|

市场调查报告书

商品编码

1644335

德国低温运输物流:市场占有率分析、产业趋势与成长预测(2025-2030 年)Germany Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

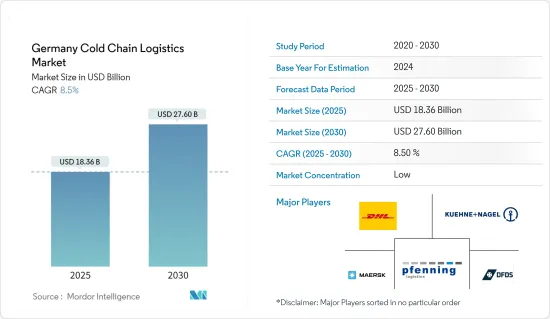

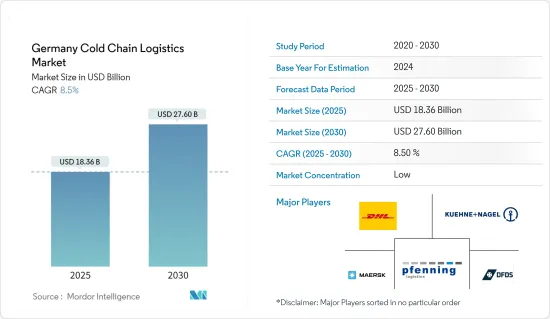

2025年德国低温运输物流市场规模预估为183.6亿美元,预估至2030年将达276亿美元,预测期间(2025-2030年)复合年增长率为8.5%。

低温运输的需求受到有组织的食品零售业的扩张、加工食品的需求以及医疗保健成本的上升所推动。德国低温运输物流市场受到电子商务在物流行业的渗透、冷藏仓库的增加以及医药市场的扩大等因素的推动。

基础设施薄弱、缺乏标准化、物流成本高以及製造商和零售商对物流服务的控制力不足等因素阻碍了德国低温运输物流市场的成长。然而,由于低温运输物流中采用多模态系统和 RFID 技术,IT 解决方案和自动化软体的使用越来越多,并且成本降低和前置作业时间缩短,预计将为德国低温运输低温运输市场的成长提供丰厚的机会。

德国以其强大的食品工业而闻名,生产和出口各种生鲜产品,包括乳製品、肉类、水果和蔬菜。低温运输物流市场对于维持这些产品在供应链中流通时的新鲜度和品质至关重要。

德国低温运输物流市场趋势

随着製药业的发展,冷藏仓库的数量也增加

作为欧盟成员国,德国对药品的运输和储存有严格的监管标准。遵守良好分销规范(GDP)等法规至关重要,这推动了对专业低温运输物流服务的需求,以维护整个供应链中的产品完整性和安全性。先进生技药品、疫苗和其他温度敏感药物的兴起推动了对可靠的低温运输物流解决方案的需求,以确保这些治疗的有效性和稳定性。製药业向个人化医疗和生物製药的转变进一步凸显了温控运输和储存设施的重要性。

该公司正在对其低温运输业务进行数百万美元的重大投资,以确保流程高效、可靠和安全。这一关注至关重要,因为端对端低温运输安全是该系统的一个薄弱方面。此外,温控药品和医疗设备的物流在医疗保健物流领域也呈现显着成长。此外,复杂生技药品的出现以及需要精确低温运输管理的荷尔蒙疗法、疫苗和复杂蛋白质的运输,推动了对温控运输和储存设施的需求。此外,旨在维护货物完整性的高品质低温运输物流服务的需求不断增长也在推动市场扩张。

冷冻食品需求不断增加

德国占据欧洲冷冻食品市场的最大份额,因为德国人偏好风味高、品质高和独特的食品,同时他们也优先避免过量摄取。中国蓬勃发展的消费经济和丰富的自然资源为低温运输物流领域提供了庞大的商机。对生鲜食品、肉类、水产品和药品的需求不断增长,刺激了德国低温运输物流市场的扩张。此外,消费者逐渐从动物性食品转向植物性食品,这推动了冷冻蔬菜市场的成长。此外,人们越来越认识到冷冻蔬菜比购买后冷藏的新鲜蔬菜保留了更多的维生素和营养。这种心态促使年轻消费者选择冷冻蔬菜。

影响现代家庭财务状况的多种因素推动了冷藏和冷冻食品的需求不断增长,其中包括老年人变得更加独立、双收入家庭的数量不断增加以及单人家庭的数量不断增加。此外,对食品浪费和食品饮料行业劳动力短缺的担忧也助长了这一趋势。根据德国冷冻食品协会的资料,上年度德国人均冷冻食品消费量为46.1公斤。

德国低温运输物流产业概况

德国的低温运输物流市场较为分散,由大量本地公司组成,以满足不断增长的需求。电子商务物流领域的市场竞争日益激烈。预计国际和国内市场农产品出口的成长将吸引许多国际仓储参与企业。市场的主要企业包括 Kuehne+Nagel International AG、DHL Group、A.P. Moller-Maersk A/S、Pfenning Logistics 和 Eurofresh Logistics GmbH。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 研究框架

- 二次调查

- 初步调查

- 资料三角测量与洞察生成

- 计划流程和结构

- 参与框架

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- 科技趋势

- 政府法规和倡议

- 环境和温度控制储存亮点

- 产业价值链/供应链分析

- 排放标准和法规对低温运输产业的影响

- COVID-19 对市场的影响

第五章 市场动态

- 市场驱动因素

- 新鲜农产品需求不断增加

- 製药业的成长

- 市场限制

- 初期投资成本高

- 劳动力短缺和技能差距

- 市场机会

- 缺乏足够的基础设施

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第六章 市场细分

- 按服务

- 贮存

- 运输

- 附加价值服务(冷冻、标籤、库存管理等)

- 按温度类型

- 常温

- 冷藏

- 冷冻

- 按应用

- 园艺(新鲜水果和蔬菜)

- 乳製品(牛奶、冰淇淋、奶油等)

- 肉类和鱼贝类

- 加工食品

- 製药、生命科学、化学品

- 其他的

第七章 竞争格局

- 市场集中度概览

- 公司简介

- Kuehne+Nagel International AG

- DHL Group

- AP Moller-Maersk A/S

- Pfenning Logistics

- Eurofresh Logistics GmbH

- Heuer Logistics GmbH & Co. KG

- KLM Kuhl-und Lagerhaus Munsterland GmbH

- Kloosterboer BLG Coldstore GmbH

- Frigolanda Cold Logistics

- NewCold Advanced Logistics

- Scan Global Logistics*

- 其他公司

第 8 章:未来趋势

第 9 章 附录

The Germany Cold Chain Logistics Market size is estimated at USD 18.36 billion in 2025, and is expected to reach USD 27.60 billion by 2030, at a CAGR of 8.5% during the forecast period (2025-2030).

The demand for cold chains stems from the expansion of the organized food retail industry, the demand for processed food, and rising healthcare costs. The German cold chain logistics market is driven by factors such as the growing penetration of e-commerce in the logistics industry, the increasing number of refrigerated warehouses, and the expanding pharmaceutical market.

Poor infrastructure, a lack of standardization, higher logistics costs, and a lack of control by manufacturers and retailers over logistics services impede the growth of the German cold chain logistics market. However, the increasing use of IT solutions and automated software for cold chain logistics, as well as cost savings and reduced lead times as a result of the adoption of multi-modal systems and RFID technologies for cold chain applications, are expected to provide lucrative opportunities for the growth of the German cold chain logistics market.

Germany is well-known for its robust food industry, which produces and exports a diverse range of perishable goods, including dairy products, meat, fruits, and vegetables. The cold chain logistics market is critical in maintaining the freshness and quality of these products as they travel through the supply chain.

Germany Cold Chain Logistics Market Trends

The Number of Refrigerated Warehouses is Rising, Along With the Growing Pharmaceutical Industry

As part of the European Union, Germany upholds rigorous regulatory standards for the transportation and storage of pharmaceutical products. Adherence to regulations like Good Distribution Practice (GDP) is vital, driving the need for specialized cold chain logistics services to preserve product integrity and safety across the supply chain. The rise of advanced biologics, vaccines, and other temperature-sensitive medications has heightened the need for reliable cold-chain logistics solutions to safeguard the effectiveness and stability of these treatments. The pharmaceutical sector's pivot toward personalized medicine and biopharmaceuticals further underscores the significance of temperature-controlled transportation and storage facilities.

Companies are making substantial investments in their cold chain operations, amounting to millions of dollars, to establish efficient, reliable, and secure processes. This focus is crucial as end-to-end cold chain security represents a vulnerable aspect of the system. Moreover, the logistics of pharmaceutical products and medical devices under controlled temperatures is experiencing significant growth within the healthcare logistics sector. Additionally, the emergence of intricate biological-based medicines and the transportation of hormone treatments, vaccines, and complex proteins, which demand precise cold chain management, is driving the need for temperature-controlled transportation and storage facilities. The market is also expanding due to the increasing demand for high-quality cold chain logistics services aimed at preserving the integrity of goods.

The Demand for Frozen Foods is Increasing

Germany commands the largest share of the frozen food market in Europe, driven by a preference for high-flavor, high-quality, and distinctive foods among Germans, who also prioritize avoiding excessive calorie intake. The country's thriving consumer economy and abundant natural resources have created significant opportunities in the cold chain logistics sector. The escalating demand for perishable foods, meat, seafood, and pharmaceutical products has fueled the expansion of the cold chain logistics market in Germany. Additionally, there is a notable shift among consumers from animal-based foods to plant-based alternatives, propelling growth in the frozen vegetable market. Moreover, there is a growing awareness that frozen vegetables retain more vitamins and nutrients compared to fresh ones that are refrigerated after purchase. This awareness is gaining traction, driving younger consumers to opt for frozen vegetables.

The rising demand for chilled and frozen foods stems from various factors impacting modern households, including independent elderly individuals, the rise in dual-income households, and the growing number of single-person households. Additionally, concerns about food waste and labor shortages in the food and beverage industry contribute to this trend. According to data from the German Frozen Food Institute, per capita consumption of frozen foods was 46.1 kilograms in the previous year.

Germany Cold Chain Logistics Industry Overview

The German cold chain logistics market is fragmented and consists of a large number of local players that cater to the growing demand. The market is witnessing increasingly fierce competition in the field of e-commerce logistics. The growth in agricultural product exports in the international and domestic markets is expected to attract many international players in the warehousing and storage fields. Some of the major players in the market include Kuehne + Nagel International AG, DHL Group, A.P. Moller-Maersk A/S, Pfenning Logistics, and Eurofresh Logistics GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

- 2.5 Project Process and Structure

- 2.6 Engagement Frameworks

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Government Regulations and Initiatives

- 4.4 Spotlight on Ambient/Temperature-controlled Storage

- 4.5 Industry Value Chain/Supply Chain Analysis

- 4.6 Impact of Emission Standards and Regulations on Cold Chain Industry

- 4.7 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Perishable Products

- 5.1.2 Growth of Pharmaceutical Products

- 5.2 Market Restraints

- 5.2.1 High Initial Investment Costs

- 5.2.2 Labor Shortages and Skills Gap

- 5.3 Market Opportunities

- 5.3.1 Lack of Adequate Infrastructure

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Services

- 6.1.1 Storage

- 6.1.2 Transportation

- 6.1.3 Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.)

- 6.2 By Temperature Type

- 6.2.1 Ambient

- 6.2.2 Chilled

- 6.2.3 Frozen

- 6.3 By Application

- 6.3.1 Horticulture (Fresh Fruits and Vegetables)

- 6.3.2 Dairy Products (Milk, Ice-cream, Butter, etc.)

- 6.3.3 Meat and Seafood

- 6.3.4 Processed Food Products

- 6.3.5 Pharmaceuticals, Life Sciences, and Chemicals

- 6.3.6 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Kuehne + Nagel International AG

- 7.2.2 DHL Group

- 7.2.3 A.P. Moller-Maersk A/S

- 7.2.4 Pfenning Logistics

- 7.2.5 Eurofresh Logistics GmbH

- 7.2.6 Heuer Logistics GmbH & Co. KG

- 7.2.7 KLM Kuhl- und Lagerhaus Munsterland GmbH

- 7.2.8 Kloosterboer BLG Coldstore GmbH

- 7.2.9 Frigolanda Cold Logistics

- 7.2.10 NewCold Advanced Logistics

- 7.2.11 Scan Global Logistics*

- 7.3 Other Companies