|

市场调查报告书

商品编码

1636549

法国二次电池:市场占有率分析、产业趋势、成长预测(2025-2030)France Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

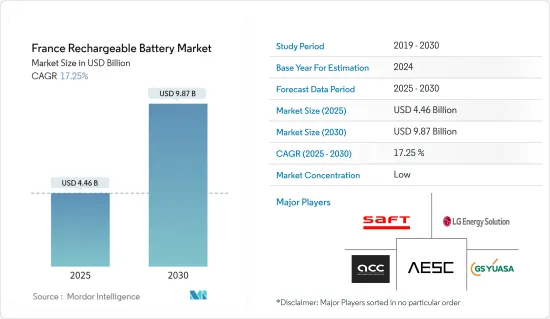

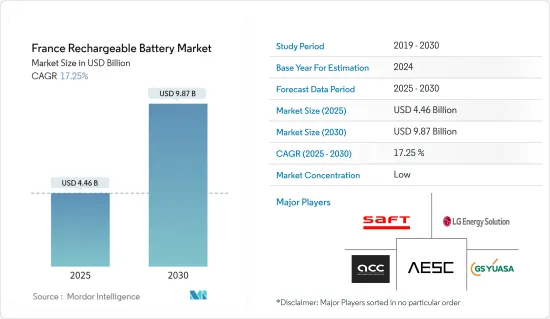

法国二次电池市场规模预计到2025年为44.6亿美元,预计到2030年将达到98.7亿美元,预测期内(2025-2030年)复合年增长率为17.25%。

主要亮点

- 从中期来看,锂离子电池价格的下降、电动车普及率的提高以及政府支持下可再生能源领域的扩张预计将在预测期内推动法国二次电池市场的发展。

- 另一方面,原材料供需不匹配以及与电池技术相关的安全问题可能会阻碍预测期内的市场成长。

- 随着新电池技术和先进电池化学材料的开发,法国二次电池市场可能会出现机会。

法国二次电池市场趋势

汽车电池大幅成长

- 在法国,汽车应用可望主导二次电池市场。随着电动车(EV)在国内的普及,对二次电池(尤其是锂离子电池)的需求将迅速增加。

- 此外,铅酸电池还为汽车启动、照明和点火 (SLI) 配件供电。这些 SLI 电池提供启动引擎所需的关键初始电力。由于它们比深迴圈电池更小、更轻,因此其需求预计将持续下去,从而加强法国二次电池市场。

- 国际工业协会(OICA)的资料显示,2023年法国新车销量将超过220万辆,较2022年的192万辆成长14.67%,较2021年的214万辆成长3.12%。汽车销量的成长预计将进一步推动二次电池在汽车应用中的采用。

- 此外,法国汽车产业电动车(EV)的采用显着增加。根据国际能源总署(IEA)的报告,2023年法国纯电动车(BEV)销量将达到约31万辆,比2022年的21万辆大幅成长47%。电动车的快速普及将刺激法国对二次电池的需求。

- 2024 年 5 月,法国政府向汽车製造商提出挑战,要求汽车製造商在 2030 年生产 200 万辆电动或混合动力汽车,儘管面临来自中国的激烈竞争。作为新中期协议的一部分,该行业的目标是到 2027 年销售 80 万辆电动车,比 2022 年的 20 万辆大幅成长。此外,该汽车製造商的目标是到 2022 年将电动车 (EV) 的年销量从 16,500 辆增加到 100,000 辆。

- 为了进一步提高电动车的生产和购买,法国政府已在 2024 年拨款 15 亿欧元(16 亿美元)。法国销售的新车中有近20%是电动车,但只有12%是国产的。政府与产业协议还设想到 2030 年在主要路线和主要城市策略性地部署 40 万个充电站和 25,000 个快速充电站。这些倡议预计在未来几年将显着增加对二次电池(尤其是锂离子电池)的需求。

- 2023 年 5 月,Stellantis 与 TotalEnergies 和梅赛德斯-奔驰合作,在法国 Billie-Belcleau-Deblanc 开设了 Automotive Cells Company (ACC) 的超级电池工厂。这是欧洲计划建造的三个超级工厂中的第一个。该工厂的产能从 13 吉瓦时 (GWh) 开始,到 2030 年扩大到 40 GWh,旨在生产高性能锂离子电池,同时最大限度地减少二氧化碳排放。该超级工厂符合 Stellantis 到 2030 年在欧洲实现 250GWh 电池产能的宏伟目标。

- 2024年1月,台湾电动车电池製造商辉能科技宣布,计画于2027年在法国新厂开始量产,并计画上市。 2023年初,法国总统马克宏强调Prologim斥资52亿欧元(56.7亿美元)在敦克尔克建设电池工厂的巨额投资,凸显了法国作为欧洲电动车产业中心的地位。这些战略倡议凸显了法国对推动二次电池领域的承诺。

- 由于这些新兴市场的发展,法国二次电池市场在汽车领域预计将迅速扩大。

扩大市场领先的可再生能源领域的采用

- 法国可再生能源的引进正在取得进展,这将极大地推动二次电池市场的发展。根据国际可再生能源机构(IRENA)的报告,2023年法国累积可再生能源装置容量达到约69.3GW,较2022年成长7%。随着法国转向太阳能和风力发电,对高效能电池能源储存系统(BESS)的需求将飙升,这对于平衡这些电源的间歇性至关重要。锂离子电池是这种情况的主要参与者,它在高峰期储存多余的能量,并在需求激增或产量下降时释放它。

- 法国雄心勃勃的能源转型计划旨在2050年将温室气体排放减少80%(与1990年相比),这将推动BESS市场的发展。此外,新法要求到2035年将核能消耗从75%减少到50%。这项转变可望抵消核能产量的下降,并加强我们对可再生能源的承诺。此类倡议不仅吸引了对可再生能源的投资,也凸显了对先进电池能源储存系统的迫切需求,放大了对尖端二次电池的需求。

- 2023年9月,Q ENERGY在法国圣阿沃尔德的Emile Huchet电厂启动了「Melbet」能源储存计划。该系统容量为35MW和44MWh,可满足约1万名居民的日常用电需求。该计划拥有 24 个最先进的电池容器,代表了能源储存产业的发展,支持可再生能源的整合并为更绿色的能源结构做出了贡献。

- 此外,多家公司也宣布了新的电池储存计划。 2022年12月,特斯拉向法国电力公司提供了196MWh电池系统,并将其与太阳能发电厂连结。 2022年8月,BayWa re受Haute-Saintonge社区委託建立太阳能发电和储存设施,拥有40 MWp太阳能发电厂和电池存储,年发电量为52 GWh。

- 可再生能源的引入和电池技术的进步之间的相互作用正在创造一个充满活力的市场格局。公司正大力投资研发,以提供高效、耐用且具成本效益的电池解决方案。这种对创新的承诺对于克服能源储存挑战和实现法国雄心勃勃的可再生能源目标至关重要。

- 2024 年 5 月,Skeleton Technologies 宣布向法国奥克西塔尼地区扩张,承诺五年内投资 6 亿欧元。作为扩张的开始,Skeleton 将在图卢兹开始研发新一代电池技术。接下来,我们将在奥克西塔尼建立「超级电池」製造部门。 Skeleton 的产品专注于高功率、快速充电能源储存,服务于从电动车到航太等各个领域,并专注于二氧化碳减排和节能。

- 2024年4月,施耐德电机发布了最新的电池储能係统(BESS)。整合到微电网系统中的 BESS 可从各种能源来源中回收能量并将其储存以供日后使用。作为一种独特的分散式能源(DER),BESS支援广泛的能源应用,从需求收费减少到可再生能源自耗。

- 总之,随着法国迈向永续、低碳能源的未来,可再生能源的采用与可靠能源储存的需求之间的协同效应将成为二次电池市场的主要催化剂。

法国二次电池产业概况

法国二次电池市场处于半分散状态。市场的主要企业包括(排名不分先后)Saft Groupe SAS、LG Energy Solution Ltd.、AESC Group Ltd.、Automotive Cells Company (ACC) 和 GS Yuasa Corporation。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 扩大可再生能源领域的采用

- 锂离子电池成本下降

- 抑制因素

- 原料供需不匹配

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 科技

- 铅酸电池

- 锂离子

- 其他技术(NiMh、Nicd 等)

- 目的

- 汽车电池

- 工业电池(用于电源、固定电池(电信、UPS、能源储存系统(ESS) 等)

- 可携式电池(家用电子电器产品等)

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Saft Groupe SAS

- LG Energy Solution Ltd.

- AESC Group Ltd.

- Automotive Cells Company(ACC)

- GS Yuasa Corporation

- Exide Technologies

- Panasonic Corporation

- Duracell Inc.

- Schneider Electric SE

- Contemporary Amperex Technology Co., Limited

- EnerSys

- 其他知名公司名单(公司名称、总部地点、相关产品及服务、联络等)

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 新型电池技术与先进电池化学材料的开发进展

简介目录

Product Code: 50004025

The France Rechargeable Battery Market size is estimated at USD 4.46 billion in 2025, and is expected to reach USD 9.87 billion by 2030, at a CAGR of 17.25% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector aided by government are expected to drive the France rechargeable battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials, and the safety issues related to battery technologies are likely to hinder the market's growth during the forecast period.

- Nevertheless, the growing progress in developing new battery technologies and advanced battery chemistries will likely create opportunities for the France rechargeable battery market.

France Rechargeable Battery Market Trends

Automotive Batteries Segment to Witness Significant Growth

- In France, automotive applications are poised to dominate the rechargeable batteries market. As electric vehicles (EVs) gain traction in the country, the demand for rechargeable batteries, particularly lithium-ion types, is set to surge.

- Moreover, lead-acid batteries power the starting, lighting, and ignition (SLI) accessories in vehicles. These SLI batteries provide the crucial initial power burst needed to start an engine. Being smaller and lighter than deep-cycle batteries, their demand is projected to persist, bolstering the French rechargeable battery market.

- Data from the International Organization of Motor Vehicle Manufacturers (OICA) reveals that France sold over 2.20 million new motor vehicles in 2023, marking a 14.67% jump from 2022's 1.92 million and a 3.12% rise from 2021's 2.14 million. This uptick in vehicle sales is expected to further drive the adoption of rechargeable batteries in automotive applications.

- Furthermore, the French automotive sector has witnessed a notable uptick in the adoption of electric vehicle (EV). The International Energy Agency (IEA) reported that battery electric vehicle (BEV) sales in France hit approximately 310,000 units in 2023, a robust 47% increase from 2022's 210,000 units. This rapid EV adoption is set to fuel the demand for rechargeable batteries in France.

- In May 2024, the French government challenged its carmakers to produce two million electric or hybrid vehicles by 2030, despite fierce competition from China. As part of a new medium-term agreement, the industry targets 800,000 electric vehicle sales by 2027, a significant jump from 200,000 in 2022. Furthermore, carmakers aim to boost annual sales of electric light utility vehicles to 100,000, up from 16,500 in 2022.

- To further bolster EV production and purchases, the French government allocated EUR 1.5 billion (USD 1.6 billion) in 2024. While nearly 20% of new cars sold in France are electric, only 12% are domestically produced. The government-industry agreement also envisions 400,000 charging points by 2030 and 25,000 quick charging points by 2027, strategically located along major routes and in major cities. These initiatives are poised to significantly boost the demand for rechargeable batteries, especially lithium-ion types, in the coming years.

- In May 2023, Stellantis, in collaboration with TotalEnergies and Mercedes-Benz, inaugurated the Automotive Cells Company's (ACC) battery gigafactory in Billy-Berclau Douvrin, France. This marks the first of three planned gigafactories in Europe. Starting with a production line capacity of 13 gigawatt-hours (GWh), set to expand to 40GWh by 2030, the facility aims to produce high-performance lithium-ion batteries with a minimal CO2 footprint. This gigafactory aligns with Stellantis' ambitious target of achieving a 250 GWh battery manufacturing capacity in Europe by 2030.

- In January 2024, ProLogium Technology Co., a Taiwanese electric vehicle battery manufacturer, announced plans to commence mass production at its new French factory in 2027, with aspirations for an initial public offering. Earlier in 2023, French President Emmanuel Macron highlighted ProLogium's significant EUR 5.2 billion (USD 5.67 billion) investment in a Dunkirk-based battery factory, further solidifying France's emerging status as a hub for Europe's electric car industry. These strategic moves underscore France's commitment to advancing in the rechargeable battery domain.

- Given these developments, the automotive segment is set for rapid expansion in France's rechargeable battery market.

Growing Adoption of Renewable Energy Sector To Drive the Market

- France's increasing embrace of renewable energy is set to significantly propel the rechargeable batteries market. The International Renewable Energy Agency (IRENA) reported that France's cumulative renewable energy capacity hit approximately 69.3 GW in 2023, marking a 7% rise from 2022. As France leans into solar and wind energy, the demand for efficient battery energy storage systems (BESS) surges, which is crucial for balancing the intermittent nature of these sources. Lithium-ion batteries, a key player in this scenario, store excess energy during peak production and release it when demand spikes or production wanes.

- France's ambitious energy transition projects, aiming for an 80% reduction in greenhouse gas emissions by 2050 (relative to 1990 levels), are set to drive the BESS market. Additionally, a new law mandates a reduction in nuclear energy consumption from 75% to 50% by 2035. This shift is poised to bolster renewable energy initiatives, compensating for the diminished nuclear output. Such moves not only attract investments in renewables but also underscore the urgent need for advanced battery energy storage systems, amplifying the demand for cutting-edge rechargeable batteries.

- In September 2023, Q ENERGY kicked off the "Merbette" energy storage project at the Emile Huchet power plant in Saint-Avold, France. With a capacity of 35 MW and 44 MWh, the system can meet the daily electricity needs of about 10,000 residents. Featuring 24 state-of-the-art battery containers, this project symbolizes the energy storage sector's growth, aiding in renewable energy integration and contributing to a greener energy mix.

- Moreover, several companies have unveiled new battery energy storage projects. In December 2022, Tesla provided a 196 MWh battery system to Electricite de France, linking it to a solar power plant. In August 2022, BayWa r.e. was selected by the Haute-Saintonge Community to establish a solar and battery storage facility, featuring a 40MWp PV park and an annual output of 52 GWh.

- The interplay between renewable energy adoption and battery technology advancements is creating a vibrant market landscape. Companies are heavily investing in R&D to devise efficient, durable, and cost-effective battery solutions. This commitment to innovation is vital for overcoming energy storage challenges and achieving France's ambitious renewable energy goals.

- In May 2024, Skeleton Technologies announced its expansion into France's Occitanie region, committing EUR 600 million over five years. Kicking off its expansion, Skeleton is initiating R&D in Toulouse for next-gen battery tech. Following this, they'll establish a manufacturing unit in Occitanie for their "SuperBattery." Focusing on high-power, fast-charging energy storage, Skeleton's products cater to diverse sectors, from EVs to aerospace, emphasizing CO2 reduction and energy conservation.

- In April 2024, Schneider Electric unveiled its latest Battery Energy Storage System (BESS). Integrated into microgrid systems, BESS captures and stores energy from various sources for future use. As a unique Distributed Energy Resource (DER), BESS supports a wide array of energy applications, from demand-charge reduction to renewable self-consumption.

- In summary, as France strides towards a sustainable, low-carbon energy future, the synergy between renewable energy adoption and the demand for reliable energy storage is poised to be a major catalyst for the rechargeable batteries market.

France Rechargeable Battery Industry Overview

The France rechargeable battery market is semi-fragmented. Some of the key players in the market (not in any particular order) include Saft Groupe SAS, LG Energy Solution Ltd., AESC Group Ltd., Automotive Cells Company (ACC), and GS Yuasa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Growing Adoption of Renewable Energy Sector

- 4.5.1.3 Declining Lithium-ion Battery Cost

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Saft Groupe SAS

- 6.3.2 LG Energy Solution Ltd.

- 6.3.3 AESC Group Ltd.

- 6.3.4 Automotive Cells Company (ACC)

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Exide Technologies

- 6.3.7 Panasonic Corporation

- 6.3.8 Duracell Inc.

- 6.3.9 Schneider Electric SE

- 6.3.10 Contemporary Amperex Technology Co., Limited.

- 6.3.11 EnerSys

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress in Developing New Battery Technologies and Advanced Battery Chemistries

02-2729-4219

+886-2-2729-4219