|

市场调查报告书

商品编码

1636548

西班牙充电电池:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Spain Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

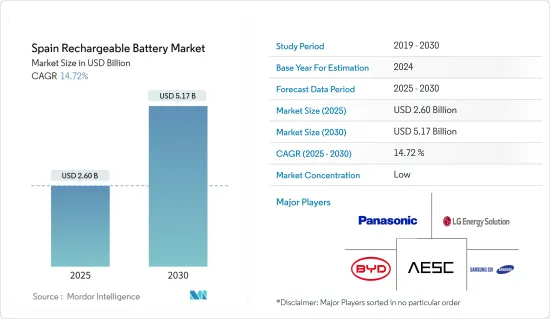

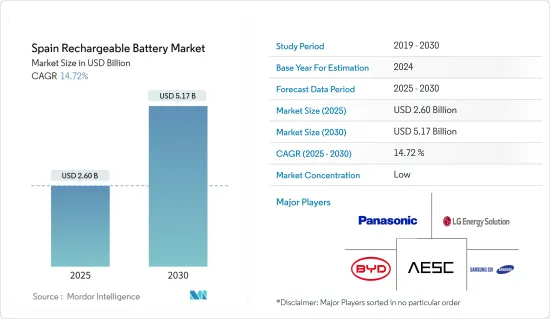

西班牙充电电池市场规模预计到2025年为26亿美元,预计到2030年将达到51.7亿美元,预测期内(2025-2030年)复合年增长率为14.72%。

主要亮点

- 从中期来看,锂离子电池价格的下降、电动车普及率的提高以及政府主导的可再生能源领域的扩张预计将在预测期内推动西班牙二次电池市场的发展。

- 另一方面,原材料供需不匹配以及与电池技术相关的安全问题预计将阻碍预测期内的市场成长。

- 随着新电池技术和先进电池化学物质的不断发展,西班牙二次电池市场可能会出现机会。

西班牙二次电池市场趋势

锂离子电池成长迅速

- 在各种电池技术中,锂离子电池(LIB)在二次电池市场中占据主导地位,预计在预测期内将快速成长。锂离子电池由于其优越的容量重量比、较长的保质期、较低的维护要求以及不断下降的价格而变得比其他电池更受欢迎。

- 与传统铅酸电池相比,锂离子电池具有明显的技术优势。例如,铅酸电池的使用寿命约为 400 至 500 次循环,而可充电锂离子电池的使用寿命可达 5,000 次以上。此外,锂离子电池需要较少的维护和更换。它还可以在整个放电週期中保持稳定的电压,从而提高所连接电气组件的效率。

- 近年来,产业龙头企业加大研发和生产投入,提升锂离子电池性能,加剧竞争,降低价格。由于技术进步、製造优化以及原材料成本降低,锂离子电池的平均价格已从2013年的780美元/千瓦时暴跌至2023年的139美元/千瓦时。预计到 2025 年,价格将进一步降至约 113 美元/千瓦时,到 2030 年,价格将进一步降至约 80 美元/千瓦时,锂离子电池将成为越来越有吸引力的选择。

- 从历史上看,锂离子电池曾为行动电话和笔记型电脑等家用电子电器产品提供动力。然而,其应用正在扩展到可再生能源领域的混合动力汽车、全电动汽车(BEV)和电池能源储存系统(BESS)。

- 2022 年初,大众汽车集团与其合作伙伴宣布计划在巴伦西亚附近的萨贡托建造一座锂离子电池超级工厂。这个地点的战略选择是为了向附近的马托雷尔和潘普洛纳电动汽车工厂供应电池。该计划估计费用32.5亿美元,目标年产能40GWh。预计 2023 年第一季开始施工,预计于 2026 年开始生产。继瑞典和德国的现有工厂之后,超级工厂将成为大众汽车的第三个工厂。此外,大众汽车集团也计划在欧洲再建立六座40GWh超级工厂,到2030年累积产能达到240GWh。

- 有鑑于永续发展的重要性,西班牙正迅速加大回收锂离子电池的力度。安全回收不仅可以保护必需矿物质,还可以提供可持续的废弃物替代品。 2023年7月,韩国电池和回收专家SungEel HiTech与西班牙BeePlanet Factory合作成立了一个联盟,专注于电动车锂离子电池的再利用和回收。

- 该财团名为 BeeCycle,将在卡帕罗索(纳瓦拉)建造一家回收工厂并开始运作。该工厂计划于 2025 年开始运营,将处理报废电池和电池製造过程中产生的废料。其年加工量为1万吨,目标是生产相当于25,000辆汽车年产量的「黑色物质」(从电池中粉碎的金属复合材料)。

- 2023年4月,嘉能可、FCC Ambito和Iberdrola宣布联手在西班牙建立大规模锂离子电池回收解决方案。他们的目标是透过建立专门的设施来解决回收锂离子电池的紧迫挑战,提供二次利用和报废回收解决方案。

- 鑑于锂离子电池重量轻、充电速度快、充电週期长、成本下降和工业进步,预计在预测期内将成为西班牙二次电池市场成长最快的电池技术。

电动车的普及正在推动市场

- 随着西班牙电动车(EV)的普及,西班牙的二次电池市场,特别是锂离子电池市场将快速成长。国际能源总署(IEA)的最新资料凸显了这一趋势。 2023年西班牙的纯电动车销量将激增至约57,000辆,比2022年的33,000辆增加72%。此外,到 2023 年,PEV 销量将达到约 65,000 辆。电动车的激增表明西班牙对二次电池的需求增加。

- 2023年,西班牙纯电动车保有量将达到约16万辆,较2022年的9.6万辆成长66%。同时,PEV库存增加了50%,达到约20万辆。儘管实现了这一增长,西班牙的汽车总保有量仍低于政府到 2030 年实现 550 万辆电动车的雄心勃勃的目标。这一差距证实了未来二次电池的需求强劲。

- 近年来,西班牙已成为电动车参与企业的焦点。值得注意的是,2024年4月,埃布罗电动汽车与奇瑞汽车在巴塞隆纳成立了一家合资企业,使奇瑞汽车成为第一家在欧洲生产的中国汽车製造商,利用埃布罗的前日产工厂。

- 另一项重大倡议是,电动车供应商摩比斯宣布计划于 2024 年 4 月在西班牙纳瓦拉地区投资 1.28 亿美元。这项投资旨在建立西欧第一家专用电气化工厂。纳瓦拉地理位置优越,位于西班牙北端,与法国位置,是通往欧洲当地的门户。摩比斯原本来自首尔,在韩国、中国和捷克共和国拥有电池系统生产设施,并正在美国和印尼建造工厂。

- Mobis 西班牙工厂计划于 2026 年开始大规模生产,目标是每年生产 36 万个电池系统组件 (BSA)。这些组件对于电动车的效率和安全性至关重要,并整合了电子元件和电池管理系统 (BMS)。作为一项策略性倡议,摩比斯于 2023 年与大众汽车签署了重要的 BSA 协议。新工厂生产的BSA将用于大众下一代EV平台,并在潘普洛纳生产。

- 随着这些发展,在不断发展的电动车格局的推动下,西班牙充电电池市场有望成长。

西班牙二次电池产业概况

西班牙的二次电池市场较为分散。该市场的主要企业包括(排名不分先后)松下公司、比亚迪有限公司、AESC集团有限公司、三星SDI和LG能源解决方案有限公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 锂离子电池成本下降

- 抑制因素

- 原料供需不匹配

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 科技

- 铅酸电池

- 锂离子

- 其他技术(NiMh、Nicd 等)

- 目的

- 汽车电池

- 工业电池(用于电源、固定电池(电信、UPS、能源储存系统(ESS) 等)

- 可携式电池(家用电子电器产品等)

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Panasonic Corporation

- BYD Company Ltd.

- AESC Group Ltd.

- Contemporary Amperex Technology Co. Limited

- Exide Technologies

- Toshiba Corporation

- Samsung SDI Co. Ltd

- Duracell Inc.

- Clarios, LLC.

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 新型电池技术与先进电池化学材料的开发进展

简介目录

Product Code: 50004024

The Spain Rechargeable Battery Market size is estimated at USD 2.60 billion in 2025, and is expected to reach USD 5.17 billion by 2030, at a CAGR of 14.72% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector aided by government initiatives are expected to drive the Spain rechargeable battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials, and the safety issues related to battery technologies are expected to hinder the market's growth during the forecast period.

- Nevertheless, the growing progress in developing new battery technologies and advanced battery chemistries will likely create opportunities for the Spain rechargeable battery market.

Spain Rechargeable Battery Market Trends

Lithium-ion Battery to be the Fastest Growing

- Among various battery technologies, lithium-ion batteries (LIBs) are poised to dominate the rechargeable battery market, experiencing rapid growth during the forecast period. Their rising popularity over other battery types can be attributed to their superior capacity-to-weight ratio, extended shelf life, reduced maintenance needs, and declining prices.

- Li-ion batteries boast distinct technical advantages over traditional lead-acid batteries. For instance, while lead-acid batteries offer a lifespan of approximately 400-500 cycles, rechargeable Li-ion batteries can exceed 5,000 cycles. Moreover, Li-ion batteries require less frequent maintenance and replacement. They also maintain consistent voltage throughout their discharge cycle, ensuring prolonged efficiency for connected electrical components.

- In recent years, major industry players have ramped up investments in R&D and production to enhance lithium-ion battery performance, intensifying competition and driving down prices. Due to technological advancements, manufacturing optimizations, and falling raw material costs, the average price of lithium-ion batteries plummeted from USD 780/kWh in 2013 to USD 139/kWh in 2023. Projections suggest a further decline to around USD 113/kWh by 2025 and USD 80/kWh by 2030, making lithium-ion batteries an increasingly attractive option.

- Historically, lithium-ion batteries powered consumer electronics like mobile phones and laptops. However, their application has expanded to include hybrids, fully electric vehicles (BEVs), and battery energy storage systems (BESS) in the renewable energy sector.

- In early 2022, the Volkswagen Group, in collaboration with partners, announced plans for a lithium-ion battery gigafactory in Sagunto, near Valencia. This location was strategically selected to supply battery cells to nearby EV plants in Martorell and Pamplona. The project, with an estimated cost of USD 3.25 billion, aims for an annual production capacity of 40 GWh. Construction commenced in Q1 2023, with production slated to begin in 2026. This gigafactory will be Volkswagen's third, joining existing sites in Sweden and Germany. Furthermore, the group envisions establishing six additional 40 GWh gigafactories across Europe, targeting a cumulative capacity of 240 GWh by 2030.

- Recognizing the importance of sustainable practices, Spain has seen a surge in lithium-ion battery recycling initiatives. Safe recycling not only conserves essential minerals but also presents a sustainable alternative to disposal. In July 2023, South Korean battery recycling specialist SungEel HiTech partnered with Spain's BeePlanet Factory to form a consortium focused on reusing and recycling lithium-ion batteries from electric vehicles.

- This consortium, named BeeCycle, will kick off its operations by constructing a recycling plant in Caparroso (Navarre). Set to commence in 2025, the facility will handle batteries at the end of their life cycle and scrap from battery cell manufacturing. With a processing capacity of 10,000 tonnes annually, it aims to produce 'black mass' - a crushed metal composite from batteries - equivalent to the output of 25,000 cars per year.

- In April 2023, Glencore, FCC Ambito, and Iberdrola announced a collaborative effort to establish large-scale lithium-ion battery recycling solutions in Spain. Their goal is to address the pressing challenge of lithium-ion battery recycling by setting up a dedicated facility that offers both second-life repurposing and end-of-life recycling solutions.

- Given their lightweight nature, rapid charging capabilities, extended charging cycles, decreasing costs, and advancements in the industry, lithium-ion batteries are set to become the fastest-growing battery technology in Spain's rechargeable battery market during the forecast period.

Increasing Adoption of Electric Vehicles To Drive the Market

- Spain's rechargeable battery market, especially for lithium-ion batteries, is set to surge, driven by the country's accelerating adoption of electric vehicles (EVs). Recent data from the International Energy Agency (IEA) highlights this trend: BEV sales in Spain jumped to approximately 57,000 units in 2023, marking a 72% increase from 33,000 units in 2022. Additionally, PEV sales reached around 65,000 units in 2023. This uptick in EV adoption signals a corresponding rise in demand for rechargeable batteries in Spain.

- In 2023, BEV stocks in Spain hit about 160,000 units, a notable 66% increase from 96,000 in 2022. Meanwhile, PEV stocks grew by 50%, reaching around 200,000 units. Despite this growth, Spain's total vehicle stock falls short of the government's ambitious target of 5.5 million electric vehicles by 2030. This gap underscores a robust future demand for rechargeable batteries.

- Spain has become a focal point for EV players in recent years. Notably, in April 2024, Ebro-EV Motors and Chery Automobile forged a joint venture in Barcelona, marking Chery as the first Chinese automaker to produce in Europe, utilizing Ebro's former Nissan plant.

- In another significant move, EV supplier Mobis, in April 2024, unveiled plans for a USD 128 million investment in Navarre, Spain. This investment aims to establish Western Europe's inaugural electrification-dedicated plant. Navarre, strategically located at Spain's northern tip bordering France, offers a gateway into mainland Europe. Mobis, hailing from Seoul, boasts battery system production facilities across Korea, China, and the Czech Republic, with additional plants underway in the U.S. and Indonesia.

- Set to commence mass production in 2026, Mobis' Spanish facility aims for an ambitious output of 360,000 annual battery system assemblies (BSA). These assemblies, crucial for EV efficiency and safety, integrate electronic components and the Battery Management System (BMS). In a strategic move, Mobis clinched a significant BSA contract with Volkswagen in 2023. The BSAs from the new plant are destined for Volkswagen's next-gen EV platforms, set to be produced in Pamplona.

- Given these developments, Spain's rechargeable battery market is poised for growth, driven by the nation's evolving EV landscape.

Spain Rechargeable Battery Industry Overview

The Spain rechargeable battery market is semi-fragmented. Some of the key players in the market (not in any particular order) include Panasonic Corporation, BYD Company Ltd., AESC Group Ltd., Samsung SDI Co. Ltd., and LG Energy Solution Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Declining Lithium-ion Battery Cost

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 BYD Company Ltd.

- 6.3.3 AESC Group Ltd.

- 6.3.4 Contemporary Amperex Technology Co. Limited

- 6.3.5 Exide Technologies

- 6.3.6 Toshiba Corporation

- 6.3.7 Samsung SDI Co. Ltd

- 6.3.8 Duracell Inc.

- 6.3.9 Clarios, LLC.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress in Developing New Battery Technologies and Advanced Battery Chemistries

02-2729-4219

+886-2-2729-4219