|

市场调查报告书

商品编码

1640517

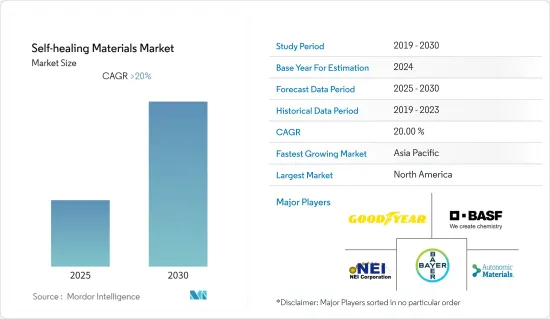

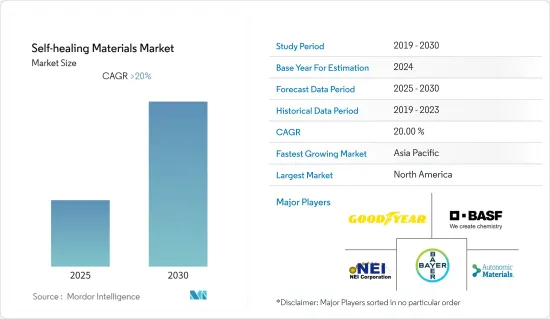

自修復材料:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Self-healing Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预测期内,自修復材料市场预计将以超过 20% 的复合年增长率成长。

COVID-19 对物流和製造业产生了重大影响,阻碍了市场成长。然而,该行业已经復苏,市场一直受到汽车、建筑和航太行业稳步扩张的推动。

关键亮点

- 新兴国家建筑业的不断扩大发展是推动市场发展的主要因素之一。医疗产业仿生技术中自修復材料的日益广泛使用也可能推动市场的发展。

- 然而,与传统材料相比,自修復材料的成本较高,阻碍了研究市场的成长。

- 随着人们认识的不断提高,汽车和电子产业越来越多地采用自修復材料,这可能为研究市场带来机会。

- 预计亚太地区将在预测期内出现最高成长率。

自修復材料的市场趋势

建筑业占据市场主导地位

- 自修復材料在建筑业发挥重要作用。这些材料具有快速修復裂缝的潜力,因为它们的自癒过程可以实现快速癒合。它用于混凝土中以加强建筑物和桥樑等结构的强度并延长其使用寿命。

- 不断发展的全球建筑业可能会推动对自修復材料的需求。

- 根据美国人口普查局的数据显示,2023年1月经季节性已调整的后按建筑许可建造的私人拥有住宅套数年率为133.9万套,比12月修订后的133.7万套高出0.1个百分点。

- 根据美国人口普查局当天的统计报告,2023年1月私人住宅竣工数量经季节性已调整的后年化率为140.6万套,较12月修订后的139.2万套下降1.0%,较12月修订后的124.7万套下降1.0%。

- 除了新住宅开发外,美国还在住宅维修方面投入大量资金。随着移民人口的不断增长,对復原的需求也日益增加。此外,人们对永续性和高效建筑重要性的认识不断提高,也刺激了修復趋势。

- 德国也核准在2022年10月建造25,399套住宅。根据联邦统计局 (Destatis) 的数据,这反映出自 2021 年 10 月以来颁发的建筑许可证数量减少了 14.2%。此外,2022 年 1 月至 10 月期间共颁发了 297,453 张住宅建筑许可证。

- 全球各地的所有这些建设活动都增加了工业对自修復材料的需求,推动了市场的发展。

亚太地区成长率最高

- 近年来,亚太地区对自修復材料的需求显着增长,尤其是来自中国和印度。由于材料寿命、耐用性、安全性、效率和性能的提高,亚太地区自修復材料的消费量预计将激增。

- 中国的建筑业正在快速扩张。根据中国国家统计局数据,2022年第四季度,中国建筑业产值约2,760亿元人民币(400亿美元),较上季成长50%。

- 未来七年,印度预计在住宅方面投资约1.3兆美元,建造6,000万住宅。印度也计划在2025年超越其成为世界第三大建筑市场的目标。对于建筑业,政府在 2022-23 年联邦预算中向公路运输和公路部拨款 6,000 亿印度卢比(77.2 亿美元)。

- 根据日本国土交通省预测,2022年建筑业投资金额预计约66.99兆日圆(5,081.6亿美元),与前一年同期比较增加0.6%。

- 此外,日本电子情报技术产业协会(JEITA)预计,截至2022年11月,日本电子领域总产值约为10.1兆日圆(845亿美元),与前一年同期比较约100.7%。与去年同期相比,截至 11 月份,日本的电子产品出口与前一年同期比较增近 15%。

- 因此,建设活动的活性化、汽车行业的兴起以及电子行业的成长正在促进自修復材料和其他应用的成长,预计这些应用将在预测期内推动市场发展。

自修復材料产业概况

自修復材料市场适度整合,主要企业占据相当大的市场占有率。市场的主要企业包括 Autonomic Materials, Inc.、固特异轮胎和橡胶公司、NEI、 BASF SE、拜耳等(不分先后顺序)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建筑业不断发展

- 自修復材料在仿生技术的应用不断扩大

- 其他驱动因素

- 限制因素

- 自我修復材料成本高

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 类型

- 聚合物

- 复合材料

- 陶瓷製品

- 混凝土的

- 其他的

- 最终用户产业

- 医疗

- 车

- 电气和电子

- 建造

- 航太

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Acciona, SA

- Apple Inc.

- Autonomic Materials, Inc.

- BASF SE

- Bayer AG

- Covestro AG

- Evonik Industries AG

- MacDermid Autotype Ltd.

- Michelin North America Inc.

- NEI Corporation

- The Goodyear Tire and Rubber Company

第七章 市场机会与未来趋势

- 汽车和电子行业越来越多地采用自修復材料

The Self-healing Materials Market is expected to register a CAGR of greater than 20% during the forecast period.

COVID-19 had a significant impact on the logistics and manufacturing industries, thus hampering the market growth. However, the industry started to recover, and from that onwards, the market is driven by steady expansion in the automotive, construction, and aerospace industries.

Key Highlights

- The increased development in the construction industry in emerging countries is one of the primary factors driving the market. The growing use of self-healing materials in biomimetics for the healthcare industry is also likely to propel the market.

- However, the high cost of self-healing materials as compared to conventional materials is hindering the growth of the market studied.

- The increasing adoption of self-healing materials in the automobile and electronics industry on the back of rising awareness is likely to act as an opportunity for the market studied.

- Asia-Pacific is expected to witness the highest growth rate during the forecast period.

Self-Healing Materials Market Trends

Construction Inudstry to Dominate the Market

- Self-healing materials play an essential role in the construction industry. These materials include the potential to rapidly fix the cracks as the self-healing process allows speedy treatment. It is used in concrete to strengthen and extend the life of buildings, bridges, and other structures.

- The ever-increasing global construction industry will likely increase the demand for self-healing materials.

- According to the US Census Bureau, the seasonally adjusted annual rate of privately owned housing units approved by building permits in January 2023 was 1,339,000, 0.1 percentage point higher than the revised December estimate of 1,337,000.

- The same statistical report by US Census Bureau also stated that privately owned housing completions were at a seasonally adjusted annual rate of 1,406,000 in January 2023, up 1.0% from the revised December estimate of 1,392,000 and 12.8% from the January 2022 pace of 1,247,000.

- Aside from new home development, the United States is investing heavily in home improvements. The necessity for rehabilitation became increasingly critical as the country's migrant population grew. In addition, the increased awareness of the importance of sustainability and high-efficiency constructions also fueled the restoration trend.

- Germany also approved the construction of 25,399 dwellings for October 2022. According to the Federal Statistics Office (Destatis), this reflects a 14.2% decrease in building permits from October 2021. Also, 297,453 residential building licenses were issued between January and October 2022.

- All these construction activities in various locations worldwide increase the demand for self-healing materials in the industry, propelling the market ahead.

Asia-Pacific to Witness the Highest Growth Rate

- In recent years, Asia-Pacific saw a considerable increase in demand for self-healing materials, particularly from China and India. The Asia-Pacific region's consumption of self-healing materials is predicted to skyrocket due to the materials' increasing lifespan, durability, safety, efficiency, and performance.

- China's building industry is expanding at a rapid pace. According to the National Bureau of Statistics of China, construction output in China was valued at around CNY 276 billion (USD 40 billion) in the fourth quarter of 2022, representing a 50% increase over the previous quarter.

- Over the next seven years, India is anticipated to see an investment of roughly USD 1.3 trillion in housing, with 60 million new dwellings being constructed. India also plans to surpass its goal of becoming the world's third-largest building market by 2025. Regarding the construction industry, the government allocated INR 60,000 crores (USD 7.72 billion) for the Ministry of Road Transport and Highways in the Union Budget 2022-23.

- According to Japan's Ministry of Land, Infrastructure, Transport, and Tourism (MLIT), overall investment in the construction sector in 2022 is expected to be around JPY 66,990 billion (USD 508.16 billion), a 0.6% increase over the previous year.

- Moreover, the Japan Electronics and Information Technology Industries Association (JEITA) estimated the overall production value of the electronics sector in Japan to be around JPY 10.1 trillion (84.5 USD billion) as of November 2022, roughly 100.7% of the value from the previous year. When compared to the prior year, the exports of electronics from Japan also increased by almost 15% up until November as compared to the previous year.

- Thus, the growing construction activities, the increasing automobile industry, and the rising electronics sector are instrumental in the growth of self-healing materials and other applications, which would boost the market during the forecast period.

Self-Healing Materials Industry Overview

The self-healing materials market is moderately consolidated as the top players account for a significant market share. Some of the key players in the market include (not in any particular order) Autonomic Materials, Inc., The Goodyear Tire and Rubber Company, NEI Corporation., BASF SE, and Bayer AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Development in the Construction Industry

- 4.1.2 Growing Use of Self-healing Materials in Biomimetics

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Self-healing Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polymers

- 5.1.2 Composites

- 5.1.3 Ceramics

- 5.1.4 Concrete

- 5.1.5 Other Types

- 5.2 End-user Industry

- 5.2.1 Healthcare

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics

- 5.2.4 Construction

- 5.2.5 Aerospace

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Acciona, S.A.

- 6.4.2 Apple Inc.

- 6.4.3 Autonomic Materials, Inc.

- 6.4.4 BASF SE

- 6.4.5 Bayer AG

- 6.4.6 Covestro AG

- 6.4.7 Evonik Industries AG

- 6.4.8 MacDermid Autotype Ltd.

- 6.4.9 Michelin North America Inc.

- 6.4.10 NEI Corporation

- 6.4.11 The Goodyear Tire and Rubber Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Self-healing Materials in the Automobile and Electronics Industry