|

市场调查报告书

商品编码

1644266

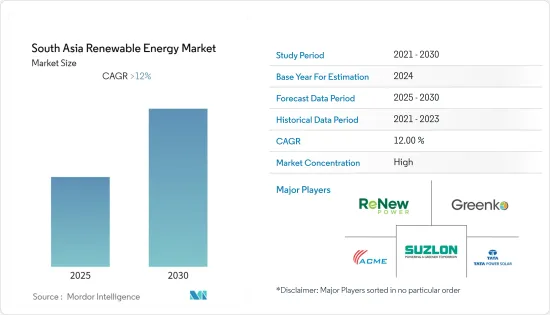

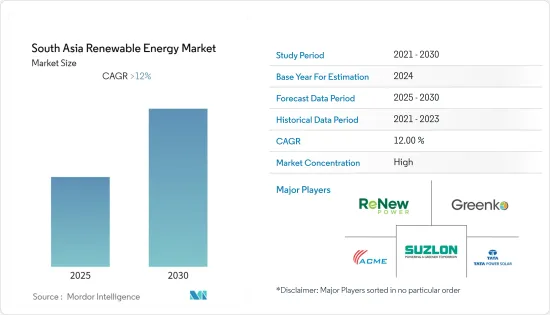

南亚可再生能源 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)South Asia Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预测期内,南亚可再生能源市场预计将以超过 12% 的复合年增长率成长。

2020 年,新冠疫情对市场产生了负面影响。现在,市场可能会达到疫情前的水准。

关键亮点

- 从中期来看,增加的投资和可再生能源目标预计将推动市场成长。

- 另一方面,预计预测期内天然气发电渗透率的提高将阻碍南亚可再生能源发电市场的成长。

- 南亚新兴国家正在转向太阳能、风能和水力发电等替代能源,这些能源取之不尽、用之不竭,并可能在预测期内为南亚可再生能源市场创造丰厚的成长机会。

- 预计印度将在预测期内占据市场主导地位并以最高的复合年增长率成长。这一增长可归因于该国不断增加的投资和政府的支持措施。

南亚可再生能源市场趋势

太阳能可望大幅成长

- 预计 2021 年太阳能领域将在南亚可再生能源市场见证显着成长,并有望在未来几年继续以显着的速度成长。预计大部分需求将来自世界领先的太阳能生产国印度。

- 商业和工业客户一直在推动该地区太阳能的发展。在预计预测期内,屋顶太阳能光电平准化电费(LCOE) 下降、优惠政策和企业社会责任计画等因素将推动该地区太阳能市场的发展。

- 2021 年,南亚显示出可观的成长率,其中印度增加了约 49,684 兆瓦的太阳能光电容量,巴基斯坦增加了 1,083 兆瓦。南亚国家正致力于安装太阳能屋顶系统,以实现其雄心勃勃的太阳能目标。

- 印度太阳能发电潜力超过750GW,该国《2047年能源安全情境》显示,到2047年印度太阳能发电装置容量可达479GW左右。由于较高的太阳辐射,印度的太阳能发电已经实现了市电平价,这鼓励了人们采用太阳能光电作为主流能源来源,并提高了公用事业规模和屋顶太阳能领域的装置容量。

- 巴基斯坦政府于2022年9月核准了国家太阳能计划,透过太阳能计划生产10,000兆瓦(MW)的电力。第一阶段,太阳能将供应给政府大楼、运作电力和柴油为动力的管井以及低耗能的家庭消费者。

- 因此,预计预测期内太阳能市场将显着成长。

印度可望主导市场

- 南亚是亚太地区再生能源应用的大本营。在印度,政府的支持性政策条件是推动该国可再生能源装置容量在 2021 年增加到 147.1GW 的关键因素。

- 印度的可再生能源目标得到了基于发电的奖励、股权、利息直接公共贷款、可行性缺口基金、优惠贷款和财政奖励等财政手段的支持。

- 2021年9月,印度政府宣布计画为离岸风力发电和储能计划提供可行性缺口资金(VGF)或补贴。新计划将有助于实现变电站的维修和现代化。政府已设定2030年增加30吉瓦离岸风力发电计划的目标。

- 2022年2月,印度政府根据生产连结奖励计画(PLI) 计画额外拨款1,950亿印度卢比支持太阳能板製造。

- 该计划有多种规定,支持建立高效太阳能模组综合製造单位,并为此类太阳能模组的销售提供 PLI。该计画旨在实现2030年安装280吉瓦太阳能发电容量的雄心勃勃的目标。

- 印度计画在2030年确保40%的发电量来自清洁能源,到2022年实现175GW,其中包括100GW太阳能发电、60GW风电、10GW生物发电、5GW小规模水力发电。

- 目前,世界银行和亚洲开发银行正在为印度的可再生能源计划提供融资,其中世界银行融资13.98亿美元,亚洲开发银行融资39个计划。

- 因此,由于即将实施和可再生可再生计划,预计印度将在计划期内占据市场主导地位。

南亚可再生能源产业概况

南亚可再生能源市场较为分散。市场的主要企业(不分先后顺序)包括 ReNew Power Limited、Greenko Group Plc、ACME Solar Holding Limited、Tata Power Solar Systems Ltd 和 Suzlon Energy Ltd。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年装置容量及预测(单位:吉瓦)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔与分析

- 类型

- 水力发电

- 太阳热

- 风

- 其他的

- 地区

- 印度

- 巴基斯坦

- 孟加拉

- 阿富汗

- 南亚其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- ReNew Power Limited

- Sindicatum Renewable Energy India Private Limited

- Greenko Group Plc

- ACME Solar Holding Limited

- Tata Power Solar Systems Ltd

- Suzlon Energy Ltd

- Adani Green Energy Limited

- Regen Renewables(Pvt)Ltd

- Zularistan Ltd.

- Sembcorp Industries Limited

第七章 市场机会与未来趋势

简介目录

Product Code: 70435

The South Asia Renewable Energy Market is expected to register a CAGR of greater than 12% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the medium term, increasing investments and ambitious renewable energy targets are expected to drive the market's growth.

- On the other hand, increasing penetration of natural gas for power generation is expected to hamper the growth of the South Asia renewable energy market during the forecast period.

- South Asian developing countries are looking into inexhaustible and repeatable alternative energy sources such as solar, wind, hydro, and others are likely to create lucrative growth opportunities for the South Asia renewable energy market in the forecast period.

- India is expected to dominate the market and will likely witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with supportive government policies in the country.

South Asia Renewable Energy Market Trends

Solar Energy is Expected to Witness Significant Growth

- The solar energy segment is expected to witness significant growth in the South Asia Renewable Energy Market in 2021 and will continue significantly over the coming years. Most of the demand is likely from India, the world's prominent producer of solar energy.

- Commercial and industrial customers have driven the growth of solar energy in the region. Factors such as the decline in the Levelized Cost of Electricity (LCOE) for rooftop solar and favorable policies and corporate social responsibility programs are expected to drive the solar energy market in the region during the forecast period.

- In 2021, in South Asia, India added about 49,684 MW of solar energy, and Pakistan had an installed solar capacity of 1,083 MW, showing a considerable growth rate. South Asia countries are focused on installing solar rooftop systems to achieve their ambitious solar PV targets.

- India's solar potential is more than 750 GW, and the country's energy security scenario 2047 shows a possibility of achieving around 479 GW of solar PV installed capacity by 2047. Solar power in India, bestowed with high solar irradiance, has already achieved grid parity that encourages the adoption of solar power as a mainstream energy source, pushing forward the capacity installations in the utility-scale and rooftop solar segments.

- In September 2022, the Pakistan government approved the National Solar Energy Initiative to produce 10,000 megawatts (MW) of electricity through solar energy projects in the following months. In the first phase, solar energy would be supplied to government buildings, tube wells operating on electricity and diesel, and domestic consumers with low consumption.

- Therefore, solar energy is expected to have significant growth in the market during the forecast period.

India is Expected to Dominate the Market

- South Asia is a stronghold of renewables deployment in the Asia-Pacific region. In India, the government's efforts to put in place supportive policy conditions were a major factor contributing to the increase in the country's renewable energy capacity to 147.1 GW in 2021.

- India's renewable targets have been supported by fiscal instruments such as generation-based incentives, capital, and interest-direct public financing, viability gap funding, concessional finance, and fiscal incentives.

- In September 2021, the Indian government announced plans to provide Viability Gap Funding (VGF) or grants for offshore wind and storage projects. The new scheme will help carry out the renovation and modernization of substations. The government has set a target of adding 30 GW of offshore wind energy projects by 2030.

- In February 2022, the Indian government allocated an additional INR 19,500 crore to support solar PV module manufacturing under the Production Linked Incentive (PLI) scheme.

- The scheme has various provisions for supporting the set up of integrated manufacturing units of high-efficiency solar PV modules by offering PLI on sales of such solar PV modules. It aims at attaining the ambitious goal of 280 GW of installed solar capacity by 2030.

- India has plans to obtain 40% of installed power generation capacity from clean energy sources by 2030 and to reach 175 GW by 2022, including 100 GW solar, 60 GW wind, 10 GW bio-power, 5 GW small-scale hydro.

- The ongoing renewable energy projects financed by the World Bank, and ADB in India are of a count of 6 active projects with a total commitment of around USD 1398 million financed by World Bank and 39 active projects financed by ADB.

- Therefore, with the upcoming and ongoing renewable energy projects, India is expected to dominate in the market during the forecast period.

South Asia Renewable Energy Industry Overview

The South Asia Renewable Energy Market is fragmented in nature. Some of the major players in the market (not in particular order) include ReNew Power Limited, Greenko Group Plc, ACME Solar Holding Limited, Tata Power Solar Systems Ltd, and Suzlon Energy Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in GW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION & ANALYSIS

- 5.1 Type

- 5.1.1 Hydro

- 5.1.2 Solar

- 5.1.3 Wind

- 5.1.4 Others

- 5.2 Geography

- 5.2.1 India

- 5.2.2 Pakistan

- 5.2.3 Bangladesh

- 5.2.4 Afghanistan

- 5.2.5 Rest of South Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ReNew Power Limited

- 6.3.2 Sindicatum Renewable Energy India Private Limited

- 6.3.3 Greenko Group Plc

- 6.3.4 ACME Solar Holding Limited

- 6.3.5 Tata Power Solar Systems Ltd

- 6.3.6 Suzlon Energy Ltd

- 6.3.7 Adani Green Energy Limited

- 6.3.8 Regen Renewables (Pvt) Ltd

- 6.3.9 Zularistan Ltd.

- 6.3.10 Sembcorp Industries Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219