|

市场调查报告书

商品编码

1636586

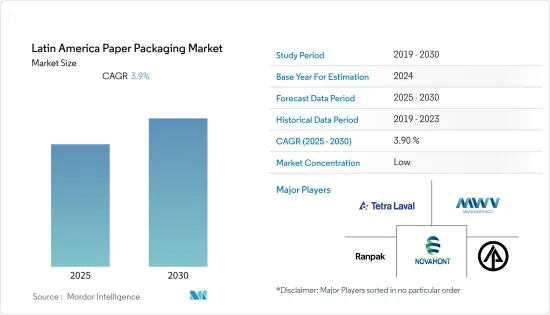

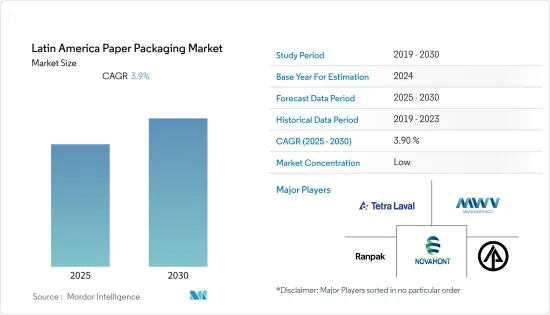

拉丁美洲纸包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Latin America Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内拉丁美洲纸包装市场的复合年增长率将达到 3.9%。

主要亮点

- 拉丁美洲的消费者越来越意识到包装对环境的危害,并正在改变他们的购买习惯,使其更加环保。消费者、政府和媒体正在向製造商施压,要求他们製造的产品、包装和生产流程更加环保。人们愿意为环保包装支付更多金额。由于这些趋势,拉丁美洲的纸包装市场预计将成长。

- 食品外卖和已调理食品的快速增长,以及购买超级市场冷冻和冷藏食品等商品的顾客数量的增加,推动了食品和饮料行业对纸质包装的需求。此外,包装材料有助于保存食品和营养价值,所有这些都促进了纸包装市场的成长。

- 该地区的包装市场正在全面成长,其中纸张和纸板领域发挥关键作用。儘管塑胶仍然占据市场主导地位,但人们对环境永续性的兴趣日益浓厚,预计将导致市场转向纸张等更永续的包装。此外,电子设备和个人保健产品的二次包装中越来越多地采用纸张等轻质包装材料,预计将支持市场成长。

- 在电气领域,铁盒、开关、插座及电器设备等消费市场优先选择瓦楞包装产品。此外,这些包装产品在空的时候可以简单地折迭起来,覆盖大量的储存空间。从物流角度来看,这些产品更便宜、更具成本效益,同时提供类似的保护等级。此外,自新冠疫情爆发以来,游戏和电视游戏机销量的成长也支持了该地区纸质包装的成长。例如,根据国际贸易中心(ITC)的数据,2021年墨西哥游戏机出口额超过3.47亿美元,与前一年同期比较成长近72%。

- 新冠肺炎疫情提高了该地区消费者的卫生意识,促使他们增加在家庭护理和卫生方面的支出,以预防新冠肺炎感染。此外,在病毒最初传播期间,对基本包装食品以及食品和饮料产品的需求激增。公司努力满足快速变化的需求条件并面临供应链中断。此外,电子商务的快速崛起推动了食品、饮料、网路药局和药局销售中纸和纸板包装的成长,促进了市场的成长。此外,俄乌战争正在影响整个包装生态系统。

- 新冠疫情对拉丁美洲各地消费行为的影响,引发了包装产业的爆炸性成长。随着消费者偏好转向电子商务,纸板的需求和成本也随之上升。 2021 年 4 月,巴西瓦楞纸包装与 2020 年 4 月相比增长了 13.5%,显示该市场的需求不断增长。

拉丁美洲纸包装市场的趋势

食品业对纸质包装的需求不断增加

- 收入的增加、都市区生活方式的改变和现代零售业推动了食品包装市场的成长,涵盖烘焙产品、加工食品、冷冻加工食品、代餐产品、调味品、乳製品、冷冻已调理食品和减肥零食、加工肉品和益生菌等。

- 折迭式纸盒等包装类型适用于满足各种尺寸和形状的包装需求,可被视为食品包装行业的先驱。包装在销售点向消费者传达各种产品优势和属性方面发挥着动态且至关重要的作用。

- 拉丁美洲消费者的生活方式正在推动对即食食品的需求。据食品和药物监管局称,便携式和即食食品的兴起正在塑造该地区未来的食品包装趋势。例如,根据仲量联行的数据,阿根廷的餐饮市场规模预计将从 2018 年到去年增长 21%,是巴西和智利 2018 年至 2022 年预计增长量的三倍。秘鲁和哥伦比亚的外食市场规模可能成长高达6%,而墨西哥的外食市场规模在同一时期可能成长4%。

- 由于可回收性、价格实惠、重量轻以及包装食品的整体增长,该地区的麻袋、牛皮纸、铜版纸和纸袋等软包装也在增长。包装食品的需求日益增长,越来越多的跨国公司进入该地区市场。

- 轻质纸板等级的兴起和再生材料的引入,以及来自品牌和消费者的环保压力,正在推动市场向环保材料的方向发展。

巴西:预计将大幅成长

- 目前,消费者更喜欢再生性和生物分解性而不是可重复使用性作为关键包装参数。这显示消费者越来越担心包装废弃物对环境的未来影响。

- 据估计,几乎一半的纸板包装用于食品领域,包括食品、饮料、糖果零食、糖果、干货和冷冻食品。此外,国际参与者也正在进入该地区以扩大客户群和市场占有率。例如,去年 9 月,瓦楞包装公司 Smurfit Kappa 同意收购巴西包装厂 Paperbox。工厂位于里约热内卢以东70公里的里约热内卢,占地50,000平方米,拥有自己的工业车队。

- 该国的饮料、服饰、配件和皮革产业受到疫情的严重影响。然而,食品、药品、清洁和香水等使用消费品的行业的需求增加。由于电子商务需求激增等趋势,纸质包装的范围在医疗保健和包装食品领域得到了扩大。

- 根据联合国粮食及农业组织 (FAO) 进行的 2020-2025 年研究,巴西的木浆和纸板生产能力预计将从 2020 年的 2,385 万吨增长到 2025 年的 2,907 万吨。包装需求产生正面影响。

拉丁美洲纸包装产业概况

拉丁美洲市场高度分散,主要参与者包括 Tetra Laval、MeadWestvaco Corporation、Ranpack Corp、International Paper Company、Mondi Group、Novamont SPA、Stora Enso 和 Biopac UK Ltd.各公司不断投资于策略伙伴关係和产品开发,以扩大市场占有率。最近的市场发展趋势包括:

2022年7月,总部位于亚特兰大的箱板纸和包装製造商WestRock Co.宣布已达成协议,以9.7亿美元加上承担债务的方式收购Grupo Gondi剩余的股份。 WestRock 考虑收购Grupo Gondi 在墨西哥的四家造纸厂、九家瓦楞纸板厂和六家高图形厂,交易完成后,该公司将成为不断扩张的拉丁美洲纸板、瓦楞纸和纸板行业的主要参与者。公司声称将进一步加强其在消费瓦楞包装市场中占据重要地位。

2022年1月,全球包装供应商NexGen Packaging Inc. 进行投资以增加在拉丁美洲的生产能力。该公司在墨西哥克雷塔罗推出了一家生产工厂,为中美洲、墨西哥和美国的零售商生产包装解决方案。这些扩张将使 NexGen 能够满足製造商和零售商日益增长的需求,同时使其客户能够从美国、加拿大、墨西哥和中美洲之间的贸易协定中受益。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- COVID-19 市场影响

- 全球纸包装市场概况

第五章 市场动态

- 市场驱动因素

- 食品和饮料行业的需求不断增加

- 轻质材料的日益普及和潜在的印刷创新将推动食品、电子和个人护理行业的成长

- 市场挑战

- 对其他国家原料的依赖和原物料价格的波动

第六章 市场细分

- 按类型

- 折迭式纸盒

- 瓦楞纸箱

- 其他类型

- 按最终用户

- 食物

- 饮料

- 卫生保健

- 个人护理

- 家居用品

- 电器

- 其他最终用户产业

- 按国家

- 巴西

- 墨西哥

- 其他拉丁美洲国家

第七章 竞争格局

- 公司简介

- Tetra Laval

- MeadWestvaco Corporation

- Ranpack Corp

- International Paper Company

- Mondi Group

- Novamont SPA

- Stora Enso

- Biopac UK Ltd

- Rengo

- Graphic Packaging International Corporation

第八章投资分析

第九章:未来市场展望

The Latin America Paper Packaging Market is expected to register a CAGR of 3.9% during the forecast period.

Key Highlights

- Consumers in Latin America are becoming more conscious of the environmental hazards of packaging and moving their purchasing habits to more environmentally friendly options. Consumers, the government, and the media are putting pressure on manufacturers to make their products, packaging, and processes more environmentally friendly. People are willing to pay more for environmentally friendly packaging. The Latin America paper packaging market will grow due to these trends.

- The demand for paper packaging from the food and beverage sector is growing due to the rapid growth of food delivery and ready-to-eat food and the number of customers purchasing supermarket products such as frozen and chilled meals. Furthermore, packaging materials aid in preserving food and nutritional value, all of which contribute to the growth of the paper packaging materials market.

- The overall packaging market in the region is growing, and the paper and cardboard segments play a significant role. Although plastic still dominates the market, due to increasing environmental sustainability concerns, the market is expected to shift to sustainable packaging such as paper. Also, the increasing adoption of lightweight packaging material such as paper in secondary packaging among electronics and personal care products is expected to support the market's growth.

- In the electrical sector, Iron boxes, switches, sockets, and electrical equipment meant for consumer markets prefer corrugated packaging products. Moreover, these packaging products only cover substantial storage space when empty and can be folded. These products are cheaper and cost-effective from a logistics point of view while offering a similar level of protection. Additionally, increasing sales of gaming consoles and video game machines since the COVID-19 pandemic supported the growth of paper packaging in the region. For instance, according to International Trade Centre (ITC), Mexico's exported gaming consoles amounted to more than USD 347 million in 2021, nearly 72% compared to the previous year.

- The COVID-19 outbreak increased hygiene awareness among consumers in the region and motivated consumers to increase their spending on home care and the hygiene sector to prevent COVID-19 infection. Additionally, during the early spread of the virus, the demand for essential packed food and beverage products surged. Companies struggled to fulfill the rapidly changing demand landscape and faced supply chain disruptions. Furthermore, the rapid rise in e-commerce promoted the growth of paper and paperboard packaging in food, beverage, and online pharmacy and drug store sales, contributing to market growth. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

- The COVID-19 pandemic's consequences on consumer behavior across Latin America led to explosive expansion in the packaging industry. Demand and costs for corrugated boxes rose as consumer preference turned toward e-commerce. Brazilian corrugated cardboard rose 13.5% in April 2021 over April 2020, demonstrating the expansion in this market's demand.

Latin America Paper Packaging Market Trends

Increase in Demand for Paper Packaging in Food Industry

- Due to the rising incomes, urban lifestyle changes, and modern retail trade, the food packaging market is expanding significantly in categories such as bakery products, processed food, frozen processed foods, meal replacement products, condiments, and emerging categories like dairy products, frozen ready-to-eat foods, diet snacks, processed meat, and probiotic drinks.

- Packaging types such as folding cartons are used for packing requirements of diverse sizes and shapes and can be regarded as a pioneer in the food packaging industry. Packaging plays a dynamic and vital role in passing on a product's various benefits and attributes to the consumer at the point of sale.

- Consumer lifestyles in Latin America are increasing demand for ready-to-eat (RTE) foods. According to Food and Drug Regulatory, the rise of grab-and-go meals and ready-to-eat meals is shaping the future of the food packaging trends in the region. For instance, according to Jones Lang LaSalle IP, the market size of food service in Argentina is anticipated to grow 21% from 2018 to last year, which is three times more than the estimates made for Brazil and Chile for 2018 to 2022. In Peru and Colombia, the food service market size could increase by up to 6%, while food service in Mexico could register a growth of 4%during the same period.

- Flexible packagings, such as sacks, kraft paper, coated papers, and paper pouches in the region, is also growing due to recyclability, affordability, lightweight, and growth in packaged foods overall. The demand for packaged foods is growing, and more multinational companies are entering the market in the region.

- In addition to incremental gains in lightweight board grades and introducing recycled paper content, environmental pressures from brands and consumers push the market toward eco-friendly materials.

Brazil is Expected to Register a Significant Growth

- Currently, consumers prefer recyclability and biodegradability as important packaging parameters over reusability. This underlines the growing concerns of consumers about the environmental impact of packaging waste in the future.

- According to certain estimates, nearly more than half of all paperboard packaging is used in food product segments, such as beverages and dairy products, candy and confectioneries, dry foods, and frozen foods. Also, international players are entering the region to expand their customer base and market share. For instance, in September last year, Smurfit Kappa, a corrugated packaging company, agreed and acquired the Brazilian packaging plant, Paperbox. The plant is located in Saquarema, 70 km east of Rio de Janeiro, and the 50,000m2 high-tech industrial park has its own logistics fleet.

- In the country, industries such as beverages, clothing, accessories, leather, and accessories were highly impacted by the pandemic. However, the demand grew in the industries that use consumer goods, such as food, pharmaceuticals, cleaning, and perfumery. The scope of paper packaging expanded in healthcare and packed food segments, owing to trends like a significant surge in the e-commerce demand.

- According to a survey carried out by the Food and Agriculture Organization of the United Nations (FAO) for the period 2020-2025, the production capacity of wood pulp for paper and paperboard is projected to go up from 23,850 thousand tonnes in 2020 to 29,070 thousand tons in 2025 in Brazil, which will positively impact the demand for paper packaging in the region.

Latin America Paper Packaging Industry Overview

The Latin American market is considerably fragmented, with several major companies like Tetra Laval, MeadWestvaco Corporation, Ranpack Corp, International Paper Company, Mondi Group, Novamont SPA, Stora Enso, and Biopac UK Ltd. The companies continuously invest in strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

In July 2022, the containerboard and packaging manufacturer WestRock Co., based in Atlanta, stated that it had reached a deal to acquire the remaining shares of Grupo Gondi for USD 970 million plus the assumption of debt. In light of Grupo Gondi's operations in Mexico, which include four paper mills, nine corrugated packaging plants, as well as six high graphic plants, WestRock claimed that after the transaction is completed, the company will further strengthen its position in the expanding Latin American paperboard, containerboard, consumer, and corrugated packaging markets.

In January 2022, Nexgen Packaging, a global packaging provider, made investments to improve its capacity for production in Latin America. To produce packaging solutions for retailers in Central America, Mexico, and the United States, the company launched a production plant in Queretaro City, Mexico. With these additions, Nexgen will meet the growing demand from manufacturers and retailers while enabling its clients to benefit from trade agreements between the United States, Canada, Mexico, and Central America.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of the COVID-19 on the Market

- 4.5 Overview of the Global Paper Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from the Food and Beverage Sector

- 5.1.2 Growing Adoption of Light Weighting Materials and the Scope for Printing Innovations Propelling Growth in the Food and Electronics and Personal Care Segment

- 5.2 Market Challenges

- 5.2.1 Reliance on Other Countries for Raw Materials and Fluctuating Raw Material Prices

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Folding Cartons

- 6.1.2 Corrugated Boxes

- 6.1.3 Other Types

- 6.2 By End-User

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care

- 6.2.5 Household Care

- 6.2.6 Electrical Products

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tetra Laval

- 7.1.2 MeadWestvaco Corporation

- 7.1.3 Ranpack Corp

- 7.1.4 International Paper Company

- 7.1.5 Mondi Group

- 7.1.6 Novamont SPA

- 7.1.7 Stora Enso

- 7.1.8 Biopac UK Ltd

- 7.1.9 Rengo

- 7.1.10 Graphic Packaging International Corporation