|

市场调查报告书

商品编码

1644471

美国印刷标籤:市场占有率分析、行业趋势、统计数据、成长预测(2025-2030 年)United States Print Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

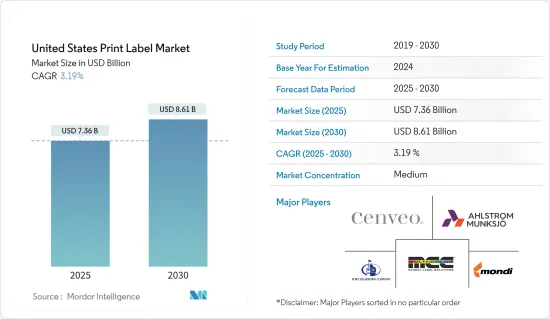

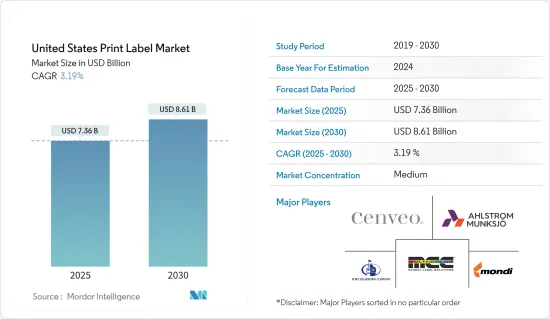

预计 2025 年美国印刷标籤市场规模为 73.6 亿美元,到 2030 年将达到 86.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.19%。

主要亮点

- 新冠疫情为标籤数位印刷提供了机会。标籤是必需品供应链的一部分。它也是传达讯息的重要工具。因此,市场对食品、卫生、药品标籤和电子商务销售相关的标籤资讯的需求日益增加。美国标籤产业在疫情爆发的第一个月发挥了至关重要的作用。在新冠肺炎疫情期间,美国标籤转换器交货了需求量大的印刷产品。

- 数位技术满足了各个终端用户产业的多种需求,并开发出了有吸引力的标籤设计,从而激发了潜在消费者的购买慾望。数位技术与现有标籤印刷技术的融合有望为各个领域带来从小规模到大规模的巨大变化,从而改善整个市场。

- 此外,柔版印刷可望引领国内印刷标籤市场。随着自动化程度的提高,客户希望他们的产品能尽可能接近订购时间交付。为了满足需求,更快的交货时间现在比以往任何时候都更重要。柔版印刷机提供连续印刷解决方案、更多软体整合到印刷机和技术中以及耐用性,以便在更短的前置作业时间内满足客户需求。

- 柔版印刷是一种高速捲筒纸印刷技术,适用于大多数包装和标籤应用。这种柔版印刷方法的最大优点是,它能够在各种产品上快速、经济、高品质地印刷标籤。柔版印刷版透过在橡胶或其他柔性材料上创建所需图像的三维凸起图像来创建柔版印刷。柔版印刷将品质、生产力和灵活性完美地融为一体,成为印刷标籤行业中最受欢迎的印刷方式。

- 由于客製印刷几乎任何尺寸和数量的标籤,印刷标籤对于产品安全和促销至关重要。先进的柔版印刷技术使品牌所有者能够有效地推广他们的产品并传达有关产品的讯息,例如其产地和重要的营养资料,以及产品召回的重要追踪资料。

- 柔版印刷成本较低,因此该平台越来越多地进入市场。创建个人化、限量版印刷标籤也变得更具吸引力。柔版印刷是一种使用柔性版(相对于固态版)的印刷技术。这是一种新的凸版印刷形式。

- 改进标籤转换过程是一项持续且艰鉅的任务,因为很难跟上最新的技术进步。 UV LED 固化技术已成为各种印刷製程的重大突破。如今,它为标籤、标记、软包装和收缩套包装应用的窄带柔版印刷和套印上光提供了显着的优势。

- UV 固化油墨不仅可以提高印刷性能,还可以解决迁移问题,使其成为 UV 柔版食品包装和标籤应用的理想选择。太阳化学公司最近推出了 SolarVerse,一种色素丰富、黏度低、多用途的 UV 柔印基底浓缩液。

- 此外,纸膜的耐用性往往不如薄膜,如果在使用过程中没有采取适当的措施,纸膜会随着时间的推移而撕裂或起皱。然而,与环境法规相关的标籤也会阻碍印刷标籤市场的成长。如果标籤在回收时残留在物品上,将会妨碍该物品的可回收性。例如,当回收一个贴有标籤的瓦楞纸箱时,高湿强度纸标籤不会阻止该箱子被回收,但如果使用薄膜代替高湿强度纸,则标籤可能无法回收。

美国印刷标籤市场的趋势

感压标籤占据最大市场占有率

- 感压标籤(PSL) 由五层组成:衬里、离型层、黏合剂、布料和麵漆,类似于高科技贴纸。 PSL 采用纸张、薄膜和箔作为主要标籤材料,并可使用多种油墨来产生Sharp Corporation、鲜艳的色彩。

- PSL 是最广泛使用的标籤施用器之一,因为它不需要任何热量、溶剂或水,只需轻轻或适度的压力即可贴在产品表面上。据 Resource Label Group 及其所有子公司称,PSL 占据了市场上所有标籤的 80% 以上。

- 在传统啤酒标籤市场这样一个竞争激烈的市场中,让您的标籤在众多竞争对手中脱颖而出的最重要因素之一就是拥有独特的外观和感觉。因此,传统的湿胶标籤由于其广泛的装饰可能性和优异的外观正在迅速被感压标籤和套管所取代。

- 在传统的啤酒标籤领域,湿胶标籤更受青睐,因为它们极具成本效益,特别是对于更大、更持久的工作。另一方面,更多的装饰可以增加标籤在拥挤的货架上吸引註意力的机会。感压标籤是湿胶标籤的一种具体而有效的替代品。感压标籤采用具有金属效果的反向印刷镜面解决方案,具有更好的黏合性能和更多的装饰选择。这就是为什么在美国企业发展的公司专注于满足市场不断变化的需求。

- 感压标籤用于食品和饮料、製药、消费品、个人护理和建设产业。为这些行业服务的供应商站在第一线,努力继续生产和供应关键消费品和医疗保健产品的标籤材料。然而,由于竞争加剧以及印刷和装饰技术的进步,原物料价格正在上涨。

饮料预计将占据较大的市场占有率

- 饮料是美国印刷标籤市场的主要终端用户产业之一。这是由于饮料领域广泛采用创新标籤和包装以及健康饮料领域的市场不断扩大。

- 预计到 2024 年,这个重要饮料类别的销售额将超过 1,700 亿美元。儘管在疫情期间,该国部分饮料细分市场的消费受到了影响,但新冠疫情的爆发扩大了许多细分市场的覆盖范围。

- 此外,中国拥有一些最大的碳酸饮料公司,能量饮料市场蓬勃发展,越来越多的公司采用新的包装技术来吸引客户。随着美国消费者对健康的关注度日益提高,这些公司越来越多地在标籤上印製产品成分。此外,这些成分可能因品牌和特定能量饮料产品而异。

- 随着葡萄酒市场的成长,标籤的需求变得至关重要。大多数葡萄酒标籤要么采用纸质标籤,要么采用薄膜标籤,即无标籤形式。此外,标籤的设计必须能够承受其运输、储存和使用的环境。因此,该国酿酒厂的增加也将导致标籤印刷和製造的扩张。

- 随着永续性在标籤供应链中变得越来越突出,我们可能会看到再生材料和可回收材料的使用量增加。潜在材料包括 PET、生质塑胶和厚可重复使用玻璃。随着永续性在标籤供应链中变得越来越重要,我们可能会看到可回收标籤材料的使用量增加。此外,艾利丹尼森正在推广多种永续性,包括回收再生用宝特瓶回收的 CleanFlake 黏合剂技术、ClearCut 黏合剂技术以及用于饮料标籤应用的各种纸张和薄膜布料。

- 饮料容器也将决定后续黏合剂的选择。研究表明,玻璃容器所需的黏合剂与塑胶容器不同。纸和聚丙烯是饮料标籤最常用的两种材料,其中大多数使用聚丙烯基材。该国的饮料业正在扩张,饮料标籤也在升级,这推动了该国的市场需求。

- 此外,美国供应商正在投资合作和收购策略,以增强其标籤解决方案并提高品牌知名度。例如,美国的Fort Dearborn 公司收购了 Wall 公司,后者是一家领先的切割堆迭、捲筒纸和收缩套筒标籤供应商。此次收购进一步加速了该公司在美国印刷标籤解决方案领域的成长,主要针对食品、饮料和家居用品领域。

美国印刷标籤产业概况

美国印刷标籤市场集中度较高,国内外都有许多大大小小的参与者。参与者正在采用产品创新、策略伙伴关係、业务扩张和併购等关键策略。主要市场发展包括:

- 2023 年 3 月美国图形通讯公司泰勒宣布将在墨西哥蒙特雷开设一个新的标籤製造工厂。最新的开业将进一步帮助该公司满足墨西哥工业公司对长效标籤日益增长的需求。

- 2023 年 10 月,All4Labels 将搬迁至墨西哥城的一个更大的工厂,并引入一系列新技术,作为扩大其在墨西哥和美国的激动人心的扩张计划的一部分。 Almirall 表示,这五条新的印刷生产线将专注于感压标籤和收缩套标,使该工厂的生产能力提高三倍。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 采用数位印刷技术生产的标籤需求不断增加

- 医疗保健和化妆品领域的采用率很高

- 市场挑战

- 缺乏能够承受恶劣天气条件的产品

- 生态系分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对美国印刷标籤市场的影响评估

第五章 市场区隔

- 按印刷工艺

- 胶版印刷

- 凹版印刷

- 柔版印刷

- 萤幕

- 凸版印刷

- 电子照相术

- 喷墨

- 按标籤格式

- 湿胶标籤

- 感压标籤

- 无底纸标籤

- 多部分追踪标籤

- 套模标籤

- 收缩和拉伸套

- 按最终用户产业

- 食物

- 饮料

- 卫生保健

- 化妆品

- 适合家庭使用

- 工业(汽车、工业化学品、耐用性和非耐用消费品)

- 后勤

- 其他最终用户产业

第六章 竞争格局

- 公司简介

- Fort Dearborn

- Multi Color Corporation

- Mondi Group

- Ahlstrom-munksjo Oyj

- Cenveo Corporation

- Avery Dennison Corporation

- Brady Corporation

- Westrock Company

- RR Donnelley & Sons Company

- Taylor Corporation

第七章:未来市场展望

简介目录

Product Code: 72261

The United States Print Label Market size is estimated at USD 7.36 billion in 2025, and is expected to reach USD 8.61 billion by 2030, at a CAGR of 3.19% during the forecast period (2025-2030).

Key Highlights

- The COVID pandemic has provided opportunities for digital printing in labeling. Labels are part of the supply chains of necessities. Additionally, they serve as an essential tool for conveying information. Hence, the market has witnessed an increased demand for food, hygiene, pharmaceutical labels, and labeling information related to e-commerce sales. Short runs on a regular and increasing basis have become the norm.The United States label industry played a key role in the initial month of the outbreak. The label converters in the US delivered printed products that were in high demand during the COVID-19 outbreak.

- Digital technology has met the multiple requirements of various end-user industries in developing attractive label designs to encourage potential consumers to make purchases. The integration of digital technology with the existing label printing techniques is expected to bring a massive change to all the small-scale and large-scale sectors, improving the overall market.

- Moreover, flexography printing is expected to drive the print label market in the country. With the rise in automation, customers want their products as close to the order time as possible. Faster turnaround times are becoming more vital than ever to meet demand. Flexographic printer with continuous print solutions, more software integrations into the presses and technologies, and durability would meet customer demand in shorter lead times.

- Flexography, a roll-feed high-speed printing technique, is appropriate for most packaging and label applications. The best thing about this flexography is that it makes it possible to print labels on a wide range of products quickly, affordably, and with excellent quality. A flexible printing plate creates a flexographic print by creating a three-dimensional relief of the desired image in rubber or another flexible material. Due to its excellent combination of quality, productivity, and flexibility, flexographic printing has become the most popular print generation in the print label industry.

- Print Labels is crucial in product safety and promotions through flexible packaging attributed to on-demand printing in almost any size or quantity. Advanced flexographic printing techniques enable brand owners to efficiently promote their products and transmit information about them, including their origin, crucial nutritional data, and even crucial tracking data for a product recall.

- Due to the lower cost of flexo printing, its platforms have increasingly entered the market. Creating personalized, limited-run print labeling has also grown more appealing. Flexography is a printing technique that uses a flexible (rather than a solid) plate. It is a newer incarnation of relief printing.

- Enhancing the process of label converting is a continuous and demanding task due to the difficulty in keeping pace with the latest advancements in technology. UV LED curing technology has emerged as a significant breakthrough in various printing processes. It now provides significant advantages for narrow web flexographic printing and overprint varnishing for labels, tags, flexible packaging, and shrink-sleeve packaging applications.

- Apart from enhancing printing performance, UV cured inks are migration-compliant and, hence, ideal for UV flexo food packaging and label applications. Sun Chemical recently launched SolarVerse, a range of highly pigmented, low viscosity, multipurpose UV flexo base concentrates that are ideal for labeling food materials.

- Moreover, paper film stocks tend to be less durable than films, potentially ripping or wrinkling over time if proper care is not taken during the application process. However, labeling about environmental regulation will also hinder the growth of the print label market. If a label remains on an item during recycling, it will hinder the recyclability of the item. For example, when labeled corrugated boxes are recycled, wet strength paper labels do not hinder box recycling, but if the film is used instead of wet strength paper, the label could not have been recycled.

United States Print Label Market Trends

Pressure-sensitive Labels Accounts for the Largest Market Share

- Pressure-sensitive labels (PSL) consist of five individual layers, such as liner, release coat, adhesive, face stock, and topcoat, and are analogous to a high-tech sticker. A PSL can use paper, film, and foil as its primary label materials and can be used with a wide range of inks to produce sharp and bright colors.

- The PSL is one of the most widely used forms of label applicator, as it does not require any heat, solvent, or water to activate; it only takes light or moderate pressure to apply it to a product surface. According to the Resource Label Group and all subsidiaries, PSLs constitute more than 80% of all labels in the market.

- In a highly competitive market like the traditional world of beer labeling, one of the most important factors in making a label stand out from the crowd and the competition is having a unique look and feel. For this reason, traditional wet glue labels are quickly being replaced by pressure-sensitive labels or sleeves because of the various embellishment possibilities and the superior appearance.

- The traditional beer labeling world prefers wet glue labels because they are very cost-effective, especially for large-scale, long-lasting jobs. On the other hand, with more decoration, a label that stands out on a crowded shelf is more likely to be noticed. A concrete and effective alternative to wet glue labels is pressure-sensitive labels. Pressure-sensitive labels offer better adhesive properties and more decoration options on a reverse-printed mirror solution with metallic effects in advancements. This is why players operating in United States, focus on catering to the changing market needs.

- Pressure pressure-sensitive labels are used in the food and drink, pharmaceutical, consumer goods, personal care, and construction industries. Depending on the application, different adhesives may make pressure-sensitive labels permanent or reusable.The vendors serving these industries are working on the front line to continue producing and supplying label materials for critical consumer and healthcare products. However, the raw material prices are rising, coupled with increased competition and evolving printing and decorating technologies.

Beverage is Expected to Account For Significant Market Share

- The beverage is one of the primary end-user industries for the US print label market, owing to the high rate of adoption of innovative label and packaging in the beverage sectors and the growing market for the health drinks segment.

- Sales of significant beverage categories is expected to cross USD 170 billion by 2024. Although the consumption of some beverage segments in the country was affected during the pandemic, the scope of many segments expanded due to the COVID-19 outbreak.

- Furthermore, the country is home to some of the largest carbonated beverage companies, along with a strong market for energy drinks, which are increasingly adopting new packaging techniques to attract customers. These companies are also printing their ingredients on their labels, as health-related concerns are growing among US consumers, expanding the scope of printing. Also, these ingredients may vary between brands and specific energy drink products.

- With the growing wine market, the need for labeling is becoming crucial. Most of the wine labels use paper label look or no label look with film label. In addition, labels need to be designed to withstand the environment in which they are shipped, stored, and used. Therefore, the growing number of wineries in the country will also expand label printing and manufacturing.

- As sustainability becomes more of a presence in the labeling supply chain, there will be an increased use of recycled and recyclable materials. Top material choices will include PET, bioplastic, and thicker reusable glass. As sustainability becomes more critical in the labeling supply chain, they will likely see increased use of recyclable label materials. In addition, Avery Dennison promotes several technologies for sustainability, including its CleanFlake adhesive technology for PET bottle recycling, ClearCut Adhesive technology, and a variety of paper and film face stocks for beverage labeling applications.

- The beverage's container also dictates the subsequent adhesive choice. According to research, glass containers require a different adhesive than plastic containers. Paper and polypropylene are the two most common materials used for beverage labels, while most employ polypropylene substrates. The growing expansion of the beverage industry in the country as well as the launch of upgraded labels for beverages in the market boosted the market demand in the country.

- Further, the US vendors invest in collaboration and acquisition strategies to enrich their label solutions and increase brand awareness. For instance, US-based Fort Dearborn Company acquired Walle Corporation, a leading supplier of cut & stack, roll-fed, and shrink sleeve labels. This acquisition helped the company grow more in the printed label solutions in the US, primarily for the food, beverage, and household products segments.

United States Print Label Industry Overview

The United States print label market is moderately concentrated, owing to the presence of many large and small players in the market operating in the domestic and international market. Players are adopting key strategies, such as product innovation, strategic partnerships, expansions, and mergers and acquisitions. Some of the key developments in the market are:

- In March 2023: Taylor, a United States-based graphic communications company, announced the opening of its new label manufacturing facility in Monterrey, Mexico. The most recent opening would further aid the business in meeting the growing demand for long-lasting labels from industrial firms in Mexico.

- In October 2023: All4Labels moved to a new larger facility in Mexico City and is in the process of installing a host of new technologies as part of an impressive expansion plan to grow its presence in Mexico and the United States. The five new printing lines, focused on pressure-sensitive labels and shrink sleeves, will treble production capacity at the site, according to Almirall, while space remains for further press installations in the future

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Labels Manufactured with Digital Print Technologies

- 4.2.2 High Adoption From Healthcare and Cosmetics Segment

- 4.3 Market Challenges

- 4.3.1 Lack of Products with Ability to Withstand Harsh Climatic Conditions

- 4.4 Industry Ecosystem Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the US Print Label Market

5 MARKET SEGMENTATION

- 5.1 By Print Process

- 5.1.1 Offset Lithography

- 5.1.2 Gravure

- 5.1.3 Flexography

- 5.1.4 Screen

- 5.1.5 Letterpress

- 5.1.6 Electrophotography

- 5.1.7 Inkjet

- 5.2 By Label Format

- 5.2.1 Wet-glue Labels

- 5.2.2 Pressure-sensitive Labels

- 5.2.3 Linerless Labels

- 5.2.4 Multi-part Tracking Labels

- 5.2.5 In-mold Labels

- 5.2.6 Shrink and Stretch Sleeves

- 5.3 By End-user Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Healthcare

- 5.3.4 Cosmetics

- 5.3.5 Household

- 5.3.6 Industrial (Automotive, Industrial Chemicals, and Consumer and Non-consumer Durables)

- 5.3.7 Logistics

- 5.3.8 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fort Dearborn

- 6.1.2 Multi Color Corporation

- 6.1.3 Mondi Group

- 6.1.4 Ahlstrom-munksjo Oyj

- 6.1.5 Cenveo Corporation

- 6.1.6 Avery Dennison Corporation

- 6.1.7 Brady Corporation

- 6.1.8 Westrock Company

- 6.1.9 R.R. Donnelley & Sons Company

- 6.1.10 Taylor Corporation

7 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219