|

市场调查报告书

商品编码

1636486

美国电动汽车电池负极:市场占有率分析、产业趋势及成长预测(2025-2030)United States Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

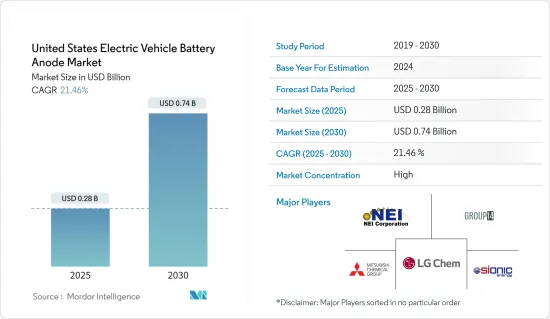

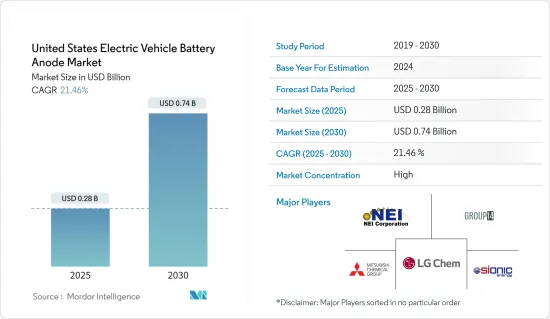

预计2025年美国电动车电池负极市场规模为2.8亿美元,2030年将达7.4亿美元,预测期内(2025-2030年)复合年增长率为21.46%。

主要亮点

- 从中期来看,政府对电池製造的支持措施和投资以及锂离子电池价格的下降预计将在预测期内推动市场发展。

- 另一方面,国内负极材料产量不足预计将抑制未来市场成长。

- 然而,负极材料和高效电解质的持续研究和进展为市场成长提供了有希望的机会。

美国电动车电池负极市场趋势

锂离子电池预计将占较大份额

- 在美国,电动车和插电式混合动力车主要使用锂离子电池,其化学成分通常与家用电子电器产品不同。电动车广泛采用此类电池的原因是,与其他电能能源储存系统相比,它们每单位质量/体积提供更多的能量。它还具有高功率重量比、高能效、高温性能、长寿命和低自放电等特点。

- 此外,锂离子电池材料价格的下降对电动车电池製造商来说是有利的。随着电动车锂离子电池产量的扩大,其製造过程中对负极的需求将会增加。这一趋势不仅支持了该行业的创新和效率,还加强了电动车电池製造商的国际竞争。

- 例如,2023年锂离子电池组的价格将比前一年下降14%,稳定在139美元/kWh。电池价格的下降将使电动车变得更加便宜,从而刺激其采用并增加其在电动车市场中的份额。这种需求的增加将导致包括负极在内的电池组件消耗增加,并将刺激技术进步以提高电池性能。

- 正在进行的研发计划主要集中于开发用于电动车锂离子电池的更稳定、更高效的阳极材料,进一步凸显了阳极需求的预期成长。

- 例如,2023年12月,美国电池材料公司Sila Nanotechnologies, Inc.与松下合作开发了采用硅负极的电动车电池。 Sila声称,与目前锂离子电池中使用的传统石墨基阳极相比,其奈米复合硅阳极材料可将续航里程提高20%。

- 未来,随着美国对电动车锂离子电池製造的新投资,负极材料的需求预计将快速成长。例如,2025年6月,埃克森美孚与电动车电池开发商SK On签署了一份不具约束力的谅解备忘录,从其位于阿肯色州的第一个计划供应10万吨美孚锂。埃克森美孚制定了雄心勃勃的计划,目标是到 2030 年每年为约 100 万个电动车电池供应锂,并加强美国电动车供应链。

- 随着电动车中越来越多地采用锂离子电池以及价格下降,锂离子电池负极市场预计在未来几年将大幅成长。

政府措施和电池製造投资将推动市场的前景

- 近年来,由于政府的支持措施,美国电动车(EV)电池製造迅速成长。这些措施,包括税收优惠、补贴、津贴和贷款,发挥着至关重要的作用。特别是先进技术汽车製造 (ATVM) 融资计划等联邦倡议将资金用于尖端电池技术和製造设施的开发。

- 随着电动车销量的上升,政府可能会采取进一步措施来进一步刺激电池製造。因此,国内对电动车电池负极的需求预计将增加。国际能源总署的资料凸显了这个趋势。 2023年,美国电动车销量将达到139万辆,较2022年的99万辆大幅成长。

- 此外,政府正在积极推动新立法以扩大国内电池製造。这不仅包括电池本身,还包括阳极、阴极和隔膜等重要部件。这些措施旨在加强美国的电动车电池供应链并加速向清洁能源的过渡。

- 例如,2024年4月,澳洲Sicona Battery Technologies公司透露计画在美国东南部建立硅碳负极材料生产设施。 Sicona 的目标是到 2030 年代初每年生产 26,500 吨,足以为每年超过 325 万辆电动车提供动力。

- 此外,政府也推出了多项措施和措施,为电动车需求提供了乐观的前景。例如,2024年3月,美国推出了关于汽车废气排放的新法规,旨在增加电动车销售并遏制温室气体排放。美国环保署(EPA)预计,由于这项规定,2030年至2032年间,30%至56%的新车将是电动车。这与 EPA 先前的预测有所不同,EPA 预测到 2030 年电动车将占新车销量的 60%,到 2032 年将上升到 67%。由于这些措施,电动车电池製造的需求预计在未来几年将进一步增加。

- 总之,在政府措施和投资支持下,电池製造的发展前景光明。

美国电动车电池负极产业概况

美国电动车电池负极市场正走向半固体。该市场的主要企业(排名不分先后)包括NEI Corporation, Ltd.、Group14 Technologies、Sionic Energy、三菱化学集团公司和LG化学集团。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 政府对电池製造的措施和投资

- 电池原物料成本下降

- 抑制因素

- 负极材料国内生产缺

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子

- 铅酸

- 其他电池类型

- 材料

- 锂

- 石墨

- 硅

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- NEI Corporation, Ltd.

- Group14 Technologies

- Sionic Energy

- Mitsubishi Chemical Group.

- Sicona Battery Technologies

- Targray Industries Inc.

- Sila Nanotechnologies

- LG Chemical Group

- Nexeon ltd

- Amprius Technologies

- 其他知名公司名单

- 市场排名分析

第七章 市场机会及未来趋势

- 加大其他负极材料的研发力度

简介目录

Product Code: 50003755

The United States Electric Vehicle Battery Anode Market size is estimated at USD 0.28 billion in 2025, and is expected to reach USD 0.74 billion by 2030, at a CAGR of 21.46% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, supportive government policies and investments in battery manufacturing, and the decreasing price of lithium-ion batteries are expected to drive the market in the forecast period.

- On the other hand, insufficient domestic manufacturing of anode materials is expected to restrain market growth in the future.

- However, ongoing research and advancements in anode materials and efficient electrolytes present promising opportunities for market growth.

United States Electric Vehicle Battery Anode Market Trends

Lithium-ion Battery is Expected to Have a Major Share

- In the United States, all-electric vehicles and PHEVs predominantly utilize lithium-ion batteries, with chemistries that often differ from those in consumer electronics. The reason behind the drastic adoption of such batteries in electric vehicles is their high energy per unit mass and volume relative to other electrical energy storage systems. They also have a high power-to-weight ratio, high energy efficiency, high-temperature performance, long life, and low self-discharge.

- Additionally, falling material prices for lithium-ion batteries are proving advantageous for EV battery manufacturers. As production of EV lithium-ion batteries scales up, the demand for anodes in their manufacturing is set to increase. This trend not only signals a boost in innovation and efficiency within the sector but also strengthens the global competitiveness of EV battery manufacturers.

- For example, in 2023, lithium-ion battery pack prices dropped by 14% from the previous year, settling at USD139/kWh. This decline in battery prices translates to more affordable EVs, spurring adoption and expanding the electric vehicle market share. Such heightened demand will lead to increased consumption of battery components, notably the anode, and propel technological advancements for enhanced battery performance.

- Ongoing R&D initiatives are focused on developing more stable and efficient anode materials for lithium-ion batteries in electric vehicles, further underscoring the anticipated rise in demand for these anodes.

- For instance, in December 2023, Sila Nanotechnologies, Inc., a US-based battery materials firm, partnered with Panasonic to craft electric vehicle batteries featuring silicon anodes. Sila claims their nano-composite silicon anode material could offer a 20% range boost over the conventional graphite-based anodes in today's lithium-ion batteries.

- Looking ahead, with fresh investments pouring into EV lithium-ion battery manufacturing in the United States, the appetite for anode materials is set to surge. For instance, in June 2025, ExxonMobil entered a non-binding memorandum of understanding with SK On, an EV battery developer, to deliver 100,000 metric tons of Mobil Lithium from its inaugural project in Arkansas. ExxonMobil has ambitious plans, targeting lithium supply for approximately 1 million EV batteries annually by 2030, bolstering the U.S. EV supply chain.

- Given the rising adoption of lithium-ion batteries in electric vehicles and the declining prices, the segment for lithium-ion battery anodes is poised for significant growth in the coming years.

Government Policies and Investments Towards Battery Manufacturing is Expected to Drive the Market

- In recent years, the United States electric vehicle (EV) battery manufacturing has surged, due to supportive government policies. These policies, encompassing tax incentives, subsidies, grants, and loans, have played a pivotal role. Notably, federal initiatives like the Advanced Technology Vehicles Manufacturing (ATVM) loan program are channeling funds into the development of cutting-edge battery technologies and their manufacturing facilities.

- With electric vehicle sales on the rise, the government is likely to introduce more policies to further stimulate battery manufacturing. This, in turn, will heighten the demand for EV battery anodes domestically. Data from the International Energy Agency highlights this trend: in 2023, the United States EV car sales reached 1.39 million units, a notable increase from 0.99 million in 2022.

- Moreover, the government is actively pushing for new legislation to expand domestic battery manufacturing. This includes not just the batteries themselves but also crucial components like anodes, cathodes, and separators. Such moves aim to strengthen America's supply chains for EV batteries and facilitate the transition to clean energy.

- For example, in April 2024, Sicona Battery Technologies, hailing from Australia, revealed plans for its inaugural silicon-carbon anode materials production facility in the Southeastern U.S. Looking ahead, Sicona targets an annual output of 26,500 tons by the early 2030s, enough to power over 3.25 million electric vehicles each year.

- Additionally, the government has rolled out multiple initiatives and policies, signaling a bullish outlook on electric vehicle demand. A case in point: in March 2024, the U.S. introduced new regulations on car tailpipe emissions, a move aimed at amplifying EV sales and curbing greenhouse gas emissions. The U.S. Environmental Protection Agency (EPA) projects these regulations could lead to 30 to 56 percent of new cars being electric between 2030 and 2032. This is a shift from the EPA's previous forecast, which anticipated EVs would make up 60 percent of new car sales by 2030, climbing to 67 percent by 2032. Such policies are poised to bolster the demand for electric vehicle battery manufacturing in the coming years.

- In conclusion, with the backing of government policies and investments, the trajectory for battery manufacturing looks promising.

United States Electric Vehicle Battery Anode Industry Overview

The United States electric vehicle battery anode market is semi-consolidated. Some of the major players in the market (in no particular order) include NEI Corporation, Ltd., Group14 Technologies, Sionic Energy, Mitsubishi Chemical Group., and LG Chemical Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Insufficient Domestic Manufacturing of Anode Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Battery Types

- 5.2 Material

- 5.2.1 Lithium

- 5.2.2 Graphite

- 5.2.3 Silicon

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 NEI Corporation, Ltd.

- 6.3.2 Group14 Technologies

- 6.3.3 Sionic Energy

- 6.3.4 Mitsubishi Chemical Group.

- 6.3.5 Sicona Battery Technologies

- 6.3.6 Targray Industries Inc.

- 6.3.7 Sila Nanotechnologies

- 6.3.8 LG Chemical Group

- 6.3.9 Nexeon ltd

- 6.3.10 Amprius Technologies

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Anode Materials

02-2729-4219

+886-2-2729-4219