|

市场调查报告书

商品编码

1683996

北美杀菌剂:市场占有率分析、产业趋势与成长预测(2025-2030)North America Fungicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

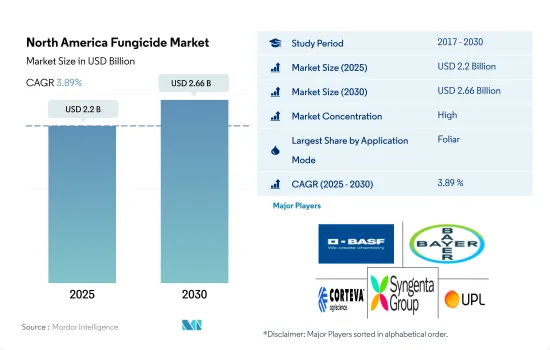

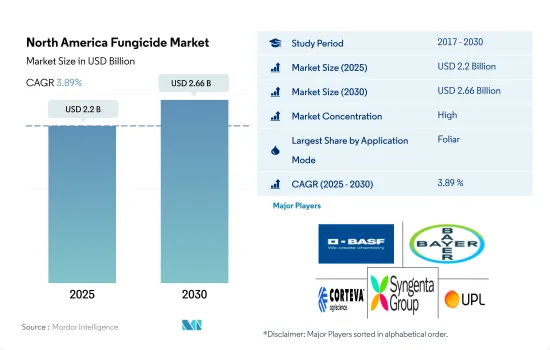

北美杀菌剂市场规模预计在 2025 年达到 22 亿美元,预计到 2030 年将达到 26.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.89%。

叶面喷布是施用杀菌剂最重要的主要方法。

- 在北美,人们使用多种杀菌剂施用技术来有效控制农业中的真菌疾病。选择正确的施用方法可以为农民提供经济有效的解决方案,使他们能够精确覆盖特定区域并最大限度地减少不必要的使用。功效的提高优化了杀菌剂的利用率并降低了农民的投入成本。

- 在农业中各种杀菌剂使用方法中,叶面喷布是主流,占2022年杀菌剂总使用量的60.8%。此方法主要用于种植谷物和谷类,占市场占有率最大的41.4%。叶面喷布的针对性和高效吸收特性有助于控制疾病,从而有可能提高产量并降低农民的成本。

- 2022年,种子治疗方法将占据第二大市场占有率,占总量的13.8%。随着农民越来越意识到使用杀菌剂种子处理产品保护幼苗和提高生产力的好处,其采用率显着增加。预计北美杀菌剂市场种子处理部分在预测期内的复合年增长率为 4.0%。

- 在北美农业领域,杀菌剂主要用于最大限度提高作物产量和提高整体盈利。预计应用方法将大幅成长,预测期内复合年增长率为 4.1%。

由于真菌感染日益严重以及对优质农产品的需求不断增长,美国在市场上占据主导地位。

- 北美杀菌剂市场正在显着扩张,该地区的各个国家都经历了显着的成长。杀菌剂需求的激增是由于控制真菌疾病和减少作物损失的需求。 2022 年,北美在全球杀菌剂市场中占有 12.1% 的显着市场占有率。

- 美国在北美杀菌剂市场占据主导地位,2022 年占 47.2% 的市场占有率。美国农业地域广阔且多样,全国各地种植着许多不同的作物。这种多样性增加了作物对各种真菌疾病的敏感性,从而导致对杀菌剂的需求增加。

- 2022年,墨西哥是第二大杀菌剂消费国,占21.1%的显着市场占有率。该国的农业实践强调集约化耕作,以大规模种植产量作物为特征。但这种密集的做法也为真菌病害的快速蔓延创造了有利条件。枯萎病、白粉病、霜霉病、炭疽病和銹病对谷物和谷类造成重大影响,导致作物受损、产量下降。因此,使用杀菌剂对于保护作物和保持生产力至关重要。

- 农民意识的提高、农业技术的进步以及农业部门的扩大等各种因素正在推动北美杀菌剂市场的成长。因此,预计北美杀菌剂市场在整个预测期(2023-2029 年)的复合年增长率将达到 4.1%。

北美杀菌剂市场趋势

真菌疾病造成的经济损失不断增加,推动了对杀菌剂的需求

- 真菌病害会损害植物并降低其产量,对作物造成重大损失。它还会对作物的品质产生不利影响,使其不适合销售或消费。墨西哥将成为北美最大的杀菌剂消费国,2022年杀菌剂消费量为1,400.0公克。墨西哥的气候从干旱到热带多样,为农作物真菌病害的发展和传播提供了有利条件。

- 2016年至2019年,美国和加拿大因真菌病害造成的玉米产量损失平均每公顷138.13美元。由于疾病导致作物减产,造成巨大的经济损失,农民为了保护作物,减少经济影响,只好增加化学杀菌剂的使用。这可能会导致对用于管理和控制疾病爆发的杀菌剂的需求增加,从而导致农业化学投入增加。

- 2022年,玉米焦油斑病、棉花烟草叶斑病、大豆猝死症候群等病害给北美地区造成了重大损失,导致每公顷农地对化学杀菌剂的需求增加。杀菌剂的反覆和广泛使用也导致了抗性菌株的产生,增加了开发创新化学分子的需求。

- 预计未来几年北美对化学杀菌剂的需求将会成长,原因是该地区气候条件变化导致真菌病害发病率增加、产量损失减少以及每公顷作物产量提高等因素。

用于保护作物免受病害的杀菌剂的需求增加可能会因原料成本上升而推高杀菌剂价格。

- Mancozeb是一种频谱接触性杀菌剂,在美国已获准用于多种水果、蔬菜、坚果和田间作物。控制多种真菌疾病,包括马铃薯枯萎病、叶斑病、疮痂病和銹病。它可用作马铃薯、玉米、高粱、番茄和谷物等作物的种子处理剂。 2022年的市场价格为每吨7800美元。

- 丙森锌是一种接触性杀菌剂,2022 年的市场价格为每吨 3,500 美元。丙森锌的用途包括控制影响苹果、马铃薯、辣椒和番茄等作物的各种疾病,如疮痂病、早疫病、晚疫病、枯萎病、七叶树腐烂病、霜霉病、果叶斑病、褐斑病和窄叶斑病。

- 福美锌是二硫代氨基甲酸类杀菌剂中的一种,註册用于控制影响多种商业种植作物的真菌疾病,包括核果、仁果、坚果、蔬菜和观赏植物。它用于防治苹果和梨的黑星病、桃子的叶腐病和炭疽病以及番茄的早疫病。它的使用有两个目的:在作物生长过程中保护其免受损害,并在储存和运输过程中保持收穫的水果的品质。 2022 年的价格为每吨 3,300 美元。

- Mancozeb、丙森锌、福美锌是最常用的杀菌剂成分。 2021年,美国大部分杀菌剂进口自印度、比利时和德国,成为全球第三大进口国。

北美杀菌剂产业概况

北美杀菌剂市场相当集中,前五大公司占74.80%的市占率。市场的主要企业有:BASF公司、拜耳公司、科迪华农业科技、先正达集团和联合磷化有限公司(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 加拿大

- 墨西哥

- 美国

- 价值炼和通路分析

第五章市场区隔

- 执行模式

- 化学喷涂

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd.

- American Vanguard Corporation

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001698

The North America Fungicide Market size is estimated at 2.2 billion USD in 2025, and is expected to reach 2.66 billion USD by 2030, growing at a CAGR of 3.89% during the forecast period (2025-2030).

Foliar application holds the utmost importance as the primary mode of fungicide application

- In North America, numerous techniques for fungicide application are utilized to effectively control fungal diseases in agriculture. By choosing suitable application methods, farmers can attain cost-efficient solutions, ensuring accurate coverage of specific areas and minimizing unnecessary usage. This improved efficacy optimizes fungicide utilization, resulting in decreased input costs for farmers.

- Among various fungicide application methods in agriculture, foliar application is the dominant mode, accounting for 60.8% of the total fungicide usage in 2022. This approach is primarily utilized in cultivating grains and cereals, which hold the largest market share of 41.4%. The targeted and efficient absorption properties of foliar application contribute to its effectiveness in controlling diseases, potentially resulting in increased yields and cost savings for farmers.

- In 2022, the seed treatment method held the second-largest market share, comprising 13.8% of the total. The rise in farmers' awareness about the benefits of using fungicide seed treatment products to protect seedlings and boost productivity resulted in a significant rise in their adoption. The seed treatment segment of the North American fungicide market is projected to experience a CAGR of 4.0% during the forecast period.

- In the North American agricultural sector, fungicides are utilized with the primary aim of maximizing crop yields and improving overall profitability. The mode of application is anticipated to experience substantial growth, with a CAGR of 4.1% during the forecast period.

The United States holds a dominant position in the market due to an increase in fungal infestations and a rising demand for high-quality agricultural produce

- The North American fungicide market is witnessing significant expansion, with various countries in the region experiencing notable growth. This surge in fungicide demand is attributed to the need to control fungal diseases and reduce crop losses. In 2022, North America held a considerable market share of 12.1%, by value, in the global fungicide market.

- The United States dominated the North American fungicide market, accounting for a market share of 47.2% in 2022. The United States has a vast and diverse agricultural landscape, with a wide range of crops grown in different parts of the country. This diversity increases the susceptibility of crops to various fungal diseases, leading to a higher demand for fungicides.

- In 2022, Mexico ranked as the second-largest consumer of fungicides, holding a substantial market share of 21.1%. The country's agricultural practices emphasize intensive farming, characterized by the cultivation of high-yield crops in large quantities. However, this intensive approach also creates a favorable environment for the rapid spread of fungal diseases. Fusarium wilt, powdery mildew, downy mildew, anthracnose, and rust diseases significantly impact grains and cereals, leading to crop damage and reduced yields. As a result, the use of fungicides becomes imperative to protect crops and maintain productivity.

- Various factors, including rising awareness among farmers, advancements in agricultural technologies, and the expansion of the agricultural sector, drive the growth of the fungicide market in North America. As a result, the North American fungicide market is projected to experience a CAGR of 4.1% throughout the forecast period (2023-2029).

North America Fungicide Market Trends

Increasing economic losses due to fungal diseases are increasing the need for fungicides

- Fungal diseases can cause substantial crop losses by damaging plants and reducing their productivity. They can negatively impact crop quality, making the crops unsuitable for sale or consumption. In North America, Mexico is the largest consumer of fungicides, with 1,400.0 g of fungicides consumed in 2022. Mexico's climate varies from arid to tropical, providing favorable conditions for the development and spread of fungal diseases in crops.

- Between 2016 and 2019, the average economic loss resulting from decreased corn yields due to fungal diseases in the United States and Canada was estimated at USD 138.13 per hectare. The significant economic losses caused by reduced crop yields from diseases can increase the usage of chemical fungicides as farmers seek to protect their crops and mitigate the financial impact. This can lead to a higher demand for fungicides to manage and control disease outbreaks, contributing to increased chemical inputs in agriculture.

- Diseases like tar spots in maize, bollworm rots in cotton, and sudden death syndrome in soybeans caused significant losses in North America in 2022, leading to higher requirements for chemical fungicide application per hectare of agricultural land. The repeated and extensive use of fungicides also resulted in the development of resistant strains, increasing the need for the development of innovative chemical molecules.

- Owing to factors like the increased incidence of fungal disease due to changing climatic conditions in the region, the need for reduced yield losses, and higher crop productivity per hectare, the demand for chemical fungicides in North America is anticipated to grow over the coming years.

The increasing demand for fungicides to protect the crops from disease may drive the prices of fungicides due to the increasing raw material prices

- Mancozeb is a broad-spectrum contact fungicide that is labeled for application on numerous fruits, vegetables, nuts, and field crops in the United States. It protects against a wide spectrum of fungal diseases, including potato blight, leaf spot, scab, and rust. It fulfills the role of seed treatment for crops like potatoes, corn, sorghum, tomatoes, and cereal grains. Its market price for 2022 achieved a value of USD 7.8 thousand per metric ton.

- Propineb, classified as a contact fungicide, accounted for a market price of USD 3.5 thousand per metric ton in 2022. Its utilization encompasses the control of various diseases such as scab, early and late blight, dieback, buckeye rot, downy mildew, and fruit spots, as well as brown and narrow-leaf spot diseases, impacting crops like apple, potato, chili, and tomato.

- Ziram, a fungicide categorized within the dimethyldithiocarbamate group, is registered to control fungal diseases that affect an extensive array of crops, including stone fruits, pome fruits, nuts, vegetables, and ornamental plants cultivated for commercial purposes. Its uses encompass addressing issues such as apple and pear scabs, peach leaf curls, anthracnose, and early blight in tomatoes. Its application serves the dual purpose of shielding crops from harm while growing and preserving the quality of the harvested fruits during storage or transport. The price for 2022 stood at USD 3.3 thousand per metric ton.

- Mancozeb, Propineb, and Ziram are the most commonly used fungicide ingredients. In 2021, the United States imported most of its fungicides from India, Belgium, and Germany, and it is the third-largest importer of fungicides worldwide.

North America Fungicide Industry Overview

The North America Fungicide Market is fairly consolidated, with the top five companies occupying 74.80%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 FMC Corporation

- 6.4.7 Nufarm Ltd

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219