|

市场调查报告书

商品编码

1642031

全球风电 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

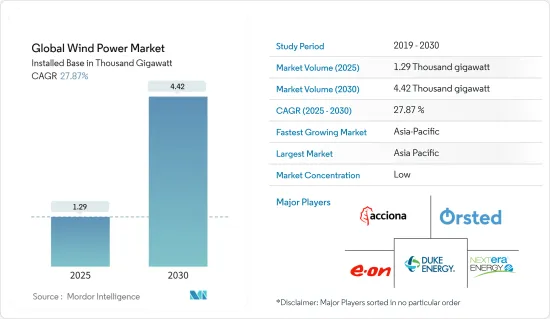

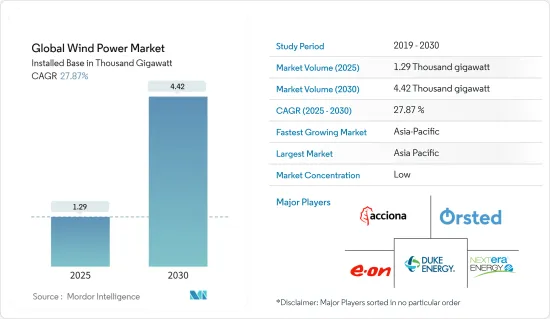

全球风电市场规模预计将从 2025 年的 1,290 GW 扩大到 2030 年的 4,420 GW,预测期内(2025-2030 年)的复合年增长率为 27.87%。

关键亮点

- 从中期来看,有利的政府政策、对即将实施的风发电工程的投资增加以及风力发电成本的下降,预计将导致风力发电的采用增加,并在 2024-2029 年期间推动市场发展。

- 预计天然气和太阳能等替代能源能源的采用将阻碍市场成长。

- 海上风力发电机效率的技术进步和生产成本的降低预计将在全球市场创造充足的机会。

- 由于能源需求不断增加,亚太地区成为成长最快的市场。这一成长归功于印度、中国和澳洲等地区国家不断增加的投资和政府的支持措施。

全球风电市场趋势

离岸风力发电产业预计将大幅成长

- 欧洲是离岸风力发电的主要大陆,也是世界上一些最大的离岸风力发电的运作。该地区的离岸风力发电容量足以满足欧洲的电力需求,预计将持续成长。

- 由于离岸风电的成长速度远远快于陆上风电,因此离岸风电场的选址正成为一个利润丰厚的市场。离岸风力发电也比陆上风电场更方便,因为风速更快,陆地障碍物更少。

- 过去五年来,全球离岸风力发电大幅成长。根据国际可再生能源机构(IRENA)的预测,2023年离岸风力发电将达到72.66吉瓦,比2019年成长1.57倍。由于预计未来几年将有许多风力发电工程运作,因此预计预测期内该数字将大幅增加。

- 2024 年 3 月,英国政府宣布了其最重要的可再生能源计划预算 10 亿英镑(12.5 亿美元),其中包括 8 亿英镑(10 亿美元)用于离岸风力发电,其中包括1.05 亿英镑(1.31 亿美元)用于浮体式海上风电和地热技术。

- 同样,英国政府在2023年9月宣布,将向95个新的可再生能源倡议分配差价付款(CFD),确保370万千瓦的清洁能源容量。这些计划包括陆上风能、太阳能和潮汐能开发。此外,总部位于英国的Octopus Energy计划到2030年在全球整体离岸风力发电领域投资200亿美元。该公司是 Octopus Energy Group 的子公司,该公司表示,这项投资每年将产生 12 千兆吨(GW)的可再生能源发电,足以为 1,000 万户家庭供电。

- 此外,2024年4月,美国能源局风力发电办公室(WETO)宣布向离岸风电投资4,800万美元,包括加强离岸风电平台的研究与开发。预计此类计划将在 2024 年至 2029 年间加速全球风力发电。

- 因此,基于这种情况,离岸风力发电市场预计将在 2024 年至 2029 年间大幅成长。

亚太地区可望主导市场

- 亚太地区是全球最重要的风电市场,主要市场包括中国、印度和澳洲。 2024 年至 2029 年间,亚太地区可能会占据榜首,尤其是中国的成长。

- 根据国际可再生能源机构(IRENA)的数据,2023年亚洲各地风力发电将达到508.45吉瓦,较2019年成长97.32%。 2023年,中国将以441.89吉瓦的风电装置容量位居世界第一,印度则以44.74吉瓦的装置容量位居第二。由于未来几年将有许多风力发电工程运作,预计这一数字将在 2024 年至 2029 年间大幅增加。

- 全部区域政府正在向重点组织授予多个可再生能源计划,以提高能源产量。例如,2023年12月,Apraava Energy订单了由印度能源公司(SECI)实施的州际输电系统(ISTS)1,200MW竞标容量计划,用于在印度卡纳塔克邦建造一座300MW风电场。计划将按照电力购买协议 (PPA) 进行建设,为期 25 年,电价为 3.24 印度卢比/千瓦时。

- 此外,近年来亚太地区对可再生能源的需求呈指数级增长,企业在该地区进行了大量投资。例如,总部位于英国的Octopus Energy于2023年5月宣布将在亚太地区投资18亿美元用于可再生能源计划,包括风发电工程。该公司计划在2027年投资风能、太阳能和其他清洁能源计划。这项投资也聚焦在日本的风力发电目标,即2030年将离岸风力发电装置容量增加150吉瓦。所有这些目标和投资都可能推动 2024 年至 2029 年期间的市场发展。

- 因此,预计大规模风电装置、即将上马的计划以及离岸风电领域的扩建计划将在 2024-2029 年期间推动亚太市场的发展。

全球风电产业概况

风电市场较为分散。该市场的主要企业包括 Acciona Energia SA、杜克能源公司、法国电力公司 (EDF)、Orsted AS、NextEra Energy Inc. 和 E.ON SE。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 可再生能源结构(2023 年)

- 2029年风电装置容量及预测(单位:GW)

- 最新趋势和发展

- 市场动态

- 驱动程式

- 增加对离岸风力发电计划的投资

- 政府支持措施

- 限制因素

- 更多采用替代清洁能源来源(如太阳能、水力发电)

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 位置

- 土地

- 海上

- 2029 年市场规模与需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 法国

- 挪威

- 德国

- 西班牙

- 土耳其

- 俄罗斯

- 北欧的

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 埃及

- 沙乌地阿拉伯

- 奈及利亚

- 卡达

- 其他中东和非洲地区

- 南美洲

- 巴西

- 智利

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率分析-风力发电机供应商

- 主要企业策略

- 公司简介

- Wind Farm Operators

- Acciona Energia SA

- Duke Energy Corporation

- EDF SA

- Orsted AS

- NextEra Energy Inc.

- E.ON SE

- 设备供应商

- Aerodyn Energiesysteme GmbH

- Envision Energy

- General Electric Company

- Xinjiang Goldwind Science & Technology Co. Ltd(Goldwind)

- Siemens Gamesa Renewable Energy SA

- Suzlon Energy Limited

- Vestas Wind Systems AS

- Dongfang Electric Corporation

- Wind Farm Operators

- 市场占有率/排名分析

第七章 市场机会与未来趋势

- 海上风力发电机效率和製造成本的技术进步

简介目录

Product Code: 66176

The Global Wind Power Market size in terms of installed base is expected to grow from 1.29 thousand gigawatt in 2025 to 4.42 thousand gigawatt by 2030, at a CAGR of 27.87% during the forecast period (2025-2030).

Key Highlights

- In the medium term, factors such as favorable government policies, the increasing investment in upcoming wind power projects, and the reduced cost of wind energy have led to increased adoption of wind energy and are expected to drive the market between 2024 and 2029.

- The increasing adoption of alternative energy sources, such as gas-based and solar power, is expected to hinder the growth of the market.

- Nevertheless, technological advancements in efficiency and decreased production costs of offshore wind turbines are expected to create ample opportunity for the global market.

- Asia-Pacific is the fastest-growing market due to the rising energy demand. This growth is attributed to increasing investments, coupled with supportive government policies in the countries of this region, including India, China, and Australia.

Global Wind Power Market Trends

The Offshore Wind Power Sector is Expected to Witness Significant Growth

- Europe is the leading continent in offshore wind and is home to the most significant operational wind farms globally. The region's offshore wind capacity is large enough to meet Europe's electricity needs, which will only continue to grow in the upcoming years.

- Installing wind farms in offshore areas is becoming a lucrative market because offshore winds are much faster than onshore winds. Also, offshore wind farms are more convenient than onshore wind farms, given that offshore areas have more wind speed and less land obstruction.

- Offshore wind energy has increased significantly over the last five years worldwide. According to the International Renewable Energy Agency (IRENA), in 2023, offshore wind energy was 72.66 GW, an increase of 1.57 times compared to 2019. The number is expected to rise significantly during the forecast period as many wind projects are expected to be operational in the upcoming years.

- In March 2024, the government of the United Kingdom announced the most significant budget of GBP 1 billion (USD 1.25 billion) for renewable energy projects, which includes GBP 800 million (USD 1 billion) for offshore wind and GBP 105 million (USD 131 million) for floating offshore wind and geothermal technologies.

- Similarly, in September 2023, the United Kingdom's Government announced the distribution of Contract for Difference (CFDs) to 95 new renewable energy initiatives, ensuring 3.7 GW of clean energy capacity. These projects include onshore wind, solar, and tidal energy developments. Furthermore, Octopus Energy, based in the United Kingdom, plans to invest USD 20 billion globally in offshore wind by 2030. The company, which is a subsidiary of Octopus Energy Group, stated that the investment will generate 12 gigatonnes (GW) of renewable electricity per year, enough to power 10 million homes.

- Furthermore, in April 2024, the United States Department of Energy's Wind Energy Technologies Office (WETO) announced an investment of USD 48 million in offshore wind, including enhancing the research and development of offshore wind platforms. These types of projects are expected to accelerate wind energy generation across the world between 2024 and 2029.

- Hence, with such a scenario, the offshore wind power market is expected to grow significantly from 2024 to 2029.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is the world's most significant wind power market, with top markets including China, India, and Australia. Encouraging growth, particularly in China, is likely to propel it to the top spot between 2024 and 2029.

- According to the International Renewable Energy Agency (IRENA), in 2023, wind energy across Asia was 508.45 GW, an increase of 97.32% compared to 2019. China generated 441.89 GW of wind energy in 2023 and became the leader, followed by India, which generated 44.74 GW. The number is expected to rise significantly between 2024 and 2029 as many wind projects are expected to be operational in the upcoming years.

- The government across the region offers multiple renewable energy projects to the leading organizations to boost energy production. For instance, in December 2023, Apraava Energy received the 1200 MW auction capacity project of the Inter-State Transmission System (ISTS) conducted by the Energy Corporation of India (SECI) to construct a 300 MW Wind farm in Karnataka, India. The project's construction is as per the Power Purchase Agreement (PPA), which is for 25 years at a competitive tariff of INR 3.24/kWh.

- Furthermore, the demand for renewable energy has been rising exponentially across the region for the past few years, and companies are investing significantly across Asia-Pacific. For instance, in May 2023, octopus Energy, a United Kingdom-based company, announced an investment of USD 1.8 billion for renewable energy projects, including wind energy projects across Asia-Pacific. The company is likely to invest in wind, solar, and other clean energy projects by 2027. The investment also focused on Japan's wind energy target to increase offshore wind energy capacity by 150 GW by 2030. All these types of targets and investments are likely to drive the market between 2024 and 2029.

- Therefore, large-scale wind power installations, upcoming projects, and plans to expand the offshore wind segment are expected to drive the Asia-Pacific market between 2024 and 2029.

Global Wind Power Industry Overview

The wind power market is fragmented. Some of the key players in this market are Acciona Energia SA, Duke Energy Corporation, Electricite de France (EDF) SA, Orsted AS, NextEra Energy Inc., and E.ON SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, 2023

- 4.3 Wind Power Installed Capacity and Forecast in GW, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Investments in Offshore Wind Power Projects

- 4.5.1.2 Supportive Government Policies

- 4.5.2 Restraints

- 4.5.2.1 Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar, Hydro)

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Norway

- 5.2.2.4 Germany

- 5.2.2.5 Spain

- 5.2.2.6 Turkey

- 5.2.2.7 Russia

- 5.2.2.8 NORDIC

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Malaysia

- 5.2.3.5 Thailand

- 5.2.3.6 Indonesia

- 5.2.3.7 Vietnam

- 5.2.3.8 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 United Arab Emirates

- 5.2.4.2 Egypt

- 5.2.4.3 Saudi Arabia

- 5.2.4.4 Nigeria

- 5.2.4.5 Qatar

- 5.2.4.6 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Chile

- 5.2.5.3 Argentina

- 5.2.5.4 Colombia

- 5.2.5.5 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis - Wind Turbine Suppliers

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Wind Farm Operators

- 6.4.1.1 Acciona Energia SA

- 6.4.1.2 Duke Energy Corporation

- 6.4.1.3 EDF SA

- 6.4.1.4 Orsted AS

- 6.4.1.5 NextEra Energy Inc.

- 6.4.1.6 E.ON SE

- 6.4.2 Equipment Suppliers

- 6.4.2.1 Aerodyn Energiesysteme GmbH

- 6.4.2.2 Envision Energy

- 6.4.2.3 General Electric Company

- 6.4.2.4 Xinjiang Goldwind Science & Technology Co. Ltd (Goldwind)

- 6.4.2.5 Siemens Gamesa Renewable Energy SA

- 6.4.2.6 Suzlon Energy Limited

- 6.4.2.7 Vestas Wind Systems AS

- 6.4.2.8 Dongfang Electric Corporation

- 6.4.1 Wind Farm Operators

- 6.5 Market Share/Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Technological Advancements in Efficiency and Decrease in the Production Cost of Offshore Wind Turbines

02-2729-4219

+886-2-2729-4219