|

市场调查报告书

商品编码

1644866

美国设施管理:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)United States Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

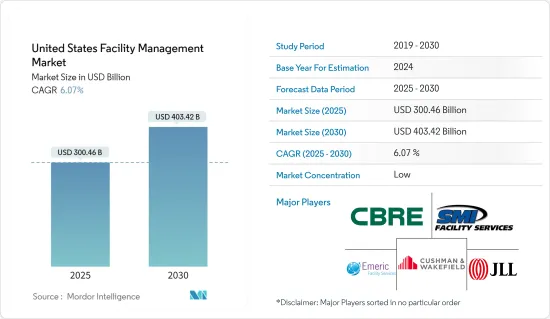

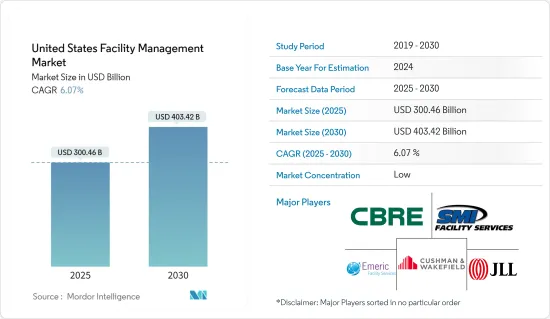

美国设施管理市场规模预计在 2025 年为 3,004.6 亿美元,预计到 2030 年将达到 4,034.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.07%。

推动美国设施管理服务市场成长的关键因素之一是对内部和外包设施管理的各种客製化解决方案的需求激增。

主要亮点

- 美国各大城市的住宅和商业建筑数量不断增加,对设施管理服务的需求也日益增长。预计,人们对综合设施管理服务的日益关注和基础设施建设的进步将对市场产生积极影响。

- 为了跟上不断变化的科技时代,机器人设备监控和与物联网结合的扩增实境等工具在国内正在稳步增加。因此,越来越多的软体供应商正在加强技术创新,为设施管理市场的人工智慧和机器人创造空间。

- 2023 年 3 月,设施服务、基础设施解决方案和停车管理提供者 ABM 签署了一份多年期合同,为 Tropicana Field 和 Al Lang Stadium 提供优质的客房服务解决方案,并管理日常业务和活动人员。透过此次伙伴关係,ABM 将作为单一供应商,为两个体育场超过 100 万平方英尺的空间配备专业清洁人员,致力于提供清洁服务,提升球迷体验。

- 根据美国人口普查局的数据,2023年11月的总建筑支出经季节性已调整的后年化率预计约为2.0501万亿美元,较10月份修订后的2.0425万亿美元增长0.4%。预计整体建筑支出的增加将为市场创造巨大的成长机会。

- 限制该市场成长的主要因素之一是对设备和网路安全的安全问题。预计,在整个预测期内,日益增多的安全漏洞和有组织犯罪集团的威胁将阻碍市场的成长。

美国设施管理市场趋势

增加对医疗基础设施和医疗设施建设的投资

- 随着患者数量的不断增长以及公共和私人医疗支出的不断上升,医疗保健已成为美国最重要的行业之一。根据美国医疗补助服务中心和医疗保险中心提供的资料,2018年至2027年间,美国全国医疗保健支出预计将以每年5.5%的速度成长,达到约6兆美元。

- 医疗保健支出的快速增长导致了医院和诊所中许多不同类型的护理设施的发展。此外,美国医疗保健产业设施管理服务的外包显着增加,包括疗养院、医院和第三方专家。因此,医疗保健产业对设施管理服务的需求日益增加。

- 医疗保健机构每天都会产生大量有害和无害废弃物。如果处理不当,危险废弃物可能会影响患者照护的品质。它还会导致环境污染和感染疾病的传播。

- 在美国,Medxcel 是规模最大、最受推崇的医疗设施服务提供者之一。在过去四年中,Medxcel 已为其客户节省了 8,000 万美元的设施管理费用。

- 根据美国国家人口问题研究所的人口快报《美国老化》,到 2060 年,美国总数预计将达到约 9,500 万人。大多数老年人面临精神疾病、慢性病、伤害和残疾。美国医疗保健产业面临着提供优质护理、高科技医疗设备以及满足新的消费者偏好的压力。

商业领域推动市场需求

- 商业建筑旨在透过新建筑(主要是办公室和工业设施)开展业务。服务提供者主要提供建筑物的整个基本基础设施,包括电梯维护、建筑维修、窗户清洁、油漆、门和天花板护理等。

- 在职场,智慧建筑技术在协助设施管理人员创造更节能、更舒适的环境、管理建筑资产和系统以及规划未来需求方面发挥关键作用。

- 2023 年 11 月,建筑领域的 3D数位双胞胎平台供应商 Matterport Inc. 和网路基础设施数位化解决方案的全球供应商 Belden Inc. 建立了新的伙伴关係,为工业自动化、智慧建筑、宽频和设施管理提供支援 3D数位双胞胎的连接解决方案。

- 多年来,具有永续IT基础设施的弹性工作空间在美国东北部得到了显着发展。该地区拥有一些最清洁的机制、计划和政策,鼓励采用绿色技术。由于「绿色清洁技术」越来越受欢迎,美国的专业清洁服务正在经历显着成长。使用涉及专门化学品、设备和技术的永续清洗产品是推动整个市场成长的关键因素。

- 零售业设施管理的主要职责是保持商店区域清洁、安全和有吸引力。 NEST 的零售客户表示,在 COVID-19 疫情期间,他们的客流量超出了预期。 NEST 在美国和加拿大管理 60,000 家零售店,其中大部分位于美国。 NEST 提供将财务洞察和业务分析与纠正性和预防性维护整体咨询方法相结合的综合解决方案。

美国设施管理产业概况

由于本地和全球领先公司的存在,美国设施管理市场比较分散。设施管理服务需求的不断增长预计将吸引更多参与者并加剧竞争。 Compass Group PLC、Sodexo Inc.、CBRE Group Inc.、Ingersoll Rand (Trane)、Ecolab、ISS Facilities Services Inc.、G4S PLC、Jones Lang LaSalle Incorporated (JLL)、EMCOR Group Inc. 和 Cushman &Wakefield 是市场上一些知名的参与者。

- 2024 年 1 月,世邦魏理仕集团 (CBRE Group Inc.) 和 Brookfield Properties 宣布建立策略伙伴关係,将利用两家公司的综合优势来提高租户满意度和物业表现。透过此次合作,世邦魏理仕与 Brookfield Properties 将相互提供全方位的物业管理服务,包括为全美超过 6,500 万平方英尺的办公空间提供建设业务、物业会计、采购业务和技术支援。

- 2024 年 1 月,Cushman & Wakefield 的另类专业资产管理部门 Nuvama Wealth Management Limited 和 Nuvama Asset Management 宣布由 Nuvama 与 Cushman & Wakefield Management Private Limited(「NCW」)成立新的 50:50 合资营业单位。新公司将成为强大的商业房地产投资全方位服务平台。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素对产业的影响

第五章 市场动态

- 市场驱动因素

- 美国医疗基础设施投资和医疗建设增加

- 商业建筑对建筑资讯模型 (BIM) 的需求

- 市场限制

- 资料外洩和安全威胁日益增多

第六章 市场细分

- 设施管理类型

- 内部设施管理

- 外包设施管理

- 单调频

- 捆绑 FM

- 整合调频

- 按服务

- 硬体维修

- 软调频

- 按最终用户

- 商业

- 设施

- 公共/基础设施

- 工业的

- 其他最终用户

第七章 竞争格局

- 公司简介

- CBRE Group Inc.

- Jones Lang LaSalle Incorporated

- Cushman & Wakefield PLC

- Emeric Facility Services

- SMI Facility Services

- Sodexo Inc.

- AHI Facility Services Inc.

- ISS Facility Services Inc.

- Shine Management & Facility Services

- Guardian Service Industries Inc.

第八章投资分析

第九章:未来市场展望

The United States Facility Management Market size is estimated at USD 300.46 billion in 2025, and is expected to reach USD 403.42 billion by 2030, at a CAGR of 6.07% during the forecast period (2025-2030).

The surge in demand for various customized solutions for different in-house and outsourced facility management is one of the significant factors driving the growth of the facility management service market in the United States.

Key Highlights

- The growing number of residential and commercial buildings in major cities is enhancing the overall need for facility management services throughout the country. With an increase in focus on integrated facility management services and the rising developments in the infrastructure, the market is expected to experience a positive impact.

- To comply with the changing technological age, tools like robot facility monitoring and augmented reality that are integrated with IoT are steadily increasing in the country. Hence, more and more software providers are now committed to innovation, making room for AI and robotics in the facility management market.

- In March 2023, ABM, a provider of facility services, infrastructure solutions, and parking management, signed a multi-year agreement to provide first-class housekeeping solutions and to manage day-to-day and event staffing for Tropicana Field and Al Lang Stadium. With this partnership, ABM would serve as a single source for deploying a professional workforce that is mainly dedicated to delivering janitorial services that augment the fan experience across over one million square feet of stadium space at the venues.

- According to the US Census Bureau, total construction spending in November 2023 was estimated at a seasonally adjusted annual rate of approximately USD 2,050.1 billion, up by 0.4% from October's revised figure of USD 2,042.5 billion. This rise in overall construction spending is expected to amplify the market's growth opportunities significantly.

- One of the key factors limiting the growth of this market is safety concerns related to device and network security. A growing number of security breaches and the increased threats posed by organized crime groups are expected to hamper the market's growth throughout the forecast period.

United States Facility Management Market Trends

Increasing Investments in Healthcare Infrastructure and the Construction of Healthcare Facilities

- Due to a growing number of patients and higher healthcare expenditures by the public and private players, healthcare has become one of the most important sectors within the United States. It is estimated that national healthcare spending will increase at an annual rate of 5.5% from 2018 to 2027 in the United States, reaching approximately USD 6 trillion, according to data provided by the Centers for Medicaid Services and Medicare.

- The extraordinary growth in healthcare spending led to the development of a number of different types of care facilities at hospitals and clinics. In addition, the outsourcing of facility management services by healthcare sectors, such as nursing homes, hospitals, and third-party professionals, has significantly increased in the United States. As a result, the demand for facility management services in the healthcare industry has increased.

- Healthcare facilities generate a large volume of both hazardous and non-hazardous waste daily. The quality of patient care may be compromised by hazardous waste if not properly handled. It may cause environmental pollution and the spread of infections.

- In the United States, Medxcel is one of the biggest and most respected providers of healthcare facility services. Over the past four years, Medxcel has provided customers with savings of USD 80 million on facility management expenditures.

- As per the Population Reference Bureau's Population Bulletin, "Aging in the United States," the overall number of Americans who are aged 65 and above is predicted to reach around 95 million by 2060. The majority of elders face mental illnesses, chronic diseases, injuries, and disabilities. The healthcare sector in the United States is under pressure to provide quality care services, high-technology healthcare equipment, and respond to new consumer preferences.

Commercial Segment to Drive Major Market Demand

- Commercial construction is mainly for the purpose of business through new buildings like offices or a new industrial facility. A service provider mainly provides the entire basic infrastructure of the building, which includes maintenance of lifts, building repair, cleaning of windows, painting, and care of doors, ceilings, and many more.

- In the workplace, smart building technology also plays a key role in assisting facilities managers in building a more energy-efficient, comfortable environment, managing building assets and systems, and planning for future needs.

- In November 2023, Matterport Inc., the 3D digital twin platform provider for the built world, and Belden Inc., a worldwide supplier of network infrastructure and digitization solutions, signed a new partnership with the aim to provide 3D digital twin-powered connectivity solutions for facilities management across industrial automation, smart buildings, broadband, and many others.

- Flexible workspaces with sustainable IT infrastructure have grown significantly in the northeastern United States over the years. The region has the cleanest mechanisms, programs, and policies that augment the adoption of green technology. The US professional cleaning services are experiencing tremendous growth on account of the amplified popularity of "green cleaning technology." The use of sustainable washing agents, which involve special chemicals, equipment, and techniques, is a key factor aiding the overall growth of the market.

- The prime responsibility for facilities management in the retail sector involves keeping the store area clean, safe, and attractive. The retail clients of NEST stated that they received more foot traffic than expected during the COVID-19 pandemic. NEST manages 60,000 retail locations throughout the United States and Canada, with the majority in the United States, and provides an integrated solution that pairs financial acumen and business analytics with an overall consultative approach for both reactive and preventative maintenance.

United States Facility Management Industry Overview

The US facility management market is fragmented owing to the presence of major local and global players. The growing demand for facility management services is expected to attract more players, which will intensify the competition. Compass Group PLC, Sodexo Inc., CBRE Group Inc., Ingersoll Rand (Trane), Ecolab, ISS Facilities Services Inc., G4S PLC, Jones Lang LaSalle Incorporated (JLL), EMCOR Group Inc., and Cushman & Wakefield are some of the notable players in the market.

- In January 2024, CBRE Group Inc. and Brookfield Properties announced a strategic partnership that leverages the combined power of both firms to drive tenant satisfaction and property performance. The partnership will allow CBRE and Brookfield Properties to provide one another with a full range of real estate management services for more than 65 million square feet of office space in the United States, which include construction operations, property accounting, procurement work, and technology support.

- In January 2024, Nuvama Asset Management, the alternatives-focused asset management arm of Nuvama Wealth Management Ltd and Cushman & Wakefield, announced the formation of a new 50:50 joint venture entity, Nuvama and Cushman & Wakefield Management Private Limited ("NCW"). The new entity will act as a powerful platform offering a full suite of capabilities for investing in commercial real estate.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macro-Economic Factors on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in Healthcare Infrastructure and the Construction of Healthcare Facilities in the United States

- 5.1.2 Requirement of Building Information Modeling (BIM) in Commercial Buildings

- 5.2 Market Restraints

- 5.2.1 Increased instances of Data Breaches and Security Threats

6 MARKET SEGMENTATION

- 6.1 By Type of Facility Management Type

- 6.1.1 Inhouse Facility Management

- 6.1.2 Outsourced Facility Mangement

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By Offerings

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End User

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CBRE Group Inc.

- 7.1.2 Jones Lang LaSalle Incorporated

- 7.1.3 Cushman & Wakefield PLC

- 7.1.4 Emeric Facility Services

- 7.1.5 SMI Facility Services

- 7.1.6 Sodexo Inc.

- 7.1.7 AHI Facility Services Inc.

- 7.1.8 ISS Facility Services Inc.

- 7.1.9 Shine Management & Facility Services

- 7.1.10 Guardian Service Industries Inc.