|

市场调查报告书

商品编码

1637859

触控萤幕控制器:市场占有率分析、行业趋势和成长预测(2025-2030 年)Touch Screen Controllers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

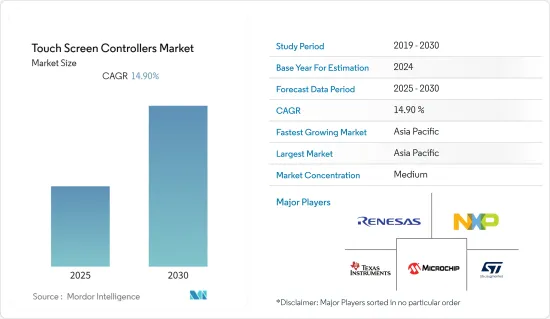

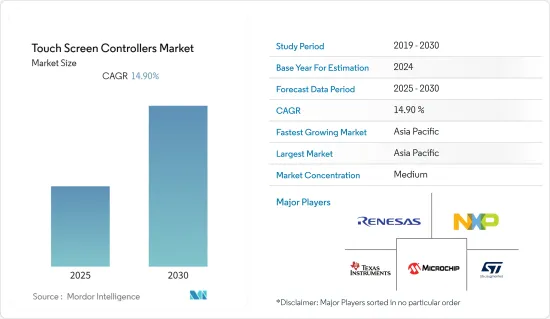

触控萤幕控制器市场预计在预测期内实现 14.9% 的复合年增长率

主要亮点

- 触控萤幕控制器是一种侦测触控感应器输入并将使用者所需的压力或触控动作传送到装置的转换器。在触控萤幕装置中,感应器内建于触控萤幕控制器中,使装置能够理解并识别使用者的进阶触控功能。近年来,由于各个终端用户行业的设备越来越多地采用触控萤幕功能,对这些设备的需求大幅增长。

- 例如,智慧型手机产业在过去十年中取得了长足发展,已成为家喻户晓的产业。与个人电脑和桌上型电脑相比,人们越来越意识到这些设备中的数位技术的价格更为实惠,这进一步推动了智慧型手机产业的成长。根据 2021 年爱立信行动报告,自 2011 年以来,4G LTE 网路的推出对于在全球范围内产生 55 亿个新的智慧型手机连接至关重要,并且随着 5G 技术在通讯业占据主导地位,预计还会进一步增长。

- 透过支援滑动、捏合缩放、轻扫(或轻拂)、扭转和按住(或长按)等手势,基于触控的手势姿态辨识技术将进一步推动市场成长。除了触控萤幕出货量的不断增加之外,汽车应用中采用投射电容式触控萤幕取代电阻式也推动了对电容式触控萤幕控制器的需求。

- 然而,实现高品质的触控介面是一项艰鉅的挑战,因为必须满足太多要求。除非系统设计得非常巧妙,否则这些不同的要求有时会发生衝突并导致权衡。此外,实现适当的功耗和刷新率的挑战也是限制市场成长的因素。

- 事实证明,触控萤幕是数位世界不可或缺的一部分,因此儘管新冠疫情严重影响了许多企业,但即使在疫情期间,触控萤幕设备的需求仍然强劲。由于政府采取限制旅行、限制集中办公人数等措施,迫使企业转向远距工作,对个人设备的需求尤其激增。随着混合工作文化预计在未来继续存在,对具有触控萤幕功能的智慧型装置的需求预计将保持高位,这同样会影响所研究市场的成长。

触控萤幕控制器市场趋势

消费性电子产品占据主要市场占有率

- 消费性电子产品是市场中最重要且最有活力的部分之一。随着对新产品和创新产品的需求快速增长,触控萤幕被广泛应用于各种产品中。行动电话、平板电脑、穿戴式装置、笔记型电脑和个人电脑是少数广泛采用触控功能的消费性电子产品。如今,无论是冰箱、洗衣机还是影印机,所有产品都配备了触控介面,以便为消费者提供更好的体验并创造差异化需求。

- 随着触控萤幕技术的接受度不断提高,大多数供应商都在将该技术整合到相机、便携式音乐播放器、健身器材和门铃视讯监视器等家用电子电器中,并推出了触控萤幕控制器。产生了正面影响。例如,领先的家电公司小米于 2022 年 7 月推出了其智慧家居萤幕 6,其配备 5.45 吋触控萤幕显示屏,解析度为 960 x 480px。

- 在穿戴式装置领域,价格正在下降,竞争预计会加剧。此外,这些设备所包含的功能越来越多,例如通话和简讯跟踪,也推动了销售。触控萤幕功能在穿戴式产业中越来越受欢迎,这种成长预计将对触控萤幕控制器市场产生积极影响。

- 此外,近年来智慧型手机的普及率大幅提升。爱立信预计,到2021年全球智慧型手机用户数将达到63.4亿。折迭式行动电话预计将加剧支援这些系统的控制器市场的竞争。 5G设备预计将维持行动装置的进一步成长,并刺激该细分市场的需求。

亚太地区预计将占据主要市场占有率

- 近几十年来,亚太地区经历了显着的成长,中国、韩国、日本和印度等国家在工业、汽车和消费性电子等领域经历了强劲成长。例如,中国是汽车製造业的领导者,根据 OICA 的数据,到 2021 年,汽车总产量将达到 2,600 万辆以上。

- 中国也是电动车的主要生产国之一。根据中国工业协会统计,中国已生产了约350万辆新能源汽车,其中包括290万辆纯电动车。触控萤幕在汽车中的使用正在增加,特别是在车载资讯娱乐系统中,汽车行业的成长预计将推动亚太地区对触控萤幕控制器的需求。

- 智慧型手錶和创新手环也在亚太地区各国迅速普及。这些设备的创新设计和功能以及不断下降的成本正在吸引消费者,尤其是年轻一代的注意。此外,中阶可支配所得的增加也是推动需求的一个主要因素。

- 智慧型手机和平板电脑等家用电子产品价格的下降、简单用户介面的日益普及以及政府在电子教育方面的倡议进一步推动了智慧家用电子设备的普及。预计这些趋势也将对所调查市场的成长产生显着影响。

触控萤幕控制器产业概览

触控萤幕控制器市场竞争激烈,由几家主要参与者组成。恩智浦半导体公司、德州仪器公司、意法半导体公司和微晶片科技公司等主要参与者主导着产业竞争。每家公司都专注于开发针对不同应用的差异化产品,并获得相对于其他公司的竞争优势。

2022 年 10 月-领先的家电公司海尔在印度推出了其全新 AI 洗衣机系列海尔 979。该洗衣机还支援物联网,用户可以使用智慧型手机应用程式或语音助理设备存取洗衣机及其功能。这台洗衣机配有直接驱动马达和新的触控萤幕控制面板。

2022 年 10 月-中国晶片设计与解决方案供应商汇顶科技宣布,正在透过GA687X 单晶片解决方案扩展其车载显示器触控控制器范围,支援对角线长度从12.3 吋到27 吋的更大显示器。根据该公司介绍,该晶片的刷新率高达 250Hz,响应时间为 10ms,让用户能够无延迟地控制功能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 智慧型设备的兴起

- 在各行各业的应用日益广泛

- 市场限制

- 技术复杂性

第六章 市场细分

- 按类型

- 电阻膜

- 电容式

- 按最终用户

- 产业

- 卫生保健

- 家电

- 零售

- 车

- BFSI

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- NXP Semiconductors

- Renesas Electronic Corporation

- SAMSUNG Electronics Co. Ltd

- Texas Instruments Incorporated

- Analog Devices Inc.

- STMicroelectronics

- MELFAS Co. Ltd

- Synaptics Incorporated

- Semtech Corporation

- Microchip Technology Inc.

第八章投资分析

第九章:未来市场展望

The Touch Screen Controllers Market is expected to register a CAGR of 14.9% during the forecast period.

Key Highlights

- Touch screen controllers are converters, as they detect the touch sensor input and send the desired user action of pressure or touch to the device. In touch screen devices, sensors are incorporated with touch screen controllers to help the device understand and recognize sophisticated touch functions from the user. In recent years, the demand for these devices has grown significantly, owing to the increasing adoption of touchscreen features across various end-user industry devices.

- For instance, the smartphone industry has grown significantly in the last decade to become a common household name. The increasing awareness about the affordability of digital technologies of these devices compared to PCs and desktops further propelled the smartphone industry's growth. According to a 2021 Ericsson Mobility report, the deployment of 4G LTE networks has been crucial in generating 5.5 billion new smartphone connections worldwide since 2011, which is expected to grow further as 5G technology takes over the communication industry.

- Technological investments in touch-based gesture recognition further propelled the market growth by supporting gestures, such as slide, pinch-to-zoom, swipe (or flick), twist, and press-and-hold (or long press). In addition to increased touch screen units shipped, projected capacitive touch screens are replacing resistive technology in automotive applications, driving the demand for capacitive touch screen controllers.

- However, with so many requirements to fulfill, creating a high-quality touch interface is challenging. These different requirements can sometimes conflict, leading to trade-offs unless the system is designed smartly. Additionally, challenges in achieving correct power consumption and refresh rate are among the factors restraining the growth of the market studied.

- As touch screens have proven to be an integral part of the digital world, the demand for touch screen devices remained steady even during the pandemic, even though COVID-19 severely impacted many businesses. The demand shooter up sharply, especially in the personal device segment, as measures taken by the government, such as travel restrictions and restrictions on the availability of several people at a place, forced the organizations to shift to remote work setup. With the hybrid work culture expected to stay, the demand for smart devices with touchscreen features is expected to remain high, which will have a similar impact on the growth of the market studied.

Touch Screen Controllers Market Trends

Consumer Electronics to Hold a Major Market Share

- Consumer electronics is one of the market's most essential and significant segments. The fast-paced demand for new and innovative products has seen touch screens being embraced by multiple products. Mobiles, tablets, wearables, laptops, and PCs are among the few consumer electronic products that have adopted touch capabilities on a broader scale. Recently, products such as refrigerators, washing machines, copiers, etc., all have been equipped with touch-enabled interfaces to offer a better consumer experience and create a differentiated demand.

- Considering the increasing acceptance of touchscreen technology, most vendors include this technology in consumer electronic devices, such as cameras, portable music players, exercise equipment, doorbell video monitors, etc., which positively impacts the demand for touchscreen controllers. For instance, in July 2022, Xiaomi, a leading consumer electronics company, launched Smart Home Screen 6 with a 5.45-inch touchscreen display with a 960 x 480 px resolution.

- The competition in the wearables segment is expected to grow as it has become more affordable. Furthermore, the increased functionality, such as calling, SMS tracking, etc., being incorporated into these devices is also driving their sales. With the touchscreen feature increasingly taking place in the wearables industry, its growth is expected to positively impact the touchscreen controller market.

- Furthermore, smartphone adoption increased significantly in recent years. According to Ericsson, in 2021, smartphone subscriptions reached 6,340 million globally. Foldable mobile phones are expected to increase competition in the market for controllers that support these systems. 5G devices are expected to sustain further mobile device growth and boost the market segment's demand.

Asia-Pacific Expected to Hold Significant Market Share

- The Asia-Pacific region witnessed remarkable growth in the last few decades; sectors such as industrial, automotive, and consumer electronics have grown significantly, especially in the countries, such as China, South Korea, Japan, and India, among others. For instance, according to OICA, China was the leading automobile manufacturer, with a total production of automobiles reaching just over 26 million in 2021.

- China is also among the leading producer of electric vehicles. According to the China Association of Automobile Manufacturers (CAAM), the country produced about 3.5 million units of new energy vehicles, including 2.9 million battery-electric vehicles. As touch screens are increasingly being used in automobiles, especially in the automotive infotainment systems, the growth of the automobile industry is expected to drive the demand for touch screen controllers in the Asia-Pacific region.

- Smartwatches and innovative bracelets are also witnessing a huge spike in adoption across various countries in the Asia-Pacific region. The declining cost, along with these devices' innovative design and features is significantly attracting consumers' attention, especially the younger generation. Furthermore, the increasing disposable income of the middle class is also among the major factor driving their demand.

- The declining cost of consumer electronics, such as smartphones and tablet PCs, the growing adoption of simplicity in the user interface, and government initiatives toward E-learning education have further encouraged the usage of intelligent consumer electronic devices. Such trends are also expected to have a notable impact on the growth of the market studied.

Touch Screen Controllers Industry Overview

The touchscreen controller market is highly competitive and consists of several major players. Major players, such as NXP Semiconductors, Texas Instruments Incorporated, STMicroelectronics, Microchip Technology Inc., etc., govern industry rivalry. The companies focus on developing differentiated products for various applications to gain a competitive advantage over other players.

October 2022 - Haier, a leading consumer electronics company, launched its new AI-enabled Washing Machine series Haier 979 in India. The washing machine is also IoT-enabled, enabling the user to use smartphone apps and voice assistant devices to access the machine and its functions. The washing machine includes a direct motion motor and a new touchscreen control panel.

October 2022 - Goodix Technology, a chip designer and solutions provider in China, announced that it is expanding its range of touch controllers for in-vehicle displays with the GA687X single-chip solution, which supports large displays from 12.3 to 27 inches diagonal. According to the company, the chip achieves a refresh rate of up to 250 Hz and a response time of 10 ms to allow users to control functions without latency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Number of Smart Devices

- 5.1.2 Increased Usage across Various Industries

- 5.2 Market Restraints

- 5.2.1 Complexities Associated with the Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Resistive

- 6.1.2 Capacitive

- 6.2 By End-user

- 6.2.1 Industrial

- 6.2.2 Healthcare

- 6.2.3 Consumer Electronics

- 6.2.4 Retail

- 6.2.5 Automotive

- 6.2.6 BFSI

- 6.2.7 Other End-users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NXP Semiconductors

- 7.1.2 Renesas Electronic Corporation

- 7.1.3 SAMSUNG Electronics Co. Ltd

- 7.1.4 Texas Instruments Incorporated

- 7.1.5 Analog Devices Inc.

- 7.1.6 STMicroelectronics

- 7.1.7 MELFAS Co. Ltd

- 7.1.8 Synaptics Incorporated

- 7.1.9 Semtech Corporation

- 7.1.10 Microchip Technology Inc.