|

市场调查报告书

商品编码

1636562

德国二次电池:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Germany Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

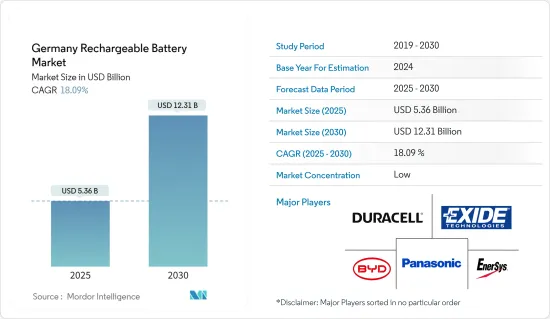

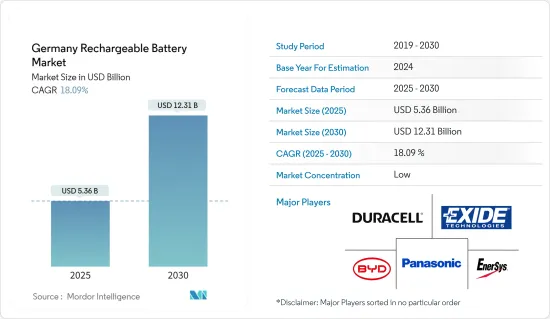

德国二次电池市场规模预计到2025年为53.6亿美元,预计2030年将达到123.1亿美元,预测期内(2025-2030年)复合年增长率为18.09%。

主要亮点

- 从中期来看,电动车(EV)普及率的上升和锂离子电池价格的下降预计将在预测期内推动二次电池需求。

- 另一方面,蕴藏量不足可能会严重限制德国二次电池市场的成长。

- 智慧型手錶、无线耳机和智慧手环等穿戴式装置的日益普及预计将在不久的将来为可充电电池市场的参与企业创造巨大的商机。

德国二次电池市场趋势

锂离子电池类型主导市场

- 锂离子二次电池因其卓越的容量重量比而优于其他技术。延长寿命、最少维护、延长保质期和大幅降价等优点进一步推动了锂离子二次电池的普及。

- 锂离子电池历来比其他替代品更昂贵,但市场领导者正在加大投资。对实现规模经济和加强研发力度的关注增加了竞争,从而降低了价格。

- 2023年,锂离子电池价格降至139美元/kWh,大幅下降13%。随着技术创新和製造流程的不断改进,预计到2025年价格将进一步下降至113美元/千瓦时,并在2030年达到80美元/度。

- 由于锂离子电池在向可再生能源和电动车转变中发挥关键作用,对锂离子电池的需求正在迅速增加。鑑于太阳能和风能等再生能源来源的间歇性,迫切需要可靠的能源储存。锂离子电池在能源储存系统中发挥至关重要的作用,有助于平衡供需、维持电网稳定。

- 随着电池储存计划在该地区激增,主要企业在积极签署协议,在全国各地建造储能基础设施。斯洛维尼亚NGEN于2024年6月与德国国有天然气公司Uniper签署了合约。该计划将耗资约 5,000 万欧元(5,400 万美元),计划于 2025 年开始营运。预计此类业务将在预测期内推动储能设施中对锂离子电池的需求。

- 为了因应锂离子电池快速成长的需求,世界各国政府都提供慷慨的补贴和激励措施,以扩大当地生产并促进技术创新。 Northvolt 就是一个例子:瑞典电池专家 Northvolt 从德国和石勒苏益格-荷尔斯泰因州获得了约 7 亿欧元(7.58 亿美元)的补贴,用于在德国北部建立电池工厂。政府的此类支持将加速国内电池生产,从而导致未来几年对锂离子电池的需求增加。

- 由于这些发展,预计在预测期内对锂离子二次电池的需求将会成长。

电动车的普及正在推动市场

- 长期以来,内燃机汽车(ICE)一直占据市场主导地位。然而,随着人们对环境的关注日益增加,人们明显转向电动车 (EV)。电动车的主流使用锂离子二次电池,锂离子二次电池因其能量密度高、重量轻、自放电率低、不需要维护而受到青睐。

- 插电式混合动力汽车和电动车由锂离子二次电池系统动力来源。其无与伦比的能量密度、快速充电能力和强大的放电功率使锂离子电池成为唯一满足OEM续航里程和充电时间标准的技术。相较之下,铅基动力电池由于重量重且能源效率较低,不适合全混合动力汽车和电动车。

- 在德国,电动车最近的普及程度引人注目。例如,根据国际能源总署(IEA)的报告,2023年纯电动车销量将达到52万辆,比2022年成长10.6%。据预测,未来几年全部区域的电动车销量将大幅成长。

- 为了促进这一成长,德国正在推出多项措施来支持电动车并引导低碳交通的未来。这些努力正在增加对锂离子电池的需求。 2023年,政府宣布了一项雄心勃勃的计划,以提高电动车产量并加速实现零碳排放。

- 德国的承诺体现在其通过的《2025 年高科技战略》和对欧洲电池创新计划的支持,这两个项目都专注于电池技术和电动车研究。此外,大量补贴措施旨在提高电动车的使用率。新电动车购买者将获得高达 6,000 欧元(6,500 美元)的补贴,插电式混合动力汽车将获得高达 4,500 欧元(4,900 美元)的补贴。由于这些措施,电动车产量预计将扩大,因此,对二次电池的需求预计将暂时增加。

- 此外,区域向电动车的转变是不可否认的。主要公司正在加紧投资和计划以提高电动车产量。举例来说:2023年6月,福特宣布将斥资20亿美元在德国科隆兴建电动车工厂,目标是每年生产25万辆汽车。科隆工厂是福特实现到 2026 年生产 200 万辆电动车的宏伟目标的基石。这些努力不仅加强了电动车的生产,也显示对锂离子电池的需求不断增长。

- 总的来说,这些共同努力将导致未来几年德国电动车销量的快速成长、充电基础设施的扩大以及对可充电电池的需求的增加。

德国二次电池产业概况

德国二次电池市场较为分散。主要企业(排名不分先后)包括比亚迪有限公司、金霸王公司、Exide Technologies、EnerSys 和松下控股公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车 (EV) 的扩张

- 锂离子电池价格下降

- 抑制因素

- 原料蕴藏量不足

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 科技

- 锂离子

- 铅酸电池

- 其他技术(NiMh、Nicd 等)

- 目的

- 汽车电池

- 工业电池(用于电源、固定电池(电信、UPS、能源储存系统(ESS) 等)

- 手提电池(家用电子电器产品等)

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Company Ltd

- Duracell Inc.

- EnerSys

- Panasonic Holdings Corporation

- Energizer

- Exide Industries Ltd

- Saft Groupe SA

- Varta AG

- BMZ Group

- Akasol AG

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 扩大穿戴式装置的采用

简介目录

Product Code: 50004068

The Germany Rechargeable Battery Market size is estimated at USD 5.36 billion in 2025, and is expected to reach USD 12.31 billion by 2030, at a CAGR of 18.09% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising electric vehicle (EV) adoption and declining lithium-ion battery prices are expected to drive the demand for rechargeable batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the Germany rechargeable battery market.

- Nevertheless, the growing adoption of wearable devices like smartwatches, wireless earphones, smart bands, and more are expected to create significant opportunities for rechargeable battery market players in the near future.

Germany Rechargeable Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- The lithium-ion rechargeable batteries are outpacing other technologies, due to their superior capacity-to-weight ratio. Their growing adoption is further fueled by advantages like extended lifespan, minimal maintenance, enhanced shelf life, and a notable drop in prices.

- While lithium-ion batteries traditionally commanded a premium over their counterparts, leading market players have been ramping up investments. Their focus on achieving economies of scale and bolstering R&D efforts has intensified competition, subsequently driving down prices.

- In 2023, lithium-ion battery prices dipped to USD 139/kWh, marking a significant 13% drop. With ongoing technological innovations and manufacturing refinements, projections suggest prices will further decline to USD 113/kWh by 2025 and reach USD 80/kWh by 2030.

- The surging demand for lithium-ion batteries is largely attributed to their pivotal role in the shift towards renewable energy and electric mobility. Given the intermittent nature of renewable sources like solar and wind, there's a pressing need for dependable energy storage. Lithium-ion batteries play a crucial role in energy storage systems, helping to balance supply and demand and maintain grid stability.

- As battery energy storage projects proliferate in the region, leading companies are actively contracting to establish storage infrastructures nationwide. A notable example is NGEN, a Slovenian firm, which in June 2024, inked a deal with Uniper, a German state-owned gas entity. They are set to construct a 50 MW/100 MWh battery energy storage facility at the Heyden power station site, a project valued at nearly EUR 50 million (USD 54 million) and slated to commence operations in 2025. Such undertakings are poised to bolster the demand for lithium-ion batteries in storage facilities during the forecast period.

- In response to the surging demand for lithium-ion batteries, governments are rolling out generous subsidies and incentives, aiming to amplify local production and spur innovation. A case in point: Northvolt, a Swedish battery specialist, received a substantial boost of about EUR 700 million (USD 758 million) in subsidies from both Germany and Schleswig-Holstein for establishing a battery factory in northern Germany. Such governmental backing is set to accelerate domestic battery production and subsequently heighten the demand for lithium-ion batteries in the years ahead.

- Given these developments, the demand for lithium-ion rechargeable batteries is poised for growth in the forecast period.

Growth in Electric Vehicle Adoption to Drive the Market

- For a long time, vehicles with internal combustion engines (ICE) dominated the market. However, as environmental concerns grow, there's a noticeable shift towards electric vehicles (EVs). Predominantly, EVs utilize lithium-ion rechargeable batteries, favored for their high energy density, lightweight nature, low self-discharge rates, and minimal maintenance needs.

- Plug-in hybrids and electric vehicles are powered by lithium-ion battery systems. Their unmatched energy density, rapid recharge capability, and robust discharge power make lithium-ion batteries the sole technology meeting OEM standards for driving range and charging time. In contrast, lead-based traction batteries fall short for full hybrids or EVs due to their heftier weight and reduced energy efficiency.

- Germany has seen a remarkable surge in electric vehicle adoption recently. For example, the International Energy Agency (IEA) reported that in 2023, battery electric vehicle sales reached 0.52 million, marking a 10.6% increase from 2022. Projections indicate a substantial rise in EV sales across the region in the coming years.

- To foster this growth, Germany has rolled out multiple policies championing electric vehicles and steering the nation towards a low-carbon transport future. These initiatives have bolstered the demand for lithium-ion batteries. In 2023, the government unveiled ambitious plans to boost EV production and expedite the journey to zero carbon emissions.

- Germany's commitment is evident with the introduction of the High-Tech Strategy 2025 and backing for the European Battery Innovation project, both emphasizing battery tech and EV research. Additionally, a substantial subsidy initiative aims to further the electric vehicle cause. New EV buyers benefit from a subsidy of up to EUR 6,000 (USD 6,500), while plug-in hybrids enjoy up to EUR 4,500 (USD 4,900). Such measures are poised to amplify EV production and, consequently, the demand for rechargeable batteries in the foreseeable future.

- Moreover, the regional shift towards electric vehicles is undeniable. Major companies are ramping up investments and projects to boost EV production. A case in point: Ford's June 2023 announcement of a USD 2 billion EV factory in Cologne, Germany, targeting an annual output of 250,000 vehicles. This Cologne plant is a stepping stone towards Ford's ambitious goal of 2 million EVs by 2026. Such endeavors not only bolster EV production but also signal a rising demand for lithium-ion batteries.

- In summary, with these concerted efforts, Germany is set to see a surge in EV sales, an expanded charging infrastructure, and an increased appetite for rechargeable batteries in the coming years.

Germany Rechargeable Battery Industry Overview

The Germany rechargeable battery market is semi-fragmented. Some of the key players (not in particular order) are BYD Company Ltd, Duracell Inc., Exide Technologies, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Electric Vehicle (EV) Adoption

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Exide Industries Ltd

- 6.3.7 Saft Groupe SA

- 6.3.8 Varta AG

- 6.3.9 BMZ Group

- 6.3.10 Akasol AG

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Wearable Devices

02-2729-4219

+886-2-2729-4219