|

市场调查报告书

商品编码

1640374

拉丁美洲能源管理系统:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Latin America Energy Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

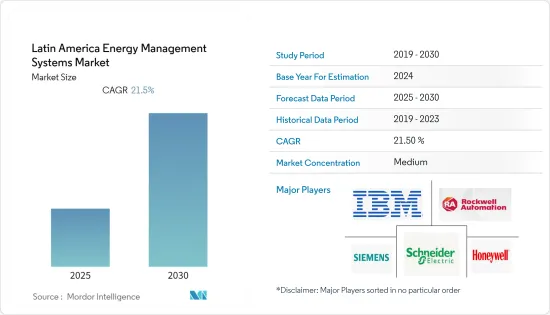

预测期内,拉丁美洲能源管理系统市场预计将以 21.5% 的复合年增长率成长。

小讯号分析等 EMS 的现代发展正在推动节能係统的增加和碳足迹的减少。此外,IBM 公司、霍尼韦尔国际公司和施耐德电气等公司正在将资料分析软体纳入其当前的 EMS 模组中,以便有效地监控资料。这些公司还正在建立和推出特定行业的 EMS 软体平台,以帮助企业规范和提供正确的解决方案,这可能会增加拉丁美洲 EMS 行业新产品的扩充性。

智慧电网和智慧电錶的广泛应用推动了该行业的发展。随着能源消费量的增加和电力基础设施的老化,世界各国政府越来越多地转向智慧电网技术来实现其能源基础设施的现代化。随着许多政府开始对电网进行现代化改造,能源效率解决方案的市场正在不断扩大。

根据联合国预测,到2050年拉丁美洲和加勒比海地区人口将超过7.5亿,比现在增加16%。 2021 年 1 月,国际原子能机构和国际专家将举办研讨会,讨论如何使用MAED 和其他国际原子能机构能源建模工具来製定需求情景,以预测和应对该地区日益增长的能源需求。了分析,并解释瞭如何用于制定适当的计划。

由于最近的 COVID-19 疫情,全球各地的居民用电部门因隔离而经历了大幅增长。相较之下,2020年第一季工业能源消费量大幅下降。 Wind Europe 执行长表示,该公司预计新风电发电工程将因新冠疫情而推迟,这可能导致开发商错过国家竞标系统的启动窗口并遭受经济处罚。

拉丁美洲能源管理系统市场趋势

巴西占据 EMS 市场主要份额

巴西政府宣布拨款约2亿美元用于智慧电网建设。该国还宣布计划于 2021 年在全国推广智慧电錶。上述因素加上该国对可再生能源发电的高度重视,预计将推动巴西智慧燃气表市场的发展。

随着巴西对天然气的需求不断增长以及管道建设的推进,公共产业部门现在正在利用物联网在其整个营运过程中推广智慧燃气表。智慧型瓦斯表系统已成为最受欢迎的选择,现在可以提供计费准确性、即时资料监控和改进的客户服务。

智慧燃气表市场是巴西智慧燃气表行业利润丰厚的领域,近来,由于该地区生质燃料和天然气行业产品部署强劲,智慧燃气表行业取得了前所未有的增长,并创造了利润。此外,智慧瓦斯表概念现已在巴西圣保罗、里约热内卢、巴拉那和亚马逊等六个州实施,并由当地供应商加入,有助于推动市场成长。

Enel 在其营运地区建立了智慧城市建设绩效。全部区域的多个智慧城市计划正在致力于向公众提供宽频,例如巴西涵盖 300 个城市的 Rede Cidade Digital。

拉丁美洲能源效率趋势日益增强

拉丁美洲是智慧型能源全球化的巨大潜在市场。根据智慧能源国际预测,到 2029 年,该地区将安装超过 8,500 万台智慧电錶。巴西、阿根廷、墨西哥、哥伦比亚、智利和秘鲁等国家正处于领先地位,预计届时将部署数百万台智慧电錶。重要的是,智慧电网可以帮助大幅提高能源供应的效率和可靠性,确保所有人更公平地分配能源。

同时,该地区也面临独特的障碍。本地能源中介、分散式发电和储能、微电网和电动车也是拉美地区的巨大机会。投资解决上述问题的技术将支撑和推动拥抱这些进步的智慧能源转型。

该地区正在经历都市化和经济成长,对能源服务和基础设施的需求不断增加。因此,该地区的城镇可以选择从城市规划的早期阶段开始整合可再生能源,并在扩建现有基础设施时利用当地现有的大规模可再生资源。例如,智利圣地牙哥是拉丁美洲的主要城市之一,人口约680万,正在推动该地区的能源革命。该市正在大力推动将电动公车引入其公共交通系统。

拉丁美洲能源管理系统产业概况

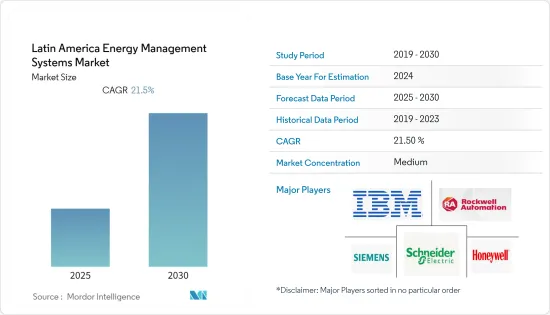

能源管理系统市场竞争激烈,有几家大公司在竞争。但从市场占有率来看,目前只有少数几家大公司占据市场主导地位。这些占据市场主导份额的企业正致力于扩大海外基本客群。这些公司正在利用策略合作措施来增加市场占有率和盈利。主要参与者是IBM公司和罗克韦尔自动化公司。近期市场发展趋势如下:

- 2021 年 6 月 罗克韦尔自动化推出能源管理平台解决方案,该解决方案整合了物联网技术和行业专业知识,可提供有意义、可操作的即时资料,用于管理製造营运中最关键的公共事业。例如空气、水、气体、电力和蒸气。

- 2021 年 1 月,脱碳和人工智慧物联网 (AIoT) 技术的全球先驱 Envision Digital International Pte Ltd 与 IBM 宣布合作打造永续能源管理解决方案。此次伙伴关係将帮助世界各地的企业和政府在数位转型过程中实现其业务目标和能源效率目标。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 智慧电网和智慧电錶的使用日益增多

- 增加能源效率投资

- 市场限制

- 初始安装和维护成本高

第六章 市场细分

- 按组件

- 硬体

- 软体

- 服务

- 按类型

- HEMS

- BEMS

- IEMS

- 按最终用户

- 製造业

- 电力和能源

- 资讯科技/通讯

- 卫生保健

- 其他最终用户

- 按地区

- 巴西

- 阿根廷

- 其他拉丁美洲国家

第七章 竞争格局

- 公司简介

- IBM Corporation

- Rockwell Automation Inc.

- General Electric Co.

- Schneider Electric SE

- Cisco Systems Inc.

- Tendril Networks Inc.

- Eaton Corporation

- EnerNOC Inc.

- Elster Group GmbH

- SAP SE

- Siemens AG

- Honeywell International Inc.

第八章投资分析

第九章:市场的未来

The Latin America Energy Management Systems Market is expected to register a CAGR of 21.5% during the forecast period.

There has been a rise in energy-efficient systems and a reduction in carbon footprint due to developments in the newest technologies in EMS, such as tiny signal analysis. Furthermore, firms like IBM Corporation, Honeywell International Inc., and Schneider Electric have incorporated data analytics software into their current EMS modules to monitor data efficiently. These companies have also created and launched sector-specific EMS software platforms to help businesses regulate and supply adequate solutions, which is likely to boost the scalability of new products in the Latin American EMS industry.

The industry is being driven by the growing use of smart grids and smart meters. With rising energy consumption and outdated power infrastructure, governments worldwide are increasingly turning to smart grid technologies to modernize their energy infrastructures. The market for energy efficiency solutions is growing as many governments embark on modernization initiatives to modernize their power grids.

According to UN predictions, Latin America and the Caribbean would have over 750 million people by 2050, up by 16% from now. In January 2021, the IAEA and international experts held a workshop to illustrate how MAED and the Agency's other energy modeling tools may be used to analyze demand scenarios and plan appropriately to help foresee and prepare for the region's expanding energy need.

Because of the recent COVID-19 pandemic, the worldwide residential power sector experienced a considerable increase due to quarantines. In contrast, industrial energy consumption fell dramatically in the first quarter of 2020. According to the CEO of Wind Europe, the firm expects delays in new wind farm projects due to the COVID-19 pandemic, which may force developers to miss deployment dates in nations' auction systems and suffer financial penalties as a result.

Latin America Energy Management Systems Market Trends

Brazil to Hold a Major Share in the EMS Market

The Brazilian government announced funding of around USD 200 million to develop smart grids. It also announced plans to deploy smart meters in the entire country by 2021. The aforementioned factors, coupled with Brazil's strong focus on renewable energy generation, are expected to drive the Brazilian smart gas meter market.

With the growing need for natural gas and the construction of pipelines in Brazil, the utility sector is now leveraging the benefits of the Internet of Things to bring about smart gas meters in various businesses. Smart gas metering systems have become the most desirable option, and they are now providing billing accuracy, real-time data monitoring, and improved customer service.

The smart gas meter market acts as a lucrative vertical for the overall smart metering industry in Brazil, and it was recently bestowed with unprecedented gains driven by robust product deployment across the biofuel and natural gas sectors in the region. Besides, the smart gas metering concept is now present in six Brazilian states, including Sao Paulo, Rio de Janeiro, Parana, and the Amazonas, involving local providers and consequently boosting the market growth.

Enel accomplished a significant smart city track record in its areas of presence. Some smart city projects across the Latin American region have strived to make broadband accessible to the public, such as Brazil's Rede Cidade Digital, which comprises 300 municipalities.

Increasing Trends Toward Energy Efficiency in Latin America

Latin America is a huge potential market for smart energy globalization. According to the Smart Energy International Projections, by 2029, the area would have deployed over 85 million smart meters. Countries like Brazil, Argentina, Mexico, Colombia, Chile, and Peru are leading the way and will have deployed millions of smart meters by then. Importantly, it is a location where the smart grid's benefits can result in significant increases in energy supply efficiency and reliability, as well as a fair distribution of energy to all.

At the same time, there are unique obstacles that this region faces. Local energy brokering, distributed generation and storage, micro-grids, and electric vehicles also present significant opportunities for LATAM. Investments in technology that address the problems raised above can also serve as the foundation and enablers for a smart energy transition that incorporates these advances.

With increased urbanization and economic growth in the region, there is a greater need for energy services and infrastructure. As a result, towns in the region have the option to integrate renewable energy from the start of the urban planning process and in the extension of existing infrastructure, allowing them to make use of the large renewable resources accessible locally. For example, Santiago de Chile, with a population of around 6.8 million people, is one of the main cities in Latin America, pushing the region's energy revolution. The city has pushed hard for electric buses to be included in its public transportation system.

Latin America Energy Management Systems Industry Overview

The energy management systems market is competitive and consists of several major players. However, in terms of market share, few of the major players currently dominate the market. With a prominent share in the market, these market players are focusing on expanding their customer bases across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market shares and profitability. The key players are IBM Corporation and Rockwell Automation Inc. Recent developments in the market are -

- June 2021: Rockwell Automation integrated IoT technology with industry expertise to build an energy management platform solution that gives meaningful, actionable real-time data to manage a variety of the manufacturing processes' most important utilities. Air, water, gas, electricity, and steam are all examples of this.

- January 2021: Envision Digital International Pte Ltd, a global pioneer in decarbonization and Artificial Intelligence of Things (AIoT) technologies, and IBM announced a partnership to create sustainable energy management solutions. The partnership will assist businesses and governments throughout the world in achieving business objectives and meeting energy efficiency targets while advancing on their digital transformation journeys.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage of Smart Grids and Smart Meters

- 5.1.2 Rising Investments in Energy Efficiency

- 5.2 Market Restraints

- 5.2.1 High Initial Installation Costs Coupled with Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 Type

- 6.2.1 HEMS

- 6.2.2 BEMS

- 6.2.3 IEMS

- 6.3 End User

- 6.3.1 Manufacturing

- 6.3.2 Power and Energy

- 6.3.3 IT and Telecommunication

- 6.3.4 Healthcare

- 6.3.5 Other End Users

- 6.4 Geography

- 6.4.1 Brazil

- 6.4.2 Argentina

- 6.4.3 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 General Electric Co.

- 7.1.4 Schneider Electric SE

- 7.1.5 Cisco Systems Inc.

- 7.1.6 Tendril Networks Inc.

- 7.1.7 Eaton Corporation

- 7.1.8 EnerNOC Inc.

- 7.1.9 Elster Group GmbH

- 7.1.10 SAP SE

- 7.1.11 Siemens AG

- 7.1.12 Honeywell International Inc.