|

市场调查报告书

商品编码

1639400

亚太纸包装:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia Pacific Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

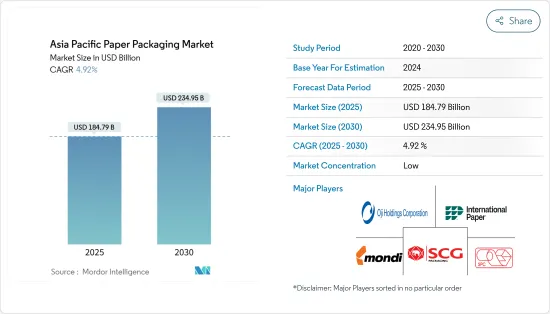

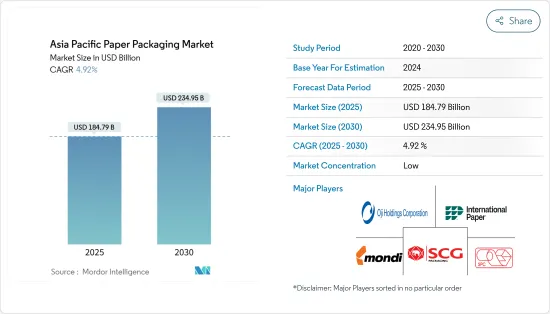

亚太地区纸包装市场规模预计在2025年为2000.4亿美元,预计到2030年将达到2550.6亿美元,预测期内(2025-2030年)的复合年增长率为4.98%。

主要亮点

- 作为世界上人口最多的两个国家,印度和中国都有各种依赖纸质包装的终端用户产业。随着中国、印度、日本、香港和新加坡等国家倾向于替代包装解决方案,亚太地区的纸张和纸板市场可望大幅成长。为了满足日益增长的需求,中国政府正积极推动包装现代化,使中国成为地区消费品收入的领导者。

- 未来十年,印度的目标是让其工业走上更永续和智慧化的道路。这项转变将主要受到禁止使用一次性塑胶并优先考虑回收和生物分解的政策所推动。这些措施为印度工业转向生物基和纸质包装提供了明显的机会。此举有利于永续性并降低进口成本。此外,也注重国内乙烯生产,以取代进口丁酮、聚氯乙烯和环氧乙烷等化学品和聚合物。

- 此外,电子商务已经巩固了其作为市场主要参与者的地位。亚马逊和其他大型电子商务公司主要使用瓦楞纸箱进行包装。为了减少对一次性塑胶的依赖,一些电子商务公司正在积极摆脱传统的瓦楞纸箱和纸袋。预计这一转变将推动市场进一步成长。

- 预计食品包装需求的不断增长将进一步推动市场发展。亚太国家,尤其是中国、日本和印度,正在经历网路食品订购的激增,这正在增强纸质包装市场的发展。纸质包装可确保您的线上餐食和杂货安全到达目的地。

- 在纸质包装需求不断增长的背景下,不负责任的森林砍伐会耗尽基本原料,对纸板包装产业构成重大威胁。忧思科学家联盟强调,包括纸张在内的「木製品」造成了全球约 10% 的森林砍伐。此外,许多类型的纸包装的生产都需要大量用水。生产过程中过度使用水可能会抵消选择纸质包装而非塑胶包装所带来的环境效益,对市场成长构成挑战。

亚太纸包装市场趋势

食品业占很大市场占有率

- 新兴食品和饮料公司的出现以及 Zomato 和 Swiggy 等食品配送巨头的显着增长,刺激了印度对纸张和包装的需求不断增长。因此,食品和饮料包装的消费量正在激增。值得注意的是,Zomato 率先在食品宅配领域引进防窜改包装,展现了对食品安全和新鲜度的承诺。

- 食品包装已经发生了重大变化,优先考虑品牌知名度,同时确保食品的完整性和品质。本地製造商不仅内部竞争激烈,而且与跨国公司 (MNC) 的竞争也十分激烈。为了保持领先地位,许多製造商都成立了专门的研究和开发部门,专注于测试和实施尖端技术,将永续包装作为优先事项并创造市场成长机会。

- 在食品加工行业中,包装材料的选择是根据每种食品的客製化要求进行的。指南这些选择的主要因素包括热封性、加工性、印刷性、强度和阻隔性(防水、防油、防气等)。纸包装市场相关人员的研究和开发努力正在强化这些考虑,旨在改善包装性能和美观度。

- 此外,在中国,决策很大程度上受到成本效益、永续性和遵守法律法规的影响。在中国,纸张是食品包装市场的重要组成部分。由于纸张独特的优势,它主要应用于食品包装,以保护食品、提高储存和食用的便利性,并向消费者传达包括行销细节在内的重要讯息。

- 受消费者对永续包装意识的推动,日本的食品宅配业主要依赖纸本产品。此举是包装行业向纸张化转变的广泛运动的一部分。此外,随着中国等国家网路食品配送的普及,食品公司开始优先考虑纸包装解决方案,进一步推动市场成长。

预计印度将占据较大的市场占有率

- 纸张和纸板产业在提供更多经济实惠的替代品的转型过程中面临着重大的机会和挑战。印度造纸厂积极生产用于各种用途的纸张和纸板,例如运输、保护、包裹、包装和容器功能。此外,近年来印度对薄纸、茶包、滤纸、轻量线上涂布纸、医用涂布纸等上游纸製品的需求激增。

- 在电子商务行业,疫情期间对人员流动、社交距离的限制以及实体店的关闭导致线上订单大幅增加。全国各地,越来越多的人开始透过网路平台购买杂货、餐点和其他必需品。由于电子商务和零售业是该国纸张和纸板解决方案的最大消费者之一,这一趋势预计将推动对永续包装解决方案的需求不断增长。

- 此外,印度快速扩张的工业格局,包括食品饮料和化妆品,正在经历加速成长。政府旨在遏制塑胶废弃物的倡议进一步推动了该市场的扩张。因此,消费者意识的增强加上印度有组织食品产业的快速成长推动了该市场的成长。根据商务部报告的资料,印度23财年纸和纸板产品出口额约为30.4亿美元。

- 印度纸质包装市场正在不断扩大,这得益于各领域对高端包装的持续需求。其中包括快速消费品(FMCG)、医药、纺织品、有组织的零售和快速成长的电子商务。此外,果肉、果汁、浓缩液、酱汁和番茄酱瓶等产品也推动了纸和纸板包装需求的成长。值得注意的是,印度工业已经拥抱永续性并取得了重大技术进展。

- 印度造纸工业协会(IPMA)预测,印度纸张消费量将每年增加6%至7%,2026-2027年达到3,000万吨。这种成长背后的主要因素是零售业的蓬勃发展以及人们对教育和读写能力的兴趣日益浓厚。此外,印度的人均纸张消费量是世界上最低的国家之一,这意味着该国的造纸业具有巨大的成长潜力。

亚太纸包装产业概况

亚太地区纸包装市场主要企业如下: SCG Packaging PCL、Huhtamaki Group、Amcor、Oji Holdings Corporation 和国际纸业公司。

- 2024 年 2 月 - 白子株式会社 (Shirako Co., Ltd.) 为其调味海藻品牌「Sumapura」采用了王子控股株式会社的纸质包装,加强了这家日本海藻製造商的永续性努力。透过改用纸质包装,Shirako 的塑胶使用量减少了 92%,保质期也延长了一倍。这显示市场供应商致力于研发阻隔性和机械强度的纸质包装解决方案,以保持市场竞争力。

- 2023 年 10 月-正大食品股份有限公司与 SCG Packaging PCL 和 SCG Chemicals Public Company Limited(SCGC)签署了一份谅解备忘录,以在泰国启动绿色包装倡议。在此方面,两家公司将共同努力寻找食品包装的环境和永续性解决方案。特别是,正大食品与SCG Packaging PCL之间的伙伴关係可望推动纸质包装领域的创新。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场动态

- 市场驱动因素

- 电子商务销售持续成长带动纸容器需求

- 主要终端用户越来越重视再生纸,推动向纸质包装转变

- 扩大医疗保健和化妆品领域的份额

- 市场挑战

- 原物料可得性困难导致价格波动

第六章 市场细分

- 按年级

- 纸板

- 固体漂白硫酸盐 (SBS)

- 未漂白固态硫酸盐 (SUS)

- 折迭式箱板 (FBB)

- 涂布再生纸板 (CRB)

- 无涂布再生纸板 (URB)

- 箱板纸

- 白色牛皮纸

- 其他牛皮卡纸

- 白色顶部测试衬垫

- 其他测试衬垫

- 半化学凹槽

- 回收瓦楞纸

- 纸板

- 按产品

- 折迭式纸盒

- 瓦楞纸箱

- 按最终用户产业

- 食物

- 饮料

- 卫生保健

- 个人护理

- 家居用品

- 电器

- 其他最终用户产业

- 按国家

- 中国

- 印度

- 日本

- 印尼

- 泰国

- 越南

- 澳洲和纽西兰

- 其他亚太地区

第七章 竞争格局

- 公司简介

- SCG Packaging PCL

- International Paper Company

- Sarnti Packaging Co. Ltd

- Oji Holdings Corporation

- Mondi Group

- Huhtamaki Group

- Harta Packaging Industries(Selangor)Sdn Bhd

- Amcor

- Hong Thai Packaging Company Limited

- New Asia Industries Co. Ltd(Rengo Co. Ltd)

- C&H Paperbox(Thailand)Co. Ltd

- Continental Packaging(Thailand)Co. Ltd

- West Rock Company

第八章投资分析

第九章:市场的未来

The Asia Pacific Paper Packaging Market size is estimated at USD 200.04 billion in 2025, and is expected to reach USD 255.06 billion by 2030, at a CAGR of 4.98% during the forecast period (2025-2030).

Key Highlights

- India and China, among the world's most populous nations, have various end-user industries that rely on paper-based packaging. With countries like China, India, Japan, Hong Kong, and Singapore gravitating towards alternative packaging solutions, the Asia-Pacific region is poised for remarkable growth in the paper and paperboard market. Responding to rising demands, the Chinese government has actively modernized packaging options, positioning China at the forefront of regional consumer goods revenue.

- Over the next decade, India aims to progress its industry towards a more sustainable and smart trajectory. This transition is primarily fueled by policies banning single-use plastics and prioritizing recycling and biodegradation. Such measures give India a distinct chance to pivot its industry towards bio-based and paper-based packaging. This move would support sustainability nd would curtail import costs. Furthermore, it redirects the emphasis on domestic ethylene production, aiming to substitute imported chemicals and polymers, including methyl ethyl ketone, PVC, and ethylene oxide.

- Furthermore, e-commerce has solidified its position as a critical player in the market. Major e-commerce giants, including Amazon, predominantly rely on corrugated board boxes for packaging. In an objective to reduce reliance on single-use plastics, several e-commerce firms are actively transitioning from traditional corrugated boxes and paper bags. This shift is anticipated to drive further growth in the market..

- The rising demand for food packaging is set to drive the market further. Countries in the Asia-Pacific region, notably China, Japan, and India, have seen a surge in online food ordering, which has bolstered the paper packaging market. Paper packaging ensures that online meals and groceries reach their destinations safely.

- Irresponsible deforestation poses a significant threat to the paperboard packaging industry by depleting essential raw materials despite the rising demand for paper packaging. The Union of Concerned Scientists highlighted that "wood products," including paper, contribute to approximately 10% of global deforestation. Furthermore, the production of many paper packaging types is water-intensive. Excessive water usage in this production could negate the environmental advantages of opting for paper over plastic packaging, presenting a challenge to market growth.

Asia Pacific Paper Packaging Market Trends

Food Segment to Hold Significant Market Share

- The rise of new food and beverage companies and the significant growth of food delivery giants like Zomato and Swiggy have spurred a heightened demand for paper and packaging in India. As a result, the consumption of food and beverage packaging has surged. Notably, Zomato pioneered the introduction of tamper-resistant packaging in the food delivery realm, underscoring its commitment to food safety and freshness.

- Food packaging has evolved considerably, prioritizing brand visibility while ensuring the food item's integrity and quality. Local manufacturers fiercely compete, not only among themselves but also against multinational corporations (MNCs). To stay ahead, many have established dedicated research and development departments focused on testing and implementing cutting-edge technologies and prioritized their sustainable packaging, creating market growth opportunities.

- In the food processing industry, packaging materials are chosen based on the customized requirements of each food product. Key factors guiding these choices encompass thermal sealability, process capability, printability, strength, and barrier properties (such as resistance to water, oil, and gas). Research and development efforts among stakeholders in the paper packaging market bolster these considerations, aiming to elevate the properties and aesthetics of packaging.

- Furthermore, in China, decision-making is significantly influenced by cost-efficiency, sustainability, and adherence to legal regulations. In China, paper constitutes a significant segment of the food packaging market. Leveraging its unique advantages, paper is predominantly employed in food packaging to safeguard food products, enhance convenience during storage and consumption, and convey essential information to consumers, including marketing details.

- The food delivery industry in Japan predominantly relies on paper-based products driven by consumer awareness of sustainable packaging. This trend is part of a broader movement within the packaging sector to embrace paper. Additionally, as online food delivery gains traction in countries like China, food companies prioritise paper-based packaging solutions, further bolstering market growth.

India is Expected to Hold a Significant Market Share

- The paper and paperboard industry has been registering significant opportunities and challenges during a transition phase to offer more affordable alternatives. The paper mills in India are actively experimenting to produce paper and paperboard tailored for various applications, including carrying, protecting, wrapping, packaging, and serving as containers. Additionally, in recent years, India has witnessed a surge in demand for upstream paper products, including tissue paper, tea bags, filter paper, lightweight online coated paper, and medical-grade coated paper.

- The restrictions on physical movement, social distancing, and the closure of physical stores during the COVID-19 pandemic impacted a significant surge in online orders for the Indian e-commerce industry. Across the nation, individuals increasingly turned to online platforms for groceries, meals, and other essentials. Since the e-commerce and retail sectors are among the country's top consumers of paper and paperboard solutions, this trend is anticipated to drive a heightened demand for sustainable packaging solutions.

- Additionally, India's rapidly expanding industrial landscape, including food and beverage and cosmetics, is witnessing accelerated growth. Government initiatives aimed at curbing plastic waste are further propelling this market's expansion. Consequently, heightened consumer awareness, coupled with India's burgeoning organized food sector, is fueling this market's growth. In FY 2023, India's export value for paper and paperboard products reached approximately USD 3.04 Billion, according to the data reported by the Department of Commerce in India.

- The paper packaging market in India is expanding, fueled by a consistent demand for premium packaging across diverse sectors. These include fast-moving consumer goods (FMCG), pharmaceuticals, textiles, organized retail, and the surging e-commerce landscape. Moreover, the rising demand for paper and paperboard packaging is driven by products like fruit pulp, juices, concentrates, sauces, and ketchup bottles. Notably, the Indian industry has embraced sustainability and has made significant technological advancements.

- The Indian Paper Manufacturers Association (IPMA) projected that India's paper consumption would grow from 6% to 7% annually, reaching 30 million tonnes by FY 2026-2027. This growth is mainly fueled by a heightened focus on education and literacy, alongside a surge in organized retail. Additionally, given that India's per capita paper consumption is among the lowest globally, the paper industry in the country showcases vast growth potential.

Asia Pacific Paper Packaging Industry Overview

The Asia-Pacific paper packaging market is fragmented, owing to key players such as SCG Packaging PCL, Huhtamaki Group, Amcor, Oji Holdings Corporation, and International Paper Company. Through continuous research and development activities, players in the market have introduced innovations in their offerings that allow them to offer sustainability to their consumers.

- February 2024 - Shirako Corporation has selected Oji Holdings Corporation's paper packaging for its 'Sumapura' brand of seasoned seaweed, bolstering the Japanese seaweed producer's sustainability initiatives. By shifting to paper-based packaging, Shirako has reduced plastic usage by 92% and doubled its shelf life. This shows the market vendors' commitment to R&D, focusing on high-barrier and mechanically robust paper packaging solutions to maintain competitiveness.

- October 2023 - Charoen Pokphand Foods Public Company signed an MoU with SCG Packaging PCL and SCG Chemicals (SCGC) to launch the Green Packaging Initiative in Thailand. The companies would work together to find an environmental and sustainability solution for food packaging in this context. In particular, a partnership between CP Foods and SCG Packaging PCL would facilitate innovation in paper packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Sustained Rise in E-commerce Sale to Drive Demand For Folding Cartons

- 5.1.2 Growing Emphasis on the Use of Recycled Paper by Major End Users to Aid the Transition to Paper Packaging Materials

- 5.1.3 Growing Share of Healthcare and Cosmetic Segments

- 5.2 Market Challenges

- 5.2.1 Challenges Related to Availability of Raw Materials Leading to Price Fluctuations

6 MARKET SEGMENTATION

- 6.1 By Grade

- 6.1.1 Carton Board

- 6.1.1.1 Solid Bleached Sulfate (SBS)

- 6.1.1.2 Solid Unbleached Sulfate (SUS)

- 6.1.1.3 Folding Boxboard (FBB)

- 6.1.1.4 Coated Recycled Board (CRB)

- 6.1.1.5 Uncoated Recycled Board (URB)

- 6.1.2 Containerboard

- 6.1.2.1 White-top Kraftliner

- 6.1.2.2 Other Kraftliners

- 6.1.2.3 White top Testliner

- 6.1.2.4 Other Testliners

- 6.1.2.5 Semi Chemical Fluting

- 6.1.2.6 Recycled Fluting

- 6.1.3 By Product

- 6.1.3.1 Folding Cartons

- 6.1.3.2 Corrugated Boxes

- 6.1.4 By End-user Industry

- 6.1.4.1 Food

- 6.1.4.2 Beverage

- 6.1.4.3 Healthcare

- 6.1.4.4 Personal Care

- 6.1.4.5 Household Care

- 6.1.4.6 Electrical Products

- 6.1.4.7 Other End-User Industries

- 6.1.5 By Country

- 6.1.5.1 China

- 6.1.5.2 India

- 6.1.5.3 Japan

- 6.1.5.4 Indonesia

- 6.1.5.5 Thailand

- 6.1.5.6 Vietnam

- 6.1.5.7 Australia and New Zealand

- 6.1.5.8 Rest of Asia-Pacific

- 6.1.1 Carton Board

7 COMPETITIVE LANDSCAPES

- 7.1 Company Profiles

- 7.1.1 SCG Packaging PCL

- 7.1.2 International Paper Company

- 7.1.3 Sarnti Packaging Co. Ltd

- 7.1.4 Oji Holdings Corporation

- 7.1.5 Mondi Group

- 7.1.6 Huhtamaki Group

- 7.1.7 Harta Packaging Industries (Selangor) Sdn Bhd

- 7.1.8 Amcor

- 7.1.9 Hong Thai Packaging Company Limited

- 7.1.10 New Asia Industries Co. Ltd (Rengo Co. Ltd)

- 7.1.11 C&H Paperbox (Thailand) Co. Ltd

- 7.1.12 Continental Packaging (Thailand) Co. Ltd

- 7.1.13 West Rock Company