|

市场调查报告书

商品编码

1683941

法国室内 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)France Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

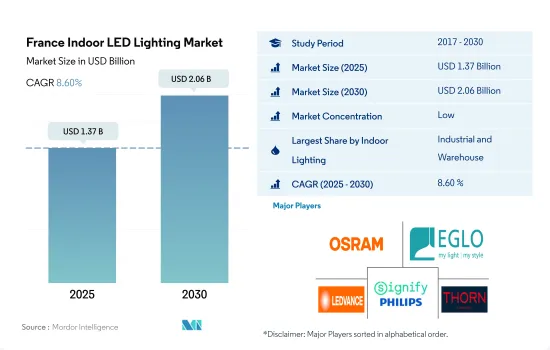

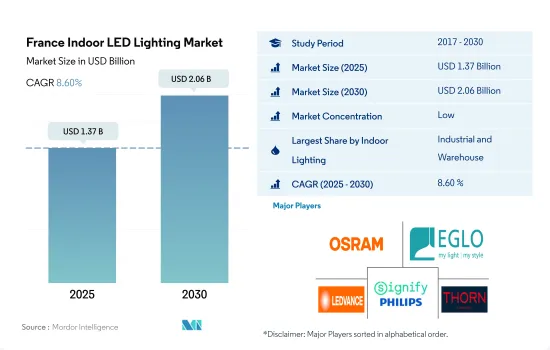

预计 2025 年法国室内 LED 照明市场规模为 13.7 亿美元,到 2030 年将达到 20.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.60%。

工业和住宅领域的发展以及商业办公领域的外国直接投资流入正在推动市场成长

- 从金额份额来看,工业和仓库将在 2023 年占据室内照明领域的大部分份额。新冠疫情似乎正在加速法国将工业能转移回国内的努力。法国12月工业生产季增1.1%,11月增长2%。 2022 年 12 月製造业产量较上季成长 0.3%,而 2022 年 11 月则成长了 2.4%。儘管该领域的市场在 LED 需求方面已经饱和状态,但由于仓库数量的增加,该领域的成长预计将继续推动需求。

- 从数量上看,2023 年住宅将占最大份额。近年来,住宅建设活动表现好坏参半。 2022年1月至11月,法国(不包括马约特岛)新建筑许可数量较去年同期增加5.6%至448,416份,而2021年则成长了18.5%。 2023年,法国住宅预计将保持相对稳定(成长率可能低于5%),每年的房产销售数量预计将维持在100多万套。自从新冠疫情导致居家隔离以来,法国许多人从大城市迁移到乡村。预计未来几年住宅室内照明市场将保持更加稳定。

- 由于居家办公条件以及开发和销售低迷,办公大楼市场的份额在疫情期间有所下降,预计从 2023 年开始该份额将增加。受新冠疫情影响,法国的外国直接投资流入量有所下降,但在 2021 年有所恢復(成长 191.4%),但仍低于危机前的水准。 2022年,法国的FDI计划成长了3%(1,259个计画)。由于办公领域销售的復苏,预计 LED 的需求将会增加。

法国室内 LED 照明市场趋势

高人均收入和节能政策推动LED照明的普及

- 2022 年法国平均家庭规模为 2.2 人。截至 2023 年 6 月,法国现有人口为 6,570 万,每年以约 0.2% 的中等速度成长。 81.5% 的人口居住在城镇(2020 年为 5,320 万)。因此,预计人口的成长将导致 LED 的采用率提高,从而增加该国的照明需求。

- 2017年至2020年间,德国的住宅率略有下降。 2021年,约有64.7%的人口住在自己的家中,2022年这数字达到63.4%。这使得法国成为世界上房屋自有率最高的国家之一,但预计未来几年这一数字将缓慢下降,并导致该国租赁房地产市场进一步增长,目前该国的租赁住宅市场已经处于最低水平。这些案例表明,LED 正变得越来越流行,但它们在住宅领域的应用并不像以前那么先进。

- 法国的可支配所得较高,因此个人消费能力较强,可以把更多的钱投入新的住宅空间。 2022年12月,法国人均收入达25,337.71美元,而2021年12月为27,184.2美元。与一些已开发国家相比,法国的购买力较高。例如,截至 2021 年,巴西的汇率较低,为 7,732.4 美元,而截至 2017 年,义大利的汇率较低,为 15,321.9 美元。

- 2017年6月,法国政府宣布了一项能源效率证书计划,允许家庭根据其收入获得最高LED灯泡价格100%的补贴。随着此类体系的建立,预计该国对LED照明的需求将进一步大幅增加。

能源维修和能源效率计划推动 LED 市场成长

- 2019 年,最终用电量最高的领域是商业和专业(47%),其次是住宅(近 38%)和重工业(16%)。由于人们在家中度过更多时间(例如远距和兼职工作),住宅领域的消费者支出在第一次封锁期间增加了近 5%。此外,法国復苏计画中新增的「Ma PrimeRenov」计画所推动的能源维修计划成为此活动的重要支持来源。因此,建筑业的增加意味着建造更多的住宅和建筑物,从而增加了对 LED 的需求。

- 商业部门的电力需求往往在工作时间最高,而在夜间和週末则会大幅下降。通常一天的工作时间是大约 8 到 10 个小时。工业部门的用电量在一天或一年内波动的幅度往往不如住宅和商业部门那么大,尤其是每天 24 小时运作的製造工厂。住宅用电需求波动在7-9小时左右。此外,巴黎政府也积极将2,500多盏路灯更换为LED路灯,力争在2017年实现绿色照明,这些努力正在推动国内LED照明市场的发展。

- 此外,Citeos(VINCI Energy)协助3,000多个城市提高能源效率。例如,巴黎郊外的塞尔吉蓬图瓦兹市承诺在18年内透过维修80%的建筑来减少47%的能源消耗。该计划透过安装额外的 7,000 盏节能 LED 灯来取代该国现有的照明基础设施,从而刺激了 LED 照明产业的发展。

法国室内LED照明产业概况

法国室内LED照明市场较为分散,前五大企业占比为23.66%。市场的主要企业是:ams-OSRAM AG、EGLO Leuchten GmbH、LEDVANCE GmbH(MLS)、Signify(飞利浦)和Thorn Lighting Ltd.(Zumtobel Group)(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均收入

- LED进口总量

- 照明电力消耗量

- 家庭数量

- LED渗透率

- 园艺区

- 法律规范

- 法国

- 价值链与通路分析

第五章 市场区隔

- 室内照明

- 农业照明

- 商业照明

- 办公室

- 零售

- 其他的

- 工业/仓库

- 住宅

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- Airis LED

- ams-OSRAM AG

- BEGA Lighting

- CisLED

- EGLO Leuchten GmbH

- LEDVANCE GmbH(MLS Co Ltd)

- Signify(Philips)

- Thorlux Lighting(FW Thorpe Plc)

- Thorn Lighting Ltd.(Zumtobel Group)

- TRILUX GmbH & Co. KG

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The France Indoor LED Lighting Market size is estimated at 1.37 billion USD in 2025, and is expected to reach 2.06 billion USD by 2030, growing at a CAGR of 8.60% during the forecast period (2025-2030).

Increasing developments in the industrial and residential segments, along with FDI flows in the commercial office segment, driving the market's growth

- In terms of value share, in 2023, industrial and warehouse accounted for the majority share among indoor lighting segments. The COVID-19 pandemic seems to have accelerated France's efforts to return industrial production capacities to the country. French industrial production increased by 1.1% over one month in December 2022, after +2% in November 2022. Manufacturing output rose by 0.3% M-o-M in December 2022, after +2.4% in November 2022. While the market in this segment is saturating in terms of LED demand, the growth in the segment with an increasing number of warehouses is expected to continue boosting the demand.

- In terms of volume, in 2023, residential accounted for the highest share. Residential construction activity has been showing mixed results in recent years. In the first 11 months of 2022, new dwellings authorized in France, excluding Mayotte, rose by 5.6% Y-o-Y to 448,416 units, following an 18.5% Y-o-Y increase in 2021. During 2023, house prices in France were expected to stabilize a bit (perhaps growth would drop below 5%), and the number of property sales would remain just above 1 million during the year. Since the COVID-19 pandemic-induced confinements, many people have moved from the major cities to the provinces in France. The market in the residential indoor lighting segment is expected to get more stable over the coming years.

- The office segment's share was expected to increase from 2023 after declining during the pandemic due to WFH conditions and low development and sales. After dropping due to the COVID-19 pandemic, FDI flows to France rebounded in 2021 (+191.4%) but remained below pre-crisis levels. In 2022, FDI projects increased by 3% (1,259 projects) in France. Rebound sales in the office segment are expected to increase demand for LEDs.

France Indoor LED Lighting Market Trends

High per capita income and energy saving scheme to promote use of LED lights

- The average household size is 2.2 people per household in France in 2022. The current population of France is 65.7 million as of June 2023, increasing at a slow pace of around 0.2% yearly. 81.5 % of the population is urban (53.2 million people in 2020). Thus, the increase in population is expected to create more LED penetration and increase the need for illumination in the country.

- Between 2017 and 2020, the homeownership rate in Germany decreased slightly. In 2021, about 64.7% of the population lived in an owner-occupied dwelling, and in 2022, it reached 63.4%. This makes France one of the countries with the highest homeownership rate, but in coming years, it is expected to decline slowly, and the lowest rental residential real estate market is expected to grow further in the country. These instances suggest that LED penetration is there, but the penetration is less compared to previous years in the residential segment.

- In France, disposable income is high, which results in the rising spending power of individuals and affording more money on new residential spaces. France's per Capita income reached USD 25,337.71 in December 2022, compared to USD 27,184.2 in December 2021. Compared to some developed nations, it has high purchasing power. For instance, Brazil had USD 7732.4 as of 2021, and Italy had USD 15,321.9 as of 2017, which is lower.

- In June 2017, the French government announced the Energy Savings Certificate scheme, which allows people to get subsidies that can cover up to 100% of the price of LED bulbs based on the householder's income. Such instances are further expected to surge the demand for LED lighting in the country.

Energy renovation and energy efficient projects to drive the growth of the LED market

- The segment with the biggest final electricity usage was business and professionals (47%), followed by residential (almost 38%) and heavy industry (16%) in 2019. Consumer expenditure in the residential sector increased by almost 5% during the first lockdown as a result of people spending more time at home (remote or part-time employment, etc.). Furthermore, the energy renovation projects that were promoted by the "Ma PrimeRenov" program added to the French recovery plan were the main source of support for this activity. Consequently, the rise in construction indicates more houses and buildings to be built, thus increasing the demand for LED.

- Electricity demand in the commercial sector tends to be highest during operating business hours; it decreases substantially on nights and weekends. Usually, in a day, it is around 8-10 hours. Electricity use in the industrial sector tends not to fluctuate through the day or year as in the residential and commercial sectors, particularly at manufacturing facilities that operate around the clock, i.e., 24 hours. Electricity demand in the residential sector varies for about 7 to 9 hours. Additionally, the government of Paris is aggressively replacing more than 2,500 LED-based streetlights in order to convert to green in 2017. The nation's market for LED lights is driven by such initiatives.

- Additionally, Citeos (VINCI Energies) supports more than 3,000 municipalities in enhancing their energy efficiency. For instance, Cergy-Pontoise, a city outside of Paris, has pledged to cut its energy use by 47% over 18 years by rehabilitating 80% of its buildings. By installing 7,000 more energy-efficient LED lights in place of the nation's existing lighting infrastructure, this project is fueling the growth of the LED light industry.

France Indoor LED Lighting Industry Overview

The France Indoor LED Lighting Market is fragmented, with the top five companies occupying 23.66%. The major players in this market are ams-OSRAM AG, EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), Signify (Philips) and Thorn Lighting Ltd. (Zumtobel Group) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 France

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Airis LED

- 6.4.2 ams-OSRAM AG

- 6.4.3 BEGA Lighting

- 6.4.4 CisLED

- 6.4.5 EGLO Leuchten GmbH

- 6.4.6 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.7 Signify (Philips)

- 6.4.8 Thorlux Lighting (FW Thorpe Plc)

- 6.4.9 Thorn Lighting Ltd. (Zumtobel Group)

- 6.4.10 TRILUX GmbH & Co. KG

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms