|

市场调查报告书

商品编码

1640403

快速消费品包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)FMCG Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

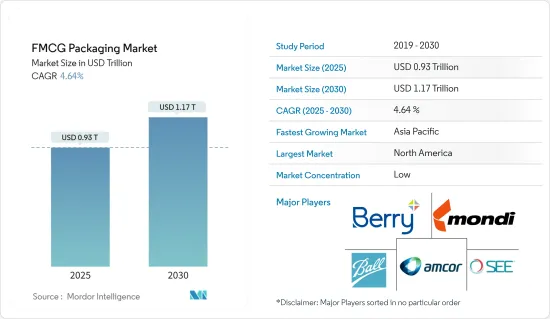

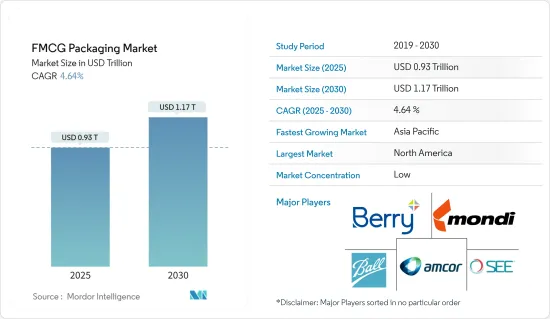

2025 年快速消费品包装市场规模预估为 9,300 亿美元,预计到 2030 年将达到 1.17 兆美元,预测期内(2025-2030 年)的复合年增长率为 4.64%。

主要亮点

- 快速消费品(FMCG)包装市场是更广泛的包装产业的重要部分。其主要使命是保存、保护和展示日常用品,从食品、饮料到个人护理和家居用品。产品週转速度快的市场对包装解决方案的要求越来越高,需要的是方便、耐用、安全的包装解决方案。包装不仅有保护作用,还能作为品牌的差异化因素,维持产品品质,满足消费者的需求,凸显其在快速消费品成功中的重要性。

- 永续性正在成为快速消费品包装领域的主导趋势。消费者对包装材料对环境影响的认识不断提高,推动了人们对传统塑胶的淘汰。公司正在研究生物分解性塑胶、可回收材料和植物来源材料等替代品。这种永续性的动力是由世界各国政府旨在减少塑胶废弃物和增加回收的法规所推动的,迫使快速消费品公司采用更环保的包装解决方案。

- 便利性是快速消费品包装的另一个关键驱动因素。可重新密封的袋子、单份量和便携式容器等简化消费者使用的功能越来越受欢迎。随着现代生活方式变得越来越忙碌,对易于处理、储存和处理的包装的需求也越来越大。为了应对这种情况,快速消费品公司正在透过便利至上的设计进行创新,以确保产品的新鲜度和品质在旅途中保持。

- 电子商务的兴起正在重塑快速消费品包装格局。随着越来越多的消费者透过线上平台购买快速消费品,包装需要足够坚固以承受配送的挑战。这需要一种坚固且易于打开和处理的保护解决方案。随着网路零售的蓬勃发展,快速消费品品牌正在投资于在运输过程中保护其产品的包装。

- 旨在提高环境安全的政府法规正在重塑快速消费品包装格局。透过不鼓励使用一次性塑胶并推广永续替代品,这些法规正在推动企业转向可回收、生物分解性和可堆肥的包装。但这样的转变往往伴随着挑战。环保选择可能更加昂贵且采购更加复杂。此外,生产者责任延伸(EPR)计画等倡议,加上对强大的废弃物管理基础设施的需求,为企业带来了物流和财务障碍。虽然这些法规可能会在短期内限制市场弹性,但它们将鼓励永续包装的创新,并推动企业采取环保做法。随着消费者对环保产品的需求不断增加,这些变化可能为快速消费品产业的长期成长机会铺平道路。

- 快速消费品包装市场前景光明,成长前景看好。推动这一扩张的因素包括消费者对包装商品的需求不断增长、电子商务的蓬勃发展以及对永续性的日益关注。随着企业将资源投入到包装创新中,重点将放在提高性能的同时减少对环境的影响。随着永续性成为市场差异化因素,快速消费品包装正在适应具有环保意识的消费者和监管要求,为新的创新和成长铺平了道路。

快速消费品包装市场的趋势

预计造纸业将占据主要份额

- 随着企业寻求传统塑胶包装的永续替代品,快速消费品包装市场越来越多地转向纸质包装。纸张是一种可再生和生物分解性的材料,它正日益取代塑胶用于包装各种快速消费品,包括食品、饮料、个人护理用品和家用产品。这种转向纸质包装的原因是人们担心环境问题、消费者对环保产品日益增长的需求以及政府对控制塑胶废弃物的监管。

- 快速消费品包装中纸张的主要优势之一是其永续性。与可以在垃圾掩埋场中存留数百年的塑胶包装不同,纸张具有生物分解性和可回收性,大大减少了我们对环境的影响。随着消费者的环保意识不断增强,企业开始转向纸包装,以符合永续性目标并遵守针对塑胶污染的法规。这种转变在食品包装等领域尤其重要,这些领域迫切需要安全、环保的一次性塑胶替代品,同时又不影响产品品质。

- 纸包装除了永续性之外,还具有多功能和可客製化的特性。它们可以具有不同的形状和尺寸以适应一系列的快速消费品。例如,纸板和硬纸板用于饮料、零食和其他消费品。在纸上列印生动的图形可以让您的品牌脱颖而出并增加货架吸引力。此外,纸质包装重量轻且耐用,可确保您的产品安全地到达消费者手中。

- 转向纸质包装也是为了应对日益增加的塑胶监管压力。在全球范围内,各国政府正在加强对塑胶包装,尤其是一次性包装的监管。欧盟、印度和东南亚国家走在了前列,纷纷颁布或计划对塑胶包装实施禁令或课税。这些法规正在推动快速消费品公司转向纸张等永续替代品,以帮助它们避免合规障碍并在市场上保持竞争力。

- 然而,向纸质包装的转变是一个挑战。儘管纸张更具永续,但有时您需要比塑料更高的耐用性或阻隔性。这对于需要防潮和延长保质期的物品(例如某些食品)至关重要。因此,公司面临的挑战是提出并创新纸张解决方案,提供这些保护性能,同时保持永续性。此外,纸包装可能比塑胶包装更贵,这可能会影响敏感市场的产品定价。

- 快速消费品市场向纸质包装的转变标誌着遏制塑胶废弃物和支持永续性的关键倡议。随着消费者越来越喜欢环保产品并且法规越来越严格,纸质包装的重要性必将日益增加,尤其是在食品和饮料领域。儘管性能和成本挑战依然存在,但纸本解决方案的不断创新预示着其将持续在快速消费品领域中得到应用。

- 例如,2024 年 6 月,包装解决方案领导者 Saika Group 和快速消费品领域的主要参与者 Mondelez 宣布推出新的纸製品。这种创新包装专为糖果零食、饼干和巧克力行业的多件包装而开发,并且可在纸质废物流中回收。它具有出色的热封性,并且可以根据所需的效果製造涂层或无涂层。

- 预计全球纸张消费量将从 2022 年的 4.15 亿吨增长至 2032 年的 4.76 亿吨,各行业对纸张的需求都在快速增长,尤其是快速消费品包装。随着永续性得到消费者和政府的青睐,纸质包装越来越受到人们的青睐,取代了塑胶包装。纸张消费量的增加凸显了纸质包装解决方案的采用激增。

- 这种转变是由消费者对环保产品的偏好日益增加,以及控制塑胶废弃物的监管压力不断增加所推动的。这些趋势与快速消费品包装的全面变革相呼应,各公司纷纷转向纸本解决方案,以实现环保目标并满足消费者对更环保包装替代品的需求。

亚太地区预计将占据主要市场占有率

- 由于亚太地区人口庞大、收入不断增加、都市化进程加快以及对永续包装的重视,亚太地区快速消费品包装市场正在蓬勃发展。亚洲是全球成长最快的消费市场之一,并将成为全球快速消费品包装市场的前列。包装在食品、饮料、个人护理、家居和保健产品等无数产品的销售和分销中发挥着至关重要的作用。

- 便利性是推动亚洲快速消费品包装市场发展的关键催化剂。随着消费者越来越注重便利性,对于易于使用、便携且省时的包装的需求正在飙升。特别是在城市中心,对即食食品、包装零食和饮料的需求日益增长,尤其是那些具有可重新密封的轻质包装的食品。此外,电子商务的蓬勃发展和线上食品宅配服务的兴起也扩大了对包装的需求,这种包装不仅要耐用、具有保护性,而且还要能承受运输和处理过程中的严格要求。

- 亚洲蓬勃发展的中阶是推动快速消费品包装市场的另一个重要力量。随着可支配收入的增加,人们明显转向高级产品,这些产品通常具有精美的高品质包装。这一趋势在印度、印尼和菲律宾等新兴市场尤其明显,这些市场的消费者越来越倾向于具有附加价值的品牌高端快速消费品。在这些市场中,包装成为吸引消费者的关键因素,推动公司投资创新和视觉衝击力强的设计,使其产品脱颖而出。

- 在不断发展的快速消费品包装市场中,几个亚洲国家已经成为焦点。中国正在利用其庞大的消费群来推广永续性和便利的包装,而这一趋势因其蓬勃发展的电子商务产业而进一步加剧。印度的都市化和收入成长推动了包装食品需求的激增,使其成为永续和创新包装解决方案的重要市场。由于严格的环境法规和挑剔的消费者,日本在环保包装创新方面处于主导。韩国对创新和环保包装解决方案的需求强劲。

- 在消费需求激增和产品价格上涨的推动下,印度快速成长的快速消费品产业为包装产业创造了巨大的机会。根据印度品牌资产基金会的数据,快速消费品市场在 2023 年的价值为 1,670 亿美元,预计在 2021 年至 2027 年期间的复合年增长率将达到 27.9%,达到 6,158.7 亿美元。这种成长凸显了对有效和永续包装解决方案日益增长的需求。都市区消费者在 2022 年占据了快速消费品市场的 65%,他们正在推动对包装商品的需求,尤其是食品、饮料、个人护理和家居用品等类别。同时,农村地区占据了35%以上的市场,迫切需要多样化的包装解决方案来满足不同的消费者偏好和购买行为。

- 此外,印度包装食品市场规模预计将从 2022 年的 513 亿美元增至 2025 年的 675 亿美元,2026 年的 702 亿美元,为快速消费品包装产业提供黄金机会。随着这个市场的成长,对于确保产品新鲜度、提供便利性并符合永续性趋势的包装的需求也日益增加。为了满足这项需求,快速消费品包装公司正在转向生物分解性塑胶、纸包装和可回收材料等解决方案,以激发都市区和农村地区日益增强的环保意识,吸引消费者。

快速消费品包装产业概况

快速消费品包装市场分散,主要企业包括 Ball Corporation、Berry Global Inc.、Sealed Air Corporation、Mondi Group 和 Amcor Group。这些公司正在透过创新、合作、併购和对永续包装解决方案的投资积极扩展业务,以满足不断变化的消费者需求。此外,为了提高市场竞争力,我们也专注于提高业务效率并引进尖端技术。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 电子商务激增推动快速消费品包装需求

- 对小型、方便包装产品的需求不断增加

- 市场限制

- 政府对环境安全的严格监管限制了市场

第六章 市场细分

- 依材料类型

- 纸和纸板

- 塑胶

- 金属

- 玻璃

- 按应用

- 食物

- 饮料

- 化妆品和个人护理

- 药品

- 家居用品

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚洲

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 哥伦比亚

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- Amcor Group

- Ball Corporation

- Mondi Group

- DS Smith PLC

- Sealed Air Corporation

- Consol Glass(Pty)Ltd

- Nampak Ltd

- Astrapak Ltd(RPC Group)

- Mpact Pty Ltd

- Crown Holdings Inc.

- Stora Enso Oyj

- Constantia Flexibles GmbH

- Toyo Seikan Kaisha Limited

- Berry Global Inc.

- East African Packaging Industries Ltd(EAPI)

- Albea SA

- Tetra Pak International SA

- Bonpak(Pty)Ltd

- Frigoglass South Africa(Pty)Ltd

第八章投资分析

第九章:未来市场展望

The FMCG Packaging Market size is estimated at USD 0.93 trillion in 2025, and is expected to reach USD 1.17 trillion by 2030, at a CAGR of 4.64% during the forecast period (2025-2030).

Key Highlights

- The Fast-Moving Consumer Goods (FMCG) packaging market is a pivotal segment of the broader packaging industry. Its primary mission is to preserve, protect, and present everyday items, ranging from food and beverages to personal care and household products. Characterized by rapid product turnover, the market increasingly demands packaging solutions that prioritize convenience, durability, and safety. Beyond mere protection, packaging serves as a brand differentiator, upholds product quality, and caters to consumer needs, underscoring its significance in the success of FMCG products.

- Sustainability is emerging as a dominant trend in the FMCG packaging arena. Heightened consumer awareness regarding the environmental repercussions of packaging materials is steering a move away from conventional plastics. Companies are delving into alternatives like biodegradable plastics, recyclable materials, and plant-based options. This sustainability push is bolstered by global government regulations targeting plastic waste reduction and recycling promotion, compelling FMCG firms to embrace greener packaging solutions.

- Convenience is another pivotal driver in FMCG packaging. Features that simplify consumer use-like resealable bags, single-serve portions, and portable containers-are gaining traction. As modern lifestyles grow busier, there's a heightened demand for easy packaging to handle, store, and dispose of. In response, FMCG companies are innovating designs prioritizing convenience, ensuring products remain fresh and high-quality, even on the go.

- The surge of e-commerce is reshaping the FMCG packaging landscape. Packaging must be robust enough to endure shipping challenges with more consumers turning to online platforms for their FMCG needs. This necessitates sturdy protective solutions and is easy to open and dispose of. As online retail burgeons, FMCG brands are channeling investments into packaging that safeguards products during transit, all while being cost-effective and visually appealing to online consumers.

- Government regulations aimed at enhancing environmental safety are reshaping the FMCG packaging landscape. By curbing single-use plastics and pushing for sustainable alternatives, these regulations steer companies towards recyclable, biodegradable, or compostable packaging. However, such transitions often come with challenges: these eco-friendly options can be pricier and more complicated to source. Furthermore, initiatives like extended producer responsibility (EPR) programs, coupled with the need for robust waste management infrastructures, introduce both logistical and financial hurdles for businesses. While these regulations may constrain market flexibility in the near term, they spur innovation in sustainable packaging and promote eco-conscious practices among companies. As consumer demand for environmentally responsible products grows, these shifts could pave the way for long-term growth opportunities in the FMCG sector.

- The future looks bright for the FMCG packaging market, with growth on the horizon. Factors fueling this expansion include rising consumer demand for packaged goods, the e-commerce boom, and an intensified focus on sustainability. As companies pour resources into packaging innovations, the emphasis will be on enhancing performance while curbing environmental impact. With sustainability carving out a niche as a market differentiator, FMCG packaging is set to adapt, catering to eco-conscious consumers and regulatory demands, paving the way for fresh avenues of innovation and growth.

FMCG Packaging Market Trends

Paper Segment is Expected to Hold Major Share

- As companies seek sustainable alternatives to traditional plastic packaging, the FMCG packaging market is increasingly turning to paper. Paper, a renewable and biodegradable material, is now replacing plastics in packaging for various FMCG products, spanning food, beverages, personal care items, and household goods. This shift towards paper packaging is fueled by environmental concerns, a growing consumer demand for eco-friendly options, and government regulations to curb plastic waste.

- One of the primary benefits of paper in FMCG packaging is its sustainability. Unlike plastic packaging, which can linger in landfills for centuries, paper's biodegradable and recyclable nature significantly lessens environmental impact. With consumers becoming more eco-conscious, companies are pivoting to paper-based packaging to align with sustainability goals and adhere to regulations targeting plastic pollution. This transition is especially pertinent in sectors like food packaging, where there's a pressing need for safe, eco-friendly materials that can substitute single-use plastics without compromising product quality.

- Beyond its sustainability, paper packaging boasts versatility and customization. It can be shaped and sized to cater to various FMCG products. For instance, beverages, snacks, and other consumer goods use paperboard and corrugated cardboard. The capability to print vibrant graphics on paper enables brands to stand out and boost shelf appeal. Moreover, paper packaging can be crafted to be lightweight yet durable, ensuring products reach consumers safely.

- The shift to paper packaging also responds to mounting regulatory pressures on plastics. Globally, governments are tightening the reins on plastic packaging, especially single-use variants. The European Union, India, and various Southeast Asian countries are at the forefront, having enacted or planning bans or taxes on plastic packaging. Such regulations nudge FMCG companies towards sustainable alternatives like paper, helping them sidestep compliance hurdles and retain market relevance.

- Yet, transitioning to paper packaging is challenging. While paper is more sustainable, it sometimes needs more durability or barrier properties than plastic. This is crucial for items needing moisture protection or extended shelf life, like certain foods. Companies are thus challenged to innovate, crafting paper solutions that offer these protective traits while staying true to sustainability. Furthermore, paper packaging can occasionally come at a premium compared to plastic, potentially affecting product pricing in sensitive markets.

- The FMCG market's pivot to paper packaging marks a pivotal move towards curbing plastic waste and championing sustainability. With consumers increasingly favoring eco-friendly products and regulations tightening, paper packaging's prominence is set to rise, especially in the food and beverage sectors. While challenges in performance and cost persist, the relentless innovation in paper solutions bodes well for its continued adoption in the FMCG realm.

- For instance, in June 2024, Saica Group, a frontrunner in packaging solutions, and Mondelez, a major player in the FMCG arena, unveiled a new paper-based product. This innovative packaging, tailored for multipacks in the confectionery, biscuit, and chocolate sectors, is recyclable within the paper waste stream. It's adept for heat sealing and can be produced either coated or uncoated, based on the desired finish.

- Global paper consumption is projected to rise from 415 million metric tons in 2022 to an estimated 476 million metric tons by 2032, underscoring the surging demand for paper across diverse sectors, notably in FMCG packaging. With sustainability gaining traction among consumers and governments alike, paper is increasingly favored over plastic packaging. This anticipated uptick in paper consumption underscores the burgeoning adoption of paper-based packaging solutions.

- This shift is propelled by a growing consumer preference for eco-friendly products and mounting regulatory pressures to curb plastic waste. Such trends resonate with the overarching evolution in FMCG packaging, where companies are pivoting towards paper-based solutions, aligning with environmental objectives, and responding to consumer calls for greener packaging alternatives.

Asia-Pacific Region is Expected to Hold Significant Market Share

- Asia Pacific's FMCG packaging market is booming, fueled by the continent's vast population, rising incomes, swift urbanization, and a pivot towards sustainable packaging. With Asia emerging as one of the globe's fastest-growing consumer markets, it's set to spearhead the global FMCG packaging arena. Packaging plays a pivotal role in the sale and distribution of a myriad of goods, from food and beverages to personal care, household items, and healthcare products.

- Convenience is a primary catalyst propelling Asia's FMCG packaging market. As consumers prioritize convenience, there's a surge in demand for user-friendly, portable, and time-efficient packaging. Urban centers, in particular, are witnessing heightened demand for ready-to-eat meals, packaged snacks, and beverages, especially those boasting resealable and lightweight packaging. Moreover, the e-commerce boom and the rise of online food delivery services amplify the demand for packaging that's not only durable and protective but also adept at withstanding the rigors of shipping and handling.

- The burgeoning middle class in Asia is another pivotal force driving the FMCG packaging market. With rising disposable incomes, there's a marked shift towards premium products, often accompanied by attractive, high-quality packaging. This trend is especially pronounced in emerging markets like India, Indonesia, and the Philippines, where consumers gravitate towards branded, premium FMCG offerings that promise added value. Packaging becomes a decisive factor in consumer attraction in these markets, prompting companies to invest in innovative and visually striking designs to set their products apart.

- Several Asian countries are taking center stage in the evolving FMCG packaging market. China, leveraging its vast consumer base, is championing sustainability and pushing for convenient packaging, a trend amplified by its booming e-commerce sector. Urbanization and rising incomes drive a surge in packaged food demand in India, positioning it as a pivotal market for sustainable and innovative packaging solutions. With its stringent environmental regulations and discerning consumers, Japan is leading the charge in eco-friendly packaging innovations. South Korea is seeing a robust appetite for innovative and eco-conscious packaging solutions.

- India's booming FMCG sector is creating substantial opportunities for the packaging industry, fueled by surging consumer demand and escalating product prices. The FMCG market, valued at USD 167 billion in 2023, is on track to grow at a CAGR of 27.9% from 2021 to 2027, potentially hitting the USD 615.87 billion mark, as per the Indian Brand Equity Foundation. This growth underscores the escalating demand for effective and sustainable packaging solutions. Urban consumers, who made up 65% of the FMCG market in 2022, are leading the charge in demand for packaged goods, especially in categories like food, beverages, personal care, and household items. Meanwhile, with rural areas accounting for over 35% of the market, there's a pronounced need for diverse packaging solutions tailored to varied consumer preferences and buying behaviors.

- Further, India's packaged food market, set to rise from USD 51.3 billion in 2022 to an estimated USD 67.5 billion by 2025 and USD 70.2 billion by 2026, offers a golden opportunity for the FMCG packaging sector. As this market grows, there's an escalating demand for packaging that ensures product freshness, offers convenience, and aligns with sustainability trends. To meet these demands, FMCG packaging companies are pivoting towards solutions like biodegradable plastics, paper-based packaging, and recyclable materials, appealing to both urban and rural consumers who are becoming increasingly eco-conscious.

FMCG Packaging Industry Overview

The FMCG packaging market is fragmented and features key players, including Ball Corporation, Berry Global Inc., Sealed Air Corporation, Mondi Group, and Amcor Group. These companies are actively expanding their businesses through innovations, collaborations, mergers and acquisitions, and investments in sustainable packaging solutions to meet evolving consumer demands. Additionally, they focus on enhancing operational efficiency and adopting advanced technologies to gain a competitive edge in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Surge in E-commerce Drives Demand for FMCG Packaging

- 5.1.2 Increasing Demand For Small Sized and Convenient Packaged Products

- 5.2 Market Restraint

- 5.2.1 Strict Government Regulations on Environmental Safety Limit the Market

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Paper and Paperboard

- 6.1.2 Plastics

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 By Application

- 6.2.1 Food

- 6.2.2 Beverages

- 6.2.3 Cosmetics and Personal Care

- 6.2.4 Pharmaceuticals

- 6.2.5 Household Care

- 6.2.6 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Mexico

- 6.3.5.3 Colombia

- 6.3.6 Middle East and Africa

- 6.3.6.1 United Arab Emirates

- 6.3.6.2 Saudi Arabia

- 6.3.6.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group

- 7.1.2 Ball Corporation

- 7.1.3 Mondi Group

- 7.1.4 DS Smith PLC

- 7.1.5 Sealed Air Corporation

- 7.1.6 Consol Glass (Pty) Ltd

- 7.1.7 Nampak Ltd

- 7.1.8 Astrapak Ltd (RPC Group)

- 7.1.9 Mpact Pty Ltd

- 7.1.10 Crown Holdings Inc.

- 7.1.11 Stora Enso Oyj

- 7.1.12 Constantia Flexibles GmbH

- 7.1.13 Toyo Seikan Kaisha Limited

- 7.1.14 Berry Global Inc.

- 7.1.15 East African Packaging Industries Ltd (EAPI)

- 7.1.16 Albea SA

- 7.1.17 Tetra Pak International SA

- 7.1.18 Bonpak (Pty) Ltd

- 7.1.19 Frigoglass South Africa (Pty) Ltd