|

市场调查报告书

商品编码

1636255

冷冻食品物流:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Frozen Food Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

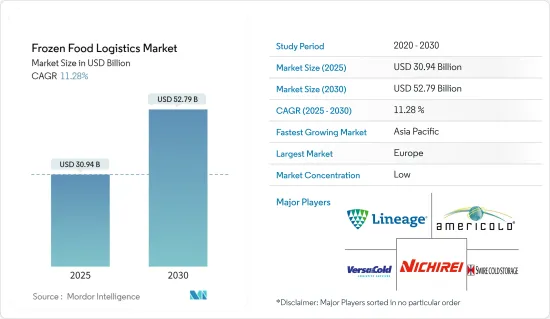

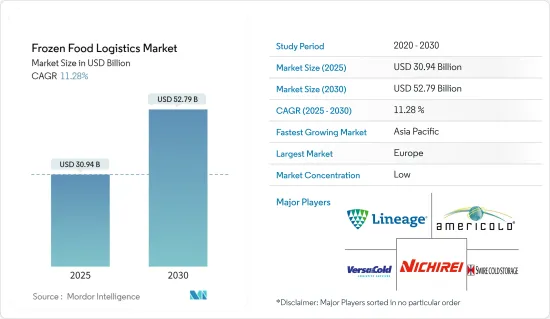

冷冻食品物流市场规模预估至2025年为309.4亿美元,预估至2030年将达527.9亿美元,预测期间(2025-2030年)复合年增长率为11.28%。

主要亮点

- 冷冻食品需求的快速成长和都市化进程的加速是冷冻食品物流市场的主要推动力。

- 在过去的几年里,优质冷冻食品产业经历了显着的成长。消费者对一流、方便和营养食品日益增长的需求是这一快速增长的主要推动力。这种趋势在追求均衡饮食和即食食品的注重健康的人群中尤其明显。

- 此外,消费者越来越欣赏现代冷冻技术所带来的卓越产品品质,能够有效地保留口味和营养价值。

- 值得注意的是,都市区的富人在这些高端冷冻食品的销售中处于领先地位。这些产品通常拥有美食配方、负责任的原料采购和前沿的口味。

- 需求的激增反映了消费者转向家庭烹饪、烹饪实验以及对餐厅品质膳食的渴望。对于挑剔的美食家来说,这是一种趋势,他们不会在品质、口味或营养上妥协。

- 2023年,冷冻食品零售额成长7.9%,达742亿美元。正如最近的一份报告所强调的那样,这意味着过去三年显着增加了 100 亿美元。与许多杂货类别一样,冷冻食品的美元金额成长主要是由通货膨胀驱动的价格上涨所推动的。

- 因此,消费行为对冷冻食品的行为正在改变。美国冷冻食品研究所 (AFFI) 和食品工业研究所 (FMI) 共同发布的《2023 年冷冻食品零售力量》报告显示,消费者平均为每件冷冻食品支付 4.99 美元。这比 2023 年成长了 13.5%,比过去三年大幅成长了 29.6%。

- 冷冻食品销售以冷冻食品和甜点为主,到 2023 年将分别产生 266 亿美元和 154 亿美元的销售额。其次是水果/蔬菜、水产品和肉类/家禽,同年销售额分别为 81 亿美元、70 亿美元和 57 亿美元。

冷冻食品物流市场趋势

冷冻食品需求正在推动产业发展

近年来,随着消费者偏好的变化,产品创新激增,已调理食品市场经历了重大演变。这种转变在印度尤其明显,那里的便利性和口味偏好至关重要。

消费者对已调理食品产业越来越要求更健康、更天然的选择。因此,对具有清洁标籤、最少添加剂和有机成分的产品的需求不断增长。此外,对植物性食品和纯素食食品的需求正在增加。随着越来越多的人采用植物性饮食或减少肉类消费量,对植物性和纯素已调理食品的需求正在增加。

该行业发展的关键是老牌公司和新兴企业坚定不移地致力于创新。尼尔森最近的一项研究强调,消费者越来越多地选择更健康的已调理食品,尤其是在印度。根据同一项调查,72%的印度消费者正在积极寻求营养均衡的已调理食品,这表明健康意识不断增强。

为此,该公司正在利用技术和烹饪技术来创造满足营养需求并迎合印度人多样化口味的产品。这包括介绍无麸质、有机和当地风味的选择。

已调理食品品牌与营养研究机构和专家之间的合作正在扩大产品范围并重塑消费者的观念,将已调理食品定位为更健康的饮食选择。

欧洲在市场上占据显着地位。

2023年,德国冷冻食品总销量达404.3万吨,较2022年的390.9万吨增加3.4%。这一激增导致销量首次突破 400 万吨里程碑。

非本土市场成长了6.5%,从2022年的193.5万吨增加到2023年的206.1万吨。这一成长已推动市场突破 200 万吨大关。

在食品零售与家庭服务业,2023年冷冻食品销售量达198.2万吨,比2022年的197.4万吨微增0.4%。值得注意的是,这一数字比 2019 年 COVID-19 大流行前的 186.1 万吨水平高出 6.5%。

人均冷冻食品消费量从2022年的47.7公斤上升到2023年的49.4公斤,创历史新高。在家庭层面,消费量增加了3公斤,从2022年的96.4公斤增加到2023年的99.4公斤。

冷冻食品物流业概况

冷冻食品物流市场本质上是分散的。 Lineage Logistics、Americold Logistics、Swire Cold Storage、Nichirei Logistics、VersaCold Logistics Services 等主要公司在低温运输物流行业处于领先地位。

这些主要企业提供一系列服务,包括温控储存、运输和配送,以满足冷冻食品产业的特定需求。这些公司利用广泛的网路、最尖端科技和冷冻食品管理方面的专业知识,在市场上拥有强大的竞争优势。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场动态与洞察

- 目前的市场状况

- 市场动态

- 促进因素

- 电子商务的崛起推动市场

- 消费者生活方式的变化推动市场

- 抑制因素

- 维持低温运输物流相关的高营运成本

- 影响市场的监理合规性

- 机会

- 市场驱动的技术进步

- 促进因素

- 价值链/供应链分析

- 政府法规、贸易协定和倡议

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 地缘政治与疫情如何影响市场

第五章市场区隔

- 副产品

- RTE

- RTC

- 依产品类型

- 冷冻水果和蔬菜

- 冷冻肉/鱼

- 冷冻已烹调调理食品

- 冷冻甜点

- 冷冻零食

- 其他产品类型

- 交通方式

- 路

- 铁路

- 海上航线

- 航空

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东/非洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- Lineage Logistics

- Americold Logistics

- Swire Cold Storage

- Nichirei Logistics

- VersaCold Logistics Services

- Burris Logistics

- Kloosterboer

- NewCold

- Interstate Cold Storage

- Preferred Freezer Services*

- 其他公司

第七章 市场的未来

第8章附录

- 总体经济指标

- 资金流向洞察(运输和仓储领域的投资)

- 电子商务及消费统计

- 对外贸易统计

The Frozen Food Logistics Market size is estimated at USD 30.94 billion in 2025, and is expected to reach USD 52.79 billion by 2030, at a CAGR of 11.28% during the forecast period (2025-2030).

Key Highlights

- A surge in demand for frozen food products and growing urbanization mainly drive the frozen food logistics market.

- Over the past few years, the premium frozen food industry has witnessed remarkable growth. A heightened consumer appetite for top-tier, convenient, and nutritious food choices predominantly propels this upsurge. This trend is especially pronounced among health-conscious individuals seeking balanced diets and the swiftness of ready-to-eat meals.

- Moreover, consumers increasingly acknowledge the superior quality of products made possible by modern freezing technologies, which effectively retain taste and nutritional value.

- Notably, affluent urban households are spearheading the sales of these premium frozen offerings. These products often boast gourmet recipes, responsibly sourced ingredients, and cutting-edge flavors.

- This surge in demand mirrors a broader consumer shift toward home cooking, culinary experimentation, and a desire for restaurant-grade meals-all enjoyed from the comfort of their homes. It is a trend tailored for discerning food enthusiasts unwilling to compromise on quality, taste, or nutrition.

- In 2023, retail sales of frozen foods surged by 7.9%, hitting USD 74.2 billion. This marked a notable USD 10 billion increase over the last three years, as highlighted in a recent report. Like many grocery segments, the growth of frozen food's value in dollars was primarily fueled by inflation-driven price hikes.

- Consequently, consumer behavior toward frozen food is changing. The Power of Frozen in Retail 2023 report, a collaboration between the American Frozen Food Institute (AFFI) and the Food Industry Association (FMI), revealed that consumers shelled out an average of USD 4.99 per unit for frozen items. This represented a 13.5% uptick from 2023 and a substantial 29.6% leap in the last three years.

- Frozen meals and desserts are leading the pack in frozen food sales, raking in USD 26.6 billion and USD 15.4 billion, respectively, in 2023. These are followed by fruits/vegetables, seafood, and meat/poultry, each boasting sales figures of USD 8.1 billion, USD 7 billion, and USD 5.7 billion, respectively, in the same year.

Frozen Food Logistics Market Trends

Demand for Frozen Food Products Gaining Traction in the Industry

The ready-to-eat market has witnessed a significant evolution in recent years, driven by a surge in product innovation tailored to changing consumer preferences. This transformation is especially pronounced in India, where convenience and taste preferences are paramount.

Consumers are increasingly gravitating toward healthier, natural options in the ready-to-eat industry. This has increased demand for products with clean labels, minimal additives, and organic ingredients. Furthermore, there is a growing appetite for plant-based and vegan choices. As more individuals adopt plant-based diets or reduce meat consumption, the demand for plant-based or vegan-friendly ready-to-eat options is rising.

Key to the industry's growth is the unwavering commitment to innovation by both established players and startups. Recent research from Nielsen underscores a significant consumer pivot toward healthier ready-to-eat choices, particularly in India. The study indicates that 72% of Indian consumers actively seek nutritious, well-balanced, ready-to-eat meals, showcasing a heightened health consciousness.

In response, companies are harnessing technology and culinary skills to craft products that meet nutritional needs and cater to the diverse Indian palate. This includes the introduction of gluten-free, organic, and locally-inspired options.

Partnerships between ready-to-eat brands and nutrition institutes or experts are broadening product offerings and reshaping consumer perceptions, positioning ready-to-eat foods as a healthier meal choice.

Europe is Holding a Prominent Position in the Market

In 2023, Germany's total frozen food sales reached 4.043 million tonnes, marking a 3.4% increase from 3.909 million tonnes in 2022. This surge pushed sales past the 4-million-tonne milestone for the first time.

The out-of-home market saw a notable 6.5% uptick in sales, hitting 2.061 million tonnes in 2023, up from 1.935 million tonnes in 2022. This growth propelled the market past the 2-million-tonne threshold.

Within the food retail and home services industry, frozen food sales in 2023 reached 1.982 million tonnes, reflecting a modest 0.4% increase from 1.974 million tonnes in 2022. Notably, this figure stood 6.5% higher than the pre-COVID-19-pandemic levels in 2019, which were at 1.861 million tonnes.

Individually, per capita consumption of frozen food hit a record high of 49.4 kg in 2023, up from 47.7 kg in 2022. At the household level, consumption saw a 3 kg increase, reaching 99.4 kg in 2023, compared to 96.4 kg in 2022.

Frozen Food Logistics Industry Overview

The frozen food logistics market is fragmented in nature. Giants like Lineage Logistics, Americold Logistics, Swire Cold Storage, Nichirei Logistics, and VersaCold Logistics Services are leading the pack in the cold chain logistics industry.

These key players provide a suite of services, including temperature-controlled storage, transportation, and distribution, tailored to the specific needs of the frozen food industry. These companies have solidified their competitive edge in the market by leveraging expansive networks, cutting-edge technologies, and specialized know-how in frozen goods management.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Rise in E-Commerce Driving The Market

- 4.2.1.2 Changing Consumer Lifestyles Driving The Market

- 4.2.2 Restraints

- 4.2.2.1 High Operating Costs Associated With Maintaining Cold Chain Logistics

- 4.2.2.2 Regulatory Compliances Affecting The Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements Driving The Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Government Regulations, Trade Agreements, and Initiatives

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Geopolitics and Pandemics on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Ready-to-eat

- 5.1.2 Ready-to-cook

- 5.2 By Product Type

- 5.2.1 Frozen Fruits and Vegetables

- 5.2.2 Frozen Meat and Fish

- 5.2.3 Frozen-Cooked Ready Meals

- 5.2.4 Frozen Desserts

- 5.2.5 Frozen Snacks

- 5.2.6 Other Product Types

- 5.3 By Transportation

- 5.3.1 Roadways

- 5.3.2 Railways

- 5.3.3 Seaways

- 5.3.4 Airways

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Lineage Logistics

- 6.2.2 Americold Logistics

- 6.2.3 Swire Cold Storage

- 6.2.4 Nichirei Logistics

- 6.2.5 VersaCold Logistics Services

- 6.2.6 Burris Logistics

- 6.2.7 Kloosterboer

- 6.2.8 NewCold

- 6.2.9 Interstate Cold Storage

- 6.2.10 Preferred Freezer Services*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators

- 8.2 Insight Into Capital Flows (Investments In Transport and Storage Sector)

- 8.3 E-commerce and Consumer Spending-related Statistics

- 8.4 External Trade Statistics