汽车工业推动市场

- 英国汽车产业正在经历成长和转型期,预计将对市场产生正面影响。随着汽车产销量持续增加,对高品质SLI电池的需求也预计会随之增加。

- 例如,国际汽车工业协会的资料显示,自2020年以来,英国的汽车产量一直呈现持续上升趋势。 2020年至2023年,汽车产量年均成长约4%。值得注意的是,从2022年到2023年,产量增加了16%以上。这一激增不仅凸显了汽车产业的稳健性,也凸显了对市场的直接影响。

- 汽车产业受到多种因素的推动,包括政府的支持措施、车辆设计的技术进步以及消费者对更有效率、更环保的交通途径的偏好的变化。

- 英国政府致力于将汽车工业发展作为国家经济战略的关键要素,从而在研发、基础设施和製造能力方面进行大量投资。随着国内外汽车製造商计划在该地区建立或扩大业务,这些努力导致汽车产量增加。

- 例如,2023年11月,英国政府宣布了一项56.8亿美元的重大资助计划,重点关註八个关键产业。汽车产业表现突出,拨款超过 20 亿美元。此次资金分配凸显了政府对成长和永续性的承诺,巩固了汽车产业在英国经济格局中的重要地位。这笔巨额资金的任务是推动汽车製造、供应链和整体开发的进步。

- 随着越来越多的汽车下线,对 SLI 电池的需求也相应增长,SLI 电池是传统内燃机汽车和许多混合模式的重要组成部分。预计未来这一趋势将持续下去,并稳步推动SLI电池市场的成长。

- 汽车产业的技术进步也在推动 SLI 电池市场方面发挥着重要作用。现代汽车配备了越来越复杂的电气系统,需要更坚固、更可靠的电池。 ADAS(高级驾驶辅助系统)、资讯娱乐系统和汽车中其他电子功能的普及导致了更高的能源需求,并需要开发更高性能的 SLI 电池。

- 因此,鑑于上述几点,汽车产业的成长预计将在预测期内推动市场。

英国SLI电池产业概况

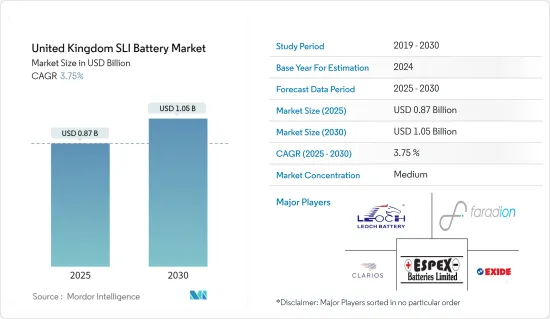

英国SLI 电池市场呈现半分裂状态。该市场的主要企业(排名不分先后)包括Leoch International Technology Limited Inc.、Faradion Limited、Espex Batteries Ltd.、Clarios International Inc.和Exide Technologies。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 不断增长的汽车工业

- 扩大电池在工业应用的采用

- 抑制因素

- 来自替代电池化学物质的竞争

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 按类型

- 液体电池

- VRLA 电池

- EBF电池

- 按最终用户

- 用于汽车

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- Strategies Adopted & SWOT Analysis for Leading Players

- 公司简介

- Leoch International Technology Limited Inc.

- Faradion Limited

- Espex Batteries Ltd

- Clarios International Inc.

- Exide Technologies

- Johnson Controls

- EnerSys

- GS Yuasa International Ltd

- C&D Technologies Inc.

- Trojan Battery Company

- List of Other Prominent Companies

- Market Ranking/Share(%)Analysis

第七章 市场机会及未来趋势

- 电池技术创新

简介目录

Product Code: 50003508

The United Kingdom SLI Battery Market size is estimated at USD 0.87 billion in 2025, and is expected to reach USD 1.05 billion by 2030, at a CAGR of 3.75% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing automotive industry in the region and the increasing adoption of SLI batteries in industrial applications are expected to be among the most significant drivers for the UK SLI battery market during the forecast period.

- On the other hand, there is increasing competition from alternate battery chemistries that pose a threat to the market's growth during the forecast period.

- Nevertheless, continued efforts to conduct research and development regarding SLI batteries are expected to create several future market opportunities.

United Kingdom SLI Battery Market Trends

The VRLA Battery Type Segment is Expected to Witness Significant Growth

- The VRLA (valve-regulated lead-acid) segment has witnessed significant growth owing to the adoption of VRLA batteries across various industrial applications in recent years. These maintenance-free batteries have gained popularity due to their sealed design, which eliminates the need for regular water top-ups and reduces the risk of acid spills.

- This trait makes VRLA batteries particularly suitable for use in sensitive environments and applications where minimal maintenance is desired. In the industrial sector, VRLA batteries are widely used in uninterruptible power supply (UPS) systems, emergency lighting, alarm systems, and backup power for critical infrastructure.

- The versatility of VRLA batteries has led to their increased adoption in various industrial settings across the United Kingdom. These batteries are commonly employed in telecommunications infrastructure, where they provide reliable backup power for cell towers and communication equipment. Their ability to function effectively in a wide range of temperatures and compact design makes them ideal for outdoor installations and remote locations.

- As per the European Recycling Forum, the market witnessed a notable surge in the quantity of SLI batteries from 2023 to 2024. In the first quarter of 2024, the region's cumulative SLI battery quantity stood at around 375 tonnes, marking a substantial 34% increase from 2023. This uptick underscored the increased popularity of SLI batteries, consequently bolstering the demand for VRLA batteries.

- The growing emphasis on renewable energy sources has created new opportunities for VRLA batteries in energy storage applications, particularly in off-grid and hybrid power systems for industrial facilities located in remote areas or seeking to reduce their reliance on the national grid.

- The healthcare sector in the United Kingdom has also become a significant consumer of VRLA batteries, particularly in hospitals and medical facilities where uninterrupted power supply is critical. These batteries are used in medical equipment, emergency power systems, and mobile medical units.

- As the healthcare infrastructure continues to expand and modernize across the United Kingdom, the demand for VRLA batteries in this sector is expected to grow further, driving innovation in battery technology to meet the specific needs of medical applications.

- For instance, in April 2024, the Statistical Office of the United Kingdom announced that healthcare expenditure reached approximately GBP 292 billion in 2023. This marked a notable 5.6% increase in nominal terms from 2022, a significant jump from the mere 0.9% growth in 2022. Notably, healthcare spending in 2023 accounted for 10.9% of the United Kingdom's nominal gross domestic product. As healthcare facilities expand and upgrade their infrastructure to accommodate the growing needs of patients, the need for reliable power sources becomes critical.

- Therefore, as per the points mentioned above, the VRLA segment is expected to witness significant growth during the forecast period.

Growing Automotive Industry To Drive the Market

- The automotive industry in the United Kingdom has been experiencing a period of growth and transformation, which is expected to positively impact the market. As vehicle production and sales continue to rise, the demand for high-quality SLI batteries is anticipated to increase correspondingly.

- For instance, data from the International Organization of Motor Vehicle Manufacturers revealed that vehicle production in the United Kingdom has been on a consistent rise since 2020. Between 2020 and 2023, vehicle production saw an average annual growth rate of about 4%. Notably, from 2022 to 2023, there was a remarkable surge, with production spiking by over 16%. This surge not only underscores the robustness of the automobile industry but also highlights its direct impact on the market.

- The automobile industry is driven by several factors, including government support initiatives, technological advancements in vehicle design, and shifting consumer preferences toward more efficient and environmentally friendly transportation options.

- The UK government's commitment to developing the automotive industry as a critical component of the nation's economic strategy has led to substantial investments in research and development, infrastructure, and manufacturing capabilities. These initiatives have attracted both domestic and international automakers to establish or expand their operations within the region, leading to an increase in vehicle production volumes.

- For instance, in November 2023, the UK government announced a significant USD 5.68 billion funding initiative, emphasizing eight key industries. Notably, the automotive industry stood out, earmarked to receive more than USD 2 billion. This allocation underscored the government's push to bolster the industry's pivotal position in the UK economic landscape, emphasizing both growth and sustainability. The directive accompanying this substantial funding is to propel advancements in vehicle manufacturing, supply chains, and overall development.

- As more vehicles roll off production lines, the need for SLI batteries - essential components in both traditional internal combustion engine vehicles and many hybrid models - grows proportionally. This trend is expected to continue in the coming years, providing a steady boost to the growth of the SLI battery market.

- Technological advancements in the automotive industry are also playing a crucial role in driving the SLI battery market. Modern vehicles are equipped with increasingly sophisticated electrical systems that require more robust and reliable batteries. The proliferation of advanced driver assistance systems (ADAS), infotainment systems, and other electronic features in vehicles has led to higher energy demands, necessitating the development of more capable SLI batteries.

- Therefore, as per the points mentioned above, the growing automotive industry is expected to drive the market during the forecast period.

United Kingdom SLI Battery Industry Overview

The UK SLI battery market is semi-fragmented. Some of the key players in this market (in no particular order) include Leoch International Technology Limited Inc., Faradion Limited, Espex Batteries Ltd, Clarios International Inc., and Exide Technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Automotive Industry

- 4.5.1.2 Growing Adoption of Batteries in the Industrial Applications

- 4.5.2 Restraints

- 4.5.2.1 Competition From Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Leoch International Technology Limited Inc.

- 6.3.2 Faradion Limited

- 6.3.3 Espex Batteries Ltd

- 6.3.4 Clarios International Inc.

- 6.3.5 Exide Technologies

- 6.3.6 Johnson Controls

- 6.3.7 EnerSys

- 6.3.8 GS Yuasa International Ltd

- 6.3.9 C&D Technologies Inc.

- 6.3.10 Trojan Battery Company

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Battery Technology

02-2729-4219

+886-2-2729-4219