|

市场调查报告书

商品编码

1642060

欧洲 PLC:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe PLC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

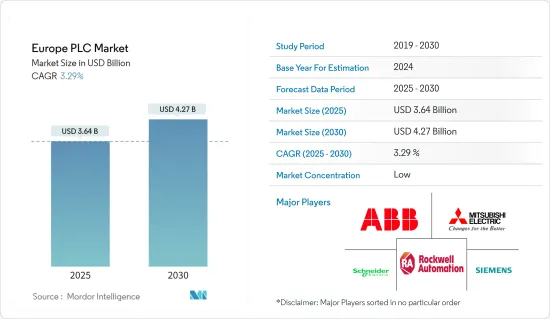

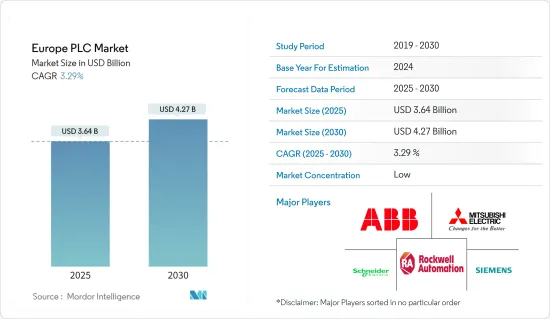

预计 2025 年欧洲 PLC 市场规模为 36.4 亿美元,预计到 2030 年将达到 42.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.29%。

主要亮点

- PLC 系统的实施允许快速识别和纠正错误,无需人工干预。因此,据估计,这种自动化 PLC 系统可以将机器停机时间从 20% 减少到近 4%。

- PLC 市场发展的驱动因素之一是自动化领域缺乏替代品。另一个重要因素是整合了 PLC 和 PC 的可程式自动化控制器 (PAC) 的发展。此外,模组化 PLC 可以在修正其他模组的错误时继续运作。

- 成员国也赞助国家倡议,例如德国的工业 4.0、义大利和法国的未来工厂以及英国的弹射中心。所研究的市场受到工业生产和电脑及软体投资的强烈影响。这些 PLC 系统传统上一直是製程和离散工厂自动化的基础。工业 4.0 在各个工业领域的日益广泛应用正在扩大所研究的市场。离散製造业中 PLC 的一个关键成长指标是汽车製造业以及电气和电子产业中机器人的部署日益增多。

- 由于智慧工厂系统的广泛应用,工业机器人市场在过去十年中出现了巨大的需求。这些机器人发挥着重要作用。例如,2022 年 6 月,使用 PLC 的工业机器人自主运动规划领域的领导者之一 Realtime Robotics 宣布与自动化领域的领导者三菱电机自动化合作,透过创新的运动控制和防撞软体加速使用 PLC 的工业机器人的编程和控制。

- 在英国,降低製造成本的需求不断增长以及机器对机器 (M2M) 技术的普及正在推动自动化的引入,预计这将促进 PLC 的使用并刺激市场成长。

- 德国是世界领先的化学品生产国和出口国之一。製造过程自动化在该国非常普及。 PLC 正在推动市场发展,因为它们有助于推理复杂演算法并提高该领域的效能。

- PLC受到记忆体、CPU和通讯频宽等资源的限制,可能会影响程式效能和质量,阻碍市场成长。

欧洲 PLC 市场趋势

石油和天然气产业占很大市场占有率

- 石油和天然气行业使用各种系统,例如 SCADA,并且需要 PLC 来实现更好的控制。由于欧洲的计划发展,预计未来几年石油和天然气终端用户行业将经历显着增长。过去两到三年来,该行业的油价一直在波动,我们正在研究该领域的各种成本节约方法。这些节省成本的努力正在推动产业在多个流程中采用自动化。

- 该行业还面临对更多熟练劳动力和专业知识的需求。这种限制也是自动化背后的主要原因之一。石油和天然气行业的安全系统也采用 PLC 设备来确保品质和性能。据预算责任办公室称,预计2023年英国的油价将达到每桶81.9英镑。

- 据 GP Systems GmbH 称,石油和天然气行业的自动化对可程式逻辑控制器 (PLC) 的可靠性和技术规格提出了很高的要求。该公司的Regul RX00 PLC满足所有行业要求,提供稳定、连续的运行控制,承受多种系统故障,并实现灵活的系统设计和现场互连子系统之间的通讯。

- 英国政府宣布,作为其新能源策略的一部分,很快就会在北海(英国)启动石油和天然气计划。例如,2022年5月,BP宣布计划在2030年终前向英国能源系统投资高达180亿欧元(191.8亿美元),彰显BP对英国的坚定承诺,助力加强能源安全、实现英国实现净零排放的雄心勃勃的目标。英国石油公司是英国最大的石油和天然气生产商之一,该公司打算继续投资北海石油和天然气计划,同时减少其营运产生的排放。预计此类案例将推动该地区的市场成长。

德国经济快速成长

- 德国是欧洲自动化设备的重要消费国,也是领先的製造国。德国拥有西门子、施耐德电气、库卡等主要企业,鼓励对研发活动进行大力投资。由于对自动化解决方案的需求不断增加,国内自动化公司也是市场成长的主要动力之一。根据德国联邦统计局的预测,2023年德国汽车产业的收益预计将达到5,943亿欧元(6,333.9亿美元)。

- 由于许多大型电力计划被搁置,该国电网需要帮助来适应可再生能源和分散式能源的崛起。同样,政府也在尝试使电网适应新的需求。国家电网营运商为提高输电能力所采取的措施可能会加大使用 PLC 来累积资料并采取进一步的渐进式行动,从而刺激市场研究。

- 该国的汽车工业也享誉全球。据德国联邦教育与研究部称,2022年德国汽车产业的创新支出将达到495.4亿欧元(528亿美元)。由于人事费用上升和安全措施加强,各汽车製造商都在引入自动化技术。随着这样的发展,预计该国对 PLC 市场的需求将会巨大。

- 较大的公司也正致力于扩大在该国的业务。例如,位于杜塞尔多夫的日立传动与自动化有限公司是日立工业设备系统公司的德国子公司。该公司的核心业务是推进零件和自动化技术的销售。例如,我们提供变频器、可程式逻辑控制器 (PLC)、交流伺服驱动器、电动/齿轮马达、操作员控制单元 (HMI)、工业喷墨印表机 (CIJ)/雷射编码器等。

欧洲 PLC 产业概况

欧洲可程式逻辑控制器(PLC)市场竞争激烈。高昂的研发成本、伙伴关係、联盟和收购是该地区企业为在激烈的竞争中保持领先地位而采取的关键成长策略。市场的主要企业包括 ABB 有限公司、三菱电机株式会社、施耐德电气 SE、罗克韦尔自动化、西门子股份公司、霍尼韦尔国际公司、Omron Corporation、Panasonic Corporation、罗伯特·博世有限公司、艾默生电气公司等。

- 2022 年 11 月 - 罗克韦尔自动化与 Comau 合作,利用机器人解决方案的强大功能,帮助企业最大程度提高製造效率并加快创新速度。将罗克韦尔自动化组件与柯马机器人集成,并透过一个 PLC 控制两者,无需其他机器人製造商所需的额外机器人程式设计技能。

- 2022 年 8 月-Honeywell国际与布加勒斯特理工大学合作,透过建立工业自动化实验室帮助学生进入全球劳动市场。该实验室包括Honeywell的 ControlEdge 可程式逻辑控制器 (PLC),它与霍尼韦尔 Experion 製程知识系统配合使用,有助于降低工厂整合成本、最大限度地减少计划外中断、透过内建网路安全降低风险并降低整体拥有成本。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 对欧洲可程式逻辑控制器 (PLC) 市场的影响

第五章 市场动态

- 市场驱动因素

- 越来越多采用自动化系统

- 易于使用且熟悉的 PLC 程式设计有利于发展

- 市场挑战

- 离散製造业产品客製化需求及由批量向连续加工的逐步转变

- 越来越多地采用具有增强的安全性和先进控制能力的分散式控制系统 (DCS)

第六章 市场细分

- 按类型

- 硬体和软体

- 大型 PLC

- 奈米PLC

- 小型 PLC

- 中型PLC

- 其他硬体

- 按服务

- 硬体和软体

- 按最终用户产业

- 食品、烟草、食物及饮料

- 车

- 化工和石化

- 能源与公共产业

- 药品

- 石油和天然气

- 其他最终用户产业

- 按国家

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲

第七章 竞争格局

- 公司简介

- ABB Ltd

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Rockwell Automation

- Siemens AG

- Honeywell International Inc.

- Omron Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Emerson Electric Co.

- Hitachi Ltd

- General Electric Co.

- Beckhoff Automation

第八章投资分析

第九章:市场的未来

The Europe PLC Market size is estimated at USD 3.64 billion in 2025, and is expected to reach USD 4.27 billion by 2030, at a CAGR of 3.29% during the forecast period (2025-2030).

Key Highlights

- The deployment of PLC systems enables the identification and rectification of errors and can initiate rapid responses even without human intervention. Hence, these automated PLC systems are estimated to reduce machine downtime from 20% to almost 4%.

- One of the driving factors of the PLC market is that it has yet to replace in the automation field. Another significant factor is the development of programmable automation controllers (PACs), which integrate PLCs with PCs. Furthermore, a modular PLC can continue working while errors in other modules are being fixed.

- Member States also sponsor national initiatives such as Industry 4.0 in Germany, the Factory of the Future in Italy and France and Catapult centers in the UK. The market studied is strongly impacted by the industrial output and the investment funneled into computers and software. These PLC systems have traditionally been the foundation of process and discrete factory automation. The growing adoption of Industry 4.0 across the industrial verticals has augmented the market studied. A significant growth indicator for PLCs in the discrete-manufacturing sectors is the amplified deployment of robots across the automotive manufacturing, electrical, and electronics industries.

- The industrial robot market has witnessed a massive demand during the past decade owing to the rising adoption of smart factory systems. These robots play a vital part. For Instance, In June 2022, Realtime Robotics, one of the leaders in autonomous motion planning for industrial robots using PLC, announced a collaboration with Mitsubishi Electric Automation, Inc., a leader in automation, to accelerate industrial robot programming and control with PLC and with innovative motion control and collision avoidance software.

- The rising need for mitigating the manufacturing cost and penetration of machine-to-machine (M2M) technologies are encouraging the adoption of automation in the United Kingdom, which is likely to boost the usage of PLC, thereby fueling market growth.

- Germany is one of the largest producers and exporters of chemicals in the world. Automating manufacturing processes is gaining high traction in the country. PLC helps in deducing complex algorithms and enhancing performance in the sector, thus, driving the market.

- PLCs are limited by the resources, such as memory, CPU and communication bandwidth, which may affect program performance and quality which might hamper the market growth.

Europe PLC Market Trends

Oil and Gas Industry to Hold Significant Market Share

- The oil and gas industry has been using various systems, such as SCADA, which needs PLCs for better control. The oil and gas end-user sector is expected to witness significant growth in the following years, owing to plans for its development in Europe. The industry has been fluctuating, in terms of oil prices, in the past two to three years, and it has been looking forward to saving various costs in the domain. The industry is adopting automation in multiple processes due to these cost-cutting activities.

- The sector has also been suffering from needing a more skilled workforce and expertise in the domain. This limitation has also been one of the primary causes behind automation. The safety systems in the oil and gas industry have also been adopting the use of PLC devices to ensure quality and performance. According to Office for Budget Responsibility, in 2023, In the United Kingdom, oil prices are expected to reach 81.9 British pounds per barrel.

- According to GP Systems GmbH, Automation in the oil and gas industry imposes stringent demands on programmable logic controllers' reliability and technical specifications (PLCs). The company's Regul RX00 PLC meets all industry requirements, provides stable and continuous operation control, resists multiple system failures, and provides flexible system design and communication between field interconnected subsystems.

- The United Kingdom government, as part of its new energy strategy, announced licensing several oil and gas projects in the North Sea (United Kingdom) to begin soon. For instance, in May 2022, BP intended to invest up to EUR18 billion (USD 19.18 billion) in the United Kingdom's energy system by the end of 2030, demonstrating BP's firm commitment to the United Kingdom and helping the United Kingdom to deliver on its strong ambitions to boost energy security and reach net zero. The United Kingdom as one of the largest oil and gas producers in the United Kingdom, BP intended to continue investing in North Sea oil and gas projects while driving down operational emissions. Such instances are expected to drive the market's growth in the region.

Germany to Witness the Significant Growth

- Germany is a significant consumer of automation equipment and a major manufacturer of automation equipment in Europe. Several important automation and control equipment players, such as Siemens, Schneider Electric, and KUKA, are based out of Germany, thus driving a high flow of investments toward R&D activities. Due to the increasing demand for automation solutions, automation companies in the country are also one of the major reasons for the market's growth. According to Statistisches Bundesamt, the predicted revenue development of the automobile industry in Germany is expected to reach EUR 594.3 Billion (633.39 USD Billion) in 2023.

- The electricity grid in the country needs help to cope with the extent of renewable and distributed energy in the country, and many major power projects are on hold. Similarly, the government attempts to adapt the grid to the new demands. The measures by national grid operators to boost power transmission capacity are likely to escalate PLC usage to accumulate data and further take successive steps, thereby fueling the market studied.

- The country is also globally recognized for its automobile industry. According to the BMBF, the German automobile industry expenditure on innovation in the automobile industry is EUR 49.54 Billion (USD 52.80 Billion) in 2022. Various automobile manufacturers are adopting automation, primarily due to the labor costs and increasing safety measures. Owing to such developments, the country is expected to hold significant demand for the PLC market.

- Major companies are also focused on expanding business in the country. For instance, Hitachi Drives & Automation GmbH in Dusseldorf is the German subsidiary of Hitachi Industrial Components & Equipment Ltd. Its core business is the distribution of propulsion components and automation technology. For instance, it offers frequency converters, programmable logic controllers (PLC), AC servo drives, electrical / geared motors, operator control units (HMI), and industrial inkjet printers (CIJ) / laser coders.

Europe PLC Industry Overview

The Europe Programmable Logic Controller (PLC) Market is highly competitive in nature. The high expense on research and development, partnerships, collaborations, and acquisitions are the prime growth strategies adopted by the companies in the region to sustain the intense competition. Key players in the market are ABB Ltd, Mitsubishi Electric Corporation, Schneider Electric SE, Rockwell Automation, Siemens AG, Honeywell International Inc., Omron Corporation, Panasonic Corporation, Robert Bosch GmbH, Emerson Electric Co., and many more.

- November 2022 - Rockwell Automation and Comau partnered to leverage the power of robotic solutions to help enterprises maximize their manufacturing efficiencies and increase the speed of innovation. Integrating Rockwell Automation components and Comau's robots, using one PLC for controlling both, eliminates the need for additional robot programming skills required by other robot manufacturers.

- August 2022 - Honeywell International Inc collaborated with the University Politehnica Of Bucharest to support student entry into the global workforce by launching an industrial automation lab. The lab includes Honeywell's ControlEdge Programmable Logic Controller (PLC), which, It is possible to reduce the cost of integrating a plant, minimize unplanned interruptions, mitigate risk through embedded cybersecurity and lower overall ownership costs by working together with Honeywell Experion Process Knowledge System.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Europe Programmable Logic Controller (PLC) Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of Automation Systems

- 5.1.2 Ease of Use and Familiarity with PLC Programming to Sustain Growth

- 5.2 Market Challenges

- 5.2.1 Demand for Customization of Products and Gradual Shift from Batch to Continuous Processing in the Discrete Industries

- 5.2.2 Increase in Adoption of Distributed Control Systems (DCS), with Enhanced Safety and Advanced Control Capabilities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware and Software

- 6.1.1.1 Large PLC

- 6.1.1.2 Nano PLC

- 6.1.1.3 Small PLC

- 6.1.1.4 Medium PLC

- 6.1.1.5 Other Hardware Types

- 6.1.2 Service

- 6.1.1 Hardware and Software

- 6.2 By End-user Industry

- 6.2.1 Food, Tobacco, and Beverage

- 6.2.2 Automotive

- 6.2.3 Chemical and Petrochemical

- 6.2.4 Energy and Utilities

- 6.2.5 Pharmaceutical

- 6.2.6 Oil and Gas

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 Europe

- 6.3.1.1 Germany

- 6.3.1.2 United Kingdom

- 6.3.1.3 France

- 6.3.1.4 Italy

- 6.3.1 Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Schneider Electric SE

- 7.1.4 Rockwell Automation

- 7.1.5 Siemens AG

- 7.1.6 Honeywell International Inc.

- 7.1.7 Omron Corporation

- 7.1.8 Panasonic Corporation

- 7.1.9 Robert Bosch GmbH

- 7.1.10 Emerson Electric Co.

- 7.1.11 Hitachi Ltd

- 7.1.12 General Electric Co.

- 7.1.13 Beckhoff Automation