|

市场调查报告书

商品编码

1637749

沥青 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Bitumen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

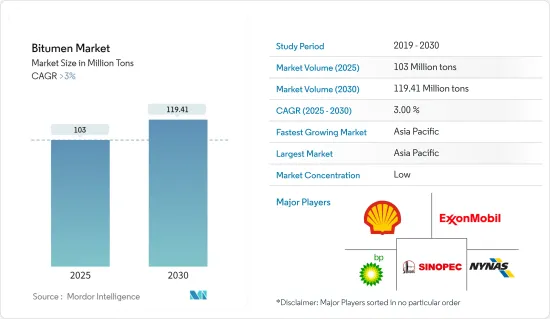

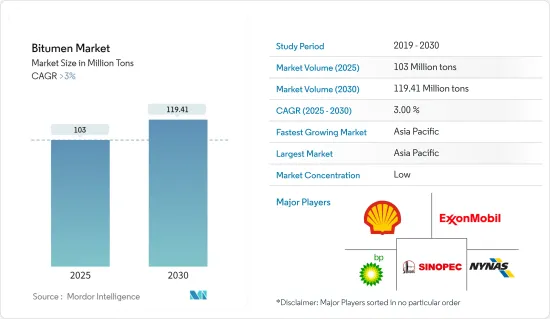

预计2025年沥青市场规模为1.03亿吨,2030年将达1,1941万吨,预测期间(2025-2030年)复合年增长率超过3%。

COVID-19 对全球市场的沥青需求产生了负面影响。在新冠肺炎 (COVID-19) 疫情期间,世界各地许多建筑计划暂停,沥青的使用量减少。然而,一旦停工和限制放鬆,关键地区的建设活动仍在继续。从那时起,市场一直稳步成长。

主要亮点

- 道路建设和维修活动的增加以及商业和国内建筑业对沥青作为填充材、黏合剂和密封剂的需求不断增加,推动了沥青市场的成长。

- 另一方面,日益严重的环境问题(例如使用会产生有害大气排放的沥青)正在阻碍市场成长。

- 沥青加工的研究和开发,以改善高性能沥青产品和道路基础设施的开发,预计将在未来几年为沥青市场创造各种机会。

- 亚太地区在沥青市场中占据主要份额,预计在预测期内仍将维持最高复合年增长率。

沥青市场趋势

道路建设领域占市场主导地位

- 道路建设产业是全球最大的沥青消费者之一,占沥青总消费量的很大一部分。铺设道路、高速公路和其他交通基础设施所需的大量沥青使其在该市场占据主导地位。

- 沥青路面耐用、柔韧且耐候,适合道路建设计划。沥青道路可以承受繁重的交通负荷、不同的天气条件和其他环境因素,确保长期性能和成本效益。

- 据 FMI Corporation(咨询和投资银行)称,到 2024年终,北美的工程和建筑支出预计将增加 2%。

- 此外,根据美国人口普查局公布的资料,2020年美国私人交通建设将增加163.1亿美元,2023年将达193.9亿美元。

- 作为一个新兴经济体,由于都市化进程的加速以及从传统领域向新兴第二产业的转变,亚太地区的基础设施计划预计将大幅增加,特别是在交通运输领域。此外,日益增长的经济繁荣正在推动消费产业的基础设施融资,例如运输和製造业,这些产业供应原材料并将其出售给消费者。

- 中国建筑工程总公司 (CSCEC) 已签署 2022 年新建公路总长 4,623 公里的总合,高于 2020 年的 4,186 公里。这一趋势也支撑着沥青市场。

- 根据NIP,印度拨出1亿美元的投资预算用于基础建设。印度已拨出开发多个工业走廊的预算,包括德里-孟买工业走廊、阿姆利则-加尔各答工业走廊、维札格-清奈工业走廊、班加罗尔-清奈工业走廊和班加罗尔-孟买工业走廊。这些计划预计将于 2025 年 3 月完成,未来几年对沥青的需求预计将增加。

- 由于所有这些因素,在预测期内,全球沥青市场可能会成长。

亚太地区主导市场

- 印度、中国和其他东南亚国家等国家的快速工业化和都市化带动了道路、高速公路、机场、港口等基础设施计划的大规模投资,带动了马苏沥青的需求。

- 亚太地区的建筑业是沥青最大的消费者之一,正在进行的住宅、商业和工业建设计划推动了对沥青材料的需求,例如用于道路铺装、屋顶和防水的沥青。

- 中国即将推出的「十五五」计画将重点放在交通、能源、水利系统和城市发展等领域的新型基础设施计划。第一轮包括约2900个计划,包括东北地区、京津冀地区高标准农地建设。

- 印度品牌资产基金会(IBEF)公布的资料显示,从2000年4月到2023年3月,印度建筑开发(包括住宅、基础设施和建筑开发计划)的外国直接投资(FDI)增加至263.5亿美元。

- 印度即将推出的预计将增加沥青需求的计划包括德里-孟买工业走廊、巴拉特马拉计划、古吉拉突邦国际金融科技城(GIFT)、科钦智慧城市、新孟买国际机场等。

- 印度国家投资促进和便利化局公布的资料显示,印度已拨出1.4兆美元预算用于2024年基础建设。其中,可再生能源占24%,公路和高速公路占18%,城市基础设施占17%,铁路占12%。

- 由于上述因素,预计亚太地区的沥青需求在预测期内将会增加。

沥青产业概述

沥青市场是细分的,没有一家大公司拥有压倒性的份额。主要参与企业(排名不分先后)包括埃克森美孚、壳牌、BP PLC、NYNAS AB 和中国石油化学股份有限公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 道路建设和维修活动增加

- 商业和住宅建筑施工的需求

- 抑制因素

- 环境问题

- 其他限制因素

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析

第五章市场区隔(市场规模(数量))

- 依产品类型

- 路面等级

- 硬质等级

- 氧化级

- 沥青乳液

- 聚合物改质沥青

- 其他产品类型(乳化型)

- 按用途

- 道路建设

- 防水的

- 胶水

- 其他用途(工业涂料)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 泰国

- 马来西亚

- 越南

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 西班牙

- 土耳其

- 北欧的

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- BMI Group(Icopal Enterprise ApS)

- Bouygues Group

- BP PLC

- China Petroleum & Chemical Corporation

- ENEOS Corporation(JXTG Nippon Oil & Energy Corporation)

- Exxon Mobil Corporation

- Indian Oil Corporation Ltd

- Kraton Corporation

- Marathon Oil Company(Marathon Petroleum LP)

- NYNAS AB

- Shell

- Suncor Energy Inc.

第七章 市场机会及未来趋势

- 用于道路基础设施改善的沥青加工研究与开发

- 高性能沥青产品的开发

The Bitumen Market size is estimated at 103 million tons in 2025, and is expected to reach 119.41 million tons by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

COVID-19 adversely influenced the demand for bitumen on the global market. During COVID-19, a large number of construction projects were on hold, reducing the use of bitumen throughout the world. However, as lockdowns and restrictions eased, there was continued construction activity in major regions. Since then, the market has been growing steadily.

Key Highlights

- The growth of the bitumen market is driven by increased road construction and repair activities, as well as a growing demand from both commercial and domestic building sectors for bitumen as fillers, adhesives, or sealants.

- On the flip side, increasing environmental concerns, such as the utilization of bitumen, which generates several harmful atmospheric emissions, have been hindering the market's growth.

- Research and development on bitumen processing to improve the development of high-performance bitumen products and road infrastructure are expected to create various opportunities for the bitumen market in the upcoming years.

- Asia-Pacific is expected to hold a significant share of the bitumen market and witness the highest CAGR during the forecast period.

Bitumen Market Trends

Road Construction Segment to Dominate the Market

- The road construction industry is one of the largest consumers of bitumen globally, accounting for a significant portion of total bitumen consumption. The sheer volume of bitumen required for paving roads, highways, and other transportation infrastructure contributes to its dominance in the market.

- Bitumen-based asphalt pavements offer excellent durability, flexibility, and resistance to weathering, making them well-suited for road construction projects. Asphalt roads can withstand heavy traffic loads, varying weather conditions, and other environmental factors, ensuring long-term performance and cost-effectiveness.

- According to the FMI Corporation (a consulting and investment bank), engineering and construction spending in North America is expected to increase by 2% by the end of 2024.

- Moreover, according to the data released by the United States Census Bureau, the value of private construction for transportation in the United States increased by USD 16.31 billion in 2020 to USD 19.39 billion in 2023.

- Infrastructure projects are expected to increase significantly in developing Asia-Pacific economies, particularly the transport sector, due to increased urbanization and shifting focus from traditional sectors toward emerging secondary industries. In addition, the growing economic prosperity is driving infrastructure financing toward consumer sectors such as transport and manufacturing, where raw materials are provided and sold to consumers.

- The China State Construction Engineering Corporation (CSCEC) signed a total of 4,623 kilometers of new road construction in 2022, up from 4,186 kilometers in 2020. This trend also supports the bitumen market.

- Under NIP, India allocated an investment budget of ~USD 1000 million for infrastructure. India passed a budget to develop several industrial corridors, including the Delhi-Mumbai Industrial Corridor, Amritsar-Kolkata Industrial Corridor, Vizag-Chennai Industrial Corridor, Bengaluru-Chennai Industrial Corridor, and the Bengaluru-Mumbai Industrial Corridor. These projects are expected to be completed by March 2025, which is expected to increase the demand for bitumen in the coming years.

- Owing to all these factors, the bitumen market is likely to grow globally during the forecast period.

Asia-Pacific to Dominate the Market

- The rapid industrialization and urbanization in various countries such as India, China, and other Southeast Asian nations have led to significant investments in infrastructure projects, including roads, highways, airports, and ports, driving the demand for bitumen.

- The construction sector in Asia-Pacific is one of the largest consumers of bitumen, with ongoing residential, commercial, and industrial construction projects fueling the demand for bitumen-based materials such as asphalt for road paving, roofing, and waterproofing.

- China's upcoming 15th Five-Year Plan focuses on new infrastructure projects in transport, energy, water systems, and urban development. The first batch includes about 2,900 projects, including the construction of high-standard farmland in northeast China and the Beijing-Tianjin-Hebei region.

- In India, according to the data published by the Indian Brand Equity Foundation (IBEF), foreign direct investment (FDI) in construction development, such as housing, infrastructure, and construction development projects, was valued at USD 26.35 billion between April 2000 and March 2023.

- The upcoming projects in India that are assumable to increase the demand for bitumen include the Delhi-Mumbai Industrial Corridor, Bharatmala Project, Gujarat International Finance Tec-City (GIFT), Smart City Kochi, and Navi Mumbai International Airport.

- According to the data published by the National Investment Promotion and Facilitation Agency, India has allocated a budget of USD 1.4 trillion for infrastructure for FY 2024. Of this, 24% is for renewable energy, 18% is for roads and highways, 17% is for urban infrastructure, and 12% is for railways.

- The factors mentioned above are expected to increase the demand for bitumen in Asia-Pacific during the forecast period.

Bitumen Industry Overview

The bitumen market is fragmented, with no major players having a dominant share. Some of the major players (not in any particular order) include Exxon Mobil Corporation, Shell, BP PLC, NYNAS AB, and China Petroleum & Chemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Road Construction and Repair Activities

- 4.1.2 Demand from Commercial and Domestic Building Constructions

- 4.2 Restraints

- 4.2.1 Environmental Concerns

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Product Type

- 5.1.1 Paving Grade

- 5.1.2 Hard Grade

- 5.1.3 Oxidized Grade

- 5.1.4 Bitumen Emulsions

- 5.1.5 Polymer Modified Bitumen

- 5.1.6 Other Product Types (Emulsified)

- 5.2 By Application

- 5.2.1 Road Construction

- 5.2.2 Waterproofing

- 5.2.3 Adhesives

- 5.2.4 Other Applications (Industrial Coatings)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Thailand

- 5.3.1.7 Malaysia

- 5.3.1.8 Vietnam

- 5.3.1.9 ASEAN Countries

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Spain

- 5.3.3.7 Turkey

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombian

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BMI Group (Icopal Enterprise ApS)

- 6.4.2 Bouygues Group

- 6.4.3 BP PLC

- 6.4.4 China Petroleum & Chemical Corporation

- 6.4.5 ENEOS Corporation (JXTG Nippon Oil & Energy Corporation)

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 Indian Oil Corporation Ltd

- 6.4.8 Kraton Corporation

- 6.4.9 Marathon Oil Company (Marathon Petroleum LP)

- 6.4.10 NYNAS AB

- 6.4.11 Shell

- 6.4.12 Suncor Energy Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research and Development on Bitumen Processing to Improve Road Infrastructure

- 7.2 Development of High-Performance Bitumen Products