|

市场调查报告书

商品编码

1651054

欧洲策略咨询服务:市场占有率分析、产业趋势与成长预测(2025-2030 年)Europe Strategic Consulting Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

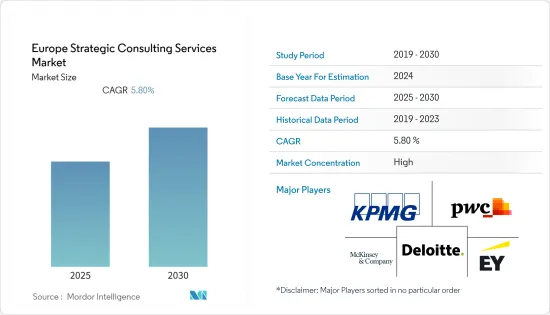

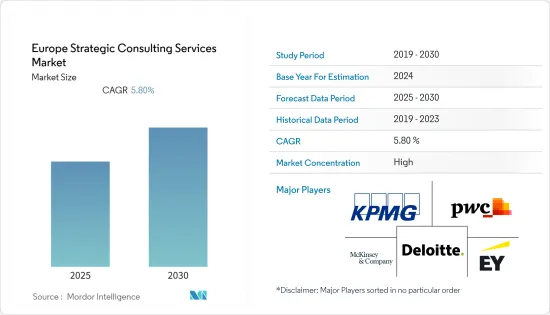

预测期内,欧洲策略咨询服务市场预期复合年增长率为 5.80%

关键亮点

- 基于成果的按收费经营模式日益增长的趋势预计将推动欧洲策略咨询市场的成长。策略咨询行业已经采取了基于时间的按收费的经营模式。在这种经营模式中,客户与顾问互动,以业务效率和策略发展的形式为客户提供价值。

- 欧洲市场不断发展,要求企业采用基于 AI/ML 的解决方案来执行研究和分析任务,以实现公司的策略成长和发展。例如,埃森哲采用了名为 myNav 的专有工具来评估现有业务需求、建立最佳云端解决方案、执行云端迁移、优化和管理云端资产,并在云端之旅中不断创新,以最大限度地为客户创造商业价值。

- 欧洲市场的公司渴望扩大对客户的服务,并越来越多地收购和合併新兴企业来开发新产品和服务,而不是依赖内部开发。随着公司的问题变得越来越复杂,多源采购模式变得越来越有吸引力。公司现在将大型计划分解为较小的项目,以便更好地服务客户。例如,新加坡经济发展局 (EDB) 的智慧工业就绪指数 (SIRI) 是一套框架和工具,旨在帮助工业和製造业企业转变业务,迎接工业 4.0。

- 每个组织都有或正在发展一个内部顾问小组。人才短缺以及自由工作者和独立顾问的崛起改变了市场。参与企业咨询市场新新兴企业的竞争日益激烈,导致价格压力加大,现有顾问公司的利润减少。这些都是策略咨询市场面临的一些挑战。

- 疫情重塑了商业流程、消费和生产模式,并引发了营商监管改革。 FEACO表示,耐用消费品(尤其是汽车)和时尚商品的需求急剧下降,而封锁措施扰乱了供应链和许多工厂,导致咨询计划被取消,工业和消费品咨询业务平均下降了14.1%。因此,欧洲策略咨询市场正在更多地向服务业领域转变。

欧洲策略咨询服务市场的趋势

金融业占据主要市场份额

- 过去十年,欧洲金融业承受着巨大的压力。企业、公民和国家当局面临英国脱欧、经济危机和疫情的影响以及开发新技术和创新解决方案的需求等挑战。金融业也正在重新崛起。必须将这些挑战作为欧盟经济復苏努力的一部分来应对。

- 根据FEACO的研究报告(2021-22),疫情迫使市场发生急剧变化,社会情势促使许多产业和客户寻求策略发展的建议。因此,数位转型已成为2020年许多咨询计划的关键方面。

- 冠状病毒(COVID-19)疫情对数位转型产生了重大影响,银行迫切需要分析客户对应用程式和平台等数位管道的需求。儘管过去两年来一直实施社交距离措施,但自疫情爆发以来,数位用户数量大幅增加。

- 欧盟委员会和国家开发银行(NDB)发现的一些挑战包括开发内部评估工具、改善组织结构、能力建设、改善软体基础设施和分析、加强审慎报告设定、评估付款基础设施和製定电子付款策略。欧洲金融改革需要强而有力的技术改革,以帮助策略咨询公司在未来赢得更多业务。

- 根据欧洲银行金融改革报告,银行业面临的主要挑战涉及内部评估工具的开发、软体基础设施的完善、审慎报告的分析、付款基础设施的评估以及电子付款策略的发展。组织结构和能力建设将吸引企业设计顾问公司来应对这些挑战并探索解决方案,包括金融部门的数位转型。来自世界各地的策略顾问公司正在寻找该地区经济转型所创造的扩张和成长机会。

英国是成长最快的地区

- 根据欧洲 MCA2021 报告,策略顾问公司希望利用全球需求来弥补疫情初期的下降,从而实现强劲成长,这使得英国在欧洲的咨询业务实现了疫情前两倍的成长。

- 策略、技术和营运是2021年英国咨询市场的三大主要服务线。随着顾问公司越来越多地参与支持数位转型过程,这些服务线每年都在扩大。

- 此外,根据併购与联盟协会(IMAA)的数据,2020 年外国公司在英国的併购活动非常活跃,总合完成 1,635 笔併购交易。 2019年,外资併购交易共1443起。 M&A的高发生率为日本引入策略咨询服务创造了机会。

- 近年来,数位化和工业 4.0 的采用趋势使得更多公司愿意在业务运营中做出战略变革,以保持市场竞争力,这为该地区更多战略咨询公司扩张和与领先企业集团合作,实现其业务核心战略的重大转变铺平了道路。

- 英国策略咨询市场正在成长,由于合作、收购和合併的增加预计还会进一步成长。例如,汤森路透和毕马威的策略合作伙伴关係将透过为英国公司法部门提供存取 HighQ 平台的权限来扩大业务。

欧洲策略咨询服务业概况

欧洲策略咨询服务市场适度细分,国内和国际参与企业均拥有数十年的产业经验。供应商正在利用他们的专业知识并投入大量广告费用来采取强有力的竞争策略。品质认证、服务提供、成本和技术力是赢得新契约的简单因素。总体而言,市场上竞争对手之间的竞争激烈,预计在预测期内将保持不变。

- 2022 年 6 月-毕马威英国宣布与分析自动化公司 Alteryx 建立合作伙伴关係,这是其投资技术以自动化业务解决方案并协助客户进行资料主导的业务转型的策略的一部分。 Alteryx 和 KPMG 结合各自的专业知识,为数位转型倡议制定资料策略,帮助企业将自动化分析融入日常业务流程,从而做出更明智、更快速的决策。

- 2022 年 6 月-埃森哲收购专门从事永续发展咨询服务的公司 Greenfish。埃森哲原定于 2022 年 4 月 20 日开发 Green Fish。

- 2022 年 6 月-Nexus 与毕马威共同开设培养箱空间。这里目前有五家公司:卡特彼勒健康、Hero Wellbeing、Work And Communications 和 Uplift 360,并透过毕马威和利兹大学获得商业和研究专业知识。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 2020-2027 年市场规模及预测

- 生态系分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 国内收购合併增加

- 数位转型和工业 4.0 的采用

- 市场问题

- 自由工作者和独立顾问数量增加导致人才短缺

- 中小企业策略咨询服务兴起分析

第六章 市场细分

- 按国家

- 英国

- 德国

- 法国

- 希腊

- 欧洲其他地区

- 按最终用户产业

- 金融服务

- 生命科学与医学

- 零售

- 政府

- 活力

- 其他的

第七章 竞争格局

- 公司简介

- Ernst & Young Global Limited

- Deloitte Consulting

- KPMG Consulting

- PwC Consulting

- McKinsey & Company

- Accenture

- PA Consulting

- Cognosis

- SNC-Lavalin Group

- Capgemini

- 供应商排名分析

第八章投资分析

第九章:未来市场展望

The Europe Strategic Consulting Services Market is expected to register a CAGR of 5.80% during the forecast period.

Key Highlights

- The rising trend of the performance-based billing business model is anticipated to fuel the Europe strategy consulting market growth. The strategy consulting industry has been working on the time-based billing business model. The business model involves the client interacting with the consultant to obtain value for money for the client in the form of operational efficiency and any strategy formulation.

- The European market has been evolving, making it necessary for businesses to adopt AI/ML-based solutions to execute research and analytical tasks for businesses' strategic growth and development. For instance, Accenture adopted a proprietary tool called myNav to assess existing business needs, architect the optimal cloud solution, execute cloud migration, optimize and manage the cloud estate, and continuously innovate cloud journey that maximizes clients' business value.

- The European market businesses are looking forward to expanding their services to clients, which has increased acquisitions and mergers with startups to develop new products and services instead of relying on in-house development. A multi-sourcing model has become more attractive as businesses' problems get more complex. Companies are now breaking their large projects into smaller ones to serve customers better. For instance, Singapore Economic Development Board (EDB) 's Smart Industry Readiness Index (SIRI) is a series of frameworks and tools to help Industries and manufacturers transform their operations for Industry 4.0.

- The organizations are having or developing in-house consulting groups. The lack of talent and the rise of Freelancers and independent consultants has changed the course of the market. New startups (entrants) in the strategy consulting market have increased competition resulting in pressure on prices and reducing profits for established consultancies. These are some of the challenges the strategy consultant market has been facing.

- The pandemic has reshaped the business process, consumption, and production patterns and attracted regulatory reforms in doing business. Accoridng to FEACO, the demand for durable products (automobiles above all) and fashion goods sharply declined, and lockdowns disrupted supply chains and many factory operations, leading to cancel consulting projects and an average 14.1% decline in the consulting towards Industrial and Consumer products. Therefore the European strategy consulting market has shifted more towards service sectors.

Europe Strategic Consulting Services Market Trends

Financial Sector will Hold the Major Share of the Market

- The European financial sector has been under considerable pressure in the past decade. Businesses, citizens, and national authorities have been affected by the Brexit, economic crisis, and pandemic, leading to challenges like developing new technologies and innovative solutions. The financial sector has been re-emerging. These challenges must be addressed as part of the EU economic recovery efforts.

- As per the survey report FEACO, 2021-22, the Pandemic has forced the market to adopt radical changes, and social scenarios have pushed many industries and clients to request more advice regarding strategic development. Therefore, digital transformation has been a key aspect of many consulting projects in 2020.

- The coronavirus (COVID-19) pandemic significantly impacted the digital transformation, creating an immediate need for banks to analyze customers' requirements for digital channels, such as apps and platforms. In the last two years, while social distancing was in effect, the number of digital users has increased significantly since the pandemic.

- Some of the challenges that the European Commission and National Development Banks (NDBs) have recognized are developing internal assessment tools, improving organizational structures, capacity building, Improving software infrastructure and analysis, enhancing prudential reporting set-ups, and assessing payment infrastructures, developing e-payment strategies. The financial reforms in the European region requires robust technological reforms which will help strategic consulting companies to gain more business in coming future.

- According to the report on financial reforms in banks in the European region, major challenges in banking sectors are related to developing internal assessment tools, Improving software infrastructure, analyze prudential reporting, set-assessing payment infrastructures, and develop e-payment strategies. Organizational structures and capacity building will attract businesses towards design consulting firms to tackle them and look for solutions, including digital transformation in the financial sector. Strategic consulting firms around the globe will find a good market opportunity for their business expansion and growth created by economic reforms in the region.

UK will be the Fastest Growing Region

- In the European region, the UK consulting business has been able to manage to record growth of double the rate before the pandemic as per the report from European MCA 2021 with the robust growth of strategic consultancies firms operating to tap into global demand to make up for declines during initial stages of the pandemic.

- In 2021 the UK consulting market, Strategy, Technology, and Operations were the three main service lines. These service lines have grown over the years in a relationship with the strong involvement of consulting firms in supporting digital transformation processes.

- Further, there was a high number of mergers and acquisitions by foreign companies in the United Kingdom in 2020, when a total l of 1,635 M&A deals were completed, according to the Institute for Mergers, Acquisitions, and Alliances (IMAA). In 2019, there were 1,443 M&A deals by foreign companies. The high occurrence of mergers and acquisitions has created an opportunity to adopt strategic consulting services in the country.

- With the recent trend toward digitalization and adoption of industry 4.0 practices, more businesses will be looking forward to making strategic changes in their business operation to remain competitive in the market, paving the way for more strategic consulting firms in the region to expand and collaborate with the major business group for major transformational changes in their core strategy of doing business.

- The UK strategy consultancy market is already on a growth trend expected to increase further with more partnerships, acquisitions, and mergers. For example, the Strategic alliance between Thomson Reuters and KPMG for expanding its business, providing HighQ platform access for UK corporate legal departments.

Europe Strategic Consulting Services Industry Overview

The European Strategic Consulting Services market is moderately fragmented, with local and international players having decades of industry experience. The vendors are incorporating a powerful competitive strategy by leveraging their expertise and spending a large amount on advertising. Quality certification, service offerings, costs, and technical capabilities are simple factors for attracting new contracts. Overall, the intensity of the competitive rivalry is high in the market, and it is expected to be the same over the forecast period.

- June 2022 - KPMG UK announced its partnership with Alteryx, the analytics automation company, as part of the firm's strategy to invest in technology to automate business solutions and help clients with data-driven business transformations. Alteryx and KPMG will combine their expertise in developing data strategies for digital transformation initiatives, assisting companies in injecting automated analytics into everyday business processes, and making smarter and faster decisions.

- June 2022 - Accenture acquired Greenfish, specializing in sustainability consultancy services. Accenture intended to develop Greenfish on April 20, 2022.

- June 2022 - Nexus and KPMG together open dedicated incubator space along with advisory support for scaling up businesses around the world. Now home to five companies: Caterpillar Health, Hero Wellbeing, Work And Communications, and Uplift 360 and interrupters with unparalleled access to commercial and research expertise through KPMG and the University of Leeds.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Sizing and Estimates for 2020-2027

- 4.3 Industry Ecosystem Analysis

- 4.4 Industry Attractiveness-Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of COVID-19 Impact on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased acquisitions and mergers in the country

- 5.1.2 Digital transformation and adoption of Industry 4.0 practices

- 5.2 Market Challenges

- 5.2.1 Lack of talent due to the rise of Freelancers and independent consultants

- 5.3 Analysis on the rise of Strategic Consultancy Services focused on Small and Mid-sized Enterprises

6 MARKET SEGMENTATION

- 6.1 By Country

- 6.1.1 UK

- 6.1.2 Germany

- 6.1.3 France

- 6.1.4 Greece

- 6.1.5 Rest of Europe

- 6.2 By End-User Industry

- 6.2.1 Financial Services

- 6.2.2 Life Sciences and Healthcare

- 6.2.3 Retail

- 6.2.4 Government

- 6.2.5 Energy

- 6.2.6 Other End-User Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ernst & Young Global Limited

- 7.1.2 Deloitte Consulting

- 7.1.3 KPMG Consulting

- 7.1.4 PwC Consulting

- 7.1.5 McKinsey & Company

- 7.1.6 Accenture

- 7.1.7 PA Consulting

- 7.1.8 Cognosis

- 7.1.9 SNC-Lavalin Group

- 7.1.10 Capgemini

- 7.2 Vendor Ranking Analysis