|

市场调查报告书

商品编码

1683970

英国户外 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)UK Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

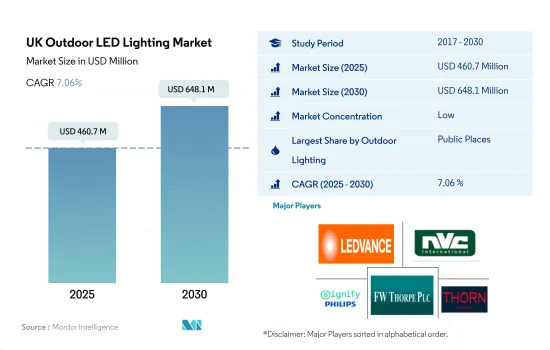

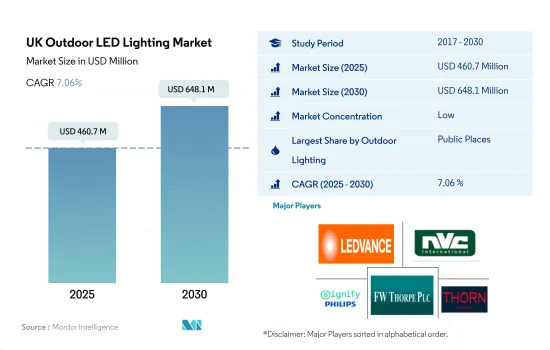

英国户外 LED 照明市场规模预计在 2025 年为 4.607 亿美元,预计到 2030 年将达到 6.481 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.06%。

停车场LED照明的增加和製造商的策略发展将推动LED照明市场的成长

- 2023年,公共场所在数量和金额上都将占据最大份额,其次是道路、公路和其他。由于 LED 照明固有的能源效率,使用 LED 照明预计会节省大量成本,这可能会对市场成长产生积极影响。英国正在进行一项倡议,以推动绿色革命并减少白炽灯和卤素灯泡的销售。

- LED 照明因其环保和耐用而需求量很大。某些计划(例如英国停车场照明 LED计划)正在实施中,以改善 LED 照明的使用。该计划涉及90盏80瓦的停车场灯,安装在八公尺的高度,为整个停车场提供均匀的照明,确保车辆安全。这些发展符合未来几年对 LED 照明日益增长的需求。市场相关人员正在投入巨资,透过扩大频谱并提高 LED 光输出和品质来改进现有技术。

- 知名户外照明製造商 Cyclone Lighting 宣布将于 2023 年 5 月推出其 Elencia 灯具。此外,2018 年 11 月,欧司朗向专业中功率市场推出了 Osconiq S3030。这些 LED 非常适合户外和工业照明,它们品质高,可以承受恶劣的条件且不会失去耐用性。

- 此外,道路建设计划投资的增加也推动了户外照明产品的需求。 2023/2024 财政年度,公路局已拨款 1.03 亿英镑(1.037 亿美元)用于英格兰西南部道路、桥樑和人行道的更新和改善计划。

英国户外 LED 照明市场趋势

创新、维修和政府对体育产业的贡献推动 LED 照明市场成长

- 预计体育场数量将从 2023 年的 262 个增加到 2030 年的 283 个,复合年增长率为 1.1%。庞大的体育场升级需求是推动英国体育场照明市场发展的主要因素。例如,DOWSIL 将在 2022 年对 LED 体育场馆照明进行创新。 2019 年,伦敦温布利 SSE 体育馆的礼堂安装了全新的 LED 照明系统。 2020年,Musco 与伦敦体育场合作升级其 LED 照明系统。托特纳姆热刺球场、伦敦温布利球场、米兰圣西罗球场和都柏林英杰华球场都安装了 Musco Lighting 的 LED 照明系统。 2018 年,托特纳姆热刺队为其 8.5 亿英镑的新体育场增添了 LED 照明。 2017 年,Zumtobel 集团与包括伦敦托特纳姆热刺队在内的体育组织联手,成为照明合作伙伴。这些因素正在支持国内LED市场的扩大。

- 英国将申办 2028 年欧洲杯,并已选定 10 座体育场作为联合主办国,包括温布利球场、卡迪夫国家体育场、托特纳姆热刺球场、曼城球场、埃弗顿球场、圣詹姆斯公园球场、维拉公园球场、汉普顿公园球场、都柏林竞技场和贝尔法斯特的凯斯门特公园球场。为了发展这项运动和体育场馆,政府透过五个协会每年投入5000万英镑用于草根足球发展。

- 一家大型投资基金收购了纽卡斯尔联队并升级了其体育场。其中包括男子板球测试赛(英格兰对爱尔兰)、2023 年英格兰足总杯决赛、2023 年 ICC 世界测试锦标赛决赛和其他重大赛事。因此,体育场升级、新体育场建设和体育赛事预计将增加该国 LED 灯的销售量。

住宅房地产上涨或将推动 LED 市场成长

- 2021 年,英格兰居住为 5,650 万,出生婴儿 1.56 名。从 2019 年到 2021 年下降了 0.1 个百分点。 2020 年,英国死亡率下降至每 1,000 人口 9.7 人,然后在 2021 年下降至每 1,000 人口 0.4 人(-3.96%)。在英国,人口成长和死亡率下降预计将推动对 LED 的需求。

- 英格兰的住宅存量正在稳步增长,到 2021 年,住宅总数将达到约 2,500 万套。截至 2022 年第二季度,在该国 71,400 套计画住宅中,约 44,500 套为现成的出租住宅。英国住宅房地产市场在 2021 年蓬勃发展,但由于疫情,2022 年陷入低迷。 40,000 英镑以上的交易数量从 2020 年的约 100 万笔增加到 2021 年的 150 多万笔和 2022 年的 130 万笔。随着交易量的预期增加,全国的平均房价也预计将上涨。随着平均交易价格的上涨,未来将有更多的人购买住宅,这可能会增加对 LED 的需求。

- 2021 年,英国持有有效驾照的汽车数量为 32,889,462 辆。 2020年,英国家庭平均拥有汽车1.24辆。 2021年,英国电动车数量将达到1,632,997辆,比2014年增加6.9倍。 2021年终,英国约5%的汽车将完全或部分由电力驱动。混合动力电动车将占据主导地位,到 2021 年上路行驶的混合动力车数量将达到 932,335 辆。随着汽车和电动车的增加,预计日本将使用更多的 LED。

英国户外 LED 照明产业概况

英国户外LED照明市场较为分散,前五大公司占比为28.99%。市场的主要企业有:LEDVANCE GmbH(MLS)、NVC INTERNATIONAL HOLDINGS LIMITED、Signify Holding(Philips)、Thorlux Lighting(FW Thorpe Plc)和Thorn Lighting Ltd.(Zumtobel Group)(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均收入

- LED进口总量

- 照明耗电量

- 家庭数量

- LED渗透率

- 体育场数量

- 法律规范

- 英国

- 价值链与通路分析

第五章 市场区隔

- 户外照明

- 公共空间

- 道路照明

- 其他的

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ACUITY BRANDS, INC.

- ams-OSRAM AG

- Dialight PLC

- Fagerhult(Fagerhult Group)

- Feilo Sylvania(Shanghai Feilo Acoustics Co., Ltd)

- LEDVANCE GmbH(MLS Co Ltd)

- NVC INTERNATIONAL HOLDINGS LIMITED

- Signify Holding(Philips)

- Thorlux Lighting(FW Thorpe Plc)

- Thorn Lighting Ltd.(Zumtobel Group)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The UK Outdoor LED Lighting Market size is estimated at 460.7 million USD in 2025, and is expected to reach 648.1 million USD by 2030, growing at a CAGR of 7.06% during the forecast period (2025-2030).

Increase of LED lights in parking lots and strategic developments by manufacturers to drive the growth of LED lighting market

- In 2023, public places had the largest share in terms of both volume and value, followed by streets and roadways, and others. The use of LED lighting is expected to offer significant cost savings due to its inherent energy efficiency, which can have a positive impact on the growth of the market. Efforts are being made to promote the green revolution and reduce the sale of incandescent and halogen bulbs in the United Kingdom.

- LED lighting is eco-friendly and durable, making it highly in demand for installations. Specific projects, such as the UK parking lot lighting LED project, are being implemented to improve the use of LED lighting. In this project, 90 80-watt parking lot lights are installed at a height of 8 meters to illuminate the entire parking lot and ensure vehicle safety evenly. These developments will meet the growing demand for LED lighting in the coming years. Market players are investing heavily to improve existing technology by expanding the spectrum and enhancing the output and quality of LED light.

- Cyclone Lighting, a reputable manufacturer of outdoor lighting, announced the launch of the Elencia lamp in May 2023. Additionally, in November 2018, Osram introduced the Osconiq S3030 to the professional mid-power market. These LEDs are ideal for outdoor lighting and industrial lighting, are of high quality, and can withstand harsh conditions without losing durability.

- Further, the growing investments in road construction projects drive the demand for outdoor lighting products. In the 2023/2024 financial years, National Highways has allocated GBP 103 million (USD 103.70 million) for road renewal and improvement projects across roads, bridges, and walking paths in Southwest England.

UK Outdoor LED Lighting Market Trends

Innovation, renovation, and government contribution for sports industry drive the growth of LED lighting market

- The number of stadiums is expected to grow from 262 units in 2023 to 283 units in 2030, exhibiting a CAGR of 1.1%. The enormous need for stadium upgrades is the main factor driving the stadium lighting market in the United Kingdom. For example, DOWSIL will innovate with LED sports stadium lighting in 2022. 2019 saw a brand-new LED lighting system installed at the auditorium of The SSE Arena, Wembley, in London. Musco and London Stadium collaborated in 2020 to upgrade the LED lighting system. Tottenham Hotspur Stadium, Wembley Stadium in London, San Siro in Milan, and Aviva Stadium in Dublin all have LED lighting systems installed by Musco Lighting. Tottenham added LED lighting in the new GBP 850 million stadium in 2018. 2017 saw Zumtobel Group join forces with sporting organizations, including Tottenham Hotspur of London, as a lighting partner. These elements support the expansion of the LED market in the nation.

- The UK will submit a bid to host Euro 2028 and has already selected ten stadiums, including Wembley, Cardiff National Stadium, Tottenham Hotspur, Manchester City, Everton, St. James' Park, Villa Park, Hampden Park, Dublin Arena, and Belfast's Casement Park, to host the event jointly. To advance both the sport of football and the stadium, the government contributed GBP 50 million a year to grassroots football development throughout five Associations.

- A sizable investment fund acquired Newcastle United to upgrade the stadium. Men's cricket Test match between England and Ireland, the 2023 English FA Cup final, the 2023 ICC World Test Championship final, and other major events are among them. Consequently, stadium upgrades, new stadium construction, and sporting tournaments are expected to increase the sales of LED lights in the country.

An increase in residential real estate may drive the growth of the LED market

- In 2021, there were 56.5 million people living in England, and 1.56 children were born in the country. There was a 0.1-point decrease from 2019 to 2021. In 2020, the death rate in the United Kingdom dropped to 9.7 fatalities per 1,000 people, which translated to a decrease of 0.4 fatalities per 1,000 people (-3.96%) in 2021. In the United Kingdom, the demand for LEDs is expected to increase due to population growth and a drop in the death rate.

- England's housing stock has steadily grown, reaching a total of about 25 million homes as of 2021. There were around 44,500 build-to-rent homes in the country's 71,400 planned residences as of the second quarter of 2022. The UK residential real estate market experienced a rise in activity in 2021 before seeing a dip in 2022 after stagnating due to the epidemic. The number of transactions with a value of at least GBP 40,000 increased from about 1 million in 2020 to over 1.5 million in 2021 and 1.3 million in 2022. The average property price is anticipated to rise across the country, along with the anticipated rise in transactions. As a result of the increase in average price transactions, more people will likely buy homes in the future, thus increasing the demand for LEDs.

- In the United Kingdom, there were 32,889,462 automobiles with valid licenses in 2021. English homes had an average of 1.24 vehicles in 2020. In the country, there were 1,632,997 electric vehicles in 2021, a 6.9x increase from 2014. About 5% of vehicles in the country were powered by electricity entirely or in part at the end of 2021. Hybrid electric vehicles are by far the most common, with 932,335 units on the road in 2021. More LEDs are expected to be used in the country as the number of vehicles and EVs increases.

UK Outdoor LED Lighting Industry Overview

The UK Outdoor LED Lighting Market is fragmented, with the top five companies occupying 28.99%. The major players in this market are LEDVANCE GmbH (MLS Co Ltd), NVC INTERNATIONAL HOLDINGS LIMITED, Signify Holding (Philips), Thorlux Lighting (FW Thorpe Plc) and Thorn Lighting Ltd. (Zumtobel Group) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 United Kingdom

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 ams-OSRAM AG

- 6.4.3 Dialight PLC

- 6.4.4 Fagerhult (Fagerhult Group)

- 6.4.5 Feilo Sylvania (Shanghai Feilo Acoustics Co., Ltd)

- 6.4.6 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.7 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.8 Signify Holding (Philips)

- 6.4.9 Thorlux Lighting (FW Thorpe Plc)

- 6.4.10 Thorn Lighting Ltd. (Zumtobel Group)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms