|

市场调查报告书

商品编码

1636533

欧洲二次电池:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

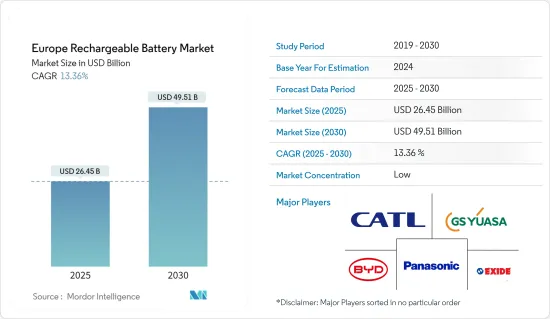

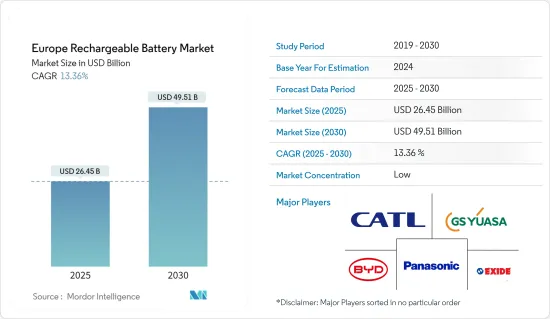

欧洲二次电池市场规模预计到2025年为264.5亿美元,预计2030年将达到495.1亿美元,预测期内(2025-2030年)复合年增长率为13.36%。

主要亮点

- 从中期来看,电动车需求的增加和可再生能源的日益采用等因素预计将成为预测期内欧洲二次电池市场的最大驱动力之一。

- 相反,在预测期内,电池采购方面的供应链严重限制威胁欧洲可充电电池市场。

- 然而,电池化学发展的不断进步正在创造更有效率的二次电池,并为市场带来许多未来的机会。

- 在快速成长的家用电子电器市场和快速可再生能源部署的推动下,德国有望引领市场,并预计在预测期内实现最高成长。

欧洲二次电池市场趋势

汽车大幅成长

- 近年来,欧盟(EU)实施了严格措施,旨在遏制温室气体排放并在全部区域推广清洁能源技术。这些倡议也强调促进交通部门的电气化。欧盟国家也反映了这些努力,并推出了提供税收优惠和补贴的措施,以鼓励电动车(EV)的采用。因此,对电动车关键零件二次电池的需求预计将大幅增加。

- 此外,人们对环境永续性的认识不断增强,以及摆脱对石化燃料的依赖,消费者的偏好正在转向环保型交通。由于直接零排放气体,电动车越来越被视为传统内燃机汽车的可持续替代品。消费者对电动车日益增长的偏好预计将促进欧洲二次电池市场的成长。

- 国际能源总署(IEA)的资料显示,整个欧洲的电动车销售持续成长。 2023年销量将达到约220万台,较2021年的160万台大幅成长,成长率超过37.5%。这种势头支撑了电动车的快速普及,也将进一步激发二次电池市场的活力。

- 此外,电池技术的持续进步正在带来电动车更高的能量密度、更长的行驶里程和更短的充电时间等增强功能。这些进步正在刺激整个欧洲增加投资,特别是在建立新的电池製造设施方面。

- 例如,2023年7月,印度着名汽车製造商塔塔汽车宣布计划在英国建造电动车电池工厂,电池年产能达40吉瓦。该工厂旨在透过本地化电池生产来加强国内汽车工业并确保长期永续性。塔塔汽车公司和政府相关人员都宣布对该厂投资 40 亿英镑。

- 鑑于这些发展,汽车产业的电动车领域将在未来几年大幅成长。

德国主导市场

- 德国因其工业和製造中心的地位以及强大的汽车工业而有望引领欧洲二次电池市场。该产业正在转向创新电动车,以跟上全球能源转型的步伐。随着欧洲对电动车需求的成长,德国汽车製造商将大幅增加对二次电池的需求,以巩固德国在该领域的领导地位。

- 此外,随着德国重点引进可再生能源发电,对二次电池的需求不断增加。鑑于再生能源来源的间歇性,能源储存对于充分发挥其潜力至关重要。随着电池能源储存系统的日益普及,德国的可再生能源产业预计将进一步推动二次电池的需求。

- 国际可再生能源机构的资料凸显了德国对可再生能源的快速利用。 2022年至2023年,该国可再生能源装置容量将激增约12%,超过五年5.6%以上的持续平均成长率。

- 此外,由于政府和私人公司的大量投资,德国已成为电池研发的领导者。国家研究机构和公司正在突破电池技术的极限,重点是提高能量密度、充电速度和整体效率。

- 例如,2024 年 5 月,德国着名电池供应商 Varta 启动了一个旨在开创工业规模钠离子二次电池技术的计划。目标是在三年内投资 750 万欧元(808 万美元),将细胞化学推向工业规模。目标是生产数量有限的适用于电动车和固定蓄电池的圆形电池。该计划预计将于2027年中期完工,并将进行全面的技术、经济和生态学评估。

- 考虑到这些新兴市场的发展,德国在欧洲二次电池市场的主导地位肯定会在预测期内出现。

欧洲二次电池产业概况

欧洲二次电池市场较为分散。该市场的主要企业(排名不分先后)包括比亚迪、Contemporary Amperex Technology、Exide Industries、Panasonic Corporation 和 GS Yuasa Corporation。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车需求不断扩大

- 扩大可再生能源

- 抑制因素

- 供应链限制

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 铅酸

- 锂离子

- 其他(镍氢、镍镉等)

- 目的

- 用于汽车

- 工业电池

- 便携式电池

- 其他的

- 地区

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 俄罗斯

- 土耳其

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Co. Ltd.

- LG Chem Ltd.

- Contemporary Amperex Technology Co Ltd

- Exide Industries

- Saft Groupe SA

- Samsung SDI Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- GS Yuasa Corporation

- Tesla, Inc.

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 新型电池化学的技术进步

简介目录

Product Code: 50003928

The Europe Rechargeable Battery Market size is estimated at USD 26.45 billion in 2025, and is expected to reach USD 49.51 billion by 2030, at a CAGR of 13.36% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing demand for electric vehicles and growing adoption of renewable energy are expected to be among the most significant drivers for the Europe rechargeable battery market during the forecast period.

- Conversely, high supply chain constraints in battery procurement threaten the European rechargeable battery market during the forecast period.

- However, ongoing advancements in battery chemistry development have resulted in more efficient rechargeable batteries, presenting numerous future opportunities for the market.

- Germany is poised to lead the market and is projected to achieve the highest growth during the forecast period, driven by a burgeoning consumer electronics segment and swift renewable energy installations.

Europe Rechargeable Battery Market Trends

Automobile to Witness Significant Growth

- In recent years, the European Union has implemented stringent measures aimed at curbing greenhouse gas emissions and promoting cleaner energy technologies across the region. These initiatives also emphasize a heightened electrification push within the transportation sector. Individual countries within the EU have mirrored these efforts, rolling out policies that offer tax incentives and subsidies to bolster the adoption of electric vehicle (EV). Consequently, this has led to an anticipated surge in demand for rechargeable batteries, a pivotal component of electric vehicles.

- Additionally, heightened awareness surrounding environmental sustainability and a collective move away from fossil fuel reliance has shifted consumer preferences towards eco-friendly transportation. Electric vehicles, with their zero direct emissions, are increasingly viewed as a sustainable alternative to traditional internal combustion engine vehicles. This rising consumer inclination towards EVs is poised to propel the rechargeable battery market's growth in Europe.

- Data from the International Energy Agency highlights a consistent uptick in electric vehicle sales across Europe. In 2023, sales reached approximately 2.2 million units, a notable increase from 1.6 million units in 2021, marking a growth rate exceeding 37.5%. Such momentum underscores the burgeoning traction of electric vehicles, further fueling the rechargeable battery market.

- Moreover, ongoing technological advancements in battery technology have ushered in enhancements like improved energy density, extended ranges, and expedited charging times for electric vehicles. These advancements have catalyzed increased investments across Europe, particularly in establishing new battery manufacturing facilities.

- For example, in July 2023, Tata Motors, a prominent Indian automobile manufacturer, unveiled plans for a 40 GW annual cell production capacity electric vehicle battery plant in Britain. This facility is poised to fortify the domestic car industry by localizing battery production, ensuring long-term sustainability. Both Tata Motors and government officials disclosed a hefty investment of GBP 4 Billion for the factory.

- Given these developments, the electric vehicle segment of the automobile industry is set for substantial growth in the coming years.

Germany to Dominate the Market

- Germany is poised to lead the European rechargeable battery market, bolstered by its status as an industrial and manufacturing hub and a strong automobile industry. This industry is pivoting towards innovative electric vehicles, aligning with the global energy transition. As Europe's appetite for electric vehicles grows, German automakers are set to significantly boost the demand for rechargeable batteries, solidifying Germany's leadership in this segment.

- Furthermore, Germany's dedication to incorporating renewable energy into its power generation amplifies its need for rechargeable batteries. Given the intermittent nature of renewable sources, energy storage becomes crucial to harness their full potential. With the rising adoption of battery energy storage systems, Germany's renewable energy sector is poised to further fuel the demand for rechargeable batteries.

- Data from the International Renewable Energy Agency highlights Germany's swift embrace of renewables: the nation's installed renewable energy capacity surged by about 12% from 2022 to 2023, outpacing a consistent five-year average growth rate of over 5.6%.

- Moreover, Germany is a leader in battery R&D, due to substantial investments from both government and private entities. Domestic research institutions and companies are pushing the envelope in battery technologies, emphasizing enhancements in energy density, charging speed, and overall efficiency.

- As an illustration, in May 2024, Varta, a prominent German battery supplier, launched a project aimed at pioneering industrial-scale rechargeable sodium-ion battery technology. With a three-year investment of EUR 7.5 million (USD 8.08 million), the initiative seeks to elevate cell chemistry to an industrial scale. The goal is to produce a limited batch of round cells, tailored for electric vehicles and stationary storage. Set to wrap up by mid-2027, the project will undergo a thorough technical, economic, and ecological evaluation.

- Given these developments, Germany's dominance in the European rechargeable battery market appears assured during the forecast period.

Europe Rechargeable Battery Industry Overview

The Europe Rechargeable Battery Market is fragmented. Some of the key players in this market (in no particular order) are BYD Co. Ltd., Contemporary Amperex Technology Co. Ltd., Exide Industries, Panasonic Corporation, and GS Yuasa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand for Electric Vehicles

- 4.5.1.2 Growing Renewable Energy Penetration

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Constraints

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Others (NiMh, NiCd, etc.)

- 5.2 Applications

- 5.2.1 Automobiles

- 5.2.2 Industrial Batteries

- 5.2.3 Portable Batteries

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 NORDIC

- 5.3.7 Russia

- 5.3.8 Turkey

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd.

- 6.3.2 LG Chem Ltd.

- 6.3.3 Contemporary Amperex Technology Co Ltd

- 6.3.4 Exide Industries

- 6.3.5 Saft Groupe SA

- 6.3.6 Samsung SDI Co., Ltd.

- 6.3.7 Murata Manufacturing Co., Ltd.

- 6.3.8 Panasonic Corporation

- 6.3.9 GS Yuasa Corporation

- 6.3.10 Tesla, Inc.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in New Battery Chemistry

02-2729-4219

+886-2-2729-4219