|

市场调查报告书

商品编码

1644368

亚太地区数位户外(DOOH):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)APAC DOOH - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

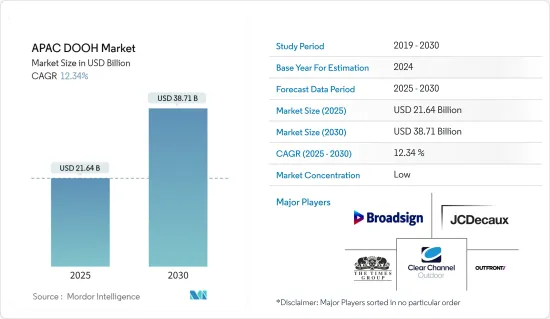

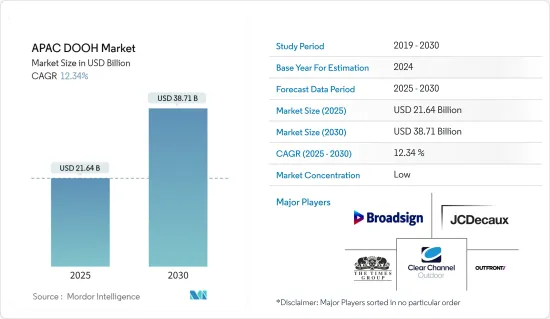

亚太地区数位户外(DOOH) 市场规模预计在 2025 年为 216.4 亿美元,预计到 2030 年将达到 387.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.34%。

亚太地区是各地区中人口最多的地区。随着城市人口的成长和购买力的增强,亚太地区被认为是数位户外广告最大的市场之一。

主要亮点

- 该地区发达的基础设施在数位户外广告市场的发展中发挥关键作用。此外,该地区主要由上海文广集团和时代互联网等本地企业主导,儘管德高贝登等规模较大的企业在该地区也占有相当大的市场占有率。 DOOH 品牌可以利用数位展示广告的优势,包括资料驱动的定位、测量、基于效果的中期宣传活动创新灵活性、保证可见性和无诈欺流量。

- 全球最大的中产阶级、快速的基础设施成长、不断加速的数位化以及不断扩张的大都市是推动数位萤幕配置激增的显着因素。泰国、马来西亚和菲律宾等国家由于市场分散,户外空间自动化发展速度加快,许多新的纯数位化参与者在这些市场涌现。

- 市场正在见证供应商进行各种联盟和收购,以加强其市场地位。例如,2022年6月,程序化数位户外广告科技公司Hivestack扩大了与雅仕维媒体集团有限公司的合作伙伴关係,后者的策略重点是大型交通广告媒体管理,包括地铁、机场和高铁。

- 此外,市场参与者推出的各种措施也进一步支持了数位户外媒体市场的成长。例如,2022 年 9 月,《印度时报》与 Times OOH 合作发起了一项 DOOH宣传活动。该宣传活动旨在透过一系列有趣的图像讲述有关印度的不同故事,鼓励观众反思和了解印度的独特之方面。

- 新冠疫情的爆发虽然阻碍了数位化,但也为新技术和新显示器的引入打开了大门。随着人们逐渐放鬆限制,将社交距离和卫生放在首位,并考虑到公共,我们很可能会看到更聪明、可操作的数位显示器出现在零售、交通、饭店、银行和教育等客户收集点,配备脸部辨识扫描器、热探测器和伫列管理平台。此类数位户外媒体公共事业基础设施的涌入可能会促进该地区的数位化,并为数位户外媒体产业创造新的机会。

亚太数位户外(DOOH) 市场趋势

预计过境将占很大份额

- 随着旅客对相关数位内容和资讯的需求日益增长,各种广告模式(如资讯亭、广告看板和平台标牌)的互动广告也应运而生,而这些广告模式占了交通媒体收益增长的很大一部分。消费行为透过各种交通途径与客户参与的行为发生了变化,从而在客户心态中策略性地建立品牌。这很可能会在未来三年内推动潜在客户转向传统媒体。

- 在所有不同的交通环境中,机场已被证明是理想的广告宣传场所,尤其是对于知名品牌和奢侈品牌而言。机场不断面临寻找增加收益方法的压力。透过将海报等静态展示转变为数位展示,机场可以利用相同的空间并将其出售给多个广告商。这将成倍地增加您的收入。机场还可以透过引入广告合作伙伴来分担升级到新广告技术的成本负担。

- 2022 年 6 月,阿达尼机场控股有限公司 (Adani Airports Holdings Ltd) 选择 Lemma 作为其技术合作伙伴,为程式化 DOOH 提供支援。采用程序化广告符合利用最新基础设施和技术对印度主要机场进行现代化改造的目标。

- 此外,生活风格平台 TataCLiQ 最近与 Lemma 合作,在机场为 TheLUXELife 开展了首个程序化 DOOH宣传活动。宣传活动旨在吸引对网路购物和奢侈品有着浓厚亲和性的受众。 Tata CLiQ Luxury 扩大了其程式化投资组合,与 Lemma 合作开展宣传活动,使用 Google DV360 作为需求端平台在不同地点的多个萤幕上即时检验DOOH宣传活动。

- 由于亚太地区 COVID-19 疫情蔓延而实施的封锁导致 RA-OOH(铁路音频广告)陷入停顿。该地区的主要公共交通连接有限,在此期间,像公车站这样的主要交通户外销售点被忽视了。封锁给多个媒体行业造成了沉重打击,户外媒体的打击尤其严重。

- RA-OOH 广告聚合了消费者接触点,是接触超当地语系化目标受众的最具成本效益和创新性的方式之一。由于封锁,接触点已暂停。然而,随着经济重新开放和运输业务恢復正常,市场成长开始加速。

预计中国将占很大份额

- 根据跟讯网路统计,中国户外广告市场规模约90亿美元,其中数位广告占比约25%至30%。由于多种因素的影响,数位萤幕和支出正在快速增长。其驱动因素包括更便宜、更高品质的萤幕的出现,广告商希望透过创新讯息提高受众参与度和影响力,以及新技术的引入。

- 另一个主要因素是,现在大多数影片广告的长度为三到五秒,因此现在可以在数位萤幕上有效地使用影片来扩大大众媒体宣传活动的覆盖范围。在中国,未来几年数位户外广告支出预计将大幅增加,而静态户外广告(大型广告看板广告除外)预计将减少。

- 程序化数位户外广告在该地区日益流行可归因于多种因素,包括中国可用的数位户外广告库存增加、为程序化宣传活动提供支援的本地资料合作伙伴的实力,以及本地品牌和广告商对目标市场受众的总体需求不断增长。

- 2022 年 11 月,程式化数位户外广告科技公司 Hivestack 宣布与 Tulip Media 合作,在中国推出户外 LED 媒体萤幕。此次合作将使国内外品牌、代理商和全通路 DSP 能够访问 Hivestack 的供应端平台,在北京、上海、广州和深圳等中国 15 个主要一线和二线城市购买超过 100 块户外大萤幕。

- 受新冠疫情影响,中国多个品牌暂停数位户外广告,但这并不意味着萤幕完全熄灭。虽然一些媒体所有者已将其网路下线,但其他媒体已将其显示器转移到面向公众的资讯来源,敦促他们保持距离,经常洗手,并向他们提供必要的更新。

- 住宅电梯上的网路萤幕也非常活跃,播放着公共广告、学习教育应用程式的广告,以及当地餐厅提供外带。在中国,随着封锁措施的放鬆和外出人数的增多,越来越多的数位户外宣传活动正在涌现。中国媒体主已经开始报告宣传活动预订量稳定成长。

亚太地区数户外广告 (DOOH) 产业概况

亚太地区的数位户外(DOOH)市场高度分散。它由几家在多个市场运营的大型户外广告和媒体公司,以及在一个或几个本地市场运营有限数量单位的小型本地公司组成。该市场的一些主要参与者包括德高集团 (JCDecaux Group)、清晰频道户外广告公司 (Clear Channel Outdoor Holdings Inc.)、BroadSign International LLC 和 Outfront Media Inc.

2022 年 6 月,Srishti Group 与 Armour Digital OOH 建立策略伙伴关係,推动 DOOH 在印度南部市场的扩张。该战略伙伴关係已确定将在清奈中央车站、清奈莫尔车站、胡布利车站、贝尔高姆车站、达尔瓦德车站和霍斯佩特车站开展户外广告运营。

2022 年 6 月,德高新加坡在新加坡樟宜机场集团的 50 块数位萤幕库存中推出了程式化交易。 VIOOH 是一个全球数位户外广告供应端平台,与全球需求端平台合作。随着此次发布,德高贝登的程式化数位户外广告将在新加坡的 191 个数位萤幕上每月带来 1.2 亿次广告曝光率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 数位萤幕日益普及

- 联网萤幕提供更大的广告弹性

- 市场挑战

- 安装和维护成本高

第六章 市场细分

- 按位置

- 室内的

- 户外的

- 按应用

- 广告看板

- 交通

- 街道家具

- 其他用途

- 按最终用户

- 零售

- 医疗保健/製药

- 金融服务

- 车

- 电信/公共事业

- 政府

- 其他最终用户

- 按国家

- 中国

- 日本

- 澳洲

- 印度

- 韩国

- 香港

- 泰国

- 新加坡

- 其他亚太地区(菲律宾、印尼、马来西亚等)

第七章 竞争格局

- 公司简介

- JCDecaux Group

- Clear Channel Outdoor Holdings Inc.

- BroadSign International LLC

- Outfront Media Inc.

- The Times Group

- Talon Outdoor Ltd

- oOh!media Limited

- Daktronics Inc.

- Eye Media LLC

第八章投资分析

第九章 市场展望

The APAC DOOH Market size is estimated at USD 21.64 billion in 2025, and is expected to reach USD 38.71 billion by 2030, at a CAGR of 12.34% during the forecast period (2025-2030).

The Asia-Pacific has the largest population among all the regions. With a rise in the urban population and increased purchasing power, Asia-Pacific is considered one of the largest markets for Digital OOH.

Key Highlights

- The developed infrastructure of the region plays a significant role in developing the Digital OOH market. Moreover, the region is dominated by various local players, like Shanghai Media Group and Times Internet, while substantial players, like JCDecaux, also have considerable market share in this region. Brands using DOOH could utilize the benefits of digital display advertising, such as data-driven targeting, measurement, and the flexibility to set creative mid-campaign based on performance and the assurance of viewability and non-fraudulent traffic.

- The largest global middle class, rapid infrastructure growth, accelerating digitization, and sprawling metropolises are prominent factors in the rampant allocation of digital screens. Countries like Thailand, Malaysia, and the Philippines are automating out-of-home spaces relatively fast due to market fragmentation, with many new players emerging in these markets, which are purely digital.

- The market is witnessing various partnerships and acquisitions from vendors to enhance its market position. For instance, in June 2022, Hivestack, a programmatic digital out-of-home AD tech company, extended its partnership with Asiaray Media Group Limited with a strategic focus on mega transport advertising media management, including metro lines, airport, and high-speed rail lines.

- Moreover, the various initiatives launched by the market players are further boosting the growth of the DOOH market. For instance, in September 2022, Times of India launched a DOOH campaign in partnership with Times OOH. The campaign aimed at communicating a wide array of stories about India, using a series of intriguing images that invoke viewers to think and know about unique aspects of India.

- The outbreak of COVID-19 halted digitization, but it also opened doors for introducing new technologies and displays. Keeping public safety in mind, as people moved towards more relaxed restrictions with social distancing and hygiene being the utmost priority, more smart utility-digital displays are likely to emerge equipped with facial-identity scanners, thermal detectors, cue management platforms across congregation points such as retail, transit, hospitality, banking, and education sectors. This influx of DOOH-utility infrastructure could help boost the digitization drive in the region and create a new opportunity for the DOOH Industry.

Asia Pacific Digital-Out-of-Home (DOOH) Market Trends

Transit is Expected to Hold Major Share

- The rising demand for digital content and information relevant to travelers has led to interactive ads through different modes of advertisements, such as Kiosks, billboards, and Signboards, at the platform that accounts for a significant share of growth in transportation media revenues. There has been a shift in consumer behavior regarding customer engagement across various modes of transportation, thereby strategically building the brands in the customer mindset. This will drive potential customers against traditional media over the next three years.

- Among various transit environments, airports have proven themselves to be ideal for advertising, particularly for top-tier and luxury brands. Airports are under constant pressure to figure out ways to generate more and more revenue. Converting static displays like posters to digital displays allows airports to utilize the same space to sell to multiple advertisers. That multiplies the amount of income exponentially. Airports can also share the cost burden of upgrading to new advertising technologies by bringing in advertising partners.

- In June 2022, Adani Airports Holdings Ltd engaged Lemma as a tech partner to power programmatic DOOH. The adoption of programmatic advertising aligns with the goal of modernizing India's major airports with the latest infrastructure and technology.

- Furthermore, , Lifestyle platform TataCLiQ executed its first programmatic DOOH campaign recently for TheLUXELife at airports in partnership with Lemma. The campaign aims to reach audiences exhibiting a high affinity for online shopping and luxury products. Expanding their programmatic portfolio, Tata CLiQ Luxury, along with Lemma, ran the campaign with Google DV360 as the demand side platform, giving the brand real-time validation of the DOOH campaign across multiple screens at various locations.

- The lockdown prompted by the spread of COVID-19 in Asia-Pacific brought the RA-OOH (Railway Audio Advertising) to a standstill. Major public modes of transport were restricted in the region, and significant transit OOH mediums, such as bus stands, were gone unnoticed during this period. The lockdown took a hit on several media industries, and OOH properties were hit significantly.

- RA- OOH advertising has a cluster of consumer touchpoints and is one of the most budget-effective and innovative techniques to reach the mass hyper-local target audience. Due to the lockdown, the touchpoints were disrupted. However, with the reopening of the economies and the transport operations coming back to normal, has provided boost to the market growth.

China is Expected to Hold Major Share

- According to Doohken Network, the China OOH market is around USD 9 billion, of which between 25% and 30% is what could be called digital. Digital screens and spending are increasing faster due to multiple factors. Some are as basic as more availability of cheaper, higher-quality screens, while advertisers want better audience engagement and impact from their creative messages, plus the introduction of new technologies.

- Another key driver is that most video advertising is now in shorter lengths, even 3-5 seconds, so the video can now work effectively on digital screens to build reach for mass media campaigns. It is expected that over the next years, Digital Outdoor spending will grow significantly while static outdoor, except for large format billboard ads, will decline in China.

- The growing popularity of programmatic DOOH in the region can be attributed to several factors, such as the increase in available Chinese DOOH inventory, the strength of local data partners to power programmatic campaigns, and the overall growing need for local brands and advertisers to target audiences within the market.

- In November 2022, Hivestack, a programmatic digital-out-of-home ad tech company, announced its partnership with Tulip Media for outdoor LED media screens in China. This partnership will help local and global brands, agencies, and omnichannel DSPs to access the Hivestack supply-side platform to buy more than 100 outdoor mega screens in over 15 first and second-tier key cities in China, including Beijing, Shanghai, Guangzhou, and Shenzhen.

- With the outbreak of COVID-19, several brands across China have put a temporary hold on DOOH ads, but screens haven't gone dark altogether. Though some media owners have taken their networks offline, other players have transitioned their display screens into an information source for the public, with measures that remind people to keep their distance, wash their hands frequently, and provide essential updates.

- Networks screens in residential elevators have also remained incredibly active, sharing Public Service Announcements, ads for learning and education apps, and local restaurants offering takeout. China has seen more DOOH campaigns emerge as lockdown measures relax and more people venture outside. Media owners in China are beginning to report a steady uptick in campaign bookings.

Asia Pacific Digital-Out-of-Home (DOOH) Industry Overview

The Asia Pacific Digital-Out-of-Home (DOOH) Market is highly fragmented. It comprises several extensive outdoor advertising and media companies with operations in multiple markets, as well as the smaller, local companies operating a limited number of structures in one or a few local markets. Some of the major players in the market include JCDecaux Group, Clear Channel Outdoor Holdings Inc., BroadSign International LLC, Outfront Media Inc., etc.

In June 2022, Srishti Group and Armour Digital OOH established a strategic partnership to drive DOOH expansion in the southern Indian markets. The strategic partnership has been defined for OOH business at Chennai Central, Chennai Egmore, Hubli, Belgaum, Dharwad, and Hospet railway stations.

In June 2022, JCDecaux Singapore launched programmatic trading for its inventory of 50 digital screens at Singapore Changi Airport Group. The offering will connect advertisers and media buyers to advertising inventory at Changi Airport via VIOOH, a global digital OOH supply-side platform connected to leverage global demand-side platforms. With this launch, JCDecaux said its programmatic DOOH offering would have 120 million monthly impressions across 191 digital screens islandwide.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Digital Screens

- 5.1.2 High Advertising Flexibility with Connected Screens

- 5.2 Market Challenges

- 5.2.1 High Installation and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Location

- 6.1.1 Indoor

- 6.1.2 Outdoor

- 6.2 By Application

- 6.2.1 Billboard

- 6.2.2 Transit

- 6.2.3 Street Furniture

- 6.2.4 Other Applications

- 6.3 By End User

- 6.3.1 Retail

- 6.3.2 Healthcare/Pharmaceuticals

- 6.3.3 Financial Services

- 6.3.4 Automotive

- 6.3.5 Telecom/Utilities

- 6.3.6 Government Agencies

- 6.3.7 Other End Users

- 6.4 By Country

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 Australia

- 6.4.4 India

- 6.4.5 South Korea

- 6.4.6 Hong Kong

- 6.4.7 Thailand

- 6.4.8 Singapore

- 6.4.9 Rest of Asia-Pacific (Philippines, Indonesia, Malaysia, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JCDecaux Group

- 7.1.2 Clear Channel Outdoor Holdings Inc.

- 7.1.3 BroadSign International LLC

- 7.1.4 Outfront Media Inc.

- 7.1.5 The Times Group

- 7.1.6 Talon Outdoor Ltd

- 7.1.7 oOh!media Limited

- 7.1.8 Daktronics Inc.

- 7.1.9 Eye Media LLC