|

市场调查报告书

商品编码

1639427

北美营运情报:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Operational Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

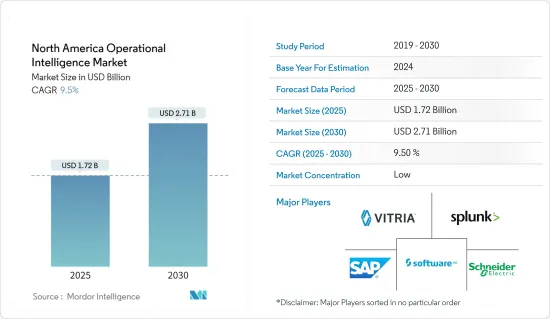

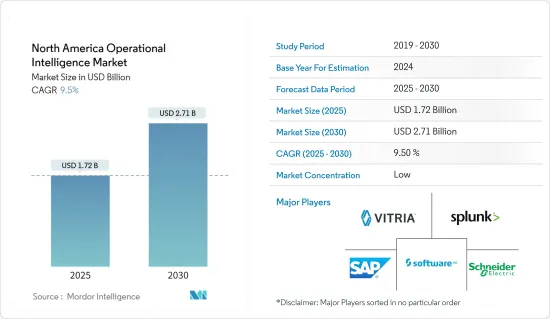

北美营运情报市场规模预计在 2025 年为 17.2 亿美元,预计到 2030 年将达到 27.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.5%。

资料品管、发现和视觉化的需求正在推动企业采用营运智慧软体。内部部署 ESB 和 BPM(业务流程管理)解决方案非常适合整合公司复杂的内部系统和架构,同时确保垂直扩充性。

主要亮点

- 营运智慧 (OI) 是一种动态、即时业务分析的形式,可提供对业务和 IT 营运的洞察。这些解决方案为企业提供了简化资料收集和分析流程的机会。企业可以即时监控和排除故障,改善安全性和合规性实践,并加快向客户提供服务。

- 商业情报和资料仓储工具等传统分析工具不允许公司充分利用可用于决策的资料潜力。这些传统的资讯管理系统受到资料量和种类的限制,难以以实用、可操作的方式分析资料。

- Cisco估计,所有生成资料中约有 42% 来自机器,包括感测器、网路、安全系统、伺服器、储存和应用程式。即时资料分析可以利用物联网和巨量资料功能来增强业务营运。

- 此外,不同装置和平台之间的互通性挑战使企业在连接动态应用程式、服务和资料时遇到的问题变得更加复杂。因此,转向云端解决方案可以帮助企业解决当前的整合挑战,同时提供未来所需的可管理性、扩充性和可靠性。

北美营运智慧市场趋势

云端运算将占据主要市场占有率

- 由于降低成本、可访问性、扩充性和服务集中化等附加优势,云端运算预计将占据相当大的市场占有率。此外,预计超过 83% 的企业工作负载将在云端运行,其中 41% 的工作负载在公共云端平台上运行。另外 20% 将基于私有云端,22% 将依赖混合云端的采用。

- Flexera 的研究表明,云端策略越来越注重混合云而不是公有云或私有云。混合云是公司提供产品和服务的新常态。据 Flexera 称,到 2023 年混合云采用率将增加到 72%。

- 此外,成本效率在推动云端运算实现营运智慧方面发挥关键作用。云端供应商提供计量收费模式,无需在硬体和基础设施上进行大量的前期投资。这使得企业能够有效地分配资源并在必要时投资营运智慧工具。云端的弹性使得公司只需为其消耗的资源付费,这对于希望在控製成本的同时优化营运智慧工作的企业来说是一个有吸引力的选择。

- 此外,云端基础的营运智慧解决方案的速度和灵活性在当今快节奏的商业环境中非常宝贵。即时资料分析使企业能够做出即时、明智的决策,快速回应不断变化的市场条件,并掌握新兴趋势。云端的分散式架构和先进的分析功能使企业能够以创纪录的时间从各种资料来源中获得可操作的见解。

零售预计将占据较大的市场占有率

- 零售业采用人工智慧将透过减少人工工作、加快交付速度、改善客户和订单管理以及简化营运来实现零售相关流程的自动化,最终降低所有成本。

- 此外,零售基础设施复杂且分散,包括销售点 (POS)、收银终端、自助结帐、个人电脑和后勤部门伺服器。这导致批发商、经销商、製造商和供应商对 IT 的依赖性不断增强,需要整合的基础设施来实现无缝的零售价值链。这与操作智能的成长相对应。

- 根据牛津经济研究院统计,83%的大型零售企业已将数位转型作为核心业务目标。牛津经济研究院也指出,中小型零售商(59%)正在推动数位转型。随着数位转型变得更加普遍,零售业变得更加重视变革,市场预计将扩大。

- 此外,零售业也越来越多地采用云端基础的解决方案,透过整合库存和订单处理等多条业务线来提高补货能力。

- 此外,云端处理还允许零售商实现企业范围的供应链可视性。最近,Gap Inc. 采用云端技术来支援其 Intermix 品牌的全球营运。时尚零售商部署Oracle云端服务来提供零售商品商品行销、整合和库存管理解决方案。

北美营运智慧产业概况

北美营运情报市场分散且竞争激烈,拥有许多大大小小的供应商,提供对业务的全面可视性和洞察力。这使企业能够做出明智的、资料主导的决策。这个充满活力的市场的其他主要企业包括 Vitoria Technology 和 Splunk。

2023年5月,SAP SE宣布与IBM建立策略伙伴关係。根据伙伴关係,SAP 将把 IBM Watson 技术整合到其解决方案中。此次整合将使 SAP SE 能够提供先进的人工智慧洞察和自动化,加速创新并改善更广泛解决方案组合中的使用者体验。

2022 年 8 月,国家农村电信合作社 (NRTC) 宣布其营运智慧平台全面上市。该平台具有与供应商无关的分析功能,旨在优化宽频供应商的业务。透过利用即时资料分析和机器学习,平台可以主动识别用户问题和潜在的服务中断,让提供者能够在问题影响客户之前解决这些问题。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场动态

- 市场驱动因素

- 对即时资料分析的需求日益增加

- 巨量资料分析和物联网的采用日益广泛

- 市场限制

- 合併来自多个资料来源的资料

第六章 市场细分

- 依部署类型

- 云

- 本地

- 按最终用户产业

- 零售

- 製造业

- BFSI

- 政府

- 资讯科技/通讯

- 军事和国防

- 运输和物流

- 卫生保健

- 能源和电力

第七章 竞争格局

- 公司简介

- Vitria Technology Inc.

- Splunk Inc.

- SAP SE

- Inside Analysis(The Bloor Group)

- Software AG

- Schneider Electric SE

- Rolta India Limited

- SolutionsPT Ltd

- IBENOX Pty Ltd

- Turnberry Corporation

- HP Inc.

- OpenText Corporation

第八章投资分析

第九章 市场机会与未来趋势

The North America Operational Intelligence Market size is estimated at USD 1.72 billion in 2025, and is expected to reach USD 2.71 billion by 2030, at a CAGR of 9.5% during the forecast period (2025-2030).

The need for data quality management, discovery, and visualization compels businesses to adopt operational intelligence software. On-premise ESB and BPM (business process management) solutions are well suited for vertical scalability while integrating an enterprise's complex internal systems and architecture.

Key Highlights

- Operational intelligence (OI) is a form of dynamic, real-time business analytics that delivers insights into business and IT operations. These solutions provide enterprises with the opportunity to streamline the process of data collection and analysis. Enterprises can monitor and troubleshoot in real-time and improve their security and compliance methods, thereby speeding up the delivery of their services to customers.

- Enterprises cannot tap the full potential of the available data for making decisions using traditional analytical tools, such as business intelligence and data warehouse tools. These conventional information management systems cannot analyze the data in any practical and actionable way due to their high volume and diversity.

- Cisco Systems estimates that around 42% of all data generated will likely be from machines, including sensors, networks, security systems, servers, storage, and applications. Real-time data analytics can influence the IoT and Big Data capabilities to enhance business operations.

- Moreover, the challenge of interoperability between different devices and platforms has complicated issues for businesses, as it is challenging to connect dynamic applications, services, and data. Therefore, the shift to cloud solutions helps enterprises address their current integration challenges while giving them the manageability, scalability, and reliability they need for the future.

North America Operational Intelligence Market Trends

Cloud Accounts for Significant Market Share

- Cloud deployment is expected to hold a prominent market share owing to the added benefits, such as cost-saving, accessibility, scalability, and centralized service. It is also expected that more than 83% of the enterprise workload will be in the cloud, out of which 41% of the enterprise workload will be run on public cloud platforms. Another 20% will be private-cloud-based, while 22% will rely on hybrid-cloud adoption.

- According to the survey by Flexera, cloud strategy is increasingly focused on hybrid instead of public and private. A hybrid cloud is a new norm for businesses delivering products and services. According to Flexera, the hybrid cloud penetration rate increased to 72% in 2023.

- Moreover, cost-effectiveness plays a crucial role in driving cloud adoption for operational intelligence. Cloud providers offer a pay-as-you-go model, eliminating the need for substantial upfront investments in hardware and infrastructure. This allows businesses to allocate resources efficiently, investing in operational intelligence tools as necessary. The cloud's elasticity ensures that organizations only pay for the resources they consume, making it an attractive option for companies looking to optimize their operational intelligence efforts while managing costs.

- Furthermore, the speed and agility of cloud-based operational intelligence solutions are invaluable in today's fast-paced business landscape. Real-time data analysis enables organizations to make informed decisions on the fly, respond swiftly to changing market conditions, and identify emerging trends. The cloud's distributed architecture and advanced analytics capabilities empower businesses to derive actionable insights from diverse data sources in record time.

Retail is Expected to Account For Significant Market Share

- The adoption of AI in the retail industry automates retail-related processes with lesser manual work, faster delivery, better customer and order management, and streamlined operations, all of which eventually reduce costs.

- Moreover, retail infrastructure is complex and distributed and includes POS (point of sale), checkout terminals, self-checkout units, PCs, and back-office servers. Thus, the increasing dependency on IT, ranging from wholesalers and distributors to manufacturers and suppliers, demands an integrated infrastructure that enables a seamless retail value chain. This caters to the growth of operational intelligence.

- According to Oxford Economics, 83% of large retailers consider digital transformation a core business goal. Oxford also highlighted the traction from small and midsize retailers ((59%) and their belief in digital transformation. In the era where digital transformation is gaining traction, the market studied is expected to grow along with the retail sector's inclination to transform.

- Additionally, the retail sector is increasingly witnessing the adoption of cloud-based solutions, as they integrate several verticals, like inventory and order processing, thus improving the restocking capabilities.

- Furthermore, with cloud computing, retailers may have enterprise-wide supply chain visibility. Recently, Gap Inc. adopted cloud technology across its global operations for its Intermix brand. The fashion retailer has deployed cloud services provided by Oracle, with solutions comprising retail merchandising, integration, and inventory management.

North America Operational Intelligence Industry Overview

The North American operational intelligence market is marked by fragmentation and fierce competition, featuring a wide range of vendors, both large and small, that offer comprehensive visibility and insights into business operations. This enables companies to make informed, data-driven decisions. Notable key players in this dynamic market include Vitria Technology Inc. and Splunk Inc., among others.

In May 2023, SAP SE announced a strategic collaboration with IBM. Under this partnership, SAP will be integrating IBM Watson technology into its solutions. This integration is set to empower SAP SE in delivering advanced AI-driven insights and automation, accelerating innovation, and enhancing user experiences throughout its extensive solution portfolio.

In August 2022, the National Rural Telecommunications Cooperative (NRTC) unveiled the general availability of its operational intelligence platform. This platform is characterized by its vendor-agnostic analytics capabilities, designed to optimize the operations of broadband providers. Leveraging real-time data analysis and machine learning, this platform proactively identifies subscriber issues and potential service disruptions, enabling providers to address these concerns before they impact users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for Real Time Data Analytics

- 5.1.2 Increasing Adoption of Big Data Analytics and the Internet-of-Things (IoT)

- 5.2 Market Restraints

- 5.2.1 Combining Data from Multiple Data Sources

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By End-user Vertical

- 6.2.1 Retail

- 6.2.2 Manufacturing

- 6.2.3 BFSI

- 6.2.4 Government

- 6.2.5 IT and Telecommunication

- 6.2.6 Military and Defense

- 6.2.7 Transportation and Logistics

- 6.2.8 Healthcare

- 6.2.9 Energy and Power

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vitria Technology Inc.

- 7.1.2 Splunk Inc.

- 7.1.3 SAP SE

- 7.1.4 Inside Analysis (The Bloor Group)

- 7.1.5 Software AG

- 7.1.6 Schneider Electric SE

- 7.1.7 Rolta India Limited

- 7.1.8 SolutionsPT Ltd

- 7.1.9 IBENOX Pty Ltd

- 7.1.10 Turnberry Corporation

- 7.1.11 HP Inc.

- 7.1.12 OpenText Corporation