|

市场调查报告书

商品编码

1636470

欧洲电动车电池製造:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

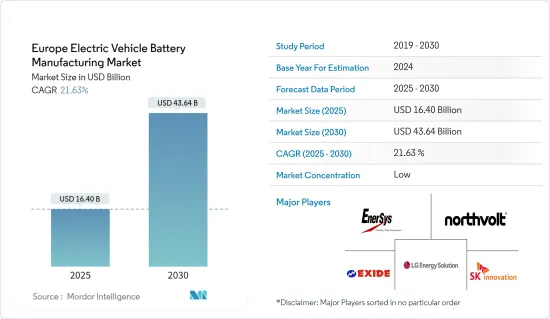

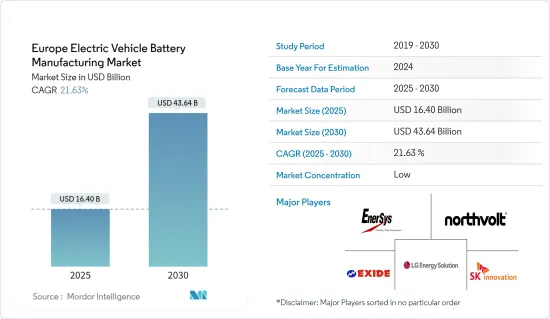

欧洲电动车电池製造市场规模预计到2025年为164亿美元,预计2030年将达到436.4亿美元,预测期内(2025-2030年)复合年增长率为21.63%。

主要亮点

- 从中期来看,电池产能投资的增加以及电池原料成本的下降预计将在预测期内提振电动车电池製造的需求。

- 相反,原材料蕴藏量的缺乏给电动车电池製造市场的成长带来了重大挑战。

- 然而,电动车雄心勃勃的长期目标,例如提高产能、技术进步和降低成本,可能在不久的将来为电动车电池製造市场创造重大机会。

- 在电动车普及率激增的推动下,德国处于欧洲电动汽车电池製造成长的前沿。该国强大的技术基础设施和有利的政府政策进一步推动了这一成长。

欧洲电动车电池製造市场趋势

锂离子电池类型主导市场

- 锂离子 (Li-ion) 电池彻底改变了电动车 (EV) 市场,并刺激了电池製造的创新。锂离子电池的关键特性,如高能量密度、长循环寿命和快速充电,使其成为当今电动车的选择。

- 此外,锂离子二次电池具有优异的容量重量比,这使得它们优于其他技术。儘管锂离子二次电池往往比其他技术更昂贵,但市场主要企业正在增加研发投资、增加产量、加剧竞争并压低价格。

- 儘管电动车电池组和电池能源储存系统(BESS)的平均价格有所上涨,但在 2023 年大幅下降至 139 美元/kWh(下降 13%)。据预测,这种下降趋势预计将持续下去,到2025年将达到113美元/千瓦时,并在2030年降至80美元/千瓦时。

- 此外,世界各国政府正在实施政策和奖励,以促进电动车(EV)的采用并鼓励锂离子电池製造的成长。为了因应快速成长的锂离子电池需求,世界各国政府不仅进行大量投资,也积极推动锂离子二次电池的生产。

- 例如,2023年11月,英国政府宣布投资5,000万英镑(6,300万美元),建立以锂离子电池为重点的强大电池供应链。该倡议符合英国雄心勃勃的电动车生产目标。该电池策略将持续到 2030 年,承诺为零排放汽车、电池及其供应链提供量身定制的支持,包括新资本和研发资金。这些措施旨在提高英国的电池产量,并推动未来对锂离子电池的需求。

- 此外,锂离子电池需求的激增促使了被称为「超级工厂」的大型生产设施的出现。这些设施旨在批量生产电池,确保我们满足电动车 (EV) 不断增长的需求。由于预计电动车电池的需求很快就会激增,该地区的领先公司正在推出多个计划来提高锂离子电池产能。

- 例如,2024年5月,法国Blue Solutions宣布计画投资约20亿欧元(21.7亿美元)在法国东部兴建一座超级工厂。该工厂旨在生产用于电动车的新型固态电池,快速充电时间为 20 分钟,预计将于 2030 年开始生产。这些努力将在未来几年扩大国内电池产量。

- 因此,这些努力将在预测期内提高锂离子电池的产量并显着扩大电动车电池的产能。

德国正在经历显着的成长

- 德国凭藉其强大的汽车工业、先进的製造能力和对永续性的坚定承诺,处于电动车 (EV) 革命的前沿。随着电动车需求的飙升,德国正在大力投资加强电动车电池製造。

- 中国不仅在向清洁能源迈进,而且还专注于向电动车的转型,这已成为许多公司的优先事项。德国电动车销量正在经历令人印象深刻的成长。国际能源总署(IEA)报告称,2023年德国电动车销量将达到70万辆,与2022年的数字相当,但比2019年高出5.5倍。凭藉这一势头以及最近欧洲政府倡议的支持,电动车销量预计将增加,对电动车电池生产的需求也将增加。

- 作为欧洲电池联盟的主要企业,德国正在主导努力在欧洲建立具有竞争力和永续的电池製造生态系统。该联盟旨在减少对非欧洲电池供应商的依赖并促进欧盟内部的创新。同时,德国政府宣布对研究、基础设施和奖励进行大量投资,以加速电动车的普及。

- 值得注意的是,2024 年 1 月,瑞典着名锂离子电池製造商 Norstvolt 获得了欧盟的核准,并获得了德国高达 9.02 亿欧元(9.8643 亿美元)的国家支持。该投资将在德国海德建造电动和混合动力汽车电池生产设施,符合德国和欧盟的净零排放目标。此类倡议预计将在未来几年提高德国的电池产量。

- 此外,德国企业和研究机构也致力于开发固态电池,与传统锂离子电池相比,固态电池具有更好的能量密度、安全性和寿命。顶级区域公司之间的合作可能会暂时推动电动车电池的需求。

- 例如,2024 年 5 月,由 VARTA主要企业的由 15 家公司和大学研究人员组成的联盟宣布了创新的钠离子电池技术。他们的目标是为电动车和其他应用生产高性能、经济高效且环保的电池。该联盟的目标是在 2027 年中期完成计划的最后阶段。这些突破预计将在预测期内增加对先进电动车电池的需求,从而促进该地区的电池製造。

- 鑑于这些发展,显然这些措施不仅会增强电动车的需求,还会显着增加未来几年对电动车电池製造的需求。

欧洲电动车电池製造业概况

欧洲电动车电池製造市场已减少一半。主要企业(排名不分先后)包括 EnerSys、SK Innovation、Northvolt AB、Exide Industries Ltd 和 LG Energy Solution。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 投资增加电池产能

- 电池原物料成本下降

- 抑制因素

- 原料蕴藏量不足

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 透过电池

- 锂离子

- 铅酸电池

- 镍氢电池

- 其他的

- 依电池形状分类

- 方形

- 袋型

- 圆柱形

- 搭车

- 客车

- 商用车

- 其他的

- 透过促销

- 电池电动车

- 油电混合车

- 插电式混合动力电动车

- 按地区

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 俄罗斯

- 土耳其

- 其他欧洲国家

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Co. Ltd

- SK Innovation

- Northvolt AB

- EnerSys

- Energizer Holdings Inc.

- LG Chem Ltd

- Italvolt

- Envision AESC

- Saft Groupe SA

- Samsung SDI

- Exide Industries Ltd

- 其他知名企业名单

- 市场排名分析

第七章 市场机会及未来趋势

- 电动车的长期目标

简介目录

Product Code: 50003737

The Europe Electric Vehicle Battery Manufacturing Market size is estimated at USD 16.40 billion in 2025, and is expected to reach USD 43.64 billion by 2030, at a CAGR of 21.63% during the forecast period (2025-2030).

Key Highlights

- In the medium term, increased investments in battery production capacity, coupled with a decline in the costs of battery raw materials, are poised to boost the demand for electric vehicle battery manufacturing during the forecast period.

- Conversely, a shortage of raw material reserves poses a significant challenge to the growth of the electric vehicle battery manufacturing market.

- However, ambitious long-term targets for electric vehicles-such as scaling up production capacity, advancing technology, and cutting costs-are set to unlock substantial opportunities for the electric vehicle battery manufacturing market in the near future.

- Germany is at the forefront of electric vehicle battery manufacturing growth in Europe, fueled by a surge in electric vehicle adoption. The nation's robust technological infrastructure, combined with favorable government policies, further accelerates this growth.

Europe Electric Vehicle Battery Manufacturing Market Trends

Lithium-Ion Battery Type Dominate the Market

- Lithium-ion (Li-ion) batteries have revolutionized the electric vehicle (EV) market, driving innovations in battery production. Their key attributes-high energy density, long cycle life, and swift charging-make them the preferred choice for today's EVs.

- Moreover, lithium-ion rechargeable batteries surpass other technologies due to their excellent capacity-to-weight ratio. Although they tend to be more expensive than alternatives, major players in the market are boosting R&D investments and ramping up production, heightening competition, and pushing prices down.

- Despite rising average battery pack prices for EVs and battery energy storage systems (BESS), 2023 witnessed a significant dip, with prices falling to USD 139/kWh-a 13% reduction. Projections suggest this downward trajectory will persist, with prices anticipated to reach USD 113/kWh by 2025 and further decline to USD 80/kWh by 2030, driven by relentless technological and manufacturing progress.

- Furthermore, governments worldwide are implementing policies and incentives to promote electric vehicle (EV) adoption and stimulate lithium-ion battery manufacturing growth. In response to the soaring demand for lithium-ion batteries, governments are not only committing significant investments but are also actively promoting the production of these rechargeable batteries.

- For example, in November 2023, the United Kingdom government announced a GBP 50 million (USD 63 million) investment to establish a robust battery supply chain, emphasizing lithium-ion batteries. This initiative aligns with the UK's ambitious EV production targets. The Battery Strategy, extending to 2030, promises tailored support for zero-emission vehicles, batteries, and their supply chains, including new capital and R&D funding. Such initiatives are poised to boost battery production in the UK and elevate the demand for lithium-ion batteries in the future.

- Additionally, the surging demand for Li-ion batteries has catalyzed the emergence of large-scale production facilities, dubbed Gigafactories. These facilities are engineered to produce battery cells en masse, ensuring they meet the rising electric vehicle (EV) demand. Major regional players are launching multiple projects to enhance their lithium-ion battery production capabilities, foreseeing a spike in EV battery demand soon.

- For instance, in May 2024, French firm Blue Solutions revealed plans for a gigafactory in eastern France, with an investment of around 2 billion euros (USD 2.17 billion). This facility aims to produce a new solid-state battery for electric vehicles, boasting a rapid 20-minute charging time, with production slated to commence by 2030. Such endeavors are set to amplify battery production in the nation in the ensuing years.

- Consequently, these initiatives are poised to bolster lithium-ion battery production and significantly expand EV battery manufacturing capacity during the forecast period.

Germany to Witness Significant Growth

- Germany is at the forefront of the electric vehicle (EV) revolution, leveraging its strong automotive industry, advanced manufacturing capabilities, and steadfast commitment to sustainability. As the demand for EVs surges, Germany is making significant investments to enhance its EV battery manufacturing.

- The country is not only shifting towards clean energy but also emphasizing the transition to electric vehicles, a priority for numerous companies. EV sales in Germany have experienced remarkable growth. In 2023, the International Energy Agency (IEA) reported that Germany sold 0.7 million electric vehicles, matching 2022's numbers but representing a 5.5-fold increase since 2019. With this momentum and support from recent European government initiatives, EV sales are projected to rise, driving an increased demand for EV battery production.

- As a key player in the European Battery Alliance, Germany is leading efforts to establish a competitive and sustainable battery cell manufacturing ecosystem in Europe. This alliance aims to reduce dependence on non-European battery suppliers and foster innovation within the EU. In tandem, the German government has announced substantial investments in research, infrastructure, and incentives to promote EV adoption.

- In a notable move, in January 2024, Northvolt, a prominent Swedish lithium-ion battery manufacturer, received a substantial EUR 902 million (USD 986.43 million) state aid package from Germany, with EU approval. This investment is directed towards building a battery production facility for electric and hybrid vehicles in Heide, Germany, aligning with the net-zero emissions goals of both Germany and the EU. Such endeavors are poised to boost battery production in the nation in the coming years.

- Additionally, German firms and research institutions are at the helm of developing solid-state batteries, which promise better energy density, safety, and longevity compared to traditional lithium-ion batteries. Collaborations among top regional companies are set to drive the demand for EV batteries in the foreseeable future.

- For example, in May 2024, a consortium of 15 companies and university researchers, led by VARTA, introduced innovative sodium-ion battery technology. Their ambition is to produce high-performance, cost-effective, and environmentally friendly batteries for EVs and other applications. The consortium aims to wrap up the project's final phase by mid-2027. Such breakthroughs are anticipated to boost the demand for advanced EV batteries and, consequently, the region's battery manufacturing during the forecast period.

- Given these developments, it's clear that these initiatives will not only bolster EV demand but also significantly heighten the need for EV battery manufacturing in the coming years.

Europe Electric Vehicle Battery Manufacturing Industry Overview

Europe's electric vehicle battery manufacturing market is semi-fragmented. Some of the key players (not in particular order) are EnerSys, SK Innovation, Northvolt AB, Exide Industries Ltd, LG Energy Solution, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Investments to Enhance the battery production capacity

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

- 5.5 Geography

- 5.5.1 Germany

- 5.5.2 France

- 5.5.3 United Kingdom

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 NORDIC

- 5.5.7 Russia

- 5.5.8 Turkey

- 5.5.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 SK Innovation

- 6.3.3 Northvolt AB

- 6.3.4 EnerSys

- 6.3.5 Energizer Holdings Inc.

- 6.3.6 LG Chem Ltd

- 6.3.7 Italvolt

- 6.3.8 Envision AESC

- 6.3.9 Saft Groupe SA

- 6.3.10 Samsung SDI

- 6.3.11 Exide Industries Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219