|

市场调查报告书

商品编码

1636502

东协电动车电池阳极:市场占有率分析、产业趋势、成长预测(2025-2030)ASEAN Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

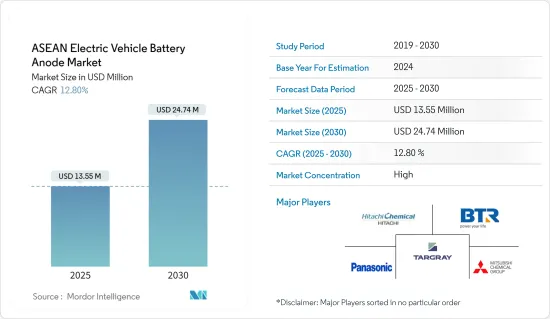

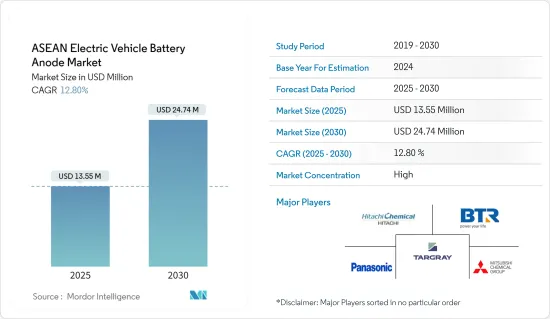

东协电动车电池阳极市场规模预计到2025年为1,355万美元,预计2030年将达到2,474万美元,预测期(2025-2030年)复合年增长率为12.8%。

主要亮点

- 未来几年,由于电动车普及率提高、锂离子电池原料成本下降以及政府支持政策等因素,东协电动车电池阳极市场预计将成长。

- 然而,原材料蕴藏量有限和供应链差异等挑战可能会阻碍市场扩张。

- 然而,随着电池材料技术的进步和电动车雄心勃勃的长期目标,东协电动车电池阳极市场蕴藏着巨大的商机。

- 在东南亚国协中,印尼有望成为电动车电池阳极市场的主要企业。

东协电动车电池阳极市场趋势

锂离子电池领域占市场主导地位

- 最初,东南亚的锂离子电池产业主要针对消费性电子领域。这主要是因为该地区是大多数行业参与者和锂离子电池必需矿物的所在地。然而,随着时间的推移,发生了重大变化。电动车(EV)製造商已开始超越消费性电子产业,并超越铅酸电池和其他电池类型,成为锂离子电池的主要消费者。这项变化主要是由东南亚国协电动车销量快速成长以及锂离子电池及相关电动车电池阳极市场投资快速增加所推动的。

- 过去几十年来,印尼、泰国、新加坡和越南等国家的锂离子电池技术快速发展,特别是在汽车领域。锂离子二次电池在东南亚国协越来越受欢迎,主要是由于其优越的容量重量比。此外,电动车中安装的锂电池不会排放氮氧化物、二氧化碳或其他温室气体,因此它们对环境的影响比传统内燃机(ICE)汽车低得多。基于这一优势,东南亚国协正在积极推动电动车的普及和当地电池负极製造市场的发展。

- 与2022年相比,2023年菲律宾和越南的乘用车销量分别成长16.4%和2.8%。这对锂离子电动车产业以及东协国家电动车电池阳极市场的参与者来说是个好兆头。

- 2023年12月,泰国着名石油天然气集团PTT开始生产锂离子电池。这项倡议符合 PTT 为其电动车品牌 Neta 建立供应链并利用泰国不断增长的绿色汽车市场的更广泛策略。 PTT相关人员宣布,合资伙伴NV Gotion已在位于曼谷东南部的罗勇府建立了一条锂离子电池生产线。该工厂目前的年产能为 2 吉瓦时,并计划在不久的将来扩大到 8 吉瓦时。

- 2024 年 7 月,印尼庆祝首家锂离子电动车电池工厂落成。作为东南亚最大的经济体和全球最富有的锂离子电池矿物生产,印尼在全球电动车供应链中具有战略地位。该工厂是韩国巨头 LG 能源解决方案公司 (LGES) 和现代汽车集团的合资企业,每年将生产 10 吉瓦时 (GWh) 的锂离子电池。如此重大的发展对于东协电动车电池阳极市场的相关人员来说是个好兆头。

- 泰国汽车研究所(TAI)的资料显示,泰国电动车註册数量大幅增加。 2023年登记车辆数量达17万辆,较2022年的84,570辆大幅增加。考虑到这些车辆中超过 95% 由锂离子技术动力来源,这一增长凸显了锂离子产业在泰国电动车电池阳极市场的主导地位。

- 总之,市场细分强烈表明锂离子电池领域在电动车电池阳极市场中占据主导地位。

印尼主导市场

- 印尼的目标是到 2030 年将二氧化碳排放减少 29%,相当于约 3.03 亿吨。随着人们对碳排放和对石化燃料的依赖日益关注,印尼将电动车 (EV) 的引入视为可行的解决方案。这一转变将为该国的电动车电池阳极市场创造重大机会。

- 此外,印尼政府也积极鼓励全球主要电动车製造商在该国投资。例如,2024年5月在峇里岛举行的世界水论坛上,印尼海洋事务和投资协调部长透露,特斯拉执行长正在向印尼政府提案建立电动车电池工厂。此举预计将大大增强雅加达成为电动车负极材料生产主导者的雄心壮志。

- 2023 年 11 月,美国和印尼举行了讨论,重点讨论建立关键矿物的伙伴关係,重点是电动车 (EV) 电池必需的金属贸易。

- 2024 年 9 月,印尼外交部宣布打算扩大在生产电动车 (EV) 电池所需的关键矿物方面的合作,这次是与非洲国家。该部秘书长在印尼-非洲论坛(IAF)上发表演说时强调,不仅电动车电池,而且正极和负极等相关零件对关键矿物的需求庞大。该部也指出在锂方面的积极合作,特别是与印尼矿业公司(MIND ID)和坦尚尼亚的合作。这些努力显示印尼电动车电池阳极市场具有强劲的成长潜力。

- 根据联合国COMTRADE资料显示,儘管印尼是电池矿产丰富的国家,但其锂离子电池进口量却激增并保持在高位。 2023年,锂离子电池进口额达2,759万美元,略高于2022年的2,757万美元。这项发展凸显了印尼电动车产业对锂离子电池的强劲需求,并突显了印尼电动车电池阳极製造能力的快速成长。

- 2024年5月,澳洲席勒资源集团从莫三比克巴拉马石墨矿运1万吨精细天然石墨粉。该批货物是为贝特瑞新能源材料位于印尼的新工厂发货。印尼正在推进电动汽车电池生产和相关负极材料的基础设施开发,这批货物是继 3 月试运的货柜之后发货的。此举不仅是席勒多元化策略的关键时刻,也巩固了其在天然石墨和活性阳极材料(AAM)供应领域的全球领先地位。

- 从这些发展来看,印尼显然正在东协电动车电池阳极市场站稳脚步。

东协电动车电池阳极产业概况

东协电动车电池阳极市场正在变得半固体。市场主要企业(排名不分先后)包括贝特瑞新材料集团、特锐科技国际有限公司、三菱化学集团、工业、Panasonic等。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 电动车的扩张

- 有利的政府政策

- 锂离子电池价格下降

- 抑制因素

- 供应链缺口

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 依电池类型

- 锂离子

- 铅酸电池

- 其他技术

- 依材料类型

- 硅

- 石墨

- 锂

- 其他材料

- 按地区

- 马来西亚

- 印尼

- 泰国

- 越南

- 其他东南亚国协

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BTR New Material Group Co., Ltd

- Shenzhen Dynanonic Co., Ltd.

- Mitsubishi Chemical Group Corporation

- Hitachi Chemical Company Ltd

- Northern Graphite Corporation

- Panasonic Corporation

- Targray Technology International Inc.

- Epsilon Advanced Materials Pvt. Ltd.

- Volt14 Solutions Pte Ltd

- List of Other Prominent Companies

- Market Ranking/Share(%)Analysis

第七章 市场机会及未来趋势

- 负极材料的持续研究和进展

简介目录

Product Code: 50003831

The ASEAN Electric Vehicle Battery Anode Market size is estimated at USD 13.55 million in 2025, and is expected to reach USD 24.74 million by 2030, at a CAGR of 12.8% during the forecast period (2025-2030).

Key Highlights

- In the coming years, the ASEAN Electric Vehicle Battery Anode Market is poised for growth, driven by factors such as the rising adoption of electric vehicles, decreasing costs of Li-ion battery raw materials, and supportive government policies.

- However, challenges like limited raw material reserves and supply chain gaps may hinder the market's expansion.

- Yet, with ongoing technological advancements in battery materials and ambitious long-term targets for electric vehicles, significant opportunities await players in the ASEAN Electric Vehicle Battery Anode Market.

- Among the ASEAN nations, Indonesia is set to emerge as a leading player in the electric vehicle battery anode landscape.

ASEAN Electric Vehicle Battery Anode Market Trends

Lithium-ion Battery Segment to Dominate the Market

- Initially, the lithium-ion battery industry in Southeast Asia primarily served the consumer electronics sector. This was largely due to the region being home to both a majority of industry players and the minerals essential for Li-ion batteries. However, a significant transformation occurred over time. Electric vehicle (EV) manufacturers began to eclipse the consumer electronics sector, emerging as the primary consumers of lithium-ion batteries, outpacing lead-acid and other battery types. This shift was predominantly fueled by surging EV sales in ASEAN countries and escalating investments in Li-ion batteries and the associated Electric Vehicle Battery Anode Market.

- In nations such as Indonesia, Thailand, Singapore, and Vietnam, the past few decades have seen a meteoric rise of lithium-ion battery technology, especially in the automotive sector. ASEAN nations are increasingly favoring lithium-ion rechargeable batteries, primarily due to their superior capacity-to-weight ratio. Furthermore, lithium batteries in EVs do not emit NOX, CO2, or any other greenhouse gases, resulting in a significantly lower environmental impact compared to conventional internal combustion engine (ICE) vehicles. Given this advantage, ASEAN nations are actively promoting EV adoption and the development of local battery anode manufacturing markets.

- Data from the Organisation Internationale des Constructeurs d'Automobiles highlights a positive trend: both the Philippines and Vietnam saw passenger vehicle sales grow by 16.4% and 2.8% respectively in 2023 compared to 2022. This bodes well for players in the Li-ion Electric Vehicle sector and, by extension, those in the Electric Vehicle Battery Anode Market across ASEAN countries.

- In December 2023, PTT, a prominent oil and gas conglomerate from Thailand, ventured into lithium-ion battery production. This initiative aligns with PTT's broader strategy to create a supply chain for its electric vehicle brand, Neta, and capitalize on Thailand's expanding green car market. PTT officials announced that their joint venture partner, NV Gotion, has established a lithium-ion battery production line in Rayong province, southeast of Bangkok. The facility currently boasts a production capacity of 2 gigawatt-hours per year, with ambitious plans to scale up to 8 gigawatt-hours in the near future, directly catering to the surging demand and subsequently fueling the nation's EV Battery Anode Market.

- In July 2024, Indonesia celebrated the inauguration of its first Li-ion EV battery plant. As the largest economy in Southeast Asia and home to the world's richest Li-ion battery minerals, Indonesia is strategically positioning itself in the global electric vehicle supply chain. This plant, a joint venture between South Korean titans LG Energy Solution (LGES) and Hyundai Motor Group, is set to produce a staggering 10 Gigawatt hours (GWh) of Li-ion battery cells annually. Such a significant development augurs well for stakeholders in the ASEAN Electric Vehicle Battery Anode Market.

- Data from the Thailand Automotive Institute (TAI) reveals a remarkable surge in electric vehicle registrations in Thailand. In 2023, registrations reached 170,000, a significant jump from 84,570 in 2022. Given that over 95% of these vehicles are powered by Li-ion technology, this growth underscores the dominance of the Li-ion segment in Thailand's Electric Vehicle Battery Anode Market.

- In conclusion, the evidence strongly indicates that the lithium-ion battery segment is poised to dominate the ASEAN Electric Vehicle Battery Anode Market.

Indonesia to Dominate the Market

- Indonesia aims to cut CO2 emissions by 29%, equating to approximately 303 million tons, by the year 2030. With rising concerns over carbon emissions and reliance on fossil fuels, Indonesia views the introduction of electric vehicles (EVs) as a viable solution. This shift is poised to unlock substantial opportunities for the Electric Vehicle Battery Anode Market in the nation.

- Moreover, the Indonesian government is actively courting major global EV players to invest domestically. For instance, in May 2024, at the World Water Forum in Bali, Indonesia's coordinating minister for maritime affairs and investment revealed that Tesla's CEO is contemplating a proposal from the Indonesian government to set up an EV battery plant in the nation. This move would significantly bolster Jakarta's ambition to emerge as a dominant player in EV anode production.

- In November 2023, discussions between the U.S. and Indonesia centered on forging a partnership focused on critical minerals, with an emphasis on trading metals essential for electric vehicle (EV) batteries.

- In September 2024, the Indonesian Foreign Affairs Ministry expressed its intent to expand collaborations on critical minerals for EV battery production, this time engaging with African nations. At the Indonesia-Africa Forum (IAF), the ministry's Director General underscored Indonesia's vast demand for critical minerals, not only for EV batteries but also for related components like cathodes and anodes. The ministry also pointed out an active collaboration in lithium, especially between Mining Industry Indonesia (MIND ID) and Tanzania. These endeavors hint at a robust growth potential for Indonesia's Electric Vehicle Battery Anode Market.

- Data from the United Nations COMTRADE reveals that even as a nation rich in battery minerals, Indonesia's imports of Li-ion batteries have surged and remained elevated. In 2023, the value of imported Li-ion batteries reached USD 27.59 million, a slight uptick from USD 27.57 million in 2022. This trend underscores a strong demand for Li-ion batteries in Indonesia's EV sector and highlights the nation's burgeoning capacity for Electric Vehicle Battery Anode manufacturing.

- In May 2024, Australia's Syrah Resources Group dispatched 10,000 metric tons of natural graphite fines from its Balama graphite operation in Mozambique. The shipment was destined for BTR New Energy Materials' new plant in Indonesia. As Indonesia ramps up its infrastructure for EV battery production and associated anode materials, this shipment follows a trial container sent in March. This move not only marks a pivotal moment in Syrah's diversification strategy but also cements its position as a global leader in supplying natural graphite and active anode materials (AAM).

- Given these developments, it's evident that Indonesia is solidifying its foothold in the ASEAN Electric Vehicle Battery Anode Market.

ASEAN Electric Vehicle Battery Anode Industry Overview

The ASEAN Electric Vehicle Battery Anode Market is semi-consolidated. Some of the major players in the market (in no particular order) include BTR New Material Group Co., Ltd., Targray Technology International Inc., Mitsubishi Chemical Group Corporation, Hitachi Chemical Company Ltd, and Panasonic Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Favorable Government Policies

- 4.5.1.3 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Battery type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-acid

- 5.1.3 Other technology

- 5.2 By Material Type

- 5.2.1 Silicon

- 5.2.2 Graphite

- 5.2.3 Lithium

- 5.2.4 Other Materials

- 5.3 Geography

- 5.3.1 Malaysia

- 5.3.2 Indonesia

- 5.3.3 Thailand

- 5.3.4 Vietnam

- 5.3.5 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BTR New Material Group Co., Ltd

- 6.3.2 Shenzhen Dynanonic Co., Ltd.

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Hitachi Chemical Company Ltd

- 6.3.5 Northern Graphite Corporation

- 6.3.6 Panasonic Corporation

- 6.3.7 Targray Technology International Inc.

- 6.3.8 Epsilon Advanced Materials Pvt. Ltd.

- 6.3.9 Volt14 Solutions Pte Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research and Advancement in Anode Material

02-2729-4219

+886-2-2729-4219