|

市场调查报告书

商品编码

1636531

南美洲充电电池:市场占有率分析、产业趋势与统计、成长预测(2025-2030)South America Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

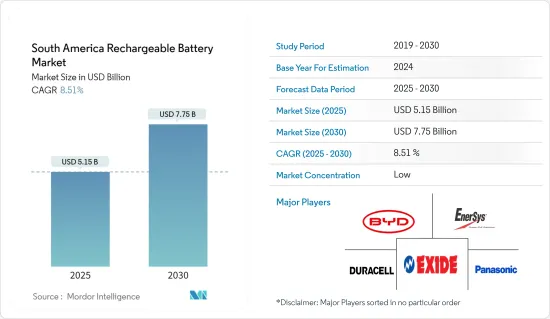

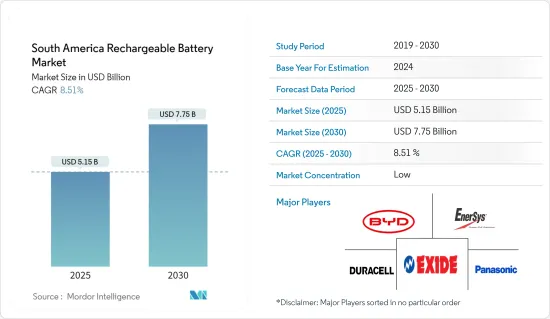

南美洲充电电池市场规模预计到2025年为51.5亿美元,预计到2030年将达到77.5亿美元,预测期内(2025-2030年)复合年增长率为8.51%。

主要亮点

- 从中期来看,电动车(EV)产量的增加和锂离子电池价格的下降预计将在预测期内推动二次电池需求。

- 另一方面,蕴藏量不足可能会严重限制南美充电电池市场的成长。

- 然而,智慧型手錶、无线耳机和智慧手环等穿戴式装置的日益普及预计将在不久的将来为可充电电池市场的参与者创造巨大的商机。

- 预计巴西将在预测期内主导南美洲二次电池市场。

南美洲二次电池市场趋势

锂离子电池类型主导市场

- 锂离子二次电池以其无数的优点而闻名,并在各个领域中得到了广泛的应用。由于其高能量密度,锂离子二次电池可以将大量电力封装成紧凑且轻量的形式,使其适合高效能的能源储存。

- 2023年1月,美国地质调查局(USGS)报告称,全球锂蕴藏量为8600万吨,其中玻利维亚为2100万吨,阿根廷为1930万吨,智利为总合万吨。

- 2023年,电池价格下降超过13%至139美元/kWh。随着采矿和精製能的增加,锂价格预计将下降,到 2026 年将达到 100 美元/kWh。

- 认识到经济成长和技术进步的潜力,政府和私人投资者都在增加对研究设施的资助并与全球电池製造商合作。这一势头将支持南美洲对锂二次电池的需求。

- 例如,2023年6月,阿根廷政府宣布大规模投资17亿美元用于锂生产,凸显其成为全球主要供应商的野心。经济部强调了中国西藏高峰会资源公司承诺扩大萨尔塔省的生产,目标是锂产量达到5万吨至10万吨。这些努力将在未来几年增加该地区锂离子电池的产量。

- 此外,世界转向清洁能源和交通已引发对电动车 (EV) 的需求激增。对电动车日益增长的需求直接增加了对锂电池的需求。随着汽车製造商投资扩大电动车产量,确保锂的稳定供应成为当务之急。这种情况使南美国家成为焦点,刺激了勘探、采矿企业和合作,以建立有弹性的锂供应链,并在预测期内推动电动车革命。

- 例如,2023年4月,全球领先的电动车製造商比亚迪宣布计画斥资2.9亿美元在智利安託法加斯塔地区兴建一座锂工厂。智利经济发展机构 CORFO 强调了这项倡议,此前政府核准比亚迪智利公司成为经过认证的锂生产商。预计此类投资将提高该地区的锂产量,并在预测期内增加锂离子二次电池的产量。

- 综上所述,由于快速成长的锂产量和策略投资,南美洲将在预测期内在全球二次电池市场中占据举足轻重的地位。

巴西可望主导市场

- 受电动车(EV)普及、再生能源来源整合以及能源储存方案需求激增的推动,巴西可充电电池市场预计将大幅成长。政府的奖励、严格的环境法规和快速的技术进步进一步推动了这种成长。

- 巴西正稳步拥抱电动车。截至2023年终,巴西电动车登记数量超出预期,达93,927辆。这比 2022 年售出的 49,245 辆大幅增加了 91%。光是2023年12月,电动车销量就达到历史新高,达到16,279辆,几乎是2022年12月销量5,587辆的三倍,与前一年同期比较去年同期成长惊人的191%。

- 为了明确转向永续交通,许多巴西公司正在大力投资电动车生产。这一趋势出现之际,通用汽车 (GM) 于 2024 年 1 月宣布,计划在未来五年投资 14 亿美元加强巴西的电动车生产,这将显着提振当地需求。

- 巴西拥有丰富的太阳能、风能等可再生能源资源,越来越认识到能源储存解决方案的重要性。二次电池对于在生产高峰时期利用剩余能源以及在高需求时期或再生能源来源停止使用时释放能源至关重要。

- 2023年1月,巴西最大的电池储能计划,容量为33.5MW/67MWh开始运作。科华科技投资约2,700万美元,占地2,000平方公尺,提供整合式PCS解决方案。该系统设计用于高峰时段放电,提高了电网的可靠性。总容量为60MWh,放电时间为两小时。此类计划将凸显二次电池解决方案的可行性,并刺激巴西电池技术领域的进一步投资和创新。

- 巴西的电池製造能力也出现激增。为了满足各个领域对二次电池不断增长的需求,国内外公司正在建立生产设施或与现有製造商合作。

- 2023年2月,WEG宣布计画增加巴西锂电池组产能。除了扩大现有设施外,WEG还计划建造一座新工厂,以满足电动交通和能源储存不断增长的需求。

- 由于这些发展,巴西对二次电池的需求预计在未来几年将大幅增加。

南美洲二次电池产业概况

南美洲二次电池市场较为分散。主要企业(排名不分先后)包括比亚迪有限公司、金霸王公司、Exide Industries Ltd.、EnerSys 和松下控股公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029 年之前的市场规模与需求预测

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 电动车 (EV) 产量增加

- 锂离子电池价格下降

- 抑制因素

- 原料蕴藏量不足

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 依电池类型

- 锂离子电池

- 铅酸电池

- 其他(镍氢、镍镉等)

- 按用途

- 用于汽车

- 工业电池

- 便携式电池

- 其他用途

- 按地区

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Company Ltd

- Duracell Inc.

- EnerSys

- Panasonic Holdings Corporation

- Energizer

- Saft Groupe SA

- Exide Industries Ltd

- Clarios

- FIAMM Energy Technology SpA

- Fedco Batteries

- 其他知名企业名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 扩大穿戴式装置的采用

简介目录

Product Code: 50003926

The South America Rechargeable Battery Market size is estimated at USD 5.15 billion in 2025, and is expected to reach USD 7.75 billion by 2030, at a CAGR of 8.51% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising electric vehicle (EV) production and declining lithium-ion battery prices are expected to drive the demand for rechargeable batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the South America recmhargeable battery market.

- Nevertheless, the growing adoption of wearable devices like smartwatches, wireless earphones, smart bands, and more are expected to create significant opportunities for rechargeable battery market players in the near future.

- Brazil is antcicpated to dominate the South American rechargeable battery market during the forecast period.

South America Rechargeable Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- Lithium-ion rechargeable batteries, celebrated for their myriad advantages, find extensive applications across diverse sectors. Their high energy density allows them to pack substantial power into a compact, lightweight form, making them a favored choice for efficient electrical energy storage.

- In January 2023, the US Geological Survey (USGS) reported global lithium reserves, highlighting Bolivia's 21 million tonnes, Argentina's 19.3 million tonnes, and Chile's 9.6 million tonnes out of a total of 86 million tonnes identified worldwide.

- In 2023, battery prices saw a notable decline, dropping over 13% to USD 139/kWh. With the ramp-up of extraction and refining capacities, lithium prices are projected to ease, aiming for USD 100/kWh by 2026.

- Recognizing the potential for economic growth and technological strides, both governments and private investors are ramping up funding for research facilities and forging partnerships with global battery manufacturers. This momentum is poised to bolster the demand for rechargeable lithium batteries in South America.

- For instance, in June 2023, Argentina's government unveiled a hefty USD 1.7 billion investment in lithium production, underscoring its ambition to emerge as a key global supplier. The Economy Ministry highlighted commitments from Chinese firm Tibet Summit Resources to boost production in Salta Province, eyeing yields between 50,000 to 100,000 tonnes of lithium. Such initiatives are set to amplify lithium-ion battery production in the region in the years ahead.

- Moreover, the global pivot towards cleaner energy and transportation has ignited a surge in demand for electric vehicles (EVs). This burgeoning appetite for EVs directly amplifies the need for lithium batteries. As automakers pour investments into expanding EV production, the urgency to secure consistent lithium supplies becomes paramount. This scenario has cast a spotlight on South American nations, spurring exploration, mining ventures, and collaborations to forge resilient lithium supply chains, fueling the EV revolution during the forecast period.

- For instance, in April 2023, BYD Co Ltd, the world's foremost electric vehicle manufacturer, unveiled plans for a USD 290 million lithium factory in Chile's Antofagasta region. This move, highlighted by Chile's economic development agency CORFO, comes on the heels of the government recognizing BYD Chile as a certified lithium producer. Such investments are poised to not only boost lithium production in the region but also elevate the output of lithium-ion rechargeable batteries in the forecast period.

- In summary, South America's burgeoning lithium production and strategic investments position it as a pivotal player in the global rechargeable battery market during the forecast period.

Brazil Expected to Dominate the Market

- Brazil's rechargeable battery market is set for substantial growth, fueled by the increasing adoption of electric vehicles (EVs), the integration of renewable energy sources, and a surging demand for energy storage solutions. This growth is further bolstered by government incentives, stringent environmental regulations, and rapid technological advancements.

- Brazil is steadily embracing electric vehicles. By the end of 2023, Brazil registered an impressive 93,927 electric vehicles, surpassing forecasts. This marks a significant 91% increase from the 49,245 units sold in 2022. December 2023 alone saw a record 16,279 EV sales, almost tripling the 5,587 units sold in December 2022, showcasing a remarkable 191% year-on-year growth.

- In a clear pivot towards sustainable transportation, numerous Brazilian companies are heavily investing in electric vehicle production. Highlighting this trend, General Motors Co. announced in January 2024 its plan to invest USD 1.4 billion over the next five years to bolster its electric vehicle production in Brazil, a move set to significantly boost the local demand for lithium-ion batteries.

- Brazil, rich in renewable energy resources like solar and wind, is increasingly recognizing the importance of energy storage solutions. Rechargeable batteries are essential for harnessing excess energy during peak production and releasing it during high demand or when renewable sources are offline.

- In January 2023, Brazil's largest battery storage project, with a capacity of 33.5MW/67MWh, began operations. Kehua Tech, investing around USD 27 million for a 2,000 square meter area, provided the integrated PCS solution. Designed to discharge during peak demand, the system enhances the electricity network's reliability. With a two-hour discharge capability, it boasts a total capacity of 60MWh. Such projects underscore the viability of rechargeable battery solutions, likely spurring further investment and innovation in Brazil's battery technology landscape.

- Brazil is also witnessing a surge in battery manufacturing capabilities. Both local and international firms are either setting up production facilities or collaborating with established manufacturers to cater to the rising demand for rechargeable batteries across diverse sectors.

- In February 2023, WEG announced its plans to boost the production capacity of lithium battery packs in Brazil. In addition to expanding its current facility, WEG is set to build a new factory to meet the growing demands of electric transportation and energy storage.

- Given these developments, the demand for rechargeable batteries in Brazil is poised to rise significantly in the coming years.

South America Rechargeable Battery Industry Overview

The South American rechargeable battery market is semi-fragmented. Some of the key players (not in particular order) are BYD Company Ltd, Duracell Inc., Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others (NiMh, NiCd, etc.)

- 5.2 Application

- 5.2.1 Automobile

- 5.2.2 Industrial Batteries

- 5.2.3 Portable Batteries

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Saft Groupe SA

- 6.3.7 Exide Industries Ltd

- 6.3.8 Clarios

- 6.3.9 FIAMM Energy Technology SpA

- 6.3.10 Fedco Batteries

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Wearable Devices

02-2729-4219

+886-2-2729-4219