|

市场调查报告书

商品编码

1636544

北美充电电池:市场占有率分析、产业趋势/统计、成长预测(2025-2030)North America Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

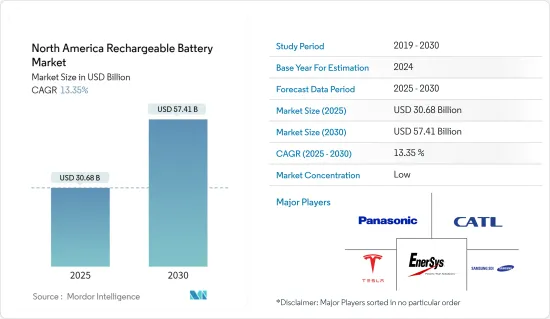

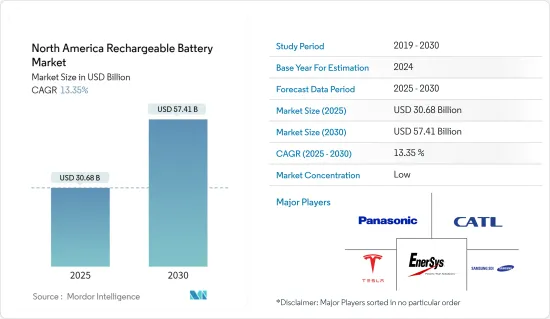

北美二次电池市场规模预计到2025年为306.8亿美元,预计2030年将达到574.1亿美元,预测期内(2025-2030年)复合年增长率为13.35%。

主要亮点

- 从中期来看,锂离子电池价格的下降、电动车渗透率的提高以及可再生能源领域的扩张预计将在预测期内推动北美二次电池市场的发展。

- 另一方面,原材料供需不匹配预计将阻碍预测期内的市场成长。

- 随着新电池技术和先进电池化学材料的开发,北美二次电池市场可能会带来重大机会。

- 由于电动车产业的扩张以及各种可再生能源计划越来越多地采用电池作为能源储存系统,预计美国将在未来几年占据市场主导地位。

北美二次电池市场趋势

汽车应用显着成长

- 未来几年,汽车应用,特别是电动车(EV)预计将成为二次电池(主要是锂离子电池)的主要领域。在电动车普及的推动下,北美二次电池产业预计将显着成长。

- 此外,铅酸电池在汽车行业的启动、照明和点火 (SLI) 配件中发挥着重要作用。这些 SLI 电池提供启动汽车引擎所需的初始电力,通常比深迴圈电池更小、更轻。

- 美国是该地区电动车的领先市场。例如,国际能源总署 (IEA) 报告称,2023 年美国纯电动车 (BEV) 销量将达到约 110 万辆,较 2022 年增长 37%。相比之下,加拿大和墨西哥的纯电动车销量分别约为 13 万辆和 13,000 辆。电动车普及率的快速成长将推动北美地区对二次电池的需求。

- 此外,能源效率和可再生能源办公室强调,美国政府已宣布计划于 2023 年初在北美建立电动车电池工厂。该地区的製造能力预计将从 2021 年的每年 55 吉瓦 (GWh/年) 飙升至 2030 年的惊人的 1,000 GWh/年。大多数即将实施的计划计划于 2025 年至 2030 年之间开始生产,这证实了汽车二次电池市场预计将成长。

- 2023年7月,加拿大政府与汽车製造商Stellantis合作,在安大略省温莎建立电动车电池工厂。根据协议,加拿大政府将向Stellantis提供约110亿美元的奖励,以加强其清洁能源供应链。此举预计将进一步巩固加拿大汽车二次电池市场。

- 2023年初,德国汽车製造商宝马宣布将在墨西哥圣路易斯波托西投资8亿欧元。该投资旨在生产高压电池和全电动「Neue Klasse」车型。 BMW的扩张计画将一半以上的投资分配给墨西哥,其中5.39亿美元专门用于现有工厂的电池组装中心,其余3.23亿美元用于车身车间改造和电池组安装。组装组装。这些措施预计将促进北美汽车产业二次电池市场的成长。

- 此外,随着锂离子电池价格的下降和电池技术的进步,电动车的竞争将会出现,进一步增加对二次电池的需求。

美国主导市场

- 对家用电子电器、电动车 (EV) 和电池能源储存计划的需求迅速增长,加上可再生能源基础设施的扩大和强大的工业基础,使美国成为全球可充电电池的热点。这些动态巩固了美国作为北美充电电池领先市场的地位。

- 近年来,在政府措施和可再生能源投资增加的推动下,美国的电池能源储存系统(BESS)经历了显着增长。美国在可再生能源领域处于世界领先地位,国际可再生能源机构 (IRENA) 报告称,从 2014 年到 2023 年,美国可再生能源装置容量增加了一倍多,到2023 年将达到385GW 以上。

- 随着可再生能源发电的快速增长,美国由于可再生能源的高度整合而面临电网稳定性的挑战。鑑于太阳能和风力发电的间歇性,在需求高峰期间储存这些能源至关重要。这种需求正在推动美国对 BESS 的需求,并推动二次电池的成长。

- 根据美国能源资讯署 (EIA) 的数据,美国电池储存容量自 2021 年以来一直在增长,预计到 2024年终将增加 89%,具体取决于开发商能否满足商业营运日期。开发商的目标是到 2024年终使美国电池储存容量达到 30 吉瓦以上,超过石油流体、地热源、木片和垃圾掩埋沼气的容量。

- 截至 2023 年,加州的发电量将达到 730 万千瓦,其次是德克萨斯州,发电量为 320 万千瓦。 EIA指出,截至年终,美国电力公司的蓄电池总容量将达到约1,600万千瓦,总合2024年新增1,500万千瓦,2025年新增9,000万千瓦。这一轨迹表明,未来几年对二次电池技术的需求将激增。

- 随着电子元件变得更小、更强大,家用电子电器变得越来越受欢迎。这些先进设备需要轻巧且复杂的电池组。消费者科技协会发布的一份报告强调,智慧型手机和笔记型电脑的消费量预计,美国智慧型手机销量将从2012 年的337 亿美元跃升至2022 年的约747 亿美元。对锂离子电池的需求不断增长。

- 因此,在都市化、消费者支出增加以及向先进设备和汽车的转变的推动下,美国有望引领北美可充电电池市场。

北美二次电池产业概况

北美二次电池市场较为分散。该市场的主要企业包括(排名不分先后)松下公司、宁德时代新能源科技有限公司、特斯拉公司、EnerSys 和三星 SDI。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 锂离子电池成本下降

- 抑制因素

- 原料供需不匹配

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 科技

- 铅酸电池

- 锂离子

- 其他技术(NiMh、Nicd 等)

- 目的

- 汽车电池

- 工业电池(用于电源、固定电池(电信、UPS、能源储存系统(ESS) 等)

- 可携式电池(家用电子电器产品等)

- 其他的

- 地区

- 美国

- 加拿大

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Panasonic Corporation

- Contemporary Amperex Technology Co. Limited

- Tesla Inc.

- EnerSys

- Samsung SDI Co. Ltd

- Duracell Inc.

- Exide Technologies

- Clarios, LLC.

- LG Chem Ltd.

- Johnson Controls International PLC

- BYD Co.Ltd.

- 其他知名公司名单(公司名称、总部地点、相关产品及服务、联络等)

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 新型电池技术与先进电池化学材料的开发进展

简介目录

Product Code: 50004020

The North America Rechargeable Battery Market size is estimated at USD 30.68 billion in 2025, and is expected to reach USD 57.41 billion by 2030, at a CAGR of 13.35% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector are expected to drive the North American rechargeable battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials is expected to hinder the market's growth during the forecast period.

- Nevertheless, the growing progress in developing new battery technologies and advanced battery chemistries will likely create significant opportunities for the North America rechargeable battery market.

- The United States is expected to dominate the market in the upcoming years due to the expansion of the electric vehicle industry and the increasing adoption of batteries as energy storage systems in various renewable energy projects.

North America Rechargeable Battery Market Trends

Automotive Application to Witness Significant Growth

- In the coming years, automotive applications, especially electric vehicles (EVs), are poised to be a dominant segment for rechargeable batteries, predominantly lithium-ion batteries. North America's rechargeable battery industry is set to experience significant growth, largely driven by the rising adoption of electric vehicles.

- Additionally, lead-acid batteries play a crucial role in the automotive industry's starting, lighting, and ignition (SLI) accessories. These SLI batteries provide the essential initial power burst needed to start a vehicle's engine, and they are generally smaller and lighter than deep-cycle batteries.

- The United States stands out as a leading market for electric vehicles in the region. For instance, the International Energy Agency (IEA) reported that battery electric vehicle (BEV) sales in the United States reached approximately 1.1 million units in 2023, marking a 37% increase from 2022. In comparison, Canada and Mexico recorded BEV sales of about 130 thousand and 13 thousand units, respectively. This surge in EV adoption is set to boost the demand for rechargeable batteries across North America.

- Moreover, the Office of Energy Efficiency and Renewable Energy highlighted that in early 2023, the United States government announced plans for electric vehicle battery plants in North America. Manufacturing capacity in the region is projected to soar from 55 gigawatts per year (GWh/year) in 2021 to a staggering 1000 GWh/year by 2030. Most of the upcoming projects are slated to commence production between 2025 and 2030, underscoring the anticipated growth of the rechargeable battery market for automotive applications.

- In July 2023, the Canadian government partnered with car manufacturer Stellantis to establish an electric vehicle battery plant in Windsor, Ontario. Under the agreement, the Canadian government is set to provide Stellantis with approximately USD 11 billion in incentives, aimed at bolstering the clean energy supply chain. This move is expected to further solidify the rechargeable battery market for automotive applications in Canada.

- In early 2023, BMW, the German automaker, declared an investment of EUR 800 million in San Luis Potosi, Mexico. This investment is aimed at producing high-voltage batteries and the fully electric "Neue Klasse" models. BMW's expansion plans allocate over half of the investment to Mexico, with USD 539 million dedicated to the battery assembly center at the existing plant and the remaining USD 323 million for adapting the body shop and establishing a new assembly line for battery pack installation. Such initiatives are expected to bolster the rechargeable battery market growth in North America's automotive sector.

- Furthermore, as lithium-ion battery prices decline and battery technologies advance, the market is likely to see the emergence of price-competitive electric vehicles, further fueling the demand for rechargeable batteries.

The United States to Dominate the Market

- Driven by the surging demand for consumer electronics, electric vehicles (EVs), and battery-based energy storage projects, coupled with an expanding renewable power infrastructure and a robust industrial base, the United States has emerged as a global hotspot for rechargeable batteries. These dynamics solidify the United States' position as North America's leading market for rechargeable batteries.

- In recent years, the battery energy storage system (BESS) in the United States has witnessed significant growth, bolstered by government initiatives and rising investments in renewable energy. The United States stands out as a global leader in renewable energy, with the International Renewable Energy Agency (IRENA) reporting that from 2014 to 2023, the nation's renewable energy capacity more than doubled, reaching over 385 GW by 2023.

- With the rapid growth in renewable power generation, the United States faces challenges in grid stability due to high renewable integration. Given the intermittent nature of solar and wind energy, it's crucial to store this energy during peak demand. This need bolsters the demand for BESS in the United States, subsequently driving the growth of rechargeable batteries.

- According to the United States Energy Information Administration (EIA), the nation's battery storage capacity, which has been on the rise since 2021, is projected to grow by 89% by the end of 2024, contingent on developers meeting their commercial operation dates. Developers aim to push the United States battery capacity beyond 30 GW by the end of 2024, surpassing capacities of petroleum liquids, geothermal sources, wood waste, and landfill gas.

- As of 2023, California leads with the highest installed battery storage capacity at 7.3 GW, followed by Texas at 3.2 GW, while other states collectively hold around 3.5 GW. The EIA notes that the combined United States utility-scale battery capacity reached about 16 GW at the end of 2023, with plans for an additional 15 GW in 2024 and 9 GW in 2025. This trajectory indicates a burgeoning demand for rechargeable battery technologies in the coming years.

- As electronic components shrink and processing power escalates, the popularity of consumer electronics is on the rise. These advanced devices demand lightweight, sophisticated battery packs. The surge in smartphone and laptop consumption, highlighted by the Consumer Technology Association's report of United States smartphone sales jumping from USD 33.7 billion in 2012 to approximately USD 74.7 billion in 2022, underscores the growing demand for lithium-ion batteries in portable devices.

- Given these factors, the United States is poised to lead North America's rechargeable battery market, buoyed by urbanization, rising consumer spending, and a shift towards advanced devices and vehicles.

North America Rechargeable Battery Industry Overview

The North America rechargeable battery market is fragmented. Some of the key players in the market (not in any particular order) include Panasonic Corporation, Contemporary Amperex Technology Co. Limited, Tesla Inc., EnerSys, and Samsung SDI Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Declining Lithium-ion Battery Cost

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Tesla Inc.

- 6.3.4 EnerSys

- 6.3.5 Samsung SDI Co. Ltd

- 6.3.6 Duracell Inc.

- 6.3.7 Exide Technologies

- 6.3.8 Clarios, LLC.

- 6.3.9 LG Chem Ltd.

- 6.3.10 Johnson Controls International PLC

- 6.3.11 BYD Co.Ltd.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress in Developing New Battery Technologies and Advanced Battery Chemistries

02-2729-4219

+886-2-2729-4219