|

市场调查报告书

商品编码

1636587

欧洲塑胶瓶盖和瓶盖 -市场占有率分析、行业趋势和统计、成长预测(2025-2030)Europe Plastic Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

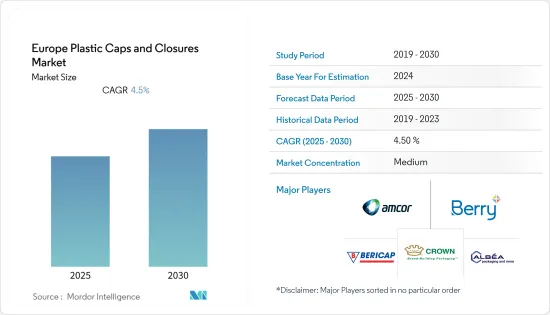

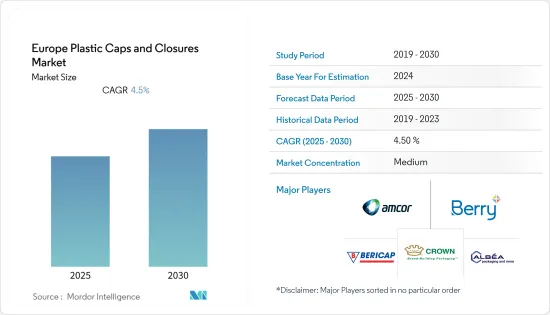

欧洲塑胶瓶盖和瓶盖市场预计在预测期内复合年增长率为 4.5%

主要亮点

- 食品消费高速成长。这导致对具有长保质期的无菌包装食品的需求不断增长。在欧洲,有许多公司生产包装,帮助食品製造商实现这些目标,以便他们可以将产品运输和销售给最终客户。此外,製药业预计将出现对防篡改瓶盖和瓶盖的需求。

- 虽然大部分瓶盖和密封件需求来自塑胶螺旋盖和金属冠等成本较低的产品类型,但更复杂的密封件产品越来越多地用于药品和美容护理产品的包装,这被认为是背后的金额力。儘管新兴市场的成长速度快于已开发市场,但西欧大市场也存在成长机会。

- 饮料领域的主要趋势包括啤酒和碳酸饮料等某些类别的包装尺寸变大,从而影响所使用的瓶盖的尺寸和类型。同时,较小的独立包装尺寸在非碳酸饮料、包装水和运动饮料类别中变得越来越普遍,其中移动消费是需求的关键驱动力。

- 食品和饮料产业是英国最大的製造业,规模超过汽车和航太产业的总合。食品和饮料出口总额超过230亿英镑,产业营业额为1,040亿英镑,占英国製造业总额的19%。 2018年英国食品製造业的收益达到1,065.8亿美元,预计2024年将达到1,177.2亿美元。

- 一些最终用户已经开始转向轻质瓶盖,帮助饮料公司实现其环境目标并节省材料能源成本。为了减少污染,欧盟 (EU) 最近在週六禁止使用各种一次性塑胶製品,包括吸管、盘子、刀叉餐具等。

欧洲塑胶瓶盖和瓶盖市场趋势

饮料业预计将大幅成长

- 欧洲瓶装水在其他包装非酒精饮料中占有稳定的市场占有率,82%的消费者更喜欢天然矿泉水,其中15%更喜欢马苏矿泉水。根据欧洲瓶装水联合会的数据,48%的非酒精饮料以包装饮用水的形式消费,38%以软性饮料的形式消费,7%以果汁和花蜜的形式消费,6%以稀释饮料的形式消费。由于饮料的高消费量,对塑胶瓶盖和瓶盖的需求预计将会增加。

- 此外,数以百万计的饮料瓶被伪造,导致了负面后果。这些结果推动了对具有附加功能的防伪瓶盖和瓶盖的需求,例如易于打开、密封和关闭,以及以最佳速率进行多种设计的可能性。因此,对瓶盖和瓶盖的需求正在增长。

- 啤酒、碳酸软性饮料(CSD)和瓶装水是最大的细分市场。儘管啤酒产量成长缓慢,但许多地区的碳酸饮料消费量正在下降。同时,欧洲大多数地区的瓶装水消费量持续成长,宝特瓶上使用的塑胶盖主要受益。虽然牛奶和果汁等大多数成熟的饮料类别几乎没有增长机会,但包括即饮茶和咖啡、运动饮料和其他健康替代饮料在内的新饮料类别正在推动饮料瓶盖的整体需求。高

- 欧洲的塑胶瓶盖和密封件的人均消费量很高,这将限制未来的成长。注重健康的消费者越来越多地消费健康饮料,包括果汁和机能饮料,导致一些成熟市场的碳酸饮料下降。过去五年软性饮料销量的下降阻碍了饮料包装领域的成长,而饮料包装领域是最大的最终用户。

英国预计将占较大市场占有率

- 英国是欧洲最大的葡萄酒消费国之一。根据国际葡萄与葡萄酒组织预测,2020年英国将占全球葡萄酒消费量总量的6%,排名第四。该市场的一个新趋势是,人们越来越青睐塑胶/合成软木塞和螺旋盖,而不是天然软木塞。此外,合成软木不受 TCA 污染,提供可预测的氧气传输率和密封性能,并且比天然软木便宜三倍。

- 随着消费者健康意识的增强和个人收入的增加,对健康饮料的需求不断增加。这使得瓶装水更容易被个人使用,这是推动瓶盖和瓶塞市场成长的因素。根据欧洲瓶装水联合会统计,英国人均瓶装水消费量为37公升,远低于欧盟平均118公升,但未来消费量预计将增加。

- 瓶装水产业使用的主要密封件是标准塑胶螺旋盖和饮水机盖。然而,有些瓶装水同时采用单剂量 PET 容器和高密度聚苯乙烯(HDPE) 散装容器,并配有分配器封闭件(例如推拉式运动盖或散装水嘴)和保护性顶盖。

- 英国软性饮料协会数据显示,英国软性饮料市场2015-2019年复合年增长率为2.62%,但2020年软性饮料市场规模七年来首次大幅下降10.5%我做到了。由于该国大部分地区处于封锁状态数月,购买模式发生了巨大变化,这解释了 2020 年软性饮料市场整体销售下降的原因。

欧洲塑胶瓶盖和瓶盖产业概述

由于初始投资较高,欧洲塑胶瓶盖和瓶塞市场适度集中。它由几家大公司主导,包括 Albea Group、Tetra Pak International SA、BERICAP GmbH &Company KG 和 Berry Global Inc。这些拥有压倒性市场份额的大公司正致力于扩大海外基本客群。这些公司利用策略合作措施来扩大市场占有率并提高盈利。

- 2021 年 6 月 - Bericap Global Inc. 收购铝捲盖製造商 Mala Verschluss-Systeme GmbH。 Mala 进入了新市场,Vericup 的产品系列扩展到铝盖。此次收购为 Vericup 提供了继续其成长轨迹的机会,并在 Mala 的保护下开发新的细分市场并开发结合塑胶和铝的创新瓶盖技术。

- 2021 年 6 月 - AptarGroup Inc. 与智慧瓶製造商 REBO 合作,加深对新兴趋势的市场了解,并利用製造、监管和创新专业知识。 REBO 推出了一款可透过瓶盖内建蓝牙技术来追踪消费量的水瓶。个人化饮水应用程式(iOS 和 Android)与 REBO 奶瓶的智慧瓶盖同步,以追踪您的健康目标。瓶子会亮起来,提醒消费者要保持水分。这款水瓶让消费者意识到他们为避免宝特瓶离开环境所做出的个人贡献。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 评估 COVID-19 对产业的影响

- 市场驱动因素

- 支持产品差异化和品牌化的产品创新

- 小包装需求不断成长

- 市场限制因素

- 轻盈且经济高效的立式袋包装替代品

第五章技术概况

第六章 市场细分

- 材料

- PET

- PP

- 低密度聚乙烯和高密度聚乙烯

- 其他的

- 最终用户

- 饮料(瓶装水、啤酒、乳製品、RTD、葡萄酒、烈酒等)

- 食物

- 製药/医疗

- 化妆品/洗护用品

- 家用化学品(清洁剂、清洁剂、肥皂、抛光粉)

- 其他最终用户产业(汽车清洁剂、油漆/被覆剂、化学品等)

- 国家名称

- 英国

- 德国

- 义大利

- 欧洲其他地区

第七章 竞争格局

- 公司简介

- Albea Group

- Amcor PLC

- Crown Holdings Inc.

- BERICAP GmbH & Company KG

- Berry Global

- Guala Closures Group

- AptarGroup Inc.

- Coral Products PLC

- Pelliconi & C. SPA

- Nippon closures Co. Ltd

- Tetra Pak International SA

- SKS Bottle & Packaging Inc.

第八章投资分析

第9章 市场的未来

The Europe Plastic Caps And Closures Market is expected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- Food consumption has been witnessing high growth. This has led to a demand for packaged food products with longer shelf life and sterility. Various companies in Europe around manufacturing packages, which help in achieving these objectives so that manufacturers of food products can transport and sell their products to the end-customers. Also, the pharmaceuticals industry is anticipated to generate demand for tamper-evident caps and closures, as they offer child-resistant and contamination-free packaging.

- Although the majority of caps and closures demand in unit terms is for low-cost commodity types such as plastic screw caps and metal crowns, market value growth will be driven by the growing use of more sophisticated closure products in packaging for pharmaceuticals and beauty care products. While gains in the developing countries will generally be faster than those in developed markets, growth opportunities will also exist in the large West European markets.

- Some of the key trends in the beverage sector include shifting to larger pack sizes in some categories, such as beer and carbonates, impacting the size and type of closure used. Meanwhile, in the still drinks, packaged water, and sports drinks categories, where on-the-go consumption is a primary driver of demand, smaller individual pack sizes are becoming more common.

- The food and beverage insudtry is the largest manufacturing sector in the United Kingdom, larger than the automotive and aerospace sector combined. The total food and beverage export figures worth more than GBP 23 billion, with an industry turnover of GBP 104 billion, accounting for 19% of the total UK manufacturing. The revenue generated from the manufacturing of food products in the United Kingdom amounted to USD 106.58 billion in 2018, and it is expected to reach USD 117.72 billion by 2024.

- Some end users already start moving towards lighter weight closures, which contribute to meeting beverage companies' environmental targets and saving material and energy costs. In an effort to reduce pollution, European Union recently banned a range of single-use plastic products on Saturday, including straws, plates, cutlery, etc. whereas drinking bottles must contain 30% recycled plastics.

Europe Plastic Caps and Closures Market Trends

Beverage Industry is Expected to Grow Significantly

- Bottled water in Europe holds a steady market share among other packaged non-alcoholic drinks, with 82% of consumers preferring to drink natural mineral water, and 15% of these consumers indicating their spring water preference. According to European Federation of Bottled Waters, of all the non-alcoholic beverages, 48% is consumed as packaged water, 38% as soft drinks, 7% as juice and nectars, and 6% as dilutable . Due to such high consumption of beverages, the demand for plastic caps and closures is expected to increase.

- In addition, millions of bottles of beverages are being counterfeited, leading to adverse consequences. Such consequences drive the need for anti-counterfeit resistant caps and closures with additional features, such as ease of opening, sealing and closing, and multiple design possibilities at optimal rates. Thus, there is a growth in demand for caps and closures.

- Beer, carbonated soft drinks (CSD), and bottled water are the largest segments. While the beer production is advancing slowly but CSD consumption is declining in many areas, whereas bottled water consumption will continue to increase in most parts of the Europe, primarily benefiting plastic caps used on PET bottles. The most established beverage categories such as milk and fruit juice will offer subpar growth opportunities, while newer beverage categories including ready-to-drink tea and coffee, sports drinks, and other healthy beverage alternatives will lift overall demand for beverage closures.

- In Europe, the per capita consumption of plastic caps & closures is high, which will result in limited future growth. The growing trend of consuming healthy beverages, including juices and functional drinks among health-conscious consumers, has also led to the decline in carbonated soft drinks in a few mature markets. The declining soft drink sales in the last five years have hampered the growth of the beverage packaging sector, which is the largest end-user.

United Kingdom is Expected to Hold Significant Market Share

- The United Kingdom is one of the biggest wine consuming countries in Europe. According to International Organization of Vine and Wine, in 2020, United Kingdom ranked 4th with share of 6% of the total worldwide wine consumption. The growing preference for plastic/synthetic corks and screw caps over natural corks is the new trend that can seen in this market. In addition, synthetic/plastic corks are not prone to TCA taint, providing predictable oxygen transfer rates and a tight immovable seal and can be up to three times cheaper than natural cork.

- Since consumers are becoming more health-conscious, and the demand for healthy beverages is on the rise, along with rising personal incomes. This has made bottled water more accessible to individuals and is a boosting factor for the growth of the caps and closures market. According to European Federation of Bottled Water, per capita consumption of bottled water in United Kingdom is 37 litres which is far less than European Union average of 118 litres but in future the bottled water consumption will rise.

- The primary closures used in the bottled water industry are standard plastic threaded caps and dispensing closures. However, some bottled waters both in single-serving PET and bulk containers made from high-density polyethylene (HDPE) utilize both a dispensing closure (such as a push-pull sports cap or bulk waterspout) and a protective overcap.

- According to British Soft Drinks Association, United Kingdom soft drink market was growing at a CAGR of 2.62% (2015-2019), but in 2020, first time in seven years soft drink market witnessed a sharp decline of 10.5% in market value. With most of the country lived in lockdown conditions for months, a radical change in purchasing patterns explains the decline in value sales in the Total Soft Drinks market in 2020.

Europe Plastic Caps and Closures Industry Overview

The Europe plastic caps and closures market is moderately concentrated due to higher initial investments. It is dominated by a few major players like Albea Group, Tetra Pak International SA, BERICAP GmbH & Company KG, Berry Global Inc. and among others. These significant players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability.

- June 2021 - Bericap Global Inc. acquired Mala Verschluss-Systeme GmbH, a manufacturer of aluminum roll-on caps. Mala gains access to new markets and BERICAP's product portfolio is extended to include aluminum closures. The acquisition will allow BERICAP to continue on its growth trajectory and, with Mala on board, it has the opportunity to open up new market segments and to develop innovative closure technologies combining plastic and aluminum.

- June 2021 - AptarGroup Inc., partnered with REBO, a smart bottle manufacturer, to advance its market knowledge on emerging trends and leverage its manufacturing, regulatory and innovation expertise. REBO launched a water bottle that uses Bluetooth technology embedded in the cap to track the amount of water consumed. A personalized hydration app (iOS and Android) syncs with the REBO bottle's smart cap to track health goals. The bottle lights up and sends consumers reminders to stay hydrated. This water bottle makes consumers aware of their personal contribution in avoiding plastic bottles ending up in the environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of COVID-19 Impact on the Industry

- 4.5 Market Drivers

- 4.5.1 Product Innovation to Aid Product Differentiation and Branding

- 4.5.2 Rising Demand for Smaller-sized Packs

- 4.6 Market Restraints

- 4.6.1 Lightweight and Cost-effective Stand-up Pouch Packaging Alternatives

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 Material

- 6.1.1 PET

- 6.1.2 PP

- 6.1.3 LDPE and HDPE

- 6.1.4 Other Materials

- 6.2 End-user

- 6.2.1 Beverage (Bottled Water, Beer, Dairy, RTD, Wine, Spirits, etc.)

- 6.2.2 Food

- 6.2.3 Pharmaceutical and Healthcare

- 6.2.4 Cosmetics and Toiletries

- 6.2.5 Household Chemicals (Detergents, Cleaners, Soaps, and Polishes)

- 6.2.6 Other End-user Industries(Automotive Cleaners, Paints and Coatings, Chemicals, etc.)

- 6.3 Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 Italy

- 6.3.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea Group

- 7.1.2 Amcor PLC

- 7.1.3 Crown Holdings Inc.

- 7.1.4 BERICAP GmbH & Company KG

- 7.1.5 Berry Global

- 7.1.6 Guala Closures Group

- 7.1.7 AptarGroup Inc.

- 7.1.8 Coral Products PLC

- 7.1.9 Pelliconi & C. SPA

- 7.1.10 Nippon closures Co. Ltd

- 7.1.11 Tetra Pak International SA

- 7.1.12 SKS Bottle & Packaging Inc.