|

市场调查报告书

商品编码

1644651

中国智慧建筑:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)China Smart Building - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

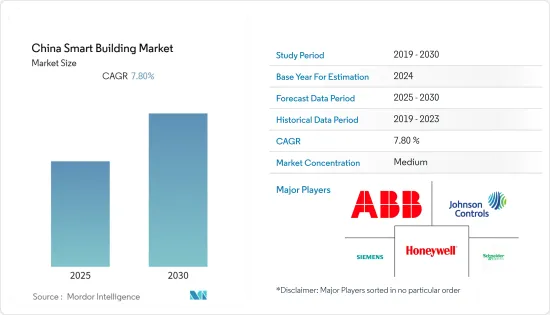

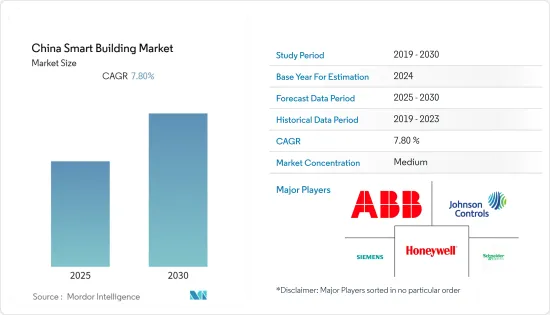

预计预测期内中国智慧建筑市场复合年增长率将达 7.8%。

主要亮点

- 智慧建筑可实现基础设施、照明、安全系统以及暖气、通风和空调系统控制流程的自动化。智慧建筑利用技术并将其融入基本建筑基础设施和其他结构和营运组件中,以使建筑更有效率、更安全、更永续性并降低成本。所研究的智慧建筑解决方案是不断发展的物联网和互联感测器生态系统的一部分。

- 目前,智慧楼宇正在采用基础设施管理系统、楼宇能源管理系统、智慧安防系统等解决方案。 BEMS 是一种整合的电脑系统,用于监控和控制与能源相关的建筑服务、工厂和设备,例如 HVAC 系统和照明。

- 透过奖励过程和设定基准,可以加速该国智慧技术的采用。通常透过公用事业强制要求的能源效率计划来推广的智慧技术包括先进的占用和空置控制、日光控制、智慧电源分接头、智慧插头以及与照明和 HVAC 系统协同工作的 BMS。

- 此外,可以透过基准化分析来抑制能源消耗的激增。业主、设施营运商、管理人员和设计师可以使用基准行销来促进能源核算,并将其设施的能源使用情况与类似设施进行比较,以评估改进机会并量化/检验能源节约。为了达到期望的基准并减少能源消耗,我们正在采用智慧型能源解决方案。

- 此外,中国政府在「数位丝路」倡议下经常推动与智慧城市的合作,该倡议是「一带一路」倡议的重要组成部分。在东协,透过《中国-东协战略伙伴关係2030愿景》加强了合作,中国致力于支持东协的技术转型倡议,例如《东协资讯通信技术总体规划2020》和东协智慧城市网路。

- 此外,从新冠疫情中恢復的过程进一步迫使当地组织重组业务以适应下一个常态。各行各业的组织都在适应整体重视业务的数位化和自动化。预计这些变化将对劳动力技能和能力要求产生重大影响。再培训有两种类型:技能提升,即员工获得有益于其目前职位的新技能;再培训,即员工获得承担不同或全新职能所需的能力。

中国智慧建筑市场趋势

基础设施管理系统可望占据主要市场占有率

- 智慧建筑使用感测器、致动器和微晶片根据业务功能和服务收集和管理资料。基础设施管理系统可协助业主、营运商和设施经理提高资产可靠性和性能、减少能源使用、优化空间利用率并最大限度地减少建筑物对环境的影响。物联网基础设施管理系统的日益普及以及对空间利用意识的不断增强预计将推动该国市场的成长。

- 随着感测器、分析和云端技术的出现,基础设施管理系统场景正在发生变化,这些技术专注于降低 BMS 成本,同时改变应用程式製造商、系统整合商和解决方案供应商的市场动态。

- 当今用于建筑和基础设施的物联网平台使用多种通讯协定实现建筑内设备和感测器之间的连接,并将它们生成的资料传输到云端的服务和应用程序,然后可以透过商业智慧(BI) 系统、分析和仪表板进行分析。从感测器和设备收集资料的基础设施会过滤、保护讯息,并透过中间通讯协定将其传输到云端或建筑物本身的资料中心。

- 此外,该地区办公大楼和购物中心的物联网系统和基础设施管理系统的开发商意识到,将环境控制平台整合到建筑基础设施中可以提高效率并显着节省成本。感测器技术和分析技术的发展正在推动基于互联网的连接系统的部署以及对大型和小型智慧建筑的需求。

- 透过物联网感测器监控居住并做出相应反应,连网的智慧建筑可以透过关闭灯和调节暖通空调系统来自动响应居住的变化以减少消费量,从而精确控制建筑物管理能源的方式和位置。

住宅预计将占据较大的市场占有率

- 与非智慧建筑相比,智慧建筑透过提供创新方法来创造价值。例如,智慧感测器可以监测住宅是否漏水,在某些地区甚至用于监测空屋。这些感测器可以透过多种方式通讯,包括行动电话服务、Wi-Fi、6lowpan、ZigBee 和 LoRa。智慧型感测器可以侦测住宅中的危险情况,并在危险发生之前进行预防。

- 市场供应商正在积极推出新的解决方案。例如,2020年1月,ADT推出了其家庭安全平台。 ADT 的 Blue 是一款先进的产品,具有可由客户安装和设计的单独家庭安全部件,并进行全面检查和容量选择。

- 此外,2020年8月,Google与ADT建立长期伙伴关係关係,共同打造下一代智慧安全解决方案。此次合作将把Google的硬体和服务与 ADT 的 DIY 和专业安装的智慧家庭安全解决方案结合起来,彻底改变住宅安全产业。

- 2020年12月,广州房地产开发商实地集团在北京发布创新OTA智慧社区。该系统采用新型云端基础下载技术OTA,为社区成员提供服务、更新和讯息,带来更大的便利性并提供更广泛的服务。

中国智慧建筑业概况

中国智慧建筑市场竞争激烈,有多家供应商为国内和国际市场提供智慧建筑。市场中等分散,主要供应商采用併购和策略联盟等策略来扩大其地理范围并保持其竞争地位。市场的主要参与者包括江森自控、西门子楼宇科技、Honeywell国际、Schneider Electric和日立。市场的最新趋势包括:

- 2021 年 5 月—Honeywell资料,云端基础资料更好的决策、提高效率并实现永续目标。

- 2021年2月,华为资料通讯产品线发表智慧云端网路解决方案「FiveOnes」新特性,包括一跳入云端、全网路连线、一键快速调度、一条光纤多用、一站式综合安全。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 市场驱动因素

- 智慧技术的日益普及将推动市场成长

- 监理变化推动对节能係统的需求

- 市场挑战

- 实施成本高以及隐私/安全问题

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场区隔

- 按解决方案

- 建筑能源管理系统

- 基础设施管理系统

- 智慧安防系统

- 其他解决方案

- 依建筑类型

- 住宅

- 商业的

- 产业

第六章 竞争格局

- 公司简介

- Johnson Controls PLC

- Siemens Building Technologies(Siemens AG)

- Honeywell International Inc.

- Schneider Electric SE

- ABB Group

- Azbil Corporation

- Hitachi Ltd.

- Huawei Technologies

- Cisco Systems Inc.

- Xiaomi Corporation

第七章投资分析

第 8 章:未来展望

The China Smart Building Market is expected to register a CAGR of 7.8% during the forecast period.

Key Highlights

- A smart building automates its processes to control its infrastructure, lighting, security systems, heating, ventilation, and air conditioning systems. A smart building uses technology and assimilates it with the basic building infrastructure and other structural and equipment components to make buildings increasingly efficient, safer, sustainable, and reduce costs. The studied smart building solutions are part of the growing IoT and connected sensor ecosystem.

- Solutions, such as the Infrastructure Management System, Building Energy Management System, and Intelligent Security System, are currently being adapted for smart buildings. BEMS is an integrated and computerized system for monitoring and controlling energy-related building services, plants, and equipment such as HVAC systems and lighting.

- The adoption of smart technologies in the country could be accelerated by incentivizing the process and by setting up benchmarks. Smart technologies often incentivized through prescriptive utility energy efficiency programs include advanced occupancy and vacancy controls that work with lighting and HVAC systems, daylighting controls, smart power strips, smart plugs, and BMS.

- Moreover, the spike in energy consumption can be controlled by benchmarking. Property owners, facility operators, managers, and designers could use bench marketing to facilitate energy accounting, comparing a facility's energy use to similar facilities to assess opportunities for improvement and quantify/verify energy savings. Smart energy solutions have been adopted to meet the desired benchmark and reduce energy consumption.

- Moreover, the Chinese government frequently promotes smart city cooperation under its Digital Silk Road Initiative, a significant component of the Belt and Road Initiative (BRI). In ASEAN, cooperation is enhanced through the ASEAN-China Strategic Partnership Vision 2030, where China has pledged to support ASEAN's technology transformation initiatives, including the ASEAN ICT Master Plan 2020 and the ASEAN Smart City Network.

- Furthermore, recovery from COVID-19 further forces regional organizations to reimagine their operations for the next normal. Organizations across industries are adapting to emphasize digitalization and automation across their operations. Such changes are expected to impact the requirements for workforce skills and capabilities significantly. This will require two changes across the workforce: upskilling, in which staff gain new skills to help in their current roles, and reskilling, in which staff needs capabilities to take on different or entirely new functions.

China Smart Building Market Trends

Infrastructure Management System is Expected to Hold a Significant Market Share

- Smart buildings use sensors, actuators, and microchips to collect and manage data according to a business' functions and services. Infrastructure management systems help owners, operators, and facility managers improve asset reliability and performance, reducing energy use, optimizing space used, and minimizing the environmental impact of buildings. The rising adoption of IoT-enabled infrastructure management systems and raising awareness of space utilization are expected to drive the market's growth in the country.

- The infrastructure management systems scenario is evolving with the arrival of sensors, analytics, and cloud technologies focused on reducing the costs of BMS while at the same time transforming the market dynamics of application manufacturers, systems integrators, and solution providers.

- The current IoT platforms for buildings and infrastructures enable a connection between the building's equipment, which is distributed by devices and sensors that use a wide variety of protocols, which transfer the data they generate to services and applications in the Cloud to be analyzed subsequently by Business Intelligence (BI) systems, analytics, and dashboards. The infrastructure for collecting data of sensors and devices filters and securitizes the information through intermediate protocols and forwards it to a cloud or the data center in the building itself.

- Further, the developers of IoT systems and infrastructure management systems for office buildings and shopping centers in the studied region have realized that integrating environmental control platforms into the architectural infrastructure leads to improved efficiency and significant cost savings. The development of sensor technology and analytics has aided the deployment of internet-based connectivity systems and the demand for smart buildings for large and small structures.

- With IoT sensors monitoring occupancy and reacting accordingly, a connected smart building can automatically respond to occupancy changes by turning off lights and adjusting HVAC systems to reduce consumption, accurately controlling how and where a building should manage its energy.

Residential is Expected to Hold a Significant Market Share

- A smart building creates value by providing an innovative approach compared to non-smart buildings. For instance, Smart sensors can monitor homes for leaks and are used in some communities to help monitor vacant homes. These sensors can communicate in various ways, including cell service, Wi-Fi, 6lowpan, ZigBee, and LoRa. Smart sensors that detect and can prevent dangerous situations from arising in residential.

- The market vendors are actively introducing new solutions. For instance, in January 2020, ADT announced a home security platform. Blue by ADT is the advanced product offering, individual home security parts that clients can install and design with proficient checking and capacity choices.

- Additionally, in August 2020, Google and ADT formed a long-term partnership to create the next generation of smart security solutions. The partnership will combine Google's hardware and services and ADT's DIY and professionally installed smart home security solutions to innovate the residential security industry.

- In December 2020, Guangzhou-based real estate developer Seedland Group released an innovative over-the-air or OTA smart community in Beijing. The system uses OTA, a new cloud-based download technology, to provide services, updates, and information to community members, creating greater convenience and offering a wider range of services.

China Smart Building Industry Overview

The China Smart Building Market is significantly competitive owing to multiple vendors providing Smart Building to the domestic and international markets. The market appears to be moderately fragmented, with the significant vendors adopting strategies for mergers and acquisitions and strategic partnerships, among others, to expand their reach and stay competitive. Some major players in the market are Johnson Controls, Siemens Building Technologies, Honeywell International, Schneider Electric, and Hitachi Ltd, among others. Some of the recent developments in the market are:

- May 2021 - Honeywell launched a cloud-based solution for building owners and managers that simplifies and combines operational and business data to support better decision-making, drive greater efficiencies, and achieve sustainability goals.

- February 2021 - Huawei Data Communication Product Line announced the Intelligent cloud network solution Five Ones' new capabilities, including one hop to the cloud, one network-wide connection, one-click fast scheduling, one fiber for multiple purposes, and one-stop integrated security.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Market Drivers

- 4.3.1 Growing adoption of smart technologies to drive market growth

- 4.3.2 Demand for energy-efficient systems driven by regulatory changes

- 4.4 Market Challenges

- 4.4.1 High implementation costs and privacy/security concerns

- 4.5 Industry Attractiveness -Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact Of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Building Energy Management System

- 5.1.2 Infrastructure Management System

- 5.1.3 Intelligent Security System

- 5.1.4 Other Solutions

- 5.2 By Building Type

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Johnson Controls PLC

- 6.1.2 Siemens Building Technologies (Siemens AG)

- 6.1.3 Honeywell International Inc.

- 6.1.4 Schneider Electric SE

- 6.1.5 ABB Group

- 6.1.6 Azbil Corporation

- 6.1.7 Hitachi Ltd.

- 6.1.8 Huawei Technologies

- 6.1.9 Cisco Systems Inc.

- 6.1.10 Xiaomi Corporation