|

市场调查报告书

商品编码

1636506

欧洲电动车电池负极:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

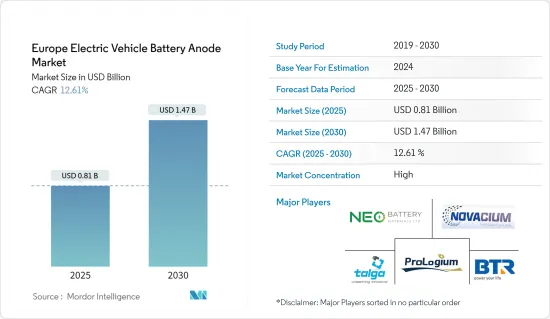

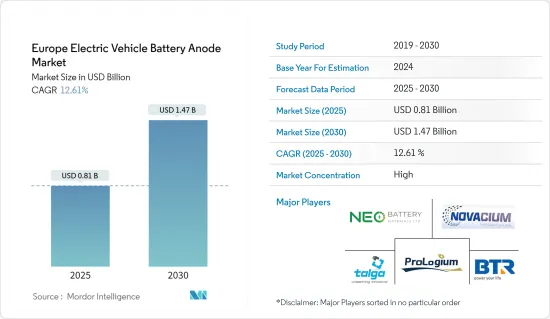

预计2025年欧洲电动车电池负极市场规模为8.1亿美元,2030年将达14.7亿美元,预测期间(2025-2030年)复合年增长率为12.61%。

主要亮点

- 未来几年,在电动车的普及、电池原料成本下降(导致锂离子电池价格下降)以及政府支持措施的推动下,欧洲电动车电池阳极市场预计将成长。

- 相反,原材料蕴藏量有限和供应链缺口等挑战可能会阻碍欧洲电动车电池阳极市场的成长。

- 然而,电池阳极技术的进步和电动车雄心勃勃的长期目标为欧洲电动车电池阳极市场的参与企业提供了重大机会。

- 在欧洲主要参与企业中,法国预计将在欧洲电动车电池负极市场实现显着成长。

欧洲电动车电池负极市场趋势

锂离子电池领域占市场主导地位

- 在锂离子电池产业的早期,家用电子电器是主要市场。然而,随着时间的推移,电动车(EV)製造商已成为锂离子电池的主要消费者。电动车领域对锂离子电池的需求不断增长,增强了电池负极材料的市场。

- 在过去的十年中,欧洲锂离子电池的采用迅速增加,特别是在汽车领域。由于锂离子二次电池优越的容量重量比,法国、英国、德国、义大利和西班牙等国家越来越青睐锂离子二次电池。此外,电动车中安装的锂电池不会排放氮氧化物、二氧化碳或其他温室气体,因此它们对环境的影响比传统内燃机(ICE)汽车低得多。认识到这一优势,一些欧洲国家正在积极推广锂离子技术主导的电动车,并透过补贴和政府倡议鼓励电动车电池阳极市场的发展。

- 彭博社报道称,2023年,电动车(EV)所用锂离子电池组的全球与前一年同期比较价格年减13%,至139美元/kWh。此次下降是在价格出现较早上涨趋势之后出现的。由于技术的持续进步和製造效率的提高,预计价格将继续下降。据预测,2025年将降至113美元/千瓦时,2030年进一步降至80美元/度。这些发展将在预测期内加强锂离子电池领域在欧洲电动车电池阳极市场的主导地位。

- 根据国际能源总署 (IEA) 的数据,主要采用锂离子电池技术(占比超过 95%)的电动车在英国的销量将从 2022 年的 37 万辆增至 2023 年的 45 万辆。鑑于电动车领域的强劲成长,锂离子电池凭藉其独特的优势,预计将在欧洲电动车电池负极市场占有重要份额。

- 2024 年 6 月,斯道拉恩索和 Altris 宣布建立合作伙伴关係,旨在在欧洲建立可持续的电池价值链和材料链。两家公司之间的合作重点是整合斯道拉恩索的硬碳解决方案 Rignode,作为 Altris 钠离子电池中的阳极材料。这些电池设计用于道路和固定储能。斯道拉恩索 (Stora Enso) 所描述的 Lignode 是一种源自木质素(纸浆生产产品)的可持续硬碳。这种新型阳极材料与锂离子和钠离子电池相容,使其成为比传统阳极解决方案更具永续性的选择。

- 鑑于这些新兴市场的发展,很明显,锂离子电池领域将在未来几年主导欧洲电动车电池负极市场。

法国主导欧洲电动车电池负极市场

- 法国作为已开发国家的代表,近来面临大幅减少温室气体排放的艰鉅任务。除了将再生能源来源纳入能源结构外,法国还将解决汽车排放作为应对气候变迁的关键策略。这项重点为电动车电池负极市场的参与企业创造了利润丰厚的机会。许多外国公司已迁往法国,并不断扩大其製造能力。

- 2024年10月14日,在巴黎车展上,锂陶瓷电池创新领跑者辉能科技宣布推出全球首款采用100%硅复合负极的电动车电池。这款革命性的电池充电仅需 8.5 分钟。这些进展证实了欧洲阳极市场的快速成长,该市场正在积极致力于电动车电池阳极材料的技术创新。

- 2024年5月,清洁能源技术公司AnteoTech透露,一家着名的电动车製造商将在原型电池中使用其电池阳极技术。在斯特拉斯堡举行的第14届国际先进汽车电池会议(AABC)上,AnteoTech与电池製造商进行了会谈,其中包括与EV1计划管理团队的会议。全球电动车製造商 EV1 正在评估将 AnteoTech XTM 技术整合到其车辆中。 AnteoTech强调,EV1证实Anteo XTM不仅降低了投入成本,也增强了其独特负极的表现。

- 2024年8月,专注于二氧化硅和硅基负极材料绿色工程的法国子公司Novacium SAS在电池创新方面达到了一个关键里程碑。该公司最新的电池将石墨与精製第三代(GEN3)硅基负极结合,容量已超过4,030mAh。这接近18650电池4,095mAh的世界纪录。这项壮举使 Novacium SAS 成为全球仅有的三家报告电池容量超过 4,000 mAh 的 18,650 的公司之一。这些里程碑增强了法国电动车电池负极材料的市场前景。

- 国际能源总署(IEA)的资料显示,法国电动车销量将从2022年的34万辆增加至2023年的47万辆,其中95%以上依赖锂离子电池技术。鑑于电动车领域的快速成长,锂离子电池因其独特的优势将在法国电动车电池负极市场占据重要份额。

- 因此,这些新兴市场的发展将使法国在未来几年的欧洲电动车阳极市场中处于至关重要的地位。

欧洲电动车电池负极产业概况

欧洲电动车电池负极市场适度整合。市场主要企业(排名不分先后)包括贝特瑞新材料集团、Novacium SAS、辉能科技、Talga Group 和 NEO Battery Materials Ltd。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 政府有利措施

- 锂离子电池价格下降

- 抑制因素

- 供应链缺口

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 依电池类型

- 锂离子

- 铅酸电池

- 其他的

- 依材料类型

- 硅

- 石墨

- 锂

- 其他的

- 按地区

- 法国

- 英国

- 德国

- 西班牙

- 义大利

- 北欧国家

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BTR New Material Group Co., Ltd

- Novacium SAS

- ProLogium Technology Co., Ltd

- Talga Group

- NEO Battery Materials Ltd

- IPCEI European Battery Innovation

- Vianode

- Epsilon Advanced Materials Pvt. Ltd.

- Altech Batteries Ltd

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章市场机会与未来趋势

- 负极材料的持续研究和进展

简介目录

Product Code: 50003835

The Europe Electric Vehicle Battery Anode Market size is estimated at USD 0.81 billion in 2025, and is expected to reach USD 1.47 billion by 2030, at a CAGR of 12.61% during the forecast period (2025-2030).

Key Highlights

- In the coming years, the Europe electric vehicle battery anode market is poised for growth, driven by the rising adoption of electric vehicles, decreasing costs of battery raw materials (leading to lower prices for Li-ion batteries), and supportive government policies.

- Conversely, challenges such as limited raw material reserves and gaps in the supply chain may hinder the growth of the Europe electric vehicle battery anode market.

- However, advancements in battery anode technologies and ambitious long-term targets for electric vehicles present significant opportunities for players in the European electric Vehicle Battery Anode Market.

- Among the key players in Europe, France is set to experience notable growth in the Europe electric vehicle battery anode market.

Europe Electric Vehicle Battery Anode Market Trends

Lithium-ion Battery Segment to Dominate the Market

- In the early days of the lithium-ion battery industry, consumer electronics were the primary market. However, over time, electric vehicle (EV) manufacturers emerged as the leading consumers of these batteries, driven by a surge in EV sales, particularly in plug-in hybrid electric vehicles (PHEVs). This growing demand for lithium-ion batteries in the EV sector bolstered the market for battery anode materials.

- Over the past decade, Europe has seen a meteoric rise in the adoption of lithium-ion batteries, especially in the automotive sector. Countries like France, the UK, Germany, Italy, and Spain are increasingly favoring lithium-ion rechargeable batteries, due to their superior capacity-to-weight ratio. Moreover, lithium batteries in EVs produce no emissions of NOX, CO2, or other greenhouse gases, resulting in a significantly lower environmental impact compared to traditional internal combustion engine (ICE) vehicles. Recognizing this advantage, several European nations are actively promoting lithium-ion technology-driven EVs and fostering the development of the Electric Vehicle Battery Anode Market through subsidies and government initiatives.

- Bloomberg reported that in 2023, global average prices for lithium-ion battery packs used in electric vehicles (EVs) fell to USD 139/kWh, a 13% drop from the previous year. This decline followed a trend of rising prices in earlier years. With ongoing technological advancements and improved manufacturing efficiencies, prices are projected to continue their downward trajectory. Forecasts indicate a price drop to USD 113/kWh by 2025, and an even steeper decline to USD 80/kWh by 2030. Such trends bolster the dominance of the lithium-ion battery segment in Europe's Electric Vehicle Battery Anode Market during the forecast period.

- According to the International Energy Agency (IEA), in 2023, electric vehicle sales in the United Kingdom, predominantly utilizing lithium-ion battery technology (over 95% share), reached 450,000, up from 370,000 in 2022. Given this robust growth in the battery electric vehicle sector, lithium-ion batteries, with their distinct advantages, are poised to capture a significant share of Europe's Electric Vehicle Battery Anode Market.

- In June 2024, Stora Enso and Altris unveiled their partnership aimed at establishing a sustainable battery value and materials chain in Europe. Their collaboration focuses on integrating Stora Enso's Lignode, a hard carbon solution, as an anode material in Altris' sodium-ion battery cells. These cells are designed for both motive and stationary power storage. Lignode, as described by Stora Enso, is a sustainable hard carbon derived from lignin, a pulp manufacturing byproduct. This novel anode material boasts compatibility with both lithium-ion and sodium-ion batteries, marking it as a more sustainable choice compared to conventional anode solutions.

- Given these developments, it's evident that the lithium-ion battery segment is set to dominate Europe's Electric Vehicle Battery Anode Market in the coming years.

France to Dominate the Electric Vehicle Battery Anode Market in Europe

- France, a leading developed nation, has taken on the monumental challenge of significantly reducing its greenhouse gas emissions in recent years. In addition to integrating renewable energy sources into its energy mix, France has prioritized tackling vehicular emissions as a key strategy in its fight against climate change. This focus has opened up lucrative opportunities for players in the EV battery anode market. Numerous foreign companies have set up operations in France, consistently expanding their manufacturing capabilities.

- On October 14th, 2024, at the Paris Motor Show, ProLogium Technology, a frontrunner in lithium ceramic battery innovation, unveiled the world's first EV battery featuring a 100% silicon composite anode. This revolutionary battery can be charged in a mere 8.5 minutes. Such advancements underscore the burgeoning anode market in Europe, with companies actively innovating in EV battery anode materials.

- In May 2024, AnteoTech, a clean energy tech firm, revealed that a prominent electric vehicle maker will adopt its battery anode technology in their prototype batteries. At the 14th International Advanced Automotive Battery Conference (AABC) in Strasbourg, AnteoTech held talks with battery manufacturers, including a meeting with EV1's project management team. EV1, a global electric vehicle manufacturer, is evaluating the integration of Anteo XTM technology into its vehicles. AnteoTech highlights that EV1 has confirmed that Anteo XTM not only reduces their input costs but also boosts the performance of their proprietary anode.

- In August 2024, Novacium SAS, a French subsidiary focused on green engineering of silica and silicon-based anode materials, reached a pivotal milestone in battery innovation. Their latest batteries, combining graphite with a refined third-generation (GEN3) silicon-based anode, achieved a capacity of over 4,030 mAh. This is nearing the world record of 4,095 mAh for 18650 batteries. With this feat, Novacium SAS becomes one of only three companies worldwide to report 18650 battery capacities surpassing 4,000 mAh. Such milestones bolster the prospects of the EV battery anode material market in France.

- Data from the International Energy Agency (IEA) reveals that in 2023, France saw electric vehicle sales hit 470,000, up from 340,000 in 2022, with over 95% relying on Li-ion battery technology. Given this surge in the battery electric vehicle sector, lithium-ion batteries, with their distinct advantages, are poised to command a substantial share of the Electric Vehicle Battery Anode Market in France.

- Consequently, these developments position France as a pivotal player in the European Electric Vehicle Battery Anode Market in the coming years.

Europe Electric Vehicle Battery Anode Industry Overview

The Europe Electric Vehicle Battery Anode Market is moderately consolidated. Some of the major players in the market (in no particular order) include BTR New Material Group Co., Ltd., Novacium SAS, ProLogium Technology Co., Ltd, Talga Group, and NEO Battery Materials Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Favorable Government Policies

- 4.5.1.3 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Battery type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-acid

- 5.1.3 Other technology

- 5.2 By Material Type

- 5.2.1 Silicon

- 5.2.2 Graphite

- 5.2.3 Lithium

- 5.2.4 Other Materials

- 5.3 Geography

- 5.3.1 France

- 5.3.2 United Kingdom

- 5.3.3 Germany

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 Nordic countries

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BTR New Material Group Co., Ltd

- 6.3.2 Novacium SAS

- 6.3.3 ProLogium Technology Co., Ltd

- 6.3.4 Talga Group

- 6.3.5 NEO Battery Materials Ltd

- 6.3.6 IPCEI European Battery Innovation

- 6.3.7 Vianode

- 6.3.8 Epsilon Advanced Materials Pvt. Ltd.

- 6.3.9 Altech Batteries Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research and Advancement in Anode Material

02-2729-4219

+886-2-2729-4219