|

市场调查报告书

商品编码

1644486

虚拟活动:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Virtual Events - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

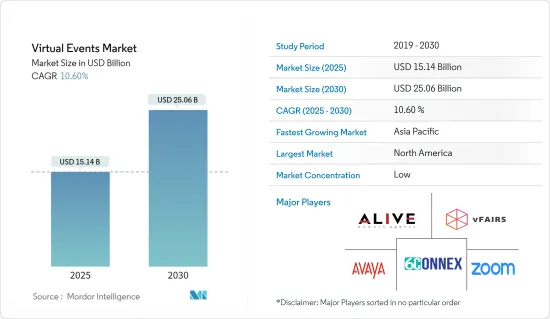

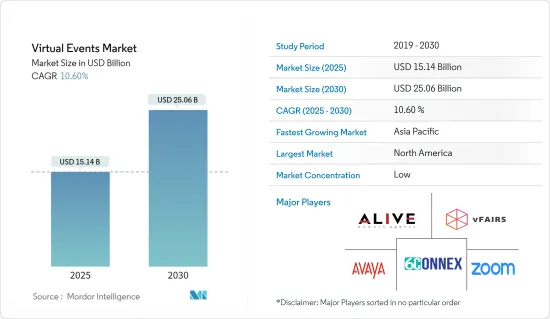

虚拟活动市场规模预计在 2025 年为 151.4 亿美元,预计到 2030 年将达到 250.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.6%。

虚拟活动,也称为线上活动、虚拟会议或直播,是一种让人们参与线上环境的活动。这些活动将利用数位平台举办各种活动,包括演讲、研讨会、社交活动和娱乐活动。虚拟活动范围从小型会议和网路研讨会到大型会议和贸易展览。利用视讯会议、直播和互动等工具来吸引与会者并重现亲临现场活动的体验。

关键亮点

- 虚拟活动的快速转变刺激了虚拟活动技术的创新和改进。每个平台都开始整合更先进的功能,例如虚拟实境(VR)、扩增实境(AR)、人工智慧主导的网路和增强的互动工具,以重现亲临现场的活动体验。

- 近年来,随着先进技术的不断普及,虚拟活动市场经历了显着成长。其中包括整合通讯即服务(UCaaS)、虚拟实境 (VR)、人工智慧 (AI)、高速网路连线等。这些进步丰富了虚拟事件体验,解决了互动和参与度有限等挑战,为沉浸式和互动式数位环境铺平了道路。

- 科技的进步使得举办虚拟活动变得比以往任何时候都更加容易。可靠的视讯会议平台、互动式虚拟环境和网路工具提高了虚拟活动的整体体验和参与度。公司正在利用这些技术进步为观众提供身临其境、互动的虚拟体验。

- 随着虚拟平台的采用率飙升,资料安全和隐私已成为虚拟活动市场最受关注的问题。虚拟活动世界的可及性和便利性推动了其日益增长的受欢迎程度,但它也使与会者和组织者面临一系列网路威胁。在当今数位优先的环境中,虚拟平台经常处理敏感资料,例如与会者资讯、付款详情和专有业务内容,凸显了先进的安全和隐私措施的重要性。

- 在后疫情时代,这些技术的使用变得民主化,提供价格合理的网路研讨会和虚拟活动,以满足各种规模组织的需求。影片内容对于提高观众参与度和增加观看时间至关重要。这种向数位化活动的变革性转变为未来几年需求的成长奠定了基础。 Zoom Video Communications, Inc. 预测,到 2025 年,网路研讨会和虚拟活动的数量将增加十倍,收益将比疫情前飙升五倍。

虚拟活动市场趋势

企业是最大的最终用户

- 随着企业越来越多地采用数位平台进行沟通、协作和举办活动,虚拟活动市场的企业部门正在经历显着成长。虚拟活动为企业提供了一种经济高效、可扩展且灵活的方式来举办会议、网路研讨会、会议、产品发布会、企业培训等。此外,全球向混合工作模式的转变,加上对永续商业实践日益增长的兴趣,正在推动企业采用虚拟活动解决方案。

- 企业界全心全意地接受了虚拟聚会。随着数位转型重塑商业格局,虚拟活动的世界正经历普及度和采用度的激增。这一趋势的主要驱动因素是高速互联网、视讯串流和虚拟实境的进步。公司将虚拟活动用于多种目的,从举办国际会议到举办虚拟招聘会。

- 混合和虚拟活动已从疫情期间的临时解决方案演变为企业活动的重要组成部分。会议 SaaS 提供者 Cvent 进行的一项调查发现,73% 的活动策划者计划在 2024 年举办更多混合活动,而 2023 年则不会。此外,永续性和社会责任在企业活动策划者中越来越受到重视。线上活动票务平台 Eventbrite 的一项调查显示,84% 的活动策划者正在积极为其活动实施永续性措施。

- 资料和分析在塑造企业活动中发挥关键作用。活动策划者不仅使用资料来评估活动的成功,而且还使用数据来指导未来聚会的决策。例如,资料可以揭示出席率、参与度和投资收益(ROI),以及揭示与会者行为的趋势和模式。有了这些资料,规划人员可以让即将举行的活动更具吸引力、更有效。

- 混合活动正在成为主流。我们预计,相当一部分企业活动将采用混合模式,既能容纳现场与会者,也能容纳虚拟与会者。永续性已成为首要任务。活动策划者致力于尽量减少活动对环境的影响并积极支持当地社区。资料和分析对于企业虚拟活动来说已变得至关重要。正在利用 AR、VR、AI 和区块链等先进技术为与会者创造更具吸引力和身临其境的体验。

- 这些趋势表明,企业活动正在变得更加混合、永续、个人化、资料主导和技术先进。接受这些变化的活动策划者将在不断发展的企业活动世界中取得成功。

亚太地区成长强劲

- 由于技术进步、商业文化的变化以及全球事件的影响,亚太地区对虚拟活动的需求激增。网路研讨会、线上会议、展览会和虚拟展览等虚拟活动已成为亚太地区企业、教育机构和组织不可或缺的一部分。

- 通讯技术的快速进步极大地促进了亚太地区虚拟活动的发展。高速网路、行动装置的普及以及云端基础的平台的普及使得组织更容易举办和参与虚拟活动。随着亚太地区许多企业拥抱数位转型,虚拟活动解决方案已成为其业务的自然延伸。该地区精通技术的人口也使得向虚拟平台的过渡变得无缝。

- 例如,2024年4月,上海虚拟体育公开赛(SVS)宣布了中国首个综合性虚拟体育赛事的计画。此市级数位体育计画扎根于上海,将传统体育与数位领域融合。利用先进的模拟设备和线上竞赛平台,我们将推出高尔夫、自行车、滑雪、划船和赛车五项虚拟运动。

- 同样,看到对虚拟活动的需求不断增长,许多公司正在推出新的虚拟活动平台以增加其市场占有率。例如,电通集团宣布,将于2023年9月改造元宇宙基础设施系统“xambr”,并将其作为在大型活动中推广元宇宙的平台,首先在虚拟会场“TOKYO GAME SHOW VR 2023”上使用。这些新兴市场的发展不断扩大,带动了整体市场的发展。

虚拟活动产业概览

研究市场中各公司之间的竞争力取决于他们的价格、产品、市场占有率以及彼此竞争的强度。

虚拟活动市场竞争激烈,许多中型和大型公司在国内和国际上提供解决方案。儘管市场集中度适中,主要企业正在利用产品创新和併购策略来超越竞争对手并扩大其地理覆盖范围。

创新为企业带来永续的竞争优势。市场参与企业正在采取强有力的产品差异化和扩张策略。领先的公司透过研发、合作和整合活动对市场产生了强大的影响力。相反,该市场的特点是高渗透率和深度细分。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 评估新冠疫情和宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 统一通讯即服务 (UCAAS)、VR 接受度不断提高等技术进步。

- 商业活动频率增加

- 全球影响力、可及性和成本效益

- 市场限制

- 资料安全和隐私问题

- 技术和经验限制

第六章 市场细分

- 按服务类型

- 通讯

- 人才招聘

- 销售与行销

- 训练

- 按应用

- 会议

- 展览/展览会

- 高峰会

- 其他的

- 按最终用户产业

- 教育机构

- 企业

- 组织

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- 6Connex International sp. zoo

- Alive Events Agency

- Zoom Video Communications Inc.

- Avaya LLC

- vFair

- ALE International

- NTT DATA Group Corporation

- Cisco Systems Inc.

- Cvent Inc.

- EventX Limited

- George P. Johnson

- Airmeet Inc.

- Microsoft Corporation

第八章投资分析

第九章:市场的未来

The Virtual Events Market size is estimated at USD 15.14 billion in 2025, and is expected to reach USD 25.06 billion by 2030, at a CAGR of 10.6% during the forecast period (2025-2030).

A virtual event, also known as an online event, virtual conference, or livestream, is an event that interests people interacting in an online environment. These events use digital platforms to host various activities, such as presentations, workshops, networking sessions, and entertainment. Virtual events range from small meetings and webinars to large-scale conferences and trade shows. They leverage tools like video conferencing, live streaming, and interactive features to engage participants and replicate the experience of in-person events.

Key Highlights

- The rapid shift to virtual events spurred innovation and improvements in virtual event technologies. Platforms integrated more advanced features such as virtual reality (VR), augmented reality (AR), AI-driven networking, and enhanced interactive tools to replicate the in-person event experience.

- In recent years, the virtual events market has experienced significant growth, driven by the rising adoption of advanced technologies. These include Unified Communications as a Service (UCaaS), Virtual Reality (VR), Artificial Intelligence (AI), and high-speed internet connectivity. Such advancements have enriched the virtual event experience and tackled challenges like limited interaction and engagement, paving the way for immersive and interactive digital environments.

- Technological advances have made it easier than ever to host virtual events. Reliable video conferencing platforms, interactive virtual environments, and networking tools have improved the overall experience and engagement levels during virtual events. Businesses use these technological advancements to create immersive and interactive virtual experiences for their audiences.

- As the adoption of virtual platforms surges, data security and privacy have become paramount concerns in the virtual events market. While the global accessibility and convenience of virtual events fuel their rising popularity, they simultaneously expose participants and organizers to many cyber threats. In today's digital-first landscape, virtual platforms frequently handle sensitive data, including attendee information, payment details, and proprietary business content, underscoring the critical importance of advanced security and privacy measures.

- The post-COVID landscape has democratized access to these technologies, with affordable webinars and virtual events catering to organizations of all sizes. Video content is becoming essential for boosting audience engagement and prolonging viewing times. This transformative shift towards digitized events has set the stage for heightened demand in the coming years. Zoom Video Communications, Inc. forecasts that by 2025, the number of webinars and virtual events will increase tenfold, with revenues soaring to five times their pre-pandemic levels.

Virtual Events Market Trends

Enterprises to be the Largest End Users

- As businesses increasingly adopt digital platforms for communication, collaboration, and event hosting, the enterprise segment of the virtual event market has experienced notable growth. Virtual events provide enterprises with a cost-effective, scalable, and flexible approach to conducting meetings, webinars, conferences, product launches, and corporate training sessions. Additionally, the global shift towards hybrid work models, coupled with an intensified focus on sustainable business practices, is driving the adoption of virtual event solutions within enterprises.

- The corporate sector is wholeheartedly embracing virtual gatherings. As digital transformation reshapes the business landscape, the global popularity and adoption of virtual events have surged. Key drivers of this trend include advancements in high-speed internet, video streaming, and virtual reality. Companies are utilizing virtual events for a wide range of purposes, from hosting international conferences to organizing virtual job fairs.

- Hybrid and virtual events have evolved from temporary solutions during the pandemic to becoming essential components of the corporate events landscape. A survey conducted by Cvent, a software-as-a-service provider for meetings, found that 73% of event planners plan to increase their hybrid event hosting in 2024 compared to 2023. Furthermore, sustainability and social responsibility are gaining prominence among corporate event planners. A study by Eventbrite, an online event ticketing platform, revealed that 84% of event planners are actively implementing sustainability measures for their events.

- Data and analytics are playing a crucial role in shaping corporate events. Event planners utilize data not only to assess the success of their events but also to guide decisions for future gatherings. For example, data can shed light on attendance rates, engagement levels, and return on investment (ROI), as well as reveal trends and patterns in attendee behavior. By leveraging this data, planners can ensure that future events are both more engaging and effective.

- Hybrid events are on track to become the norm. A significant portion of corporate events is expected to adopt a hybrid model, accommodating both in-person and virtual attendees. Sustainability is emerging as a top priority. Event planners are focusing on minimizing their events' environmental impact and actively supporting local communities. Data and analytics are becoming indispensable for corporate virtual events. Advanced technologies such as AR, VR, AI, and blockchain are being utilized to create more engaging and immersive experiences for attendees.

- These trends suggest that corporate events are evolving to be more hybrid, sustainable, personalized, data-driven, and technologically advanced. Event planners who embrace these changes are poised to succeed in the evolving landscape of corporate events.

Asia Pacific to Register Major Growth

- The demand for virtual events in the Asia-Pacific has been surging, driven by advancements in technology, a shift in business culture, and the impact of global events. Virtual events, including webinars, online conferences, trade shows, and virtual exhibitions, have become essential for companies, educational institutions, and organizations across the region.

- The rapid advancement in communication technologies has significantly contributed to the growth of virtual events in the Asia-Pacific. High-speed internet, widespread adoption of mobile devices, and the increasing penetration of cloud-based platforms have made it easier for organizations to host and participate in virtual events. Many businesses in Asia Pacific have adopted digital transformation, and virtual event solutions have become a natural extension of their operations. The region's tech-savvy population also makes the transition to virtual platforms seamless.

- For instance, in April 2024, the Shanghai Virtual Sports Open (SVS) unveiled plans for China's inaugural comprehensive virtual sports event. This city-owned digital sports initiative, rooted in Shanghai, merges traditional sports with the digital realm. Utilizing advanced simulation equipment and online competition platforms, the event showcases five virtual sports: golf, cycling, skiing, rowing, and car racing.

- Again, looking at the growing demand for virtual events, many companies are launching new virtual event platforms to increase their market share. For instance, in September 2023, Dentsu Group Inc. announced that the company updated its metaverse infrastructure system "xambr", which would provide it as a platform for promoting the metaverse at large-scale events, beginning with its use in the virtual venue "TOKYO GAME SHOW VR 2023'. Such developments are continuously growing in the market, which drives the overall market.

Virtual Events Industry Overview

The competitive rivalry between various firms in the market studied depends on prices, products, market shares, and the intensity with which they compete against one another.

The virtual events market is fiercely competitive, with numerous mid-sized and large players offering domestic and international solutions. While the market shows moderate concentration, key players employ product innovations and mergers & acquisitions strategies to outpace competitors and broaden their geographical footprint.

Innovation can give companies a sustainable competitive advantage. Market players are adopting powerful strategies based on product differentiation and expansion. The big companies strongly influence the market through R&D, collaborations, and consolidation activities. Conversely, the market can be characterized by high levels of penetration and increasing fragmentation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 and Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technology Advancements such as Growing Acceptance of Unified Communication as a Service (UCAAS), VR, etc.

- 5.1.2 Increased Frequency of Business Events

- 5.1.3 Global Reach, Accessibility, and Cost Efficiency

- 5.2 Market Restraints

- 5.2.1 Data Security and Privacy Issues

- 5.2.2 Technology Constraints and Experiential Limitations

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Communication

- 6.1.2 Recruitment

- 6.1.3 Sales and Marketing

- 6.1.4 Training

- 6.2 By Application

- 6.2.1 Conferences

- 6.2.2 Exhibitions/Trade Shows

- 6.2.3 Summits

- 6.2.4 Other Applications

- 6.3 By End-User Industry

- 6.3.1 Educational Institutions

- 6.3.2 Enterprise

- 6.3.3 Organizations

- 6.3.4 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 6Connex International sp. z.o.o.

- 7.1.2 Alive Events Agency

- 7.1.3 Zoom Video Communications Inc.

- 7.1.4 Avaya LLC

- 7.1.5 vFair

- 7.1.6 ALE International

- 7.1.7 NTT DATA Group Corporation

- 7.1.8 Cisco Systems Inc.

- 7.1.9 Cvent Inc.

- 7.1.10 EventX Limited

- 7.1.11 George P. Johnson

- 7.1.12 Airmeet Inc.

- 7.1.13 Microsoft Corporation