|

市场调查报告书

商品编码

1636557

日本二次电池:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Japan Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

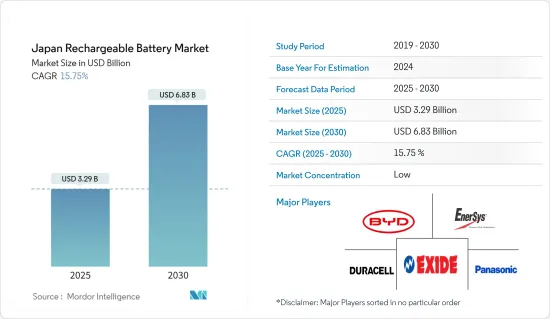

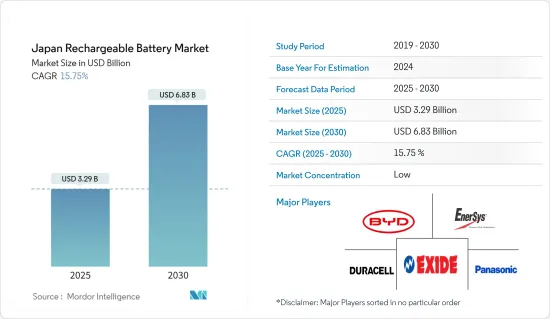

日本二次电池市场规模预计到2025年为32.9亿美元,预计2030年将达到68.3亿美元,预测期间(2025-2030年)复合年增长率为15.75%。

主要亮点

- 从中期来看,电动车(EV)产量的增加和锂离子电池价格的下降预计将在预测期内推动二次电池需求。

- 另一方面,蕴藏量不足可能会严重限制日本二次电池市场的成长。

- 智慧型手錶、无线耳机、智慧手环等穿戴式装置的日益普及预计将在不久的将来为二次电池市场的参与企业创造巨大的商机。

日本二次电池市场动向

锂离子电池类型主导市场

- 锂离子二次电池以其许多优点而闻名,在各个领域都得到了广泛的应用。这些电池已成为可靠且高效的电能能源储存解决方案。锂离子二次电池的显着特征之一是其高能量密度,这使得它们能够将大量电力装入紧凑且轻量的形式。

- 日本锂离子二次电池市场是一个充满活力、充满机会和挑战的地方。由于其良好的容量重量比,锂离子二次电池比其他技术更受欢迎。儘管与同类电池相比,锂离子电池的价格通常较高,但市场上的领先公司正在大力投资研发以扩大业务。这种加剧的竞争不仅提高了电池性能,也促成了锂离子电池价格的下降趋势。

- 2023年,由于电动车(EV)和电池能源储存系统(BESS)电池组平均价格上涨,电池价格将显着下降,稳定在139美元/kWh,下降超过13%。随着采矿和精製能的增加,锂价格预计将稳定并到 2026 年达到 100 美元/kWh。

- 锂离子电池是许多电池能源储存系统(BESS)的核心,因其高能量密度、快速充电和长循环寿命而备受讚誉。这些特性非常适合 BESS 应用中的高效能源储存和释放。日本公司正积极开展未来几年加强 BESS 的计划。

- 例如,2023 年 8 月,日本着名电池製造商 Power X 与当地可再生能源开发商 West Holdings 合作。两家公司之间的合资企业旨在全国扩大电池储存系统和太阳能发电设施。两家公司计划实现200MWh的蓄电容量和30MW的太阳能发电输出,目标于2025年春季完工。这项措施不仅有望加强当地的能源储存系统,还可以满足快速增长的能源需求,从而增加对锂离子二次电池的需求。

- 日本对可再生能源,特别是太阳能和风能的承诺凸显了锂离子二次电池的关键作用。这些电池对于利用和储存可再生能源的剩余能源以及在天气条件变化的情况下确保稳定的电力供应至关重要。

- 在所有能源中,太阳能占据主导地位。作为减少对核能依赖策略的一部分,日本计划在 2030 年将太阳能发电容量提高到近 108GW,这表明对锂离子电池的需求将在不久的将来激增。

- 鑑于这些计划和倡议,预计未来几年对锂离子二次电池的需求将激增。

汽车领域经历显着成长

- 内燃机汽车(ICE)长期以来一直主宰着道路。然而,随着人们对环境的关注日益增加,人们明显转向电动车 (EV)。电动车的主流使用锂离子二次电池,具有能量密度高、重量轻、自放电低、维护要求低等优点。

- 插电式混合动力汽车和电动车由锂离子二次电池系统动力来源。快速充电能力和高能量密度使锂离子电池脱颖而出,成为满足OEM对续航里程和充电时间要求的唯一技术。相较之下,铅基动力电池由于重量重且比能量低,不适合全混合动力汽车和电动车。

- 在日本,电动车最近开始流行。国际能源总署(IEA)宣布,2023年电动车销量将达14万辆,比2022年成长44.3%。预测表明,未来几年全部区域的电动车销量将大幅成长。

- 为了支持电动车和可再生能源,日本政府推出了一系列措施和奖励。这些努力正在增加对锂离子电池的需求。 2023年,政府宣布了扩大电动车生产规模并加速实现零碳排放的雄心勃勃的计画。

- 日本政府推出了“2050年电动车战略”,目标是到2050年日本汽车製造商生产的所有汽车完全转向电动车。此外,考虑到日本电动车充电基础设施的现状,东京电力控股公司决定在 2025 年将高速公路快速充电桩的数量增加到 1,000 个。

- 此外,随着国际社会转向永续性,日本也全心全意地拥抱这场电力革命。东京的目标是到 2030 年将公共充电点的数量从 30,000 个增加到 150,000 个。透过这些共同努力,日本可望增加电动车产量,进而增加对锂离子电池的需求。

- 此类积极措施预计将导致该地区电动车销售和充电基础设施蓬勃发展,从而导致预测期内二次电池的需求增加。

日本二次电池产业概况

日本的二次电池已减半。主要企业(排名不分先后)包括比亚迪有限公司、金霸王公司、Exide Industries Ltd.、EnerSys 和松下控股公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车 (EV) 产量增加

- 锂离子电池价格下降

- 抑制因素

- 原料蕴藏量不足

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 其他技术(NiMh、Nicd 等)

- 目的

- 汽车电池

- 工业电池(用于电源、固定电池(电信、UPS、能源储存系统(ESS) 等)

- 可携式电池(家用电子电器产品等)

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Company Ltd

- Duracell Inc.

- EnerSys

- Panasonic Holdings Corporation

- Energizer

- Saft Groupe SA

- Exide Industries Ltd

- Gotion High tech Co Ltd

- Murrata Manufacturing Co. Ltd.

- GS Yuasa International Ltd.

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 扩大穿戴式装置的采用

简介目录

Product Code: 50004063

The Japan Rechargeable Battery Market size is estimated at USD 3.29 billion in 2025, and is expected to reach USD 6.83 billion by 2030, at a CAGR of 15.75% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising electric vehicle (EV) production and declining lithium-ion battery prices are expected to drive the demand for rechargeable batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the Japan rechargeable battery market.

- Nevertheless, the growing adoption of wearable devices like smartwatches, wireless earphones, smart bands, and more are expected to create significant opportunities for rechargeable battery market players in the near future.

Japan Rechargeable Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- Lithium-ion rechargeable batteries, known for their numerous advantages, find extensive applications across various sectors. These batteries have emerged as a trusted and efficient solution for electrical energy storage. One of their standout features is their high energy density, allowing them to pack substantial power into a compact and lightweight form.

- Japan's lithium-ion rechargeable battery market is a dynamic arena, brimming with both opportunities and challenges. Thanks to their favorable capacity-to-weight ratio, lithium-ion batteries are outpacing other technologies in popularity. While lithium-ion batteries typically come with a premium price tag compared to their counterparts, leading market players are heavily investing in R&D and scaling up operations. This intensified competition has not only enhanced battery performance but also contributed to a downward trend in lithium-ion battery prices.

- In 2023, driven by rising average battery pack prices in electric vehicles (EVs) and battery energy storage systems (BESS), battery prices saw a notable dip, settling at USD 139/kWh-a drop of over 13%. With the ramp-up of extraction and refining capacities, lithium prices are projected to stabilize, aiming for USD 100/kWh by 2026.

- Central to many Battery Energy Storage Systems (BESS), lithium-ion batteries are prized for their high energy density, rapid charging, and extended cycle life. These attributes make them exceptionally suited for efficient energy storage and release in BESS applications. Companies in Japan are actively pursuing projects to bolster BESS in the upcoming years.

- As a case in point, in August 2023, Power X, a prominent Japanese battery manufacturer, teamed up with West Holdings, a local renewable energy developer. Their joint venture aims to roll out battery storage systems and solar power facilities nationwide. Targeting a spring 2025 completion, the duo plans to achieve a storage capacity of 200MWh and a solar output of 30MW. This initiative not only promises to bolster regional storage systems but also addresses the surging energy demand, subsequently driving up the need for lithium-ion rechargeable batteries.

- Japan's commitment to renewable energy, particularly solar and wind, underscores the pivotal role of lithium-ion batteries. These batteries are essential for harnessing and storing surplus energy from renewables, ensuring consistent power supply despite weather variations.

- Solar energy, among all sources, is set to take center stage. Japan's ambition to boost its solar capacity to nearly 108 GW by 2030, as part of its strategy to reduce nuclear energy reliance, signals a burgeoning demand for lithium-ion batteries in the near future.

- Given these projects and initiatives, the demand for lithium-ion rechargeable batteries is poised for an upswing in the coming years.

Automobile Segment to Witness Significant Growth

- For a long time, vehicles with internal combustion engines (ICE) dominated the roads. However, as environmental concerns grow, there's a noticeable shift towards electric vehicles (EVs). Predominantly, EVs utilize lithium-ion rechargeable batteries, celebrated for their high energy density, lightweight nature, minimal self-discharge, and low maintenance needs.

- Plug-in hybrids and electric vehicles are powered by lithium-ion battery systems. Thanks to their rapid recharge capability and high energy density, lithium-ion batteries stand out as the sole technology meeting OEM demands for driving range and charging time. In contrast, lead-based traction batteries fall short for full hybrids or EVs, given their heftier weight and lower specific energy.

- Japan has seen a remarkable surge in electric vehicle adoption recently. In 2023, the International Energy Agency (IEA) reported sales of 140,000 electric vehicles, marking a 44.3% increase from 2022. Projections indicate a significant uptick in EV sales across the region in the coming years.

- To champion electric vehicles and renewable energy, the Japanese government has rolled out a suite of policies and incentives. These initiatives have bolstered the demand for lithium-ion batteries. In 2023, the government unveiled ambitious plans to ramp up EV production and expedite the journey to zero carbon emissions.

- Japan's government introduced the Electrified Vehicle Strategy 2050, targeting a complete transition to EVs for all vehicles produced by Japanese automakers by 2050. Additionally, under Japan's EV Charging Infrastructure Landscape, Tokyo Electric Power Company Holdings is set to increase rapid highway chargers to 1,000 units by 2025.

- Moreover, as the global community pivots towards sustainability, Japan is wholeheartedly embracing this electric revolution. The Tokyo government aims to amplify public charging points from 30,000 to 150,000 by 2030. With these concerted efforts, Japan is poised to boost EV production and, consequently, the demand for lithium-ion batteries.

- Given these proactive measures, it's anticipated that EV sales and charging infrastructure will flourish in the region, subsequently driving up the demand for rechargeable batteries in the forecast period.

Japan Rechargeable Battery Industry Overview

The Japan rechargeable Battery is semi-fragmented. Some of the key players (not in particular order) are BYD Company Ltd, Duracell Inc., Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Saft Groupe SA

- 6.3.7 Exide Industries Ltd

- 6.3.8 Gotion High tech Co Ltd

- 6.3.9 Murrata Manufacturing Co. Ltd.

- 6.3.10 GS Yuasa International Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Wearable Devices

02-2729-4219

+886-2-2729-4219